10 Reasons Why Solana (SOL) Could Skyrocket to $1,000: Analyst Bullish Outlook for SOL

After experiencing a big bounce from a 6-month low of $109, Solana (SOL) has managed to consolidate above the $150 mark up to now 24 hours, showcasing its resilience and power as one of many prime performers out there to this point this 12 months.

The current uptrend out there has injected new optimism into Solana, with crypto analyst Miles Deutscher projecting a powerful 5x to 10x upside potential for SOL, doubtlessly reaching a worth level of $1,000. Deutscher laid out 10 compelling causes behind his bullish outlook on Solana in a complete social media publish.

Reasons Behind Deutscher’s Bullish Stance on Solana

Deutscher first highlights Solana’s constant relative power all through varied market cycles, drawing consideration to its dominant place and growing recognition, particularly throughout the meme coin sector.

He additionally underscores the significance of consideration in driving worth actions, noting Solana’s vital presence throughout the current Bitcoin convention and its constructive affect on SOL’s worth trajectory.

Associated Studying

Deutscher additionally describes Solana as a vibrant crypto ecosystem, likening it to a bustling on line casino the place meme cash thrive, with SOL performing as the important thing change medium. This thriving atmosphere contributes to the general worth throughout the Solana community.

One other essential level in favor of SOL, in accordance to Deutscher, is its market cap differential in contrast to Ethereum, providing speculative alternatives as Solana’s metrics proceed to outperform these of Ethereum.

Deutscher anticipates a possible repricing of ETH, which might additional elevate SOL’s market cap, presumably main to a valuation of $1,320 or $660 per SOL. Moreover, he predicts a breakthrough in SOL/ETH resistance on the weekly chart, signaling a transparent path for additional progress.

Fast Progress in DeFi, Income, and Institutional Adoption

Delving deeper into Solana’s ecosystem metrics, Deutscher highlights its robust place in decentralized finance (DeFi) person progress, surpassing well-established chains like Bitcoin and Tron.

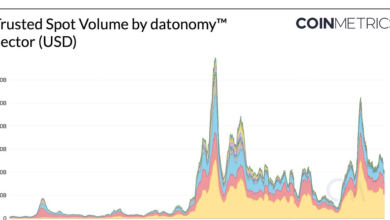

The community’s Whole Worth Locked (TVL) has surged to document highs of $5.367 billion, whereas its decentralized change (DEX) quantity has outpaced Ethereum during the last 30 days.

Furthermore, Solana’s income era has exceeded that of main gamers within the crypto trade, demonstrating its growing prominence within the crypto panorama.

Associated Studying

Deutscher additionally praises Solana’s current improve, Firedancer, aimed toward enhancing scalability, community effectivity, and institutional compatibility, marking a big milestone for the blockchain and additional bolstering optimism for SOL.

Moreover, the analyst factors out asset administration agency Hamilton Lane’s launch of a fund on the Solana community, indicating a rising institutional curiosity within the ecosystem and reinforcing Solana’s credibility.

The potential introduction of a spot Solana ETF, proposed by VanEck, might open the floodgates to institutional capital, paving the best way for better adoption and enlargement throughout the Solana ecosystem.

As of the most recent knowledge, SOL is at the moment buying and selling at $153, a slight decline from its current weekly excessive of $163.

Featured picture from DALL-E, chart from TradingView.com