Exploring the Impacts of ETH ETF Approvals

Get the finest data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

The reversal in Ether ETF approval odds triggered a 25% rise in ETH’s value, alongside different Ethereum ecosystem associated tokens

-

The low cost to web asset worth (NAV) for Grayscale’s Ethereum Belief (ETHE) closed from 50% a 12 months in the past to 1.28% upon ETF approval

-

Absence of staking from ETH ETFs has potential implications for ETH’s provide dynamics, staking ecoystem and community resilience

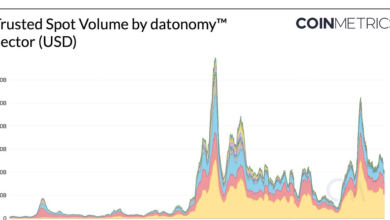

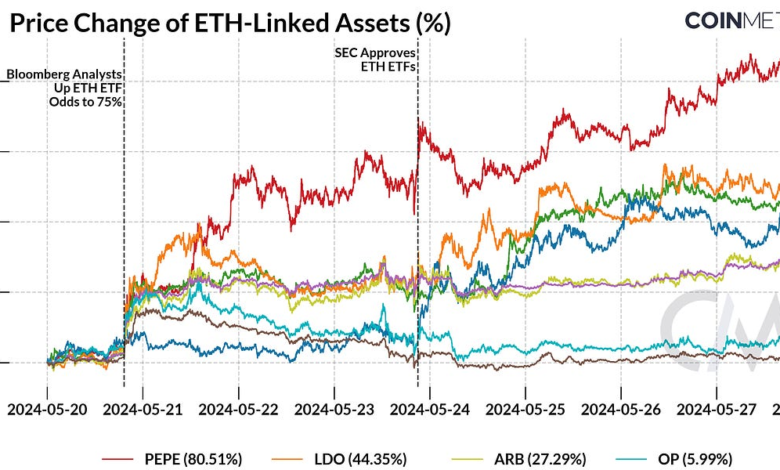

In a shocking flip of occasions, the U.S. Securities & Trade Fee (SEC) has greenlighted spot change traded funds (ETFs) for the second largest digital asset—ETH. The 19b-4 proposals for 8 issuers have been authorised on Could 23rd, together with business giants akin to BlackRock, Constancy, Bitwise, VanEck, and Grayscale. Simply 4 months in the past, we noticed a decade long-quest for a spot bitcoin ETF come to an finish, with 11 issuers coming into the race dubbed the ‘Cointucky Derby’. Months of anticipation constructed as much as the launch, subsequently attracting $12B in web flows, making it the quickest rising ETFs launch in historical past.

Nevertheless, for Ethereum, the circumstances have formed up otherwise. The safety standing of Ethereum and its Proof-of-Stake (PoS) consensus mechanism has been unclear, with the SEC taking actions in opposition to notable business gamers like Coinbase, Consensys, and others. Regardless of this, the odds of a spot Ethereum ETF approval have shifted dramatically from unlikely in January, to a actuality in Could, capping off a pivotal week that marked a big turning level in the regulatory panorama for the digital property business.

On this difficulty of Coin Metrics’ State of the Community, we gauge the market response and community implications in the wake of SEC’s approval for spot Ether ETFs in the US.

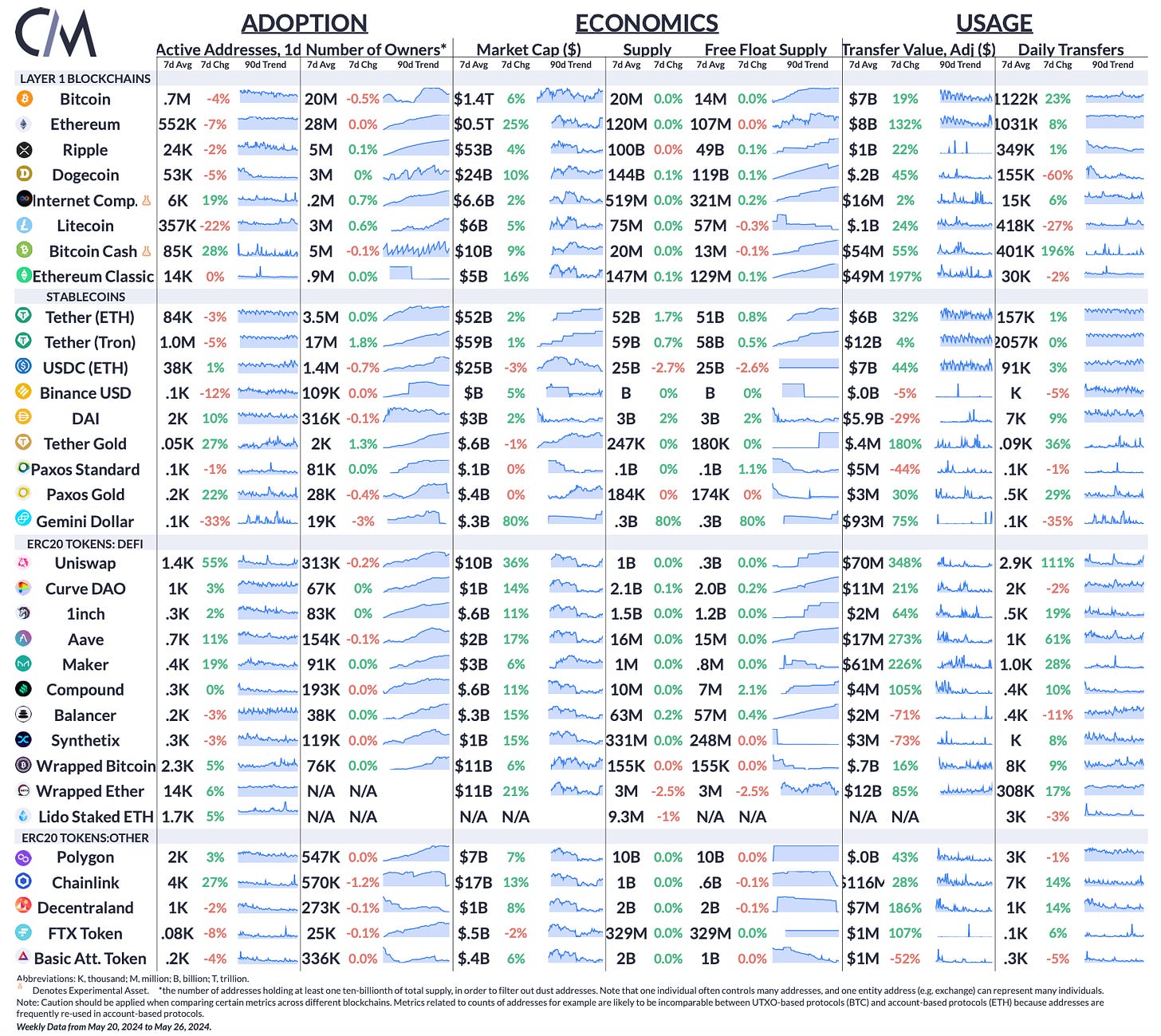

With such a slender time-window to price-in this growth, the market reacted swiftly. Elevated approval odds to 75% triggered a right away response in the market costs of ETH and different Ethereum ecosystem tokens. PEPE (+80%) the largest memecoin on Ethereum, LDO (+44%) the governance token for the liquid staking supplier—Lido, and UNI (+44%), the token behind the Uniswap decentralized change (DEX) supplied the highest returns, whereas ETH adopted with a (+27%) acquire.

Source: Coin Metrics Reference Rates

The efficiency of ETH relative to BTC (ETH/BTC Ratio), which has been on a downtrend trend since September 2022, obtained a a lot wanted increase from this information. Regardless of rising to 0.056 previous to the ETF approval, it wants to interrupt previous key resistance ranges to renew its uptrend and recoup its underperformance relative to different giant cap crypto-assets like BTC & SOL. Whereas the approval of the 19b-4’s has not accelerated returns, the anticipated approval of S-1 registration statements and the subsequent launch of Ether ETFs ought to show to be a powerful tailwind for the wider acceptance of ETH as an investable “commodity” and mainstream adoption of the Ethereum community.

Source: Coin Metrics Reference Rates

The market sentiment round the approval of spot Ether ETFs is mirrored in the narrowing low cost to web asset worth (NAV) for Grayscale’s Ethereum Belief (ETHE). From a considerable ~50% low cost only a 12 months in the past, ETHE’s market value has converged to inside 1.28% of its NAV, with 20% of this discount occurring over a span of 5-days.

Whereas that is reminiscent of Grayscale Bitcoin Belief (GBTC) forward of its ETF conversion in January, the swifter tempo of ETHE’s low cost compression underscores how this growth caught market contributors abruptly. However, traders are strategically positioning themselves in anticipation of ETHE’s conversion to an exchange-traded product upon public launch.

Source: Coin Metrics Institutional Metrics, Grayscale

The record-high $13.8B open curiosity (OI) in ETH futures contracts additionally alerts the presence of elevated hypothesis round Ether ETFs. Whereas nonetheless comparatively decrease than ranges witnessed for BTC previous to the spot bitcoin ETF launch, elevated worth of excellent ETH futures contracts throughout Binance, OKX and the Chicago Mercantile Trade (CME), signifies increased ranges of exercise from retail and institutional contributors alike.

Source: Coin Metrics Market Data Feed

An necessary growth regarding the approval of spot Ethereum ETFs is that they may exclude staking from these merchandise. The lack for issuers to stake ETH, may have potential downstream implications for the provide dynamics of ETH, the well being of Ethereum’s consensus layer and the staking ecosystem as a complete.

As the native asset of the Ethereum ecosystem, Ether (ETH) serves as the spine for its operations and safety. It may well perform as a unit of account, retailer of worth or kind of collateral, with a various economic system constructed round it. This contains the Proof-of-Stake (PoS) consensus mechanism using ETH to safe the community by staking, depositing ETH into sensible contracts that facilitate providers like decentralized finance (DeFi), utilizing ETH to pay transaction charges or just holding ETH in user-owned accounts as a kind of funding or retailer of worth.

Source: Coin Metrics Network Data Pro

At present, out of the whole 120M ETH provide, 27% is staked on the consensus layer, 11% is held in sensible contracts (unstaked), and 61% is held by externally-owned accounts (EOAs). As ETF issuers soak up extra circulating ETH, a bigger portion of the provide is predicted to be locked up, probably decreasing the market’s accessible provide. This discount in circulating provide, coupled with strong demand, may improve the chance of value appreciation for ETH.

At present, 32 million ETH, accounting for 27% of the whole provide, is staked on the Ethereum Beacon Chain by solo staking, staking swimming pools like Lido or custodial staking suppliers like Coinbase. Nevertheless, with the exclusion of staking from ETH ETFs, the ratio of 27% staked to 73% unstaked is unlikely to vary drastically. Staking yield is a key element of the returns on holding ETH. Due to this fact, the exclusion of ETFs from staking could possibly be useful for current stakers, because it prevents the dilution of staking returns that might happen if institutional capital have been to enter the staking ecosystem.

Source: Coin Metrics Network Data Pro

The potential affect on validator yields from consensus rewards (excluding ideas and MEV) may be visualized in the chart above. Assuming Ethereum ETF issuers purchase 10% of ETH provide (12M ETH) and stake 30% of that quantity, the quantity of energetic validators on the consensus layer would improve by 11.25%, from the present 1.00M to 1.12M. Following an inverse relationship, this inflow of validators and staked ETH would end in decrease annual proportion yields (APY’s) for stakers, lowering from roughly 2.9% to 2.7%. Whereas this doesn’t present a precise measure, it illustrates the potential affect on staking yields if extra ETH have been staked by ETF issuers.

It’s additionally necessary to contemplate that modifications to Ethereum’s most efficient stability per validator—presently set at 32 ETH—is about to increase to 2048 ETH in the forthcoming Electra improve, which can alter validator and community safety dynamics.

Moreover, the absence of staking from ETH ETFs may have optimistic implications for Ethereum’s staking ratio and decentralization. At present, with the quickly rising staking ratio, suppliers like Lido and Coinbase maintain a 28% and 13% market share of staked ETH, respectively. If institutional capital have been to take part in staking, Coinbase, as a significant ETF custodian, may probably change into the major beneficiary of staked ETH, exacerbating these centralization dangers.

These issues have prompted discussions in the Ethereum group about adjusting ETH’s issuance rate to mitigate unfavourable externalities akin to stake centralization, decrease competitiveness of solo stakers and inflationary pressures on non-stakers. It stays to be seen whether or not the SEC will permit staking for Ether ETFs in the long term. Nevertheless, by not staking ETH, ETFs may not directly assist preserve a balanced staking ratio and promote a more healthy staking distribution for the time being.

Source: Coin Metrics Network Data Pro

The Ethereum consensus layer’s participation rate of 99.5% means that a big proportion of validators are testifying (voting on) and proposing blocks to keep up the safety of the community. It additionally signifies that staking rewards are being distributed amongst a bigger pool of validators, making certain decentralization. Going ahead, the proposed modifications to issuance and the efficient stability, alongside the SEC’s stance on ETFs with staking will form issues to come back for the Ethereum staking ecosystem.

The previous week marked a pivotal shift in the US regulatory panorama for digital property with the approval of the FIT21 crypto market structure bill and the inexperienced mild for Ether ETFs, to call a number of. Nonetheless, a number of questions stay unanswered: Will Ether ETFs garner funding flows similar to Bitcoin ETFs? How will staking dynamics evolve in mild of these developments? And what will probably be the broader affect for the relaxation of the crypto market? Whereas these stay to be seen, the regulatory readability and elevated accessibility are poised to draw wider demand to ETH and its ecosystem.

Supply: Coin Metrics Community Knowledge Professional

The market capitalization of Ethereum (ETH) rose by 25% over the week, whereas adjusted switch worth elevated by 132% to $8B. A number of ERC-20’s noticed elevated exercise and rising valuations on the again of ETH ETF approvals.

This week’s updates from the Coin Metrics workforce:

-

Coin Metrics is happy to announce the addition of market data support for the Curve decentralized change (DEX) on Ethereum. See this post for extra particulars.

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, when you’ve got any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier points of State of the Community right here.