Appraising Growth in Digital Asset Markets

Get the very best data-driven crypto insights and evaluation each week:

By: Matías Andrade & Tanay Ved

-

Bitcoin’s correlation with the S&P 500 and Gold has strengthened for the reason that starting of 2024, reflecting a shift in investor sentiment in the direction of Bitcoin as each a risk-on funding and a possible hedge towards macroeconomic uncertainties.

-

The rising market share of altcoins and the surge in exercise throughout varied sectors of the datonomy classification counsel a extra numerous and dynamic digital asset market panorama.

-

The rising open curiosity in Bitcoin futures on the CME signifies the deepening liquidity and maturity of the Bitcoin derivatives market, doubtlessly resulting in larger worth stability and lowered volatility in the spot market.

-

The digital asset market has skilled important progress and a notable shift in sentiment for the reason that introduction of Bitcoin ETFs, with the Data Expertise, Decentralized Finance, and Specialised Cash sectors main the way in which in phrases of year-to-date returns.

Digital asset markets have grown tremendously for the reason that bitcoin ETFs have been introduced, with BTC reaching document highs of $73K and the full crypto-asset market cap increasing to $2.5T over the interval. The ETF launch has introduced ahead institutional curiosity, and this in flip has introduced retail again into the circulate with a renewed curiosity in speculative property—chief amongst them memecoins. However at the same time as these speculative flows collect extra consideration, a momentous shift in sentiment is underneath manner.

On this week’s subject of State of the Community, we take a better take a look at the shift in digital asset market sentiment, leveraging market information and datonomy™ sector classification to contextualize the most recent market actions.

Understanding Bitcoin’s dynamics relative to conventional property and the crypto-asset ecosystem reveals essential tendencies. Spurred by the introduction of spot bitcoin ETFs, new entrants are evaluating allocation in the direction of this rising asset class. On this context, understanding Bitcoin’s historic correlation with conventional property just like the S&P 500 and Gold is useful. Whereas Bitcoin has largely exhibited properties of an uncorrelated macroeconomic asset over its lifespan, it has showcased intervals of upper correlation with the S&P 500, displaying “risk-on” traits akin to know-how shares, in addition to intervals of correlation with Gold, suggesting “safe-haven” traits.

Source: Coin Metrics Formula Builder

Nonetheless, these correlations have additionally damaged down on a number of cases, highlighting its function as a portfolio and threat diversifier, stemming from this distinctive habits. Because the starting of 2024, its 90-day correlation to the technology heavy S&P 500 and Gold has strengthened in tandem, as each synthetic intelligence pushed equities and Gold surge in worth. This displays a nuanced shift in investor sentiment in the direction of Bitcoin as each a risk-on funding and a possible hedge towards macroeconomic uncertainties. With the introduction of an unlimited entry channel by way of bitcoin ETFs, elevated institutional participation, and altering macroeconomic circumstances, Bitcoin’s market function is poised to evolve.

Equally, Bitcoin dominance, which excludes stablecoins and different on-chain derivatives, reveals attention-grabbing insights into the dynamics between Bitcoin and altcoins in the digital asset market. Bitcoin dominance consolidated throughout 2023, reaching a peak of round 60% in February. This means that in the course of the market downturn, traders doubtless favored Bitcoin as a extra established and fewer risky asset in comparison with altcoins. The resilience of Bitcoin’s dominance throughout future market fluctuations, particularly with a brand new entry channel by way of spot bitcoin ETFs, will even present insights into the long-term dynamics between Bitcoin and altcoins in the digital asset panorama.

Source: Coin Metrics Formula Builder

Nonetheless, the current pattern in the chart exhibits a notable enlargement of altcoins’ market share. Since February 2024, the dominance of property aside from Bitcoin in the datonomy™ universe (excluding on-chain derivatives) has been steadily rising. This pattern might be defined by a shift in investor sentiment in the direction of a extra speculative and risk-tolerant method, favoring the potential greater returns supplied by altcoins.

Because the altcoin market share continues to develop, it is going to be essential to observe the sustainability of this pattern and assess whether or not it represents a basic shift in investor preferences or a short lived reflection of the market cycle.

Since Might 2023, the open curiosity for Bitcoin futures on the CME has skilled a outstanding upward trajectory, at the moment over $11B. This surge in open curiosity coincides with the rising acceptance and adoption of Bitcoin as a professional asset class amongst institutional traders.

Source: Coin Metrics Formula Builder

Because the open curiosity on the CME continues to climb, it signifies the deepening liquidity and maturity of the Bitcoin derivatives market. This pattern is more likely to entice much more institutional individuals, doubtlessly resulting in larger worth stability and lowered volatility in the spot market.

Nonetheless, it’s important to observe the sustainability of this progress in open curiosity and assess whether or not it interprets into long-term institutional dedication or displays short-term speculative positioning. Nonetheless, the rising institutional presence, as evidenced by the CME open curiosity, is a constructive signal for the general growth and mainstream adoption of Bitcoin as a longtime asset class.

Source: Coin Metrics Formula Builder

A breadth of digital property have benefited from the current enlargement in crypto-asset markets. That is exhibited in rising trusted spot volumes for notable property, together with Bitcoin (BTC), Ethereum (ETH), Tether (USDT) and Solana (SOL), amongst others. The 7-day common of trusted spot volumes for BTC, at the moment close to $26B, is simply $1B shy from its all-time excessive in Might 2021. Whereas ETH has but to hit its historic excessive mark in spot quantity, the profitable Dencun improve might present a lift in exercise. USDT–denominated volumes reached an all-time excessive of $53B in March as provide crossed $100B. Equally, Solana (SOL) quantity can also be nearing its peak of $4.7B—reflecting a considerable rebound in curiosity amid this market cycle.

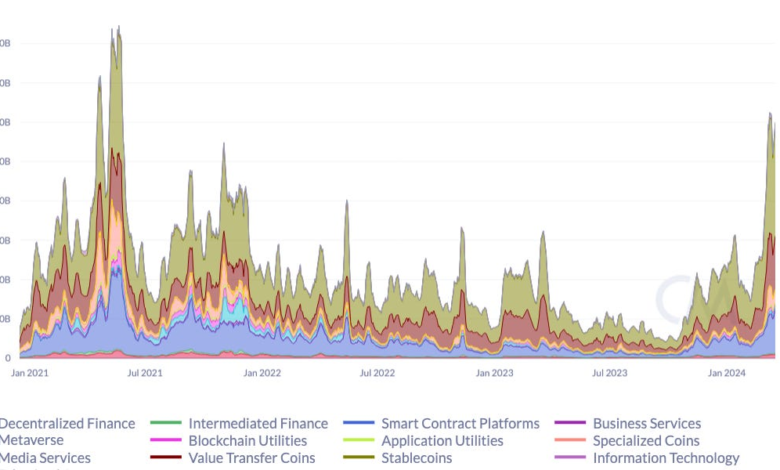

Supply: Coin Metrics Formula Builder & datonomy™

Breaking down this progress by Coin Metrics’ datonomy™ sector classification reveals deeper tendencies into the beneficiaries of the current market motion. With mixture spot volumes across exchanges hitting $160B in March, this progress is mirrored in a number of sectors of the datonomy™ universe. Most notably, this surge is especially pronounced in sectors related to “Value Transfer Coins,” “Smart Contract Platforms,” and “Stablecoins”. Nonetheless, just lately, there has additionally been important exercise in “Specialized Coins,” (together with memecoins), the “Information Technology” sector, and the “Decentralized Finance” sector, indicating numerous areas of progress.

The sturdy efficiency of those sectors demonstrates the diversification of the digital asset market and the rising curiosity in blockchain-based options past conventional cryptocurrencies. As traders search to capitalize on the potential of those rising sectors, it’s doubtless that we are going to proceed to see elevated capital inflows and innovation in these areas.

The digital asset market has skilled important progress and a notable shift in sentiment for the reason that introduction of the Bitcoin ETFs. Whereas bitcoin stays a dominant pressure, the rising market share of altcoins and the surge in exercise throughout varied sectors of the datonomy™ classification counsel a extra risk-on and dynamic market panorama. As institutional curiosity continues to develop, as evidenced by the document ETF volumes and skyrocketing open curiosity in Bitcoin futures on the CME, the market is more likely to see elevated liquidity and maturity. Nonetheless, it’s essential to observe the sustainability of those tendencies and assess whether or not they signify basic shifts in investor preferences or momentary market cycles.

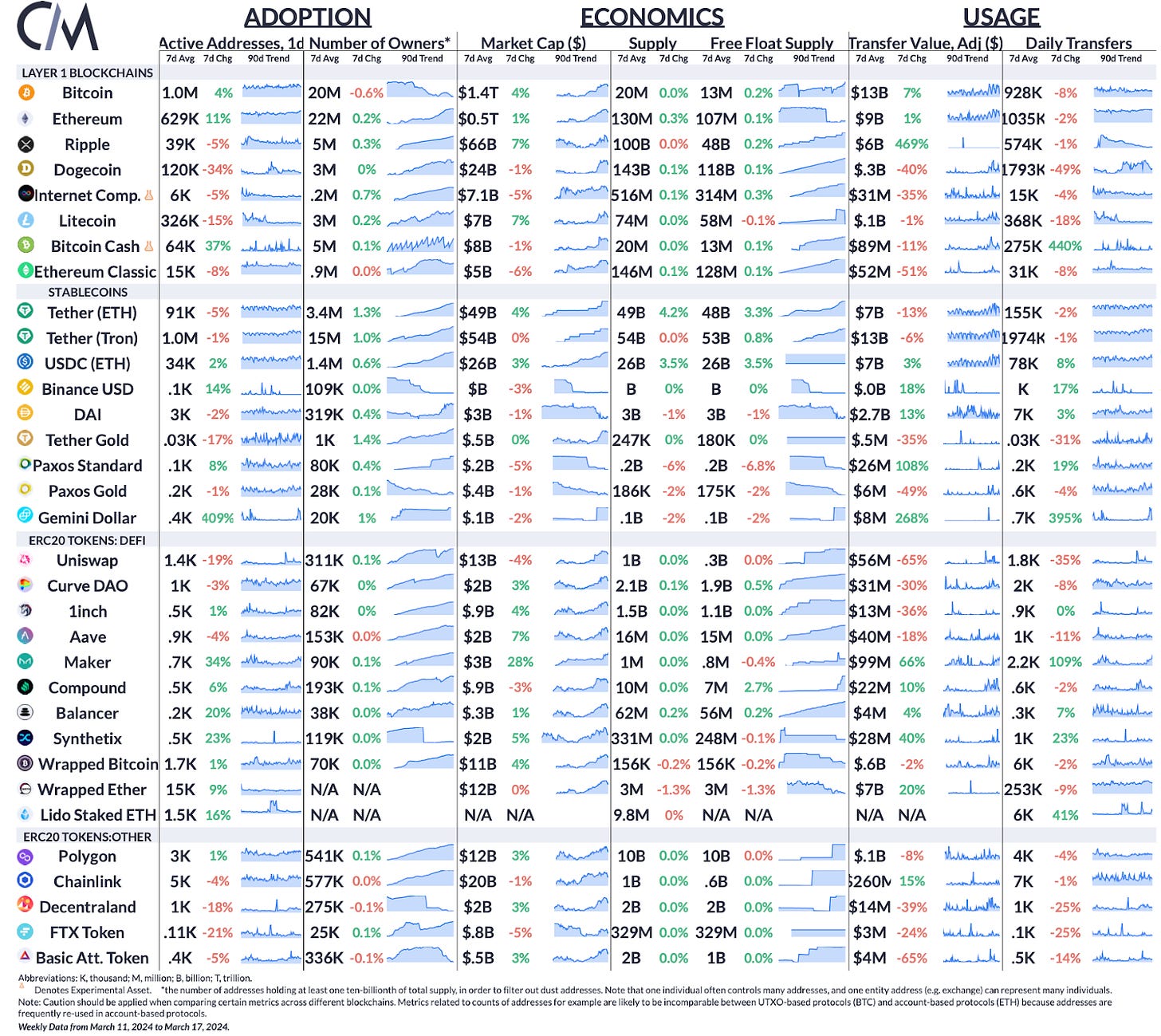

Supply: Coin Metrics Community Information Professional

Bitcoin and Ethereum energetic addresses grew 4% and 11% over the week, respectively. The availability of Tether (ETH) expanded by 4.2% over the week, whereas USDC (ETH) provide elevated by 3.5% to succeed in $26B.

This week’s updates from the Coin Metrics staff:

-

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, if in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.