A Short Guide to Bitcoin On-Chain Data for ETF Newcomers

Get the most effective data-driven crypto insights and evaluation each week:

By: Kyle Waters

Final week’s approval and launch of spot bitcoin ETFs like BlackRock’s IBIT, Constancy’s FBTC, and an extra eight further spot ETF merchandise, marked a historic second in Bitcoin’s historical past. The ETFs present buyers with a brand new possibility to entry bitcoin via conventional brokerage accounts whereas decreasing the friction for asset managers to acquire publicity to BTC. In complete, the ETFs have now traded ~$10B throughout three full buying and selling days, with BlackRock’s providing seeing shut to half a billion {dollars} value of inflows in two days’ time.

With larger accessibility, Bitcoin is certain to attain new corners of the monetary world. To the uninitiated taking their first look, Bitcoin might sound daunting. Phrases like UTXO, Byzantine Generals, and Proof-of-Work are sometimes tossed round, signaling a substantial amount of technicality when researching Bitcoin the protocol. However a particular characteristic of bitcoin the asset lies within the nature of its information, which is transparently out there from the blockchain. This can be a sort of information generally referred as “on-chain” information within the trade lexicon. The character of the Bitcoin blockchain permits for the exact monitoring of every coin’s actions, providing a stage of transparency and evaluation hardly ever seen in different asset lessons. On this version of State of the Community, we flip our consideration to the cohort of ETF newcomers now taking a more in-depth have a look at bitcoin. Our focus is to introduce or reacquaint some to the sphere of on-chain information, underscoring the properties that make bitcoin an intriguing asset to analysis.

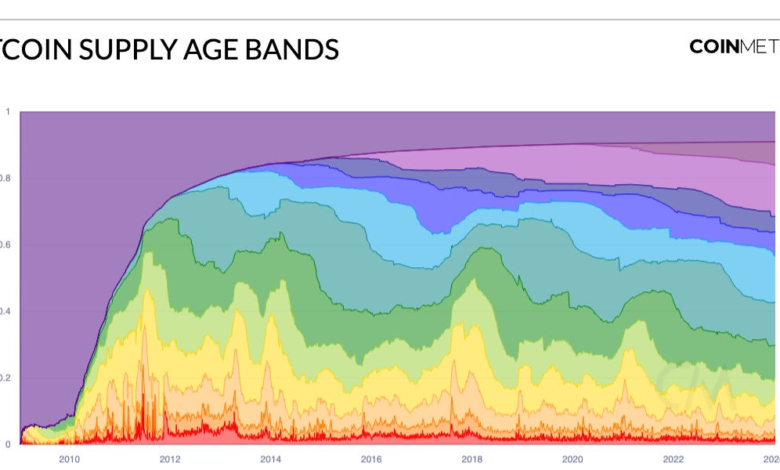

Bitcoin age distribution bands, typically referred to as “HODL waves,” are instrumental in monitoring Bitcoin’s velocity and provide liquidity. HODL waves group bitcoin’s provide based mostly on the period since its final motion, offering a macro perspective of the shifts in bitcoin’s provide distribution over time. For instance, the underside pink band reveals that about 1-2% of the whole bitcoin provide tends to transfer on-chain in a given day, whereas the highest darkish purple band signifies that about 9% of the bitcoin provide has by no means moved because it was mined—a big portion of which is believed to have been mined by Satoshi within the early days of Bitcoin’s historical past.

Source: Coin Metrics Network Data Pro

Usually, the variety of distinctive house owners of an asset is a troublesome information level to verify. There are some nuances (one tackle doesn’t at all times map to one particular person); nevertheless, we are able to get a proxy for Bitcoin adoption with the variety of addresses holding some stability quantity. The chart under reveals the whole variety of Bitcoin addresses with no less than 1 BTC, which lately surpassed 1M, rising from 800K in 2022.

Source: Coin Metrics Network Data Pro

Questions on Bitcoin’s purported utility will not be unusual amongst its critics. Nevertheless, a transparent quantitative demonstration of its utilization may be noticed by inspecting the quantity settled on-chain every day. Right now, Bitcoin settles billions of {dollars} on daily basis with none middleman, rivaling another value-transfer techniques. For instance, on the day of the spot ETF launch, Coin Metrics noticed $11B value of bitcoin transferring on the blockchain, after adjusting for change and pass-through accounts.

Source: Coin Metrics Network Data Pro

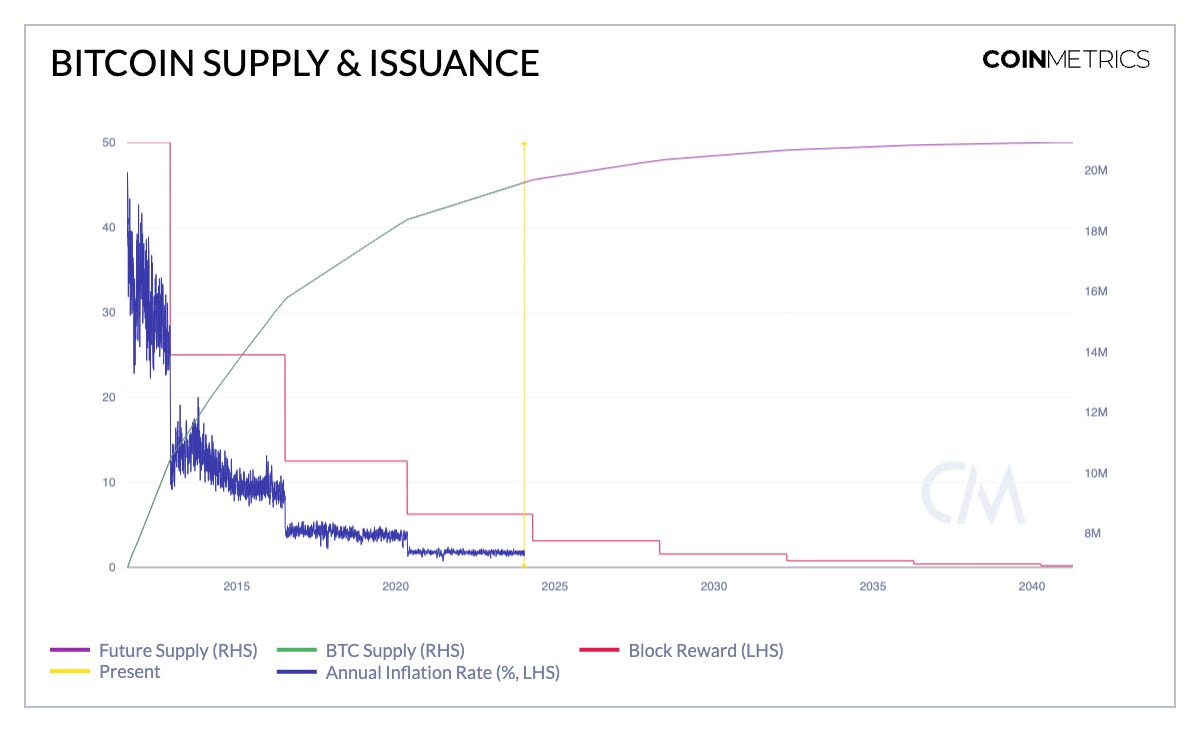

Bitcoin’s clear and predetermined issuance schedule is considered one of its defining traits. Simply auditable, we are able to completely predict the long run bitcoin provide and declining inflation price because it progresses via its halving schedule, the place issuance is lower in half roughly each 4 years. The 4th halving is shortly approaching this yr, and is ready for late April.

Source: Coin Metrics Network Data Pro

Realized capitalization, considered one of Coin Metrics’ flagship metrics introduced in 2018, completely demonstrates the distinctive analyses supplied by blockchain information. Realized cap is conceptually comparable to a conventional market cap, however with a spin. As a substitute of multiplying your complete provide by the present market worth, realized cap is calculated by valuing every unit of bitcoin individually based mostly on the value on the time it final moved on-chain. Which means that cash which moved in periods when costs had been decrease are discounted. Realized cap may be considered a gross approximation of bitcoin’s combination value foundation, and offers a extra long run and sluggish transferring measurement of bitcoin’s complete valuation. Bitcoin’s realized cap as we speak stands at $440B, in contrast to its market cap of $830B.

Source: Coin Metrics Network Data Pro

Constructing off realized cap, the market worth to realized worth (MVRV) ratio is one other on-chain metric carrying attention-grabbing properties. The MVRV is discovered by dividing bitcoin’s market capitalization by its realized cap. Although future efficiency needn’t replicate the previous, traditionally, MVRV has been a dependable gauge of market cycles as a result of it could possibly present perception into the habits of bitcoin house owners with income or losses.

A excessive MVRV ratio means that bitcoin’s market worth is considerably larger than realized worth, indicating that many holders may be in substantial revenue and will probably promote, main to market tops. Conversely, a low MVRV ratio has steered that the realized worth is holding its floor in contrast to market worth, signaling that the capitulation has ended, traditionally coinciding with market bottoms. With our earlier remark in thoughts relating to future efficiency, MVRV values of 1 and 4 have traditionally corresponded to market lows and highs, respectively.

Source: Coin Metrics Network Data Pro

As acknowledged earlier, each Bitcoin transaction recorded for the reason that community’s inception is maintained on a publicly shared ledger that anybody can entry by working their very own Bitcoin node. This permits node operators like Coin Metrics to assemble detailed breakdowns of the bitcoin provide, like under. The chart under reveals the quantity of bitcoin held by that tackle measurement. Whereas this transparency is exceptional in contrast to different property, it additionally permits for elevated scrutiny on the focus of provide, which may be simply misjudged with out further nuance.

Source: Coin Metrics Network Data Pro

Fifteen years in the past on January eleventh, 2009, Bitcoin had solely simply emerged as a nascent open-source challenge, its consumer base consisting of only a small cadre of cryptographers. There have been no crypto exchanges, no marketplaces to purchase or promote bitcoin, and the digital foreign money’s existence was principally unknown to the world. Fifteen years on, the launch of the primary spot bitcoin ETFs within the US final week marks an unbelievable milestone in Bitcoin’s evolution from thought to the linchpin and driving pressure behind a complete rising digital asset class. As Bitcoin continues to evolve and mature, the crucial to critically analysis it grows correspondingly. This text gives a basis to begin this on-chain journey.

To comply with the information used on this piece and discover our different on-chain metrics take a look at our charting tool, formula builder, correlation tool, and mobile apps. You may as well discover all of Coin Metrics’ analysis insights right here: https://coinmetrics.io/insights/

Supply: Coin Metrics Community Data Professional

The free float provide of Tether (USDT) throughout the Ethereum and Tron networks has hit 93B, persevering with its upward march previous new all-time highs. This coincides with remarks from Cantor Fitzgerald CEO Howard Lutnick on the World Financial Discussion board’s annual gathering in Davos, Switzerland. In a conversation with Bloomberg, Lutnick indicated that Cantor’s evaluation corroborates the backing of USDT by Tether’s property, aligning with the issuance figures recorded on-chain.

This week’s updates from the Coin Metrics workforce:

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary from the Coin Metrics workforce, wealthy visuals, and well timed information.

As at all times, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.