Bitcoin Investors Again Show Extreme Fear As BTC Slips To $59,000

Information reveals the Bitcoin market sentiment has taken to excessive concern once more because the asset’s value has seen a retrace to the $59,000 mark.

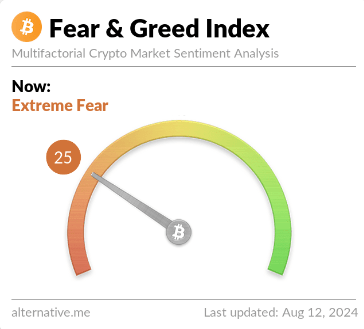

Bitcoin Fear & Greed Index Suggests Market Now Extraordinarily Fearful

The “Fear & Greed Index” is an indicator created by Various that tells us in regards to the common sentiment that’s at the moment current within the Bitcoin and wider cryptocurrency markets.

The index makes use of the next 5 elements to find out the sentiment: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments. It then represents this estimation utilizing a scale that runs from 0-100

Associated Studying

All values of the indicator past the 53 mark suggest that traders are exhibiting greed, whereas these beneath 47 recommend the presence of concern out there. The area between these two cutoffs naturally corresponds to a impartial mentality.

In addition to these three territories, there are additionally two particular sentiments referred to as the acute concern and the acute greed. The previous of those happens at 25 and beneath, whereas the latter at 75 and above.

Now, here’s what the most recent worth of the Bitcoin Fear & Greed Index appears to be like like:

As is seen above, the indicator has a price of 25 for the time being, that means that the market is simply inside the acute concern zone. It is a fairly important change from how the metric was simply yesterday.

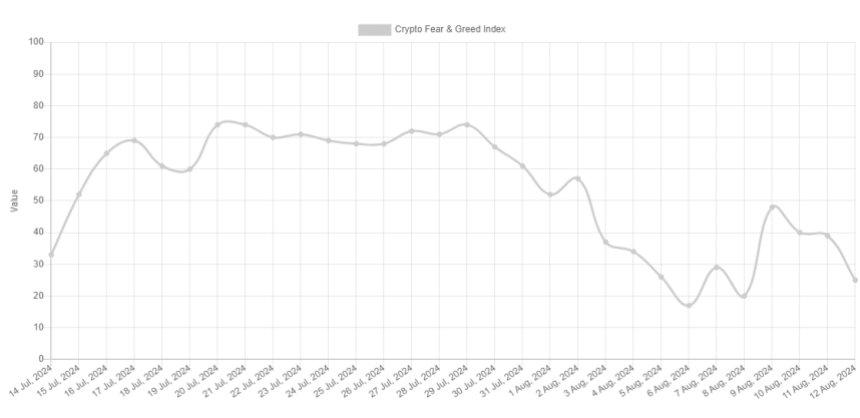

The beneath chart reveals the pattern within the Bitcoin Fear & Greed Index over the previous month.

From the graph, it’s obvious that the Fear & Greed Index had been at a excessive stage close to the tip of July, however in the course of the bearish momentum that had adopted within the BTC value, the metric’s worth had additionally gone by a notable drop.

On the twenty ninth, the index was at a price of 74, that means it was proper on the sting of utmost greed, however by the sixth of this month, it had gone into the acute concern zone with a price of 17.

The asset’s latest restoration did result in an enchancment to the sentiment, with the index touring again as much as 48. It will seem, although, that this development couldn’t final, because the sentiment has once more declined into excessive concern, because the BTC value has seen a retrace.

Associated Studying

The truth that the sentiment has worsened, nonetheless, could not truly be a nasty signal for the cryptocurrency. Traditionally, Bitcoin has tended to maneuver in opposition to the expectations of the bulk, and the acute areas are the place this expectation is probably the strongest.

As such, tops and bottoms have tended to kind each time the market has been inside these zones. With the Fear & Greed Index now again inside excessive concern, It’s attainable {that a} backside could possibly be more likely to happen. It now stays to be seen if the asset’s decline ends with this drop, or if there may be extra to return.

BTC Value

Bitcoin seems to already be exhibiting indicators of a rebound as its value has climbed again as much as $59,700 from its low of beneath $58,000 earlier within the day.

Featured picture from Dall-E, Various.me, chart from TradingView.com