An Update on Layer-1 Networks

Get the most effective data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matías Andrade

-

Layer–1 tokens surged early in 2024 however have since misplaced momentum, with YTD returns falling beneath 50% throughout most networks’ native tokens.

-

A decline in on-chain and market exercise has led to decreased whole charges throughout main Layer–1s, together with Ethereum ($1.15M), Solana ($724K), and Bitcoin ($463K)

-

Excessive-throughput networks like Solana reveal distinct transaction patterns, marked by extra frequent, lower-value transactions in comparison with Bitcoin and Ethereum.

The panorama of Layer–1 blockchains has advanced considerably lately. Networks like Bitcoin, Ethereum and Solana kind the spine of the cryptocurrency ecosystem, every providing distinctive approaches to scalability, safety, and decentralization. Because the demand for blockchain-based purposes grows, L1 networks are repeatedly adapting to satisfy the challenges of elevated transaction volumes, vitality effectivity, and interoperability. The competitors amongst these networks has pushed speedy technological developments, from Ethereum’s transition to Proof of Stake with the Merge, to Solana’s focus on high-speed transactions, and Avalanche’s customizable subnet structure.

On this week’s difficulty of Coin Metrics’ State of the Community, we take a dive into Layer–1 networks, evaluating their efficiency, transaction traits, and payment markets.

On the onset of 2024, the Layer–1 sector—representing base layer blockchain networks—garnered vital consideration. On the again of the market’s resurgence alongside Solana’s speedy development publish the FTX debacle, mindshare appeared to shift onto different layer–1’s with their differing approaches coming to the forefront. Particularly, dialogue round built-in networks like Solana in comparison with modular scaling approaches taken by Ethereum, different digital machines and high-performance blockchains like Aptos and Sui grew to become a outstanding narrative.

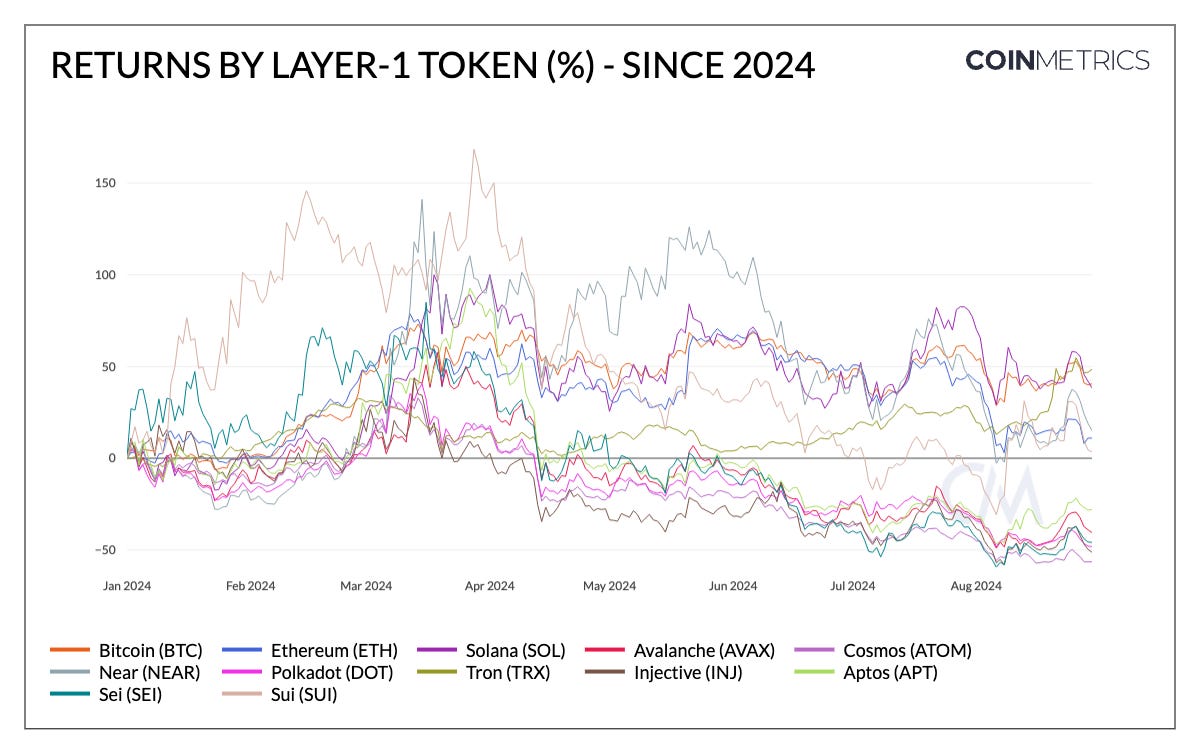

Source: Coin Metrics Reference Rates

That is evident within the chart above, during which YTD returns for layer–1 tokens collectively hit their peak in March. Regardless of this synergic mindshare, there have been a number of areas of dispersion amongst these tokens, with built-in, high-throughput networks like Solana, Sui, Sei, and Aptos main good points alongside NEAR, which benefited from its affiliation with the AI sector. Whereas a cohort of those tokens have entered destructive territory because the market has consolidated, others like Solana, Tron, Ethereum, NEAR and SUI stay constructive YTD.

Market sentiment and architectural trade-offs will possible proceed to form the perceived worth of L1 native tokens, however in the long run—it is essential to think about elementary metrics that drive utilization and worth, which can stem from their nature analogous to rising market currencies, commodity-like traits, or equity-like traits stemming from cash-flows.

As suppliers of finite blockspace, Layer–1 blockchains and their validators (in PoS) or miners in (PoW), are compensated by transaction charges paid by customers who need to have their transactions included within the community. Whereas payment mechanisms can differ throughout L1s, they’re a supply of incentive for community members and income for Layer–1 networks, usually paid within the community’s native token (i.e., BTC, ETH, SOL).

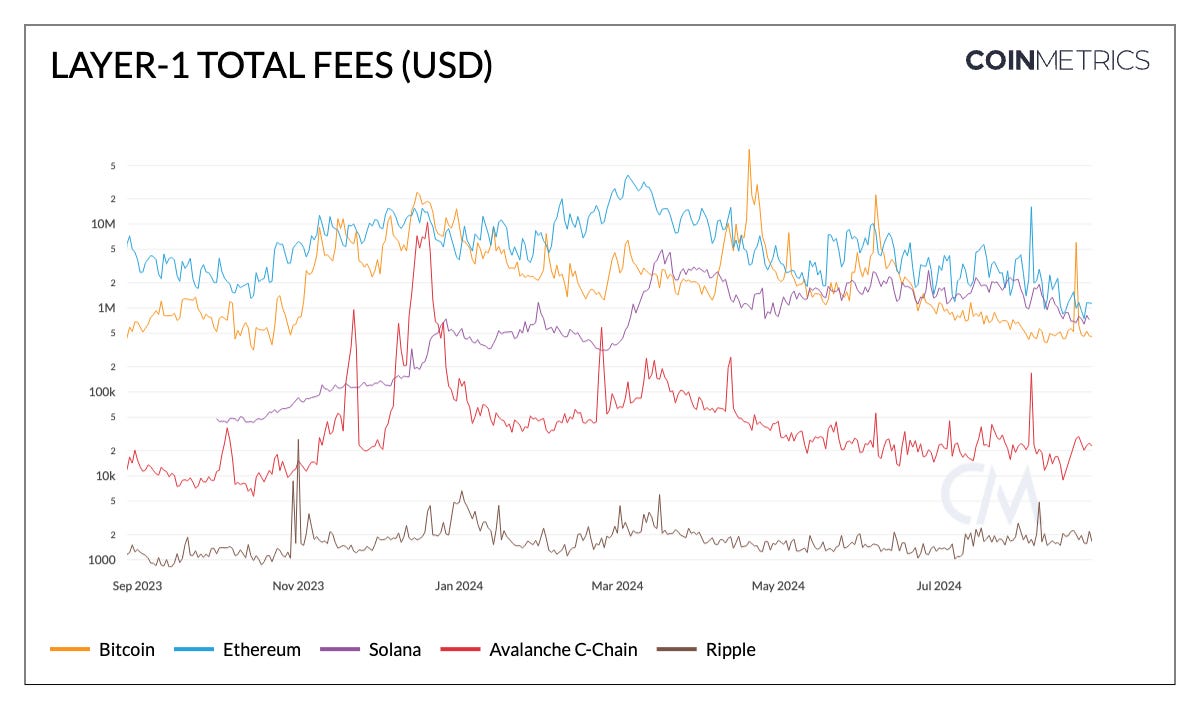

Source: Coin Metrics Network Data Pro

As depicted within the chart above, whole charges throughout L1s differ based mostly on blockspace demand with market occasions and payment buildings influencing this variability. As an example, Ethereum has traditionally maintained the best whole charges, averaging round $4–5M underneath common market situations, with occasional spikes during times of excessive community exercise. That is observable in March, when whole charges reached $38M, and on August 5th, when on-chain exercise surrounding the Yen carry-trade introduced charges to $16M.

Relative to historic figures, whole charges on Ethereum have declined, with Solana, regardless of that includes decrease common transaction charges, has gained floor by supporting a better frequency of lower-value transactions—albeit trending decrease not too long ago. On Bitcoin, community particular occasions like Bitcoin’s 4th halving, launch of Runes and most not too long ago, the introduction of Bitcoin staking, have led to periodic spikes in transaction charges as a share (%) of miner income.

It is usually necessary to consider burn and issuance mechanisms adopted by L1s which immediately affect provide dynamics of their native tokens—impacting holders/stakers through shortage or staking rewards.

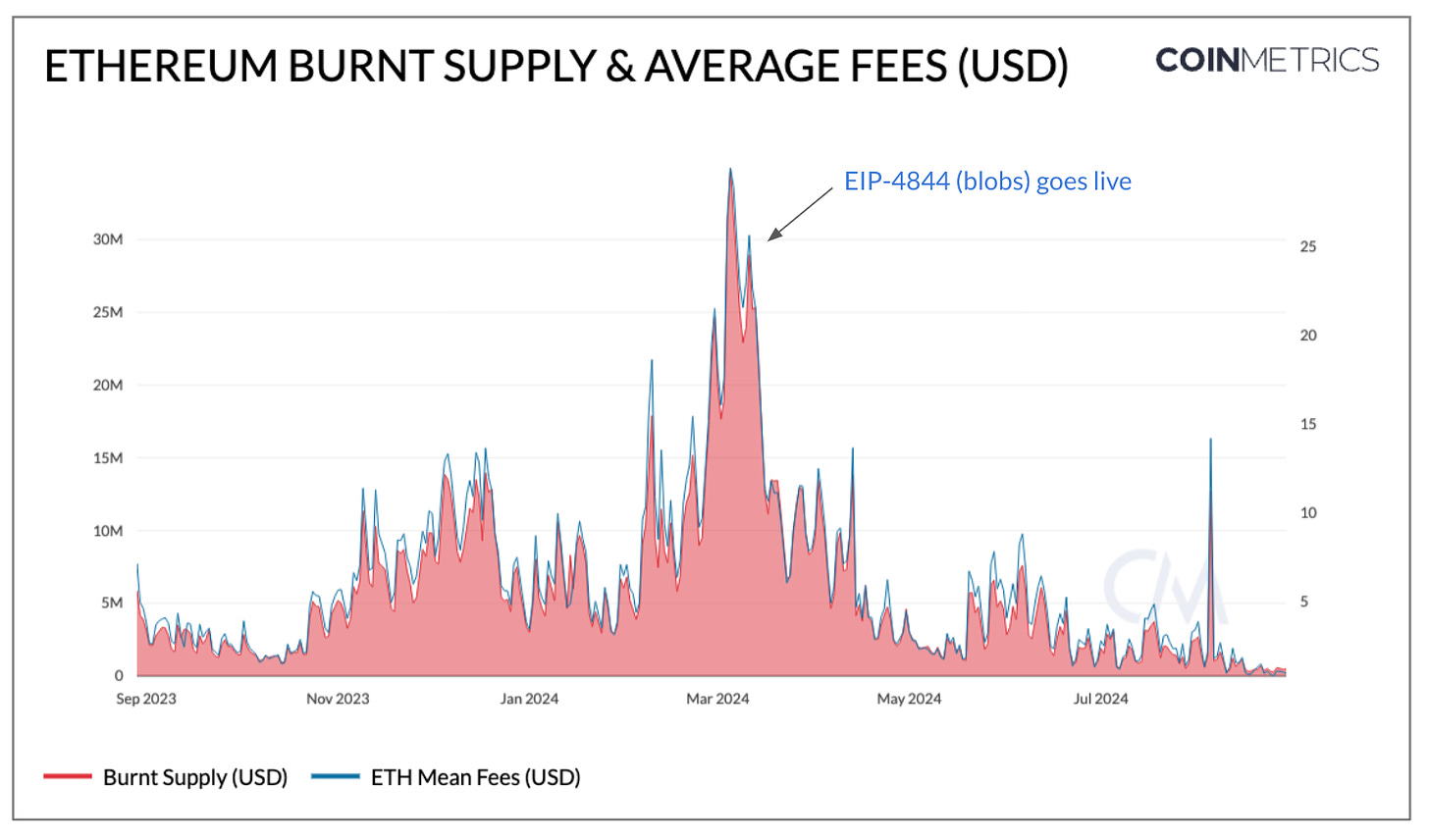

As Ethereum evolves by its rollup-centric roadmap, EIP–4844 introducing blobs has introduced L2 transaction charges to fractions of a greenback, making its ecosystem of Layer–2s vastly extra accessible. Nonetheless, within the near-term, this has arguably come on the expense of whole charges generated on mainnet (L1). Subsequently, this has hampered the speed of ETH burn, reaching as little as 80 ETH or $194K. Therein lies the dual-nature of “ultra sound money,” creating deflationary strain for ETH, alongside making Ethereum hospitable for all whereas additionally proliferating ETH throughout its Layer–2s (L2).

Source: Coin Metrics Network Data Pro

Complete charges on Ethereum comprise base charges (dynamic based mostly on demand and burned from circulation), precedence charges (“tip” incentivizing validators to prioritize transactions) and blob charges (paid by L2s using blobs to settle transactions on L1). Nonetheless, as the price of L2 settlement has fallen considerably, blob charges contribute a negligible quantity to L1 charges in the present day, thereby impacting holders (non-stakers) through decrease burn and inflationary strain on ETH provide. Nonetheless, Ethereum is properly positioned to learn from a surge in exercise because of the development and accessibility of its L2s.

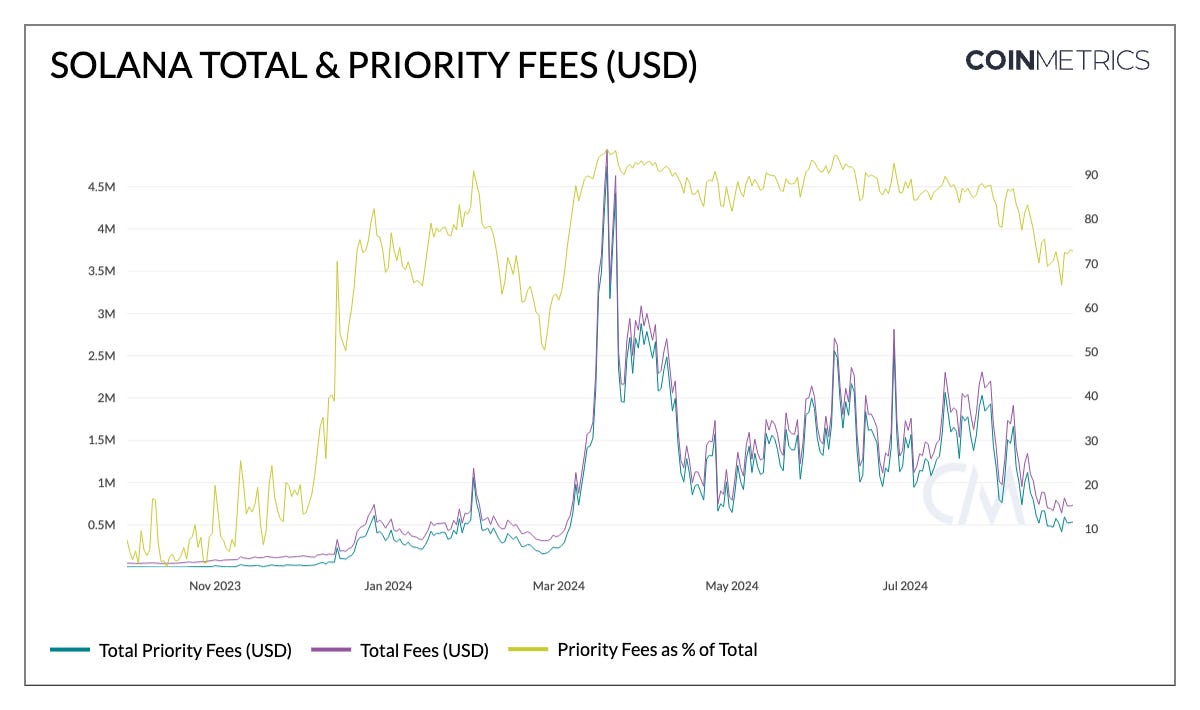

Solana’s payment mechanism is structured in a different way, with a fastened base payment of 5000 lamports per signature (0.000005 SOL, smallest unit of SOL). Whether or not minting a brand new memecoin or making a token switch on a DEX, customers on Solana pay the identical base payment. That is not like Ethereum, the place the bottom payment dynamically adjusts to community demand. Precedence charges, on the opposite hand, are an non-obligatory payment that customers pays to extend the probability of transaction inclusion by the lead validator, of which 50% are burned and 50% go to validators. Nonetheless, estimating the optimum precedence payment will be difficult attributable to fluctuating demand, leading to circumstances the place non-prioritized transactions will be priced out of being executed in a block.

Source: Coin Metrics Network Data Pro

Pushed by the general market and memecoin surge, whole charges on Solana reached a peak of $4.5M in March. At this level, precedence charges represented 95% of whole charges—a determine that is remained round 80% since August—representing the excessive demand for transaction inclusion. Nonetheless, exercise has considerably tapered off, with whole charges now at $732K and precedence charges at $533K.

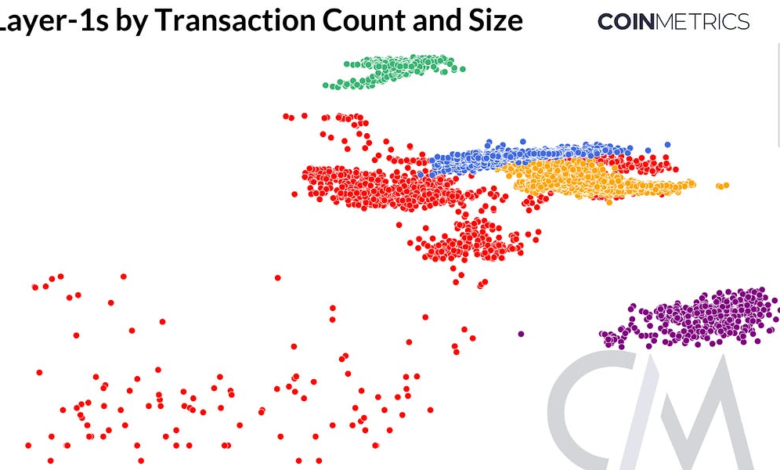

Layer–1 blockchains can differ of their typical utilization patterns with some optimized for high-volume, low-value transactions, whereas others excel at transactions with bigger values. Subsequently, it is necessary to holistically think about the “economic throughput” of those techniques, wanting past easy transaction rely.

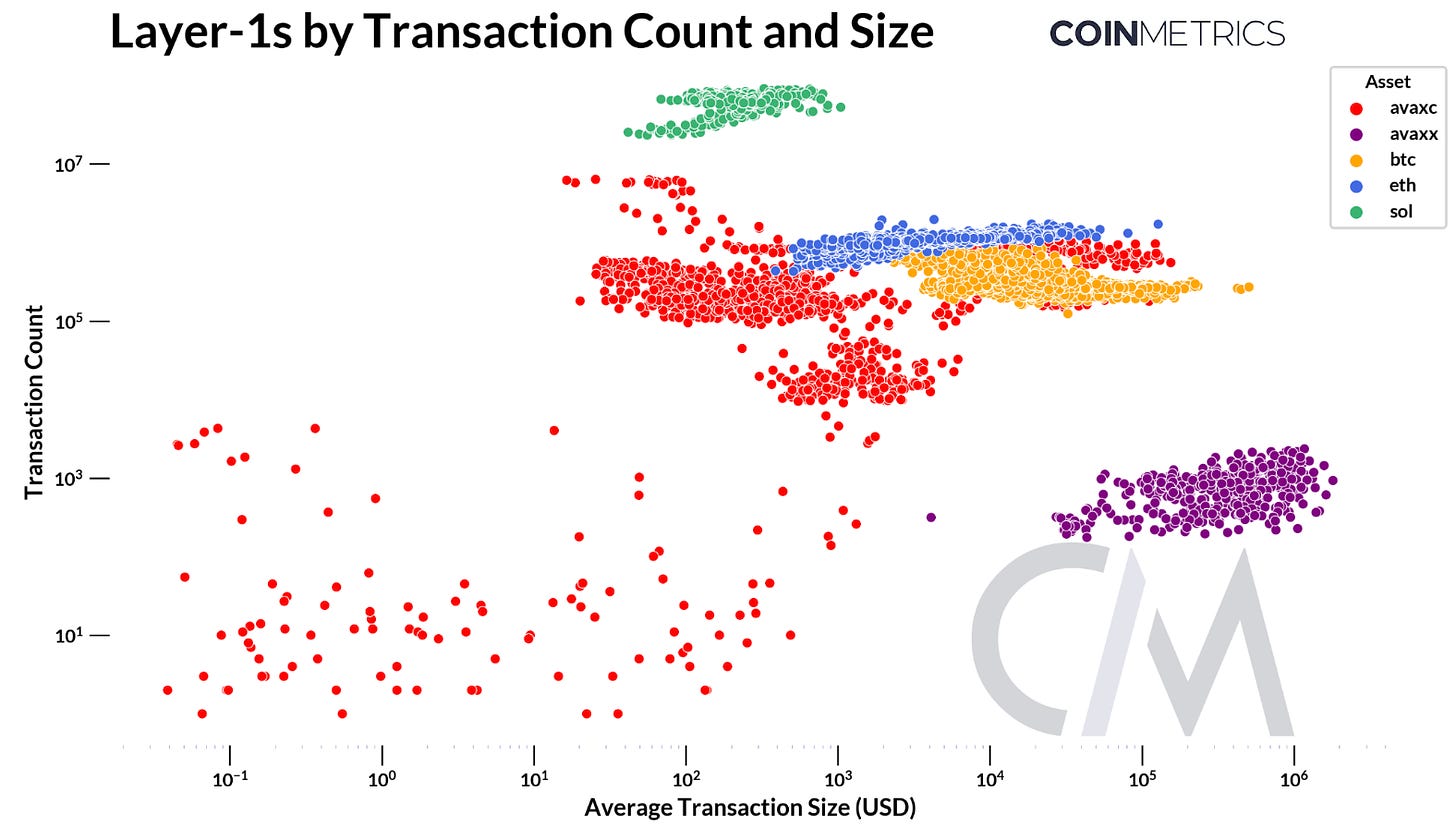

Source: Coin Metrics Network Data Pro, Nic Carter: Transaction Count is An Inferior Measure

As seen above, low-fee networks like Solana are optimized and primarily used for high-frequency, low worth transactions. It’s necessary to notice that Solana additionally consists of validator vote transactions in a block (which have been faraway from this plot to signify user-transactions). Bitcoin usually sees high-value transfers, aligning with its function as a retailer of worth and settlement layer, whereas Ethereum lies between high-value transfers and extra frequent, lower-value transactions, reflecting its nature as a general-purpose blockchain. Avalanche’s variability suggests a versatile community able to adapting to totally different use circumstances, stemming from its multi-chain structure.

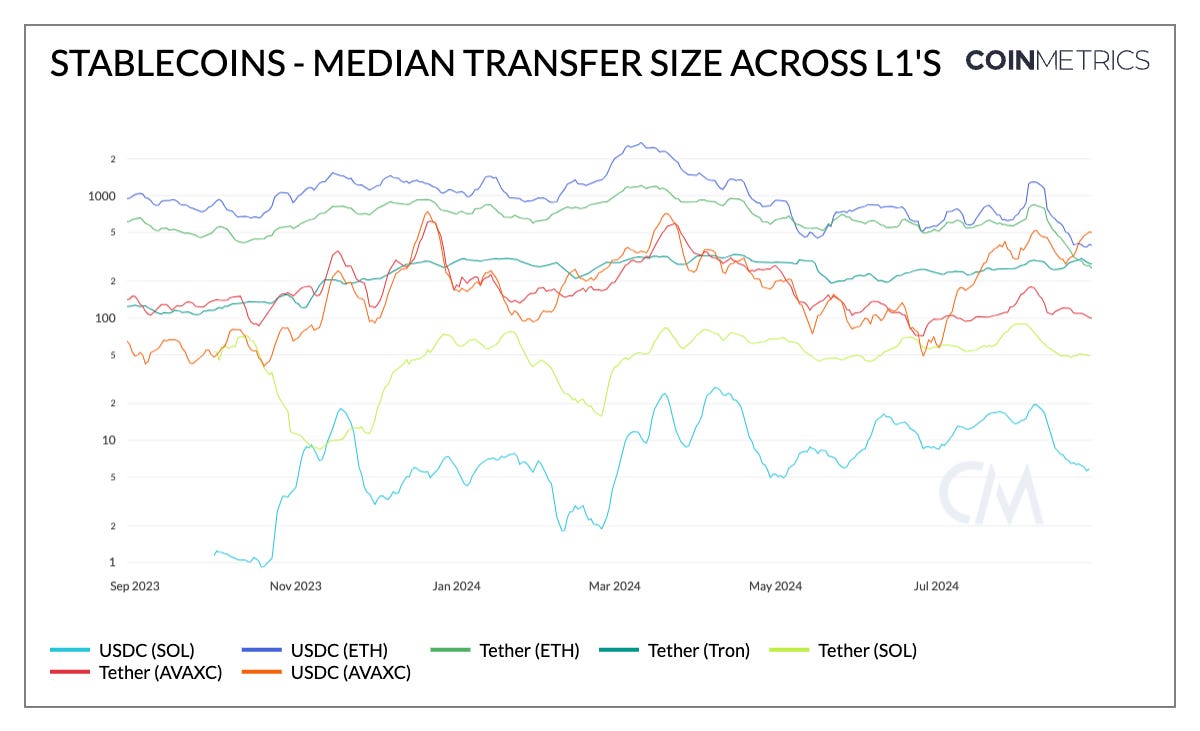

Source: Coin Metrics Network Data Pro

This pattern can also be mirrored within the chart above, which shows the median switch measurement of main stablecoins (USDC and USDT) throughout Layer–1’s. Each USDC and USDT on Ethereum have usually displayed a excessive median switch measurement—albeit falling not too long ago to $400 and $267, respectively—on the again of decrease charges on Ethereum mainnet. Tether on Tron has maintained a typical measurement of $270, whereas Solana has the bottom stablecoin transfer-values ($7 for USDC) and ($50 for USDT).

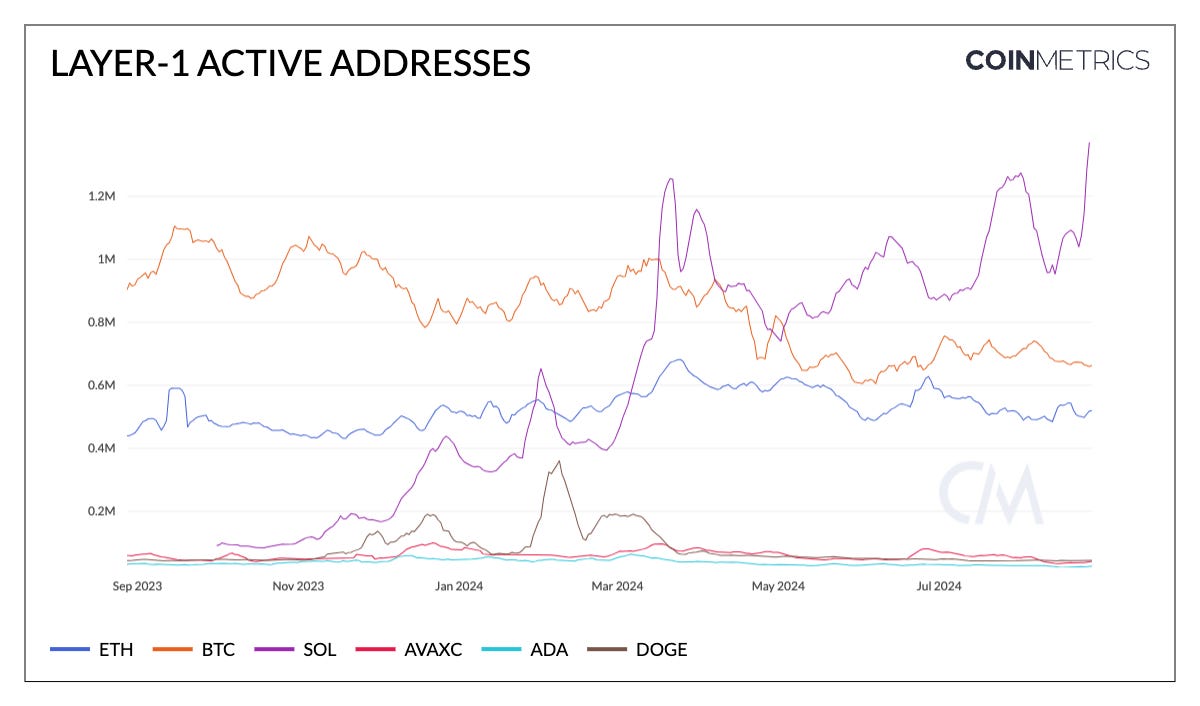

Source: Coin Metrics Network Data Pro

Every day lively addresses throughout Layer–1s, representing the rely of distinctive addresses lively within the community every day, can function a proxy for blockchain adoption and exercise. Bitcoin (672K) and Ethereum L1 (500K) have maintained comparatively secure lively deal with counts, whereas Solana has seen a ~219% improve in lively wallets since January 2024—crossing 1.5M. When deciphering this metric, it is necessary to think about variations in blockchain structure (UTXO vs. Account-based fashions), potential inflation attributable to bot exercise and the excellence that an deal with doesn’t essentially equate to a singular person.

Because the foundational layer for the on-chain ecosystem, Layer–1s will proceed to garner vital consideration. Wanting forward, technological enhancements and the flexibility to draw adoption by its purposes will form the way forward for these networks. Ethereum’s upcoming Pectra improve, together with discussions round optimizing blob worth discovery and L1 scalability, will improve its efficiency and accessibility. Solana’s Breakpoint Convention might reveal key developments that additional its high-throughput capabilities. In the meantime, new entrants like Monad current alternatives for development, including to the aggressive panorama.

Whereas every Layer-1 follows alongside its roadmap, they are going to possible converge by totally different trade-offs—balancing scalability, safety, and decentralization to satisfy the rising calls for of blockchain adoption.

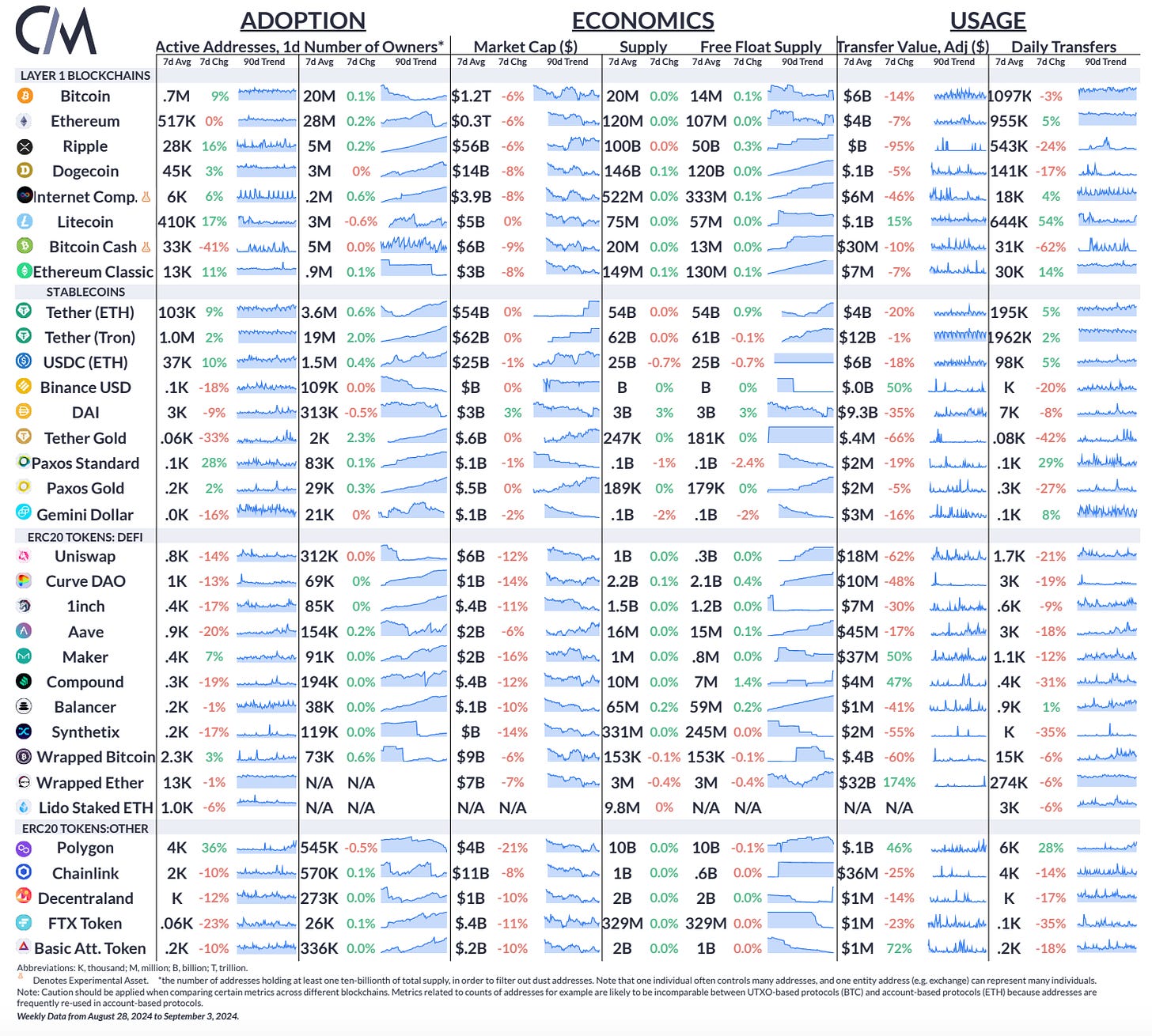

Source: Coin Metrics Network Data Pro

Every day lively addresses on Bitcoin and Ripple rose by 9% and 16% over the week respectively. Polygon’s (MATIC) noticed a 46% rise in USD adjusted switch worth and 28% improve in every day transfers because the MATIC token undergoes a transition to POL.

This week’s updates from the Coin Metrics group:

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.