A Primer on Blockchain Network Health

Get the perfect data-driven crypto insights and evaluation each week:

By: Matías Andrade, Kevin Bornatsch

Key Takeaways:

-

Key well being metrics embrace block time consistency, transaction inclusion charges, measures of centralization, and validator participation—informing essential institutional choices.

-

Elevated institutionalization has heightened the significance of community efficiency, making well being monitoring important for danger administration.

-

Superior market surveillance and danger administration instruments have gotten important for establishments within the evolving crypto panorama.

Network well being has develop into a essential focus for institutional members within the cryptocurrency house. As digital asset markets mature and entice extra vital gamers, the demand for dependable, real-time metrics to evaluate community efficiency and stability has grown exponentially. On this week’s situation of Coin Metrics’ State of the Network, we discover the significance of community well being, its impression on institutional operations, and the way superior surveillance instruments are shaping danger administration methods within the crypto ecosystem.

Network well being is a complete idea with diverse interpretations throughout the business. On the highest stage, Coin Metrics considers community well being to incorporate all elements that point out if the community is working as anticipated. This could embrace elements corresponding to: if blocks are being produced as anticipated (i.e., is the blockchain useful and able to processing new transactions), if the mempool is receiving transactions at a traditional price (i.e., is the community present process a DDOS assault), if the variety of transactions broadcast are inside the anticipated vary and if provide for the native asset that is getting used to safe the community is behaving as anticipated (i.e., do financial safety concerns for the community proceed to use).

Whereas “Network Health” is a broad time period, we think about it probably the most basic and overarching indicator of community performance. Vital deviations from anticipated values in any of those areas might sign essential underlying community points with far-reaching implications.

In conventional monetary markets, establishments rely on quite a lot of indicators to gauge market well being and inform their methods. Equally, within the crypto house, a set of key metrics has emerged to measure the robustness and effectivity of blockchain networks. These embrace:

-

Block Time Consistency: Common block occasions are indicative of a well-functioning community.

-

Transaction Inclusion: Common and well timed inclusion of transactions in blocks displays the community’s effectivity in processing transactions. Excessive inclusion charges of transactions within the mempool recommend a wholesome, uncongested community.

-

Decentralization & Censorship Resistance: Provide distribution exhibits the decentralization of the asset whereas compositions of consensus members (i.e., miners or validators) is an indicator of how decentralized consensus is and by extension censorship resistant a community is.

-

Validator Participation Charges: Essential in Proof-of-Stake networks like Ethereum, excessive participation charges point out a safe and decentralized community.

For institutional clients, these metrics aren’t simply numbers—they’re important indicators that inform essential operational and funding choices, whether or not it is for tokenizing a fund or launching a layer-2. Every of those metrics supplies essential insights into totally different elements of community efficiency.

The cryptocurrency market’s growing institutionalization has raised the stakes for community efficiency and reliability. Institutional gamers, together with funding funds, banks, and monetary service suppliers, function in an atmosphere the place even minor disruptions can have vital penalties, as evidenced by the reluctance of institutional actors to undertake networks with downtime or different sources of execution danger.

Contemplate the next eventualities:

-

A hedge fund executing a time-sensitive arbitrage technique throughout a number of exchanges and networks.

-

A custodian service making certain the safe switch of enormous volumes of belongings for purchasers in a well timed method whereas minimizing charges paid to the community.

-

A DeFi protocol managing billions in whole worth locked (TVL) throughout numerous blockchain networks .

In every of those instances, community well being is not only a technical consideration—it is a essential enterprise issue. Establishments require not simply excessive efficiency, but additionally assurances and predictability. They should know that transactions shall be processed inside anticipated timeframes, that the community can deal with sudden spikes in exercise, and that there are not any looming safety threats that might compromise their operations or belongings.

That is the place complete community well being monitoring turns into indispensable. By gaining access to real-time, correct information on community efficiency, establishments could make knowledgeable choices about transaction timing and payment allocation, present higher service and assurances to their purchasers, and handle danger extra successfully throughout their digital asset operations.

Within the part forward, we lay out the most important subcategories that comprise community well being, together with consensus well being and centralization for Proof-of-work (PoW) and Proof-of-stake (PoS) networks.

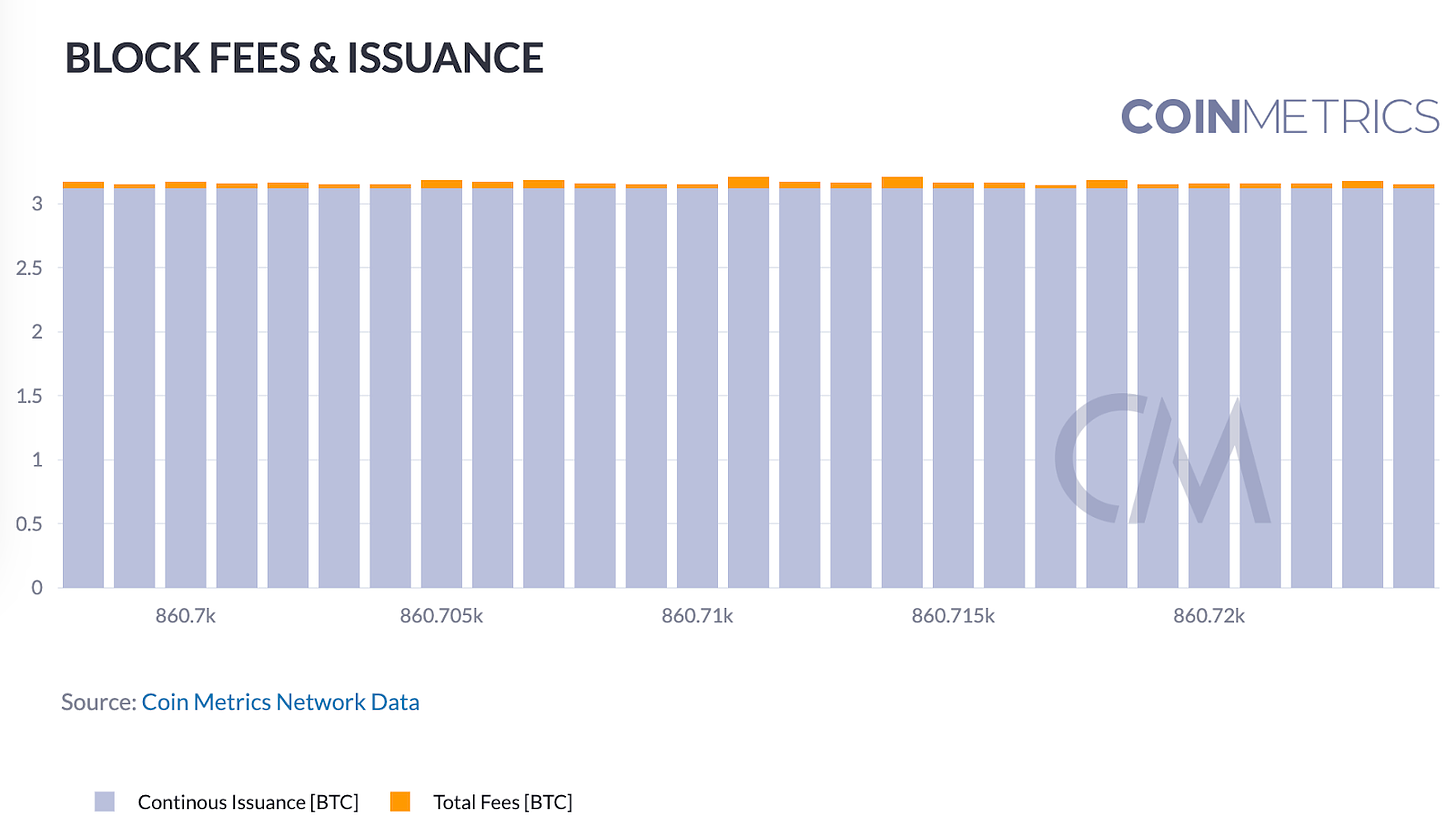

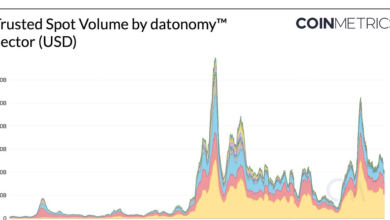

One key indicator of PoW consensus well being is the connection between block charges and issuance, which supplies insights into the community’s financial mannequin and miner incentives. The chart beneath illustrates the exceptional stability of block charges and issuance for Bitcoin over current blocks (860,545 to 860,57). This consistency is a optimistic signal for Bitcoin’s community well being, indicating a balanced and predictable reward construction for miners which safe the community.

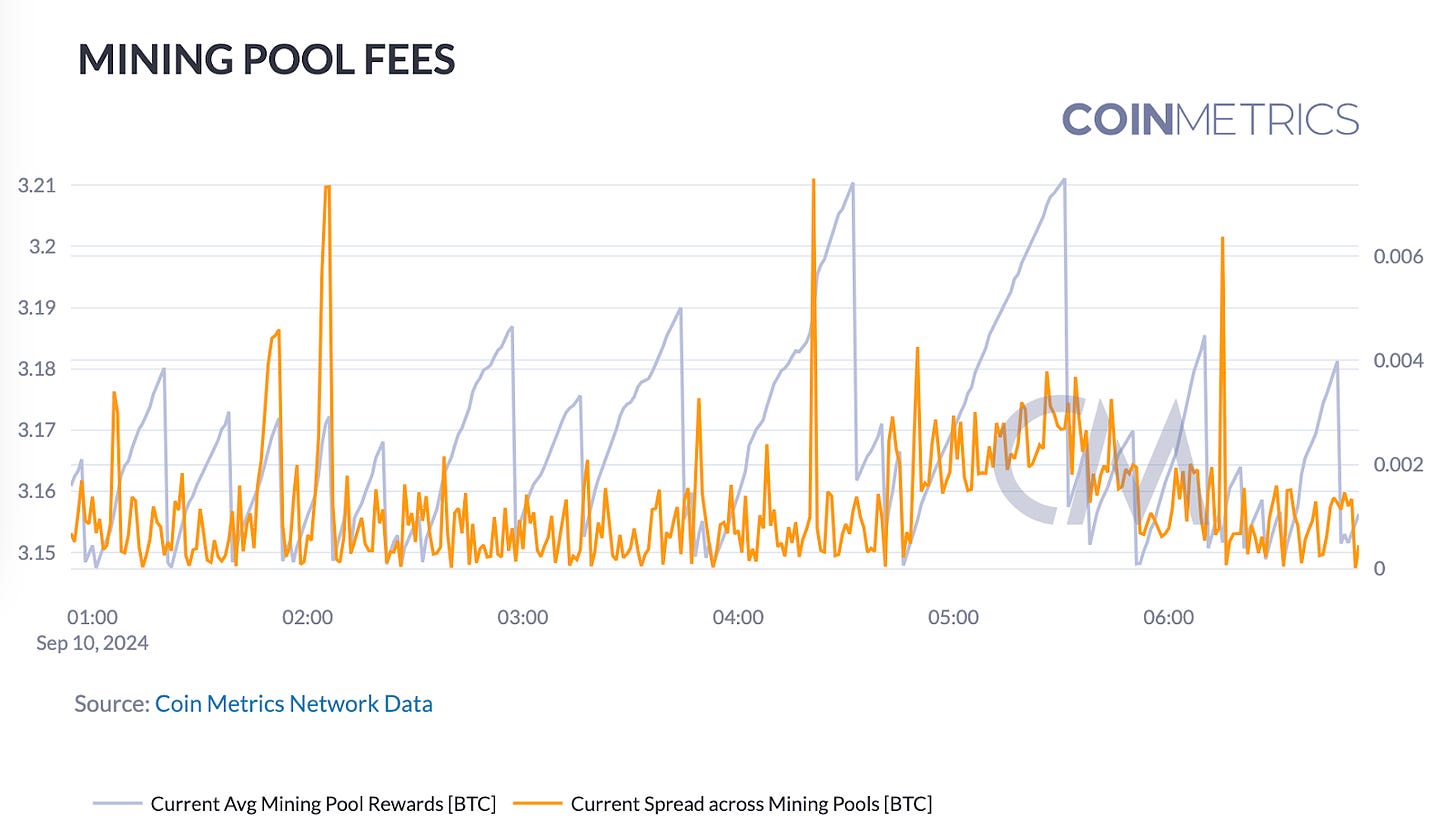

Mining pool dynamics play an important position within the decentralization and total well being of Proof-of-Work networks like Bitcoin. The chart beneath illustrates two key metrics: the present common mining pool rewards (in BTC) and the unfold throughout mining swimming pools.

The typical mining pool rewards (proven in blue) fluctuate between roughly 3.14 and three.2 BTC per block. These fluctuations seemingly correspond to variations in transaction charges included in blocks. The unfold throughout mining swimming pools (in orange) stays comparatively steady, hovering near zero, with just a few notable spikes. These spikes might point out short-term shifts in hash price distribution or strategic payment changes by sure swimming pools. The general stability suggests a aggressive and comparatively balanced mining ecosystem. However, a constant, elevated unfold throughout mining swimming pools might point out that sure mining swimming pools are both underneath performing or that particular mining swimming pools have entry to a set of transactions that the remainder of mining swimming pools should not have entry to.

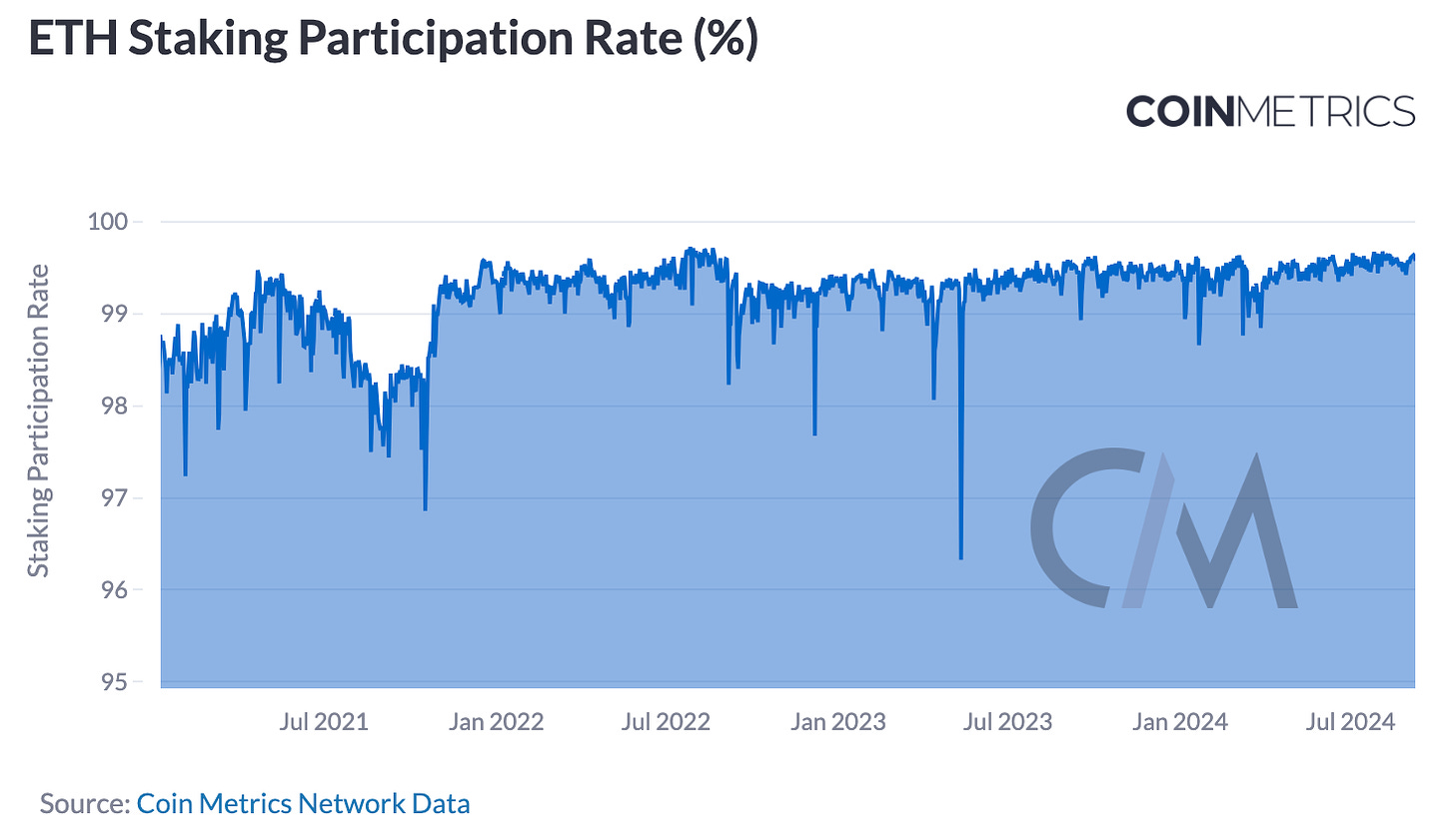

Proof-of-Stake networks rely on validator participation and adherence to protocol guidelines to keep up consensus and safety. The charts beneath present essential insights into the well being and stability of Ethereum.

The chart beneath exhibits the proportion of energetic validators which might be efficiently testifying to blocks. The speed constantly hovers above 99%, indicating a extremely engaged validator set. Nonetheless, we observe periodic dips. The fluctuations pictured beneath, whereas minor, might symbolize short-term community points, validator upkeep, or different short-term disruptions, which previously have been noticed because of bugs in validator code and outages in cloud service providers, such as AWS.

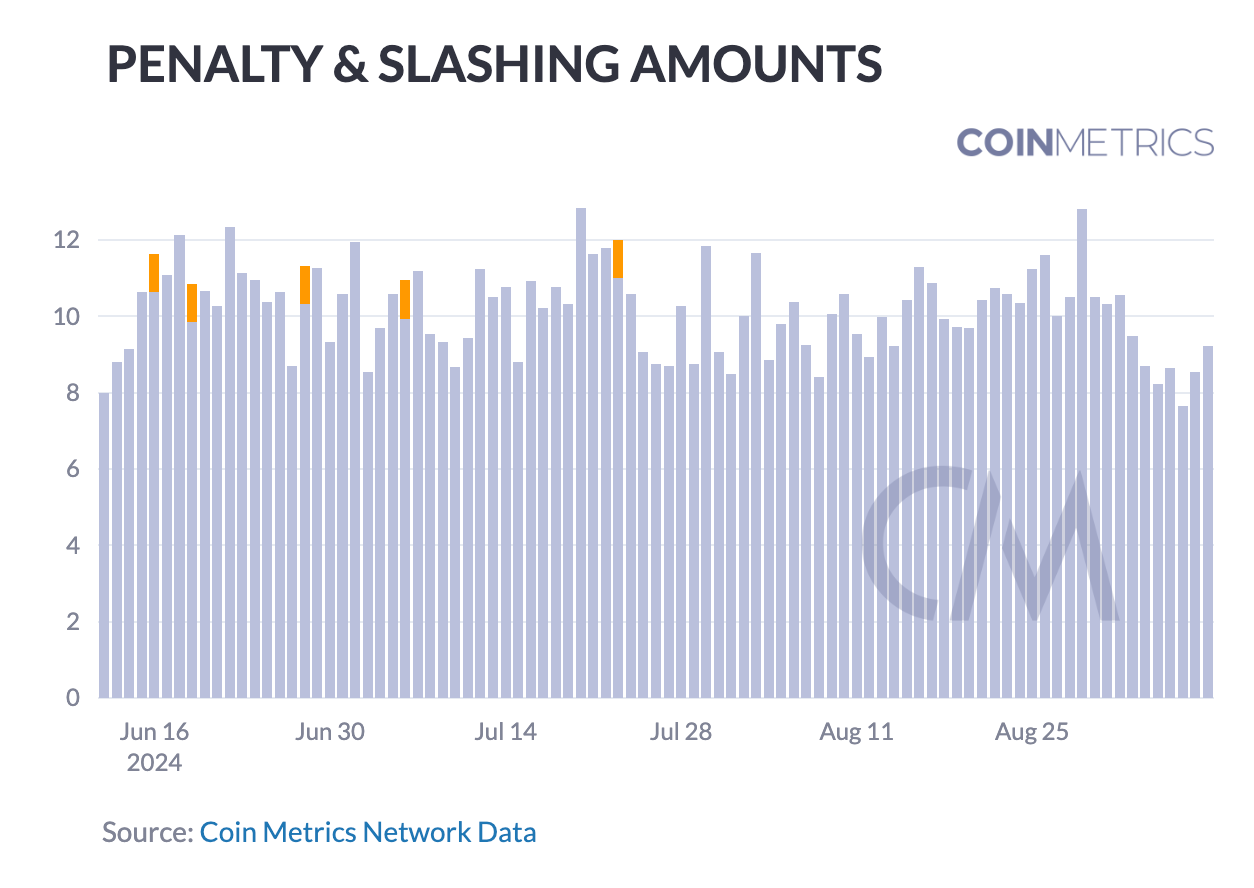

The chart beneath supplies a view of penalty and slashing exercise within the Ethereum community, illustrating the community’s disincentives towards underperforming or misbehaving validators. The chart exhibits common penalty occasions, seemingly reflecting missed attestations or proposals, aggregated throughout the ~1.07M energetic validators. Slashing occasions happen lots much less steadily, indicating that validators are total performing their duties with none main disruptions or malicious conduct.

If Ethereum was underneath assault, or if it was going through mass outages amongst validators (which might not inherently have an effect on community liveness), one would be capable of reply quickly by monitoring these metrics.

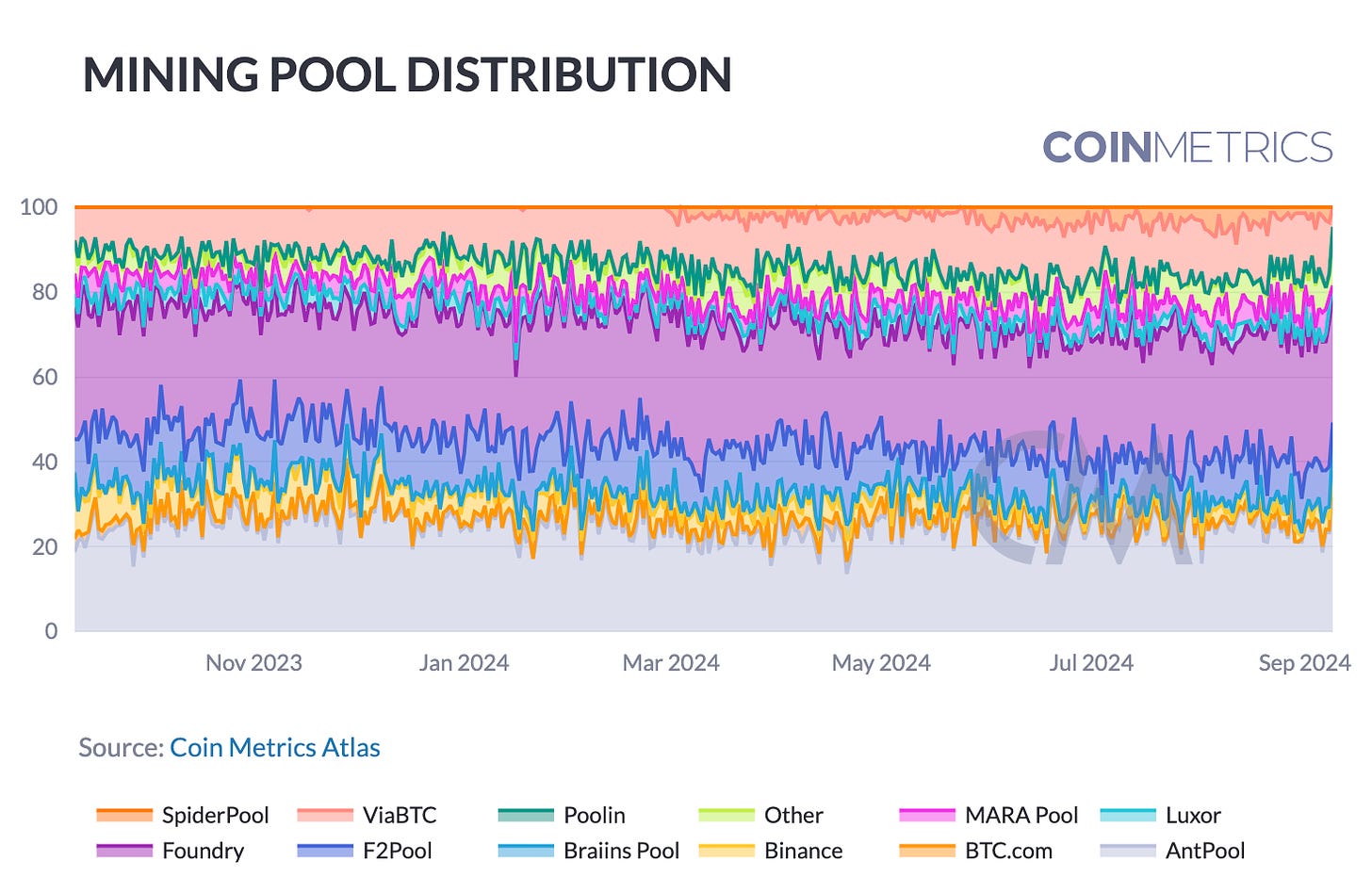

The well being and safety of blockchain networks closely rely on the distribution of mining energy and block manufacturing. These charts present essential insights into the centralization tendencies of Bitcoin mining swimming pools and Ethereum block builders over the previous 12 months.

The chart beneath showcases the mining pool distribution for Bitcoin from September 2023 – early September 2024, revealing a number of noteworthy tendencies. Foundry, AntPool and MARA are evidenced as constant hashrate leaders. Notably, the presence of quite a few smaller miners, represented by “Other,” has remained comparatively steady, suggesting a wholesome stage of decentralization inside the Bitcoin mining ecosystem.

Future tendencies and consistency within the distribution of mining energy is a essential metric to comply with because it reduces the chance of censorship and potential manipulation. Whereas the general distribution is the important thing issue to watch, earlier analysis analyzing on-chain flows between miners has proven there that there may be further elements that decision into query into the independence of mining pool operations.

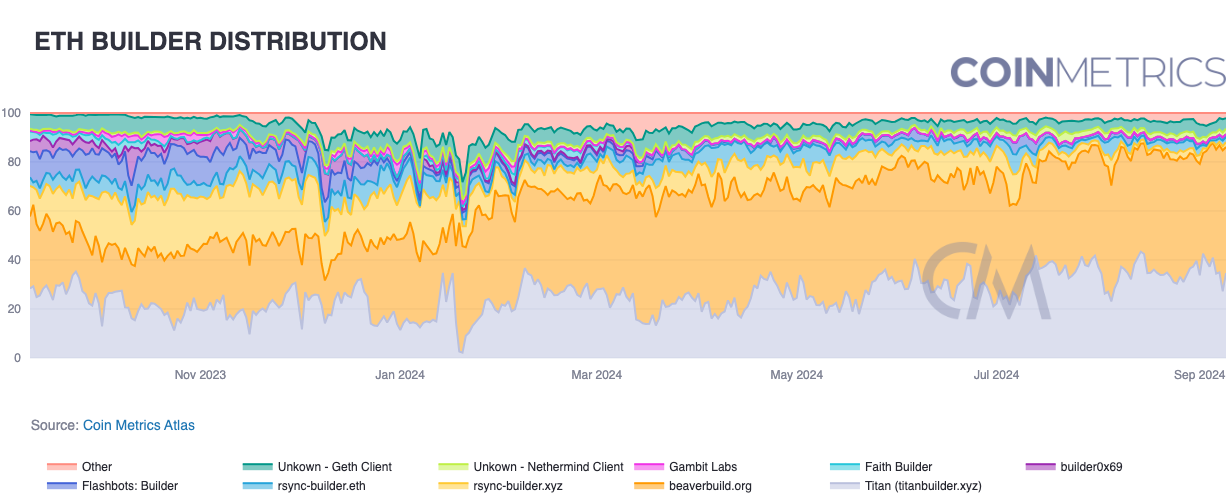

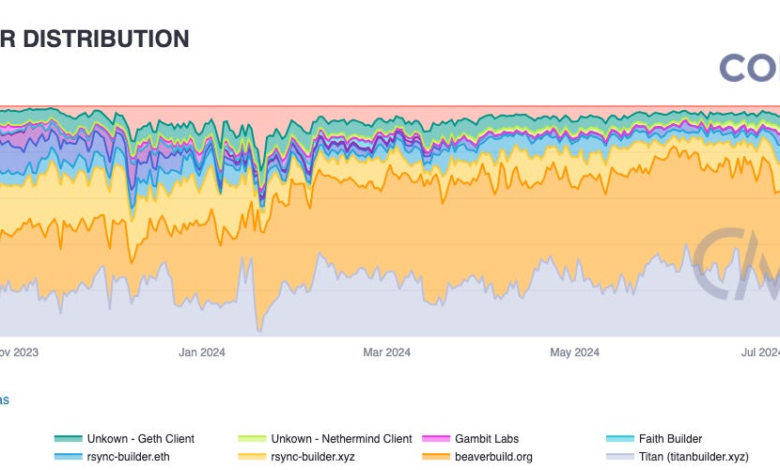

The underside chart exhibits the distribution of Ethereum block builders, revealing some attention-grabbing tendencies. Notably, beaverbuild.org and titanbuilder.xyz have emerged as the 2 most dominant block builders, significantly from early 2024 onwards, accountable for constructing practically 80% of all blocks by September 2024. Regardless of this focus, the presence of a number of smaller builders suggests an ongoing competitors within the block constructing house. Nonetheless, a development in direction of centralization is clear, as just a few main builders have consolidated their positions over time.

This gradual consolidation of block constructing energy warrants shut monitoring, because it might have potential implications for transaction ordering and Miner Extractable Worth (MEV) inside the Ethereum community, together with time-attacks and transaction censorship.

The crypto market’s speedy evolution has introduced with it a brand new set of dangers and challenges. For institutional members, navigating these waters requires not simply an understanding of community well being, but additionally superior instruments for market surveillance and danger administration. Coin Metrics’ suite of information merchandise stands on the forefront of this want, providing establishments the flexibility to watch community well being, assess liquidity danger utilizing Coin Metrics’ order e-book information and liquidity metrics throughout numerous buying and selling pairs and exchanges, and optimize operational effectivity, scale back downtime and decrease transaction failures.

As we glance to the long run, the position of community well being monitoring and market surveillance within the institutional crypto house is about to develop even additional. The establishments that thrive shall be people who not solely perceive the significance of those metrics but additionally actively incorporate them into their decision-making processes. For institutional members, staying forward of this curve is not simply a bonus—it is a necessity.

Source: Coin Metrics Network Data Pro

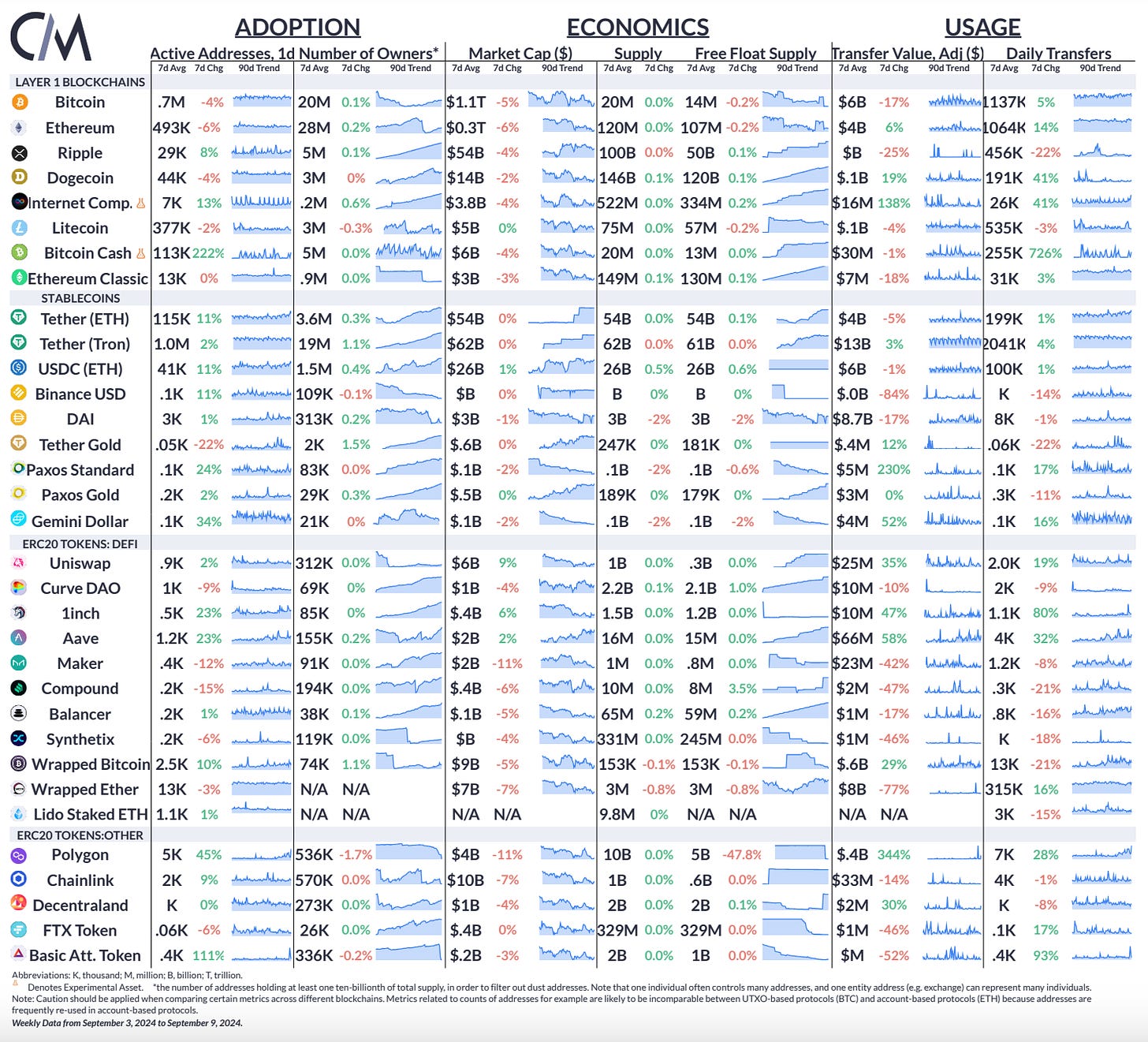

A number of ERC-20s together with 1INCH and AAVE displayed heightened exercise, whereas energetic addresses for Polygon’s MATIC elevated by 45% as customers migrate, bridge or swap to POL amid its transition.

This week’s updates from the Coin Metrics crew:

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Network in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Network right here.