Follow the (fake) Data

One thing that has increasingly bothered me in recent years is the growing reliance of this industry on “data”. The reason I put it in quotes is because most of it is fake/not true. To show what’s going on and how it works, I thought I’d write a longer piece around the whole thing. As I started researching this article I realized how industrialized this whole thing is and how much investors are being fooled by it. The whole thing is a big joke and shows how far the industry as a whole has to go.

Our issues begin with these overvalued, overhyped tokens that investors are willing to pay billions of dollars for. All you need is a fancy white paper and you can skew the unit’s financials. My research begins in Dune where I found This dashboard that calculates CAC for multiple airdrops.

This is a good start, although I want to point out that these CACs (from a project perspective) are all underestimated numbers, since they simply go: dollar value ($) / claimed addresses. What this calculation doesn’t take into account is the percentage that actually retained the airdrop. Since only 10%-20% of addresses typically contain airdrops, it’s safe to assume that these CAC numbers are anywhere from 5x-10x higher than what you see above.

The second thing here is that we have an implicit tier for what the airdrops will be worth:

Fortunately, the two are not mutually exclusive! If you use the right apps in the right chains, you’ll get both airdrops — woo!!! Go to agriculture airdrop!

So ideally you want to structure your airdrop farming to focus on chains first and then take advantage of as many airdrops as you can beyond that point. OK, but the question is what’s next?

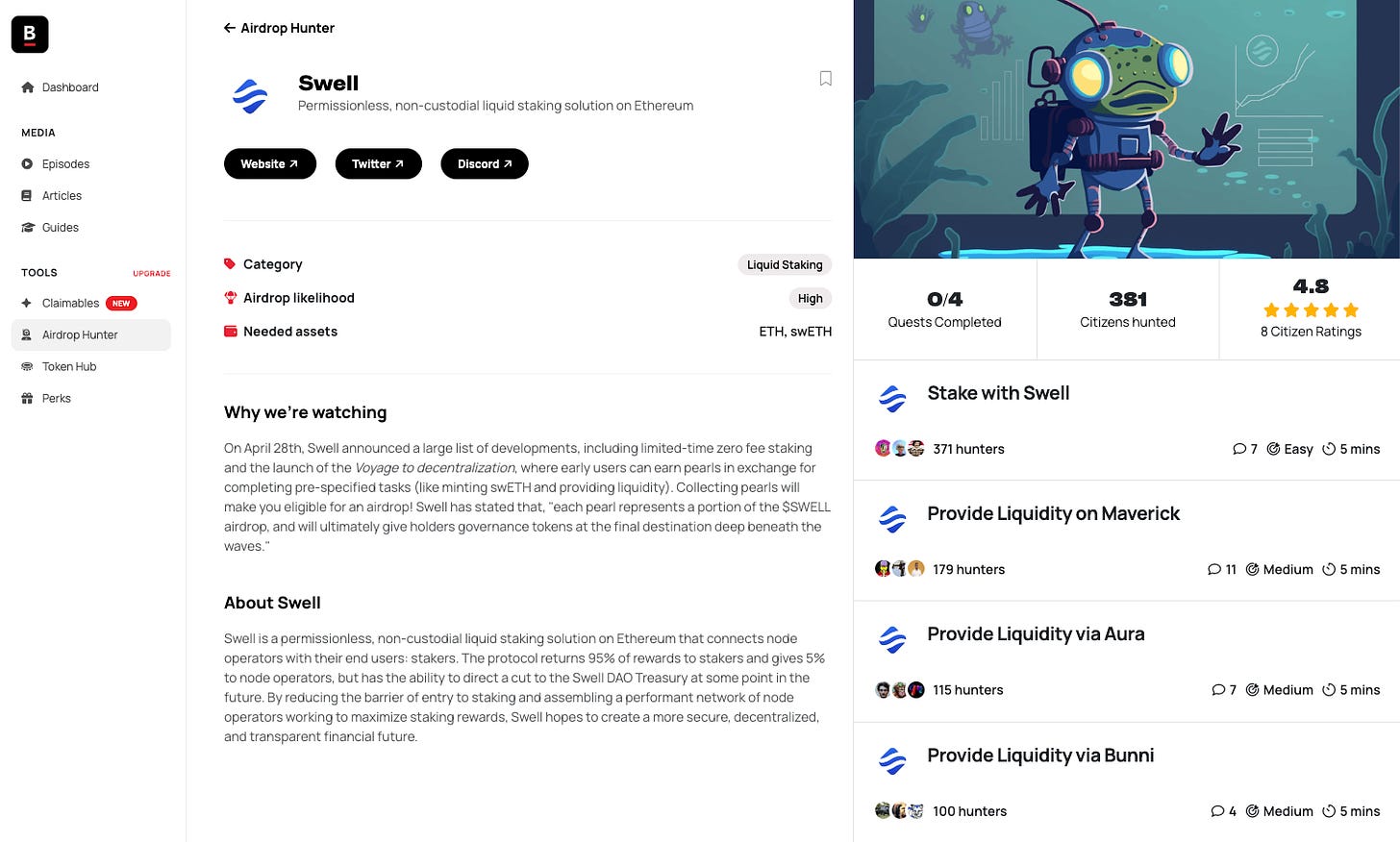

Luckily for you airdrop farmer, there is an entire industry around hunting airdrops created just for you. Usually, these airdrop discovery sites require you to do some sort of very defined “actions” that you need to have proof that you’re on-chain. It doesn’t matter if it’s your grandma or your bot, just make sure the transaction appears on-chain.

All these “questing” platforms are actually just airdrop discovery sites in disguise. Now this wouldn’t normally be a problem if they were able to attract high quality users, however the users you attract when using these sites are highly mercenary and represent the short term pain the industry suffers from as a whole.

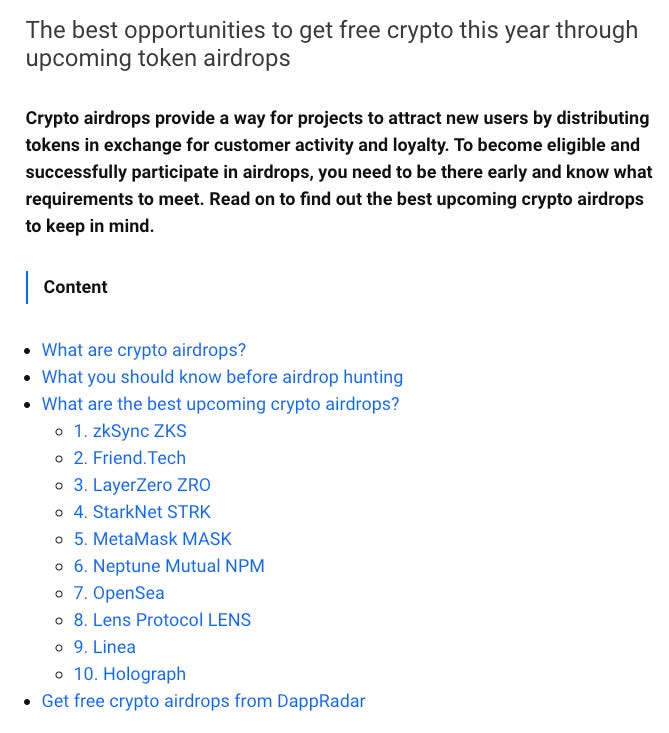

Let’s go to our highly trusted friends at dApp Radar to see what airdrops might be happening right now.

Based on this my game plan would most likely be:

-

Use zkSync as my mainchain

-

Layer Zero to bridge my money

-

Disguise as my chain wallet

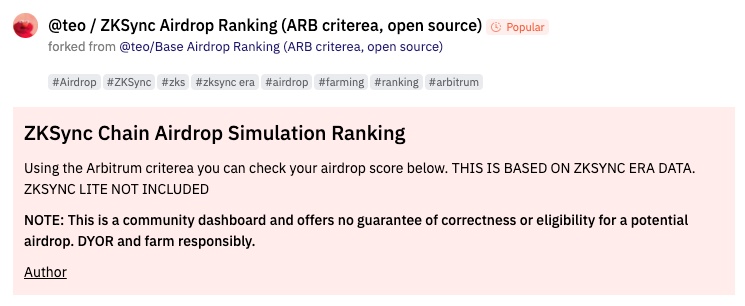

This could just be my natural workflow, without any extra work. But the question is, what do you need to do to figure out where you rank for these potential airdrops? Well, to my surprise, there is a whole community of “airdrop simulators” that have been born. These people are there to help you understand where you stand in relation to other airdrop farmers. A simple search for “airdrop” will help you find dashboards that use older airdrop criteria to simulate how projects might distribute airdrops. Here is one I found for zkSync.

What is fascinating is the level of detail being mapped. Look at all the columns in this table that are used mapped. An arbitrary rating, last tx time, number of trades, unique contracts, USD amount of total trades, unique active days/weeks/months, wallet age and block time. Awesome.

Why bother doing an airdrop calculation when your “community” has done it for you? This table I have taken a screenshot of has 765,000 rows mapped.

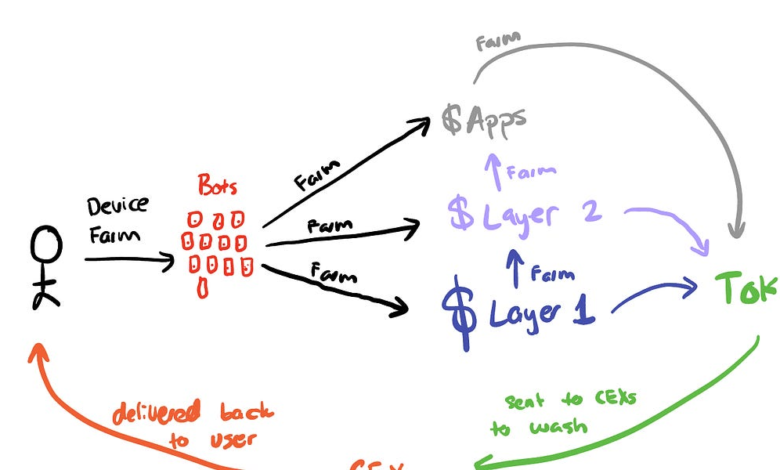

If you’re surprised at how mapped out the whole thing is, wait until you see this next part: if you know all the permutations and combinations of things used for criteria, then you can start automating and building efficient systems around it. I spent some time researching and found these two amazing tools. You might try them just to point out how corrupt this whole airdrop game is. The first is our friends at nftcopilot.com who have created an elegant dashboard to automate and regulate your farms. Here’s a video on their homepage that walks you through the process:

What’s amazing is the level of depth and detail that goes with it. In the product, you can create “groups” that you can customize the following parameters:

-

Number of transactions to route through a bridge

-

Networks to bridge (Ethereum, Polygon, Binance Smart Chain, Arbitrum, Avalanche, Optimism, Metis, Aptos)

-

Random actions to configure, including probabilities to configure, sleep intervals, and maximum number of random transactions per transaction.

Here are some copies directly from their website:

There is no danger of becoming a Sybil[1]

The system completely randomizes the actions taken by your wallets to eliminate any possible identification of them as Sybil. Each wallet has different times, orders and amounts, creating a different and unpredictable strategy that prevents identification.

Automatic expense tracking

You no longer need to track all your transactions in Excel & Sheets and calculate your fees manually. We will do everything automatically for each wallet. You will have a real automated control room for your farm.

Automatic Withdrawal & Consolidation

After reaching your goal, the funds could be automatically consolidated into the selected chain and token and withdrawn to your CEX wallet. You no longer have to spend hours managing your funds.

What I find misleading about the whole thing is their “mission”:

Help the winners win.

We believe that everyone in the market benefits from semi-automation in the right hands — projects, people and the industry as a whole.

We help projects increase engagement, raise funds and distribute tokens to the right people with a long-term vision.

We help people save valuable time, gain knowledge and allocate more resources in the long run.

We help industry attract new users, distribute resources into the hands that create value and drive growth.

All this is guaranteed only when we help the winners.

To find them, our team interviews every candidate before accepting the Copilot and filters out the bad actors to maintain the highest level of membership and ensure that such an instrument is only available in the right hands.

If that’s you – let’s fly.

Let’s be clear, this is far from value-add and value-destroying for the entire ecosystem. Fake products to justify false valuations.

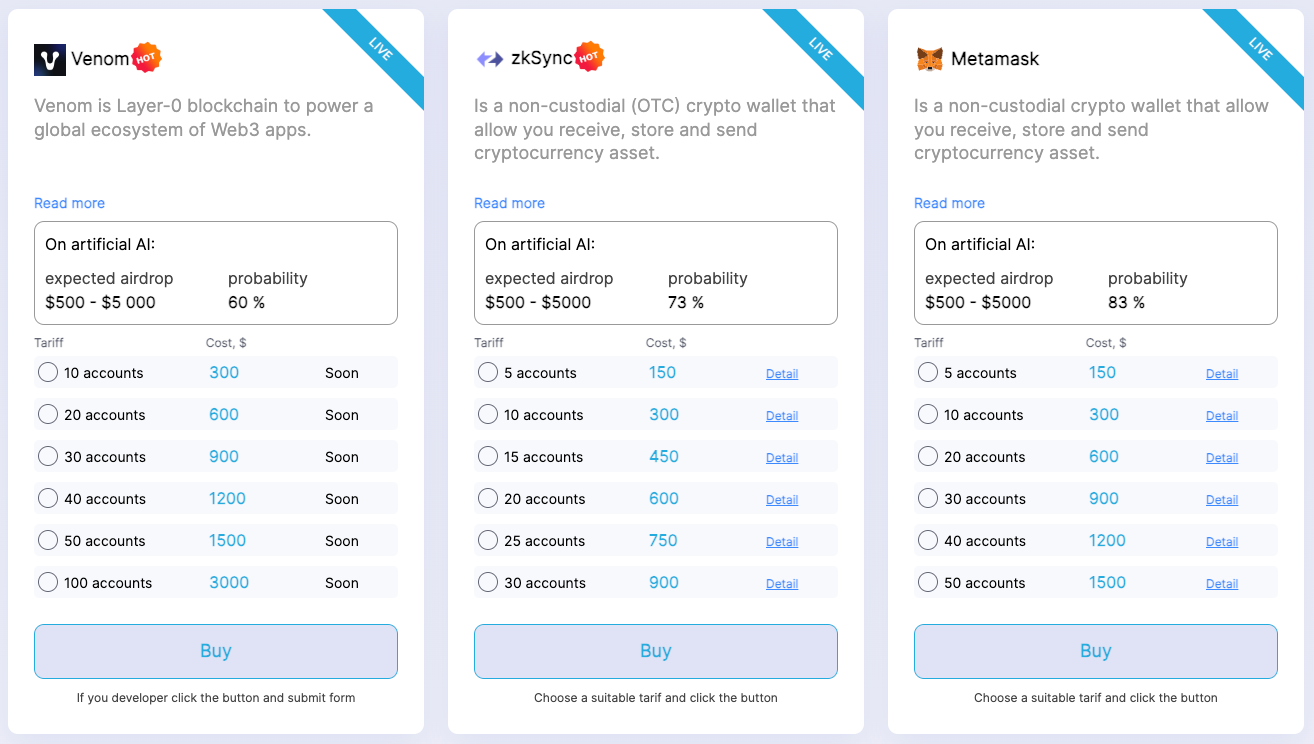

If you zoom out, what’s really going on is that the cost incurred to justify cultivating these airports is less than the potential reward that can come from such an effort. Another site I found helps make this trade even clearer by clarifying prices and potential ROI. Check this out.

Now you can use your own simplified math to calculate how much money you want to put in and how much money you expect to see. Phew, I’m solving a real problem for everyone. At some point, it’s probably more profitable for VCs to invest in airdrops than to invest in real projects. Faster fluidity, less mental gymnastics.

Since the cost to play an airdrop is less than the reward potential, airdrop farming will dominate.

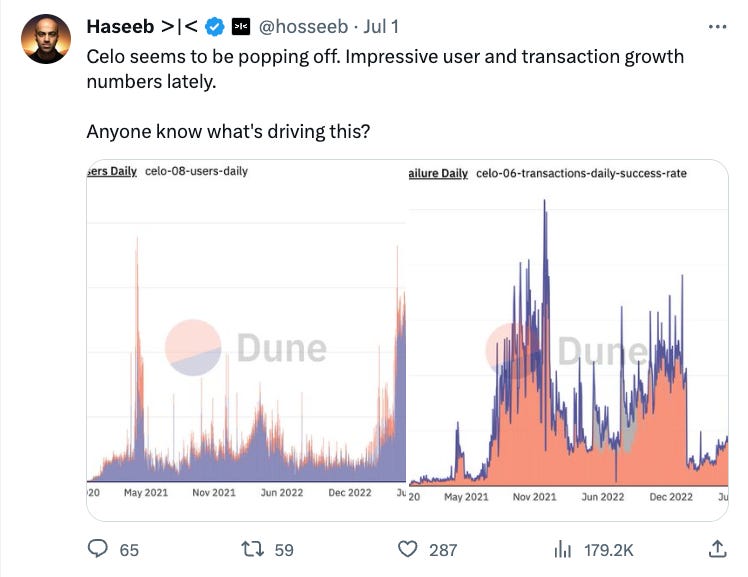

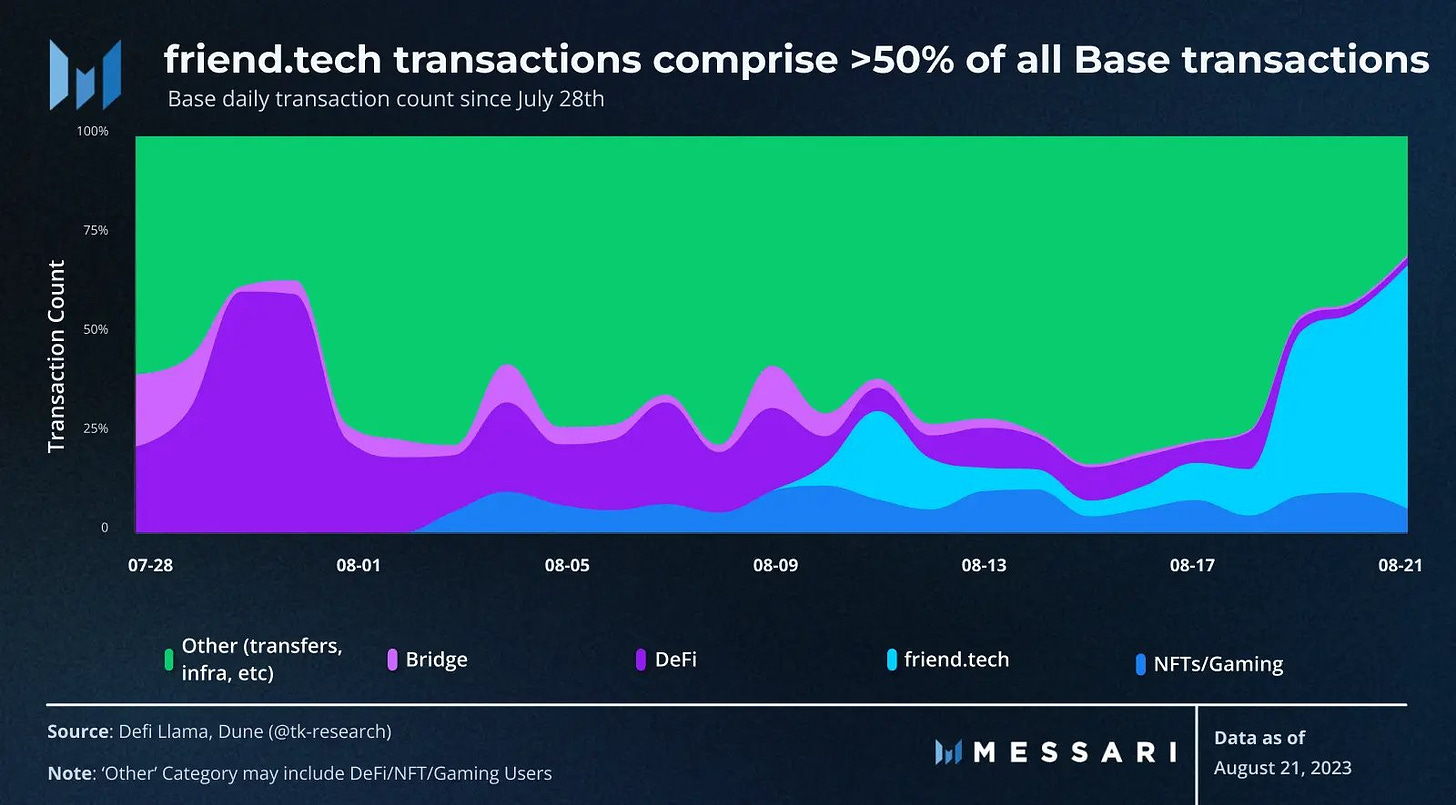

So what do you think is the result of the over-hyped projects that the agriculture sub-industries are built on? It’s just a battle of who has a bigger symbiote industry built on them. If the numbers are inflated up the chain, then unsophisticated actors who don’t know how to crunch the data will report what they see and ultimately fool the end retail investor that what they are buying has real traction. Check out the tweet below. If you were on Twitter, you might catch it and think “wow, this thing is really starting to work, I have to buy it”. The more people believe the data, the more the cycle perpetuates. Here are some things I found on Twitter about data misuse.

Based on what I’ve shown you in this article, do you think any of these pull metric numbers are real? Of course not, it’s all fake. The data is fake.

Identity without permission. Until we actually look at metrics based WHERE produces this activity, we are all deluding ourselves. Counting the core numbers as is means you set the bar for the identities you include extremely low (given the zero cost of creating a licenseless identity). Common to all of the above is that no weight is given to past actions or actions in a larger context. So how would you actually fix the above problems if you had a stronger level of identity in encryption?

This is a big question that I will answer in the next article. Until then, let me know your thoughts in the Telegram chat ( or by tagging me on Twitter (@kermankohli).