At the Crossroads: Bitcoin ETFs & Coinbase

Get the greatest data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matías Andrade

The widespread acceptance of cryptocurrencies has developed considerably in current occasions, transferring from relative obscurity into the limelight. This shift has been notably propelled by the launch and memorable efficiency of Bitcoin spot Change-Traded Funds (ETFs), capturing the consideration of analysts, bankers, and technologists.

As the panorama of digital belongings continues to evolve, the intersection of know-how, regulation, and market dynamics presents a fancy tapestry for stakeholders. Regardless of going through regulatory challenges in the United States, the place stringent oversight limits direct cryptocurrency custody by banks and monetary establishments, the sector’s progress trajectory is plain. On this week’s subject of State of the Community, we have a look at the interaction between the launch of spot Bitcoin ETFs and Coinbase’s current efficiency, highlighting their dynamics and broader implications.

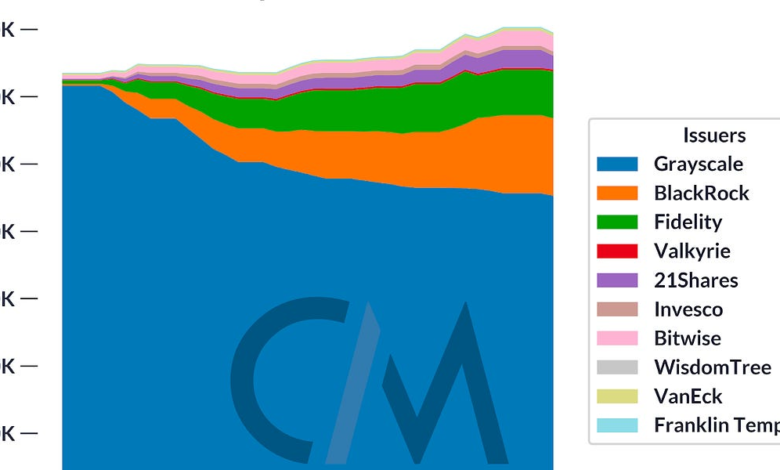

Since the ETFs had been accepted, we’ve seen a speedy change in the distribution of BTC between the issuers, with outflows from Grayscale and inflows towards the newly-approved ETFs. One in all the causes for this choice is that the new ETFs have dramatically decrease charges in contrast with Grayscale BTC (GBTC) at 1.5%, with Constancy and BlackRock at 0.25% (each waiving or decreasing charges for an preliminary interval). One more reason is the liquidation of a number of necessary holders of GBTC, equivalent to FTX selling approximately $1B and Digital Currency Group’s Genesis investments. Nonetheless, we’ve seen over $4.8B influx since the official ETF launch, with over $37B in provide absorbed by exchange-traded merchandise.

In the lead as much as the spot Bitcoin ETFs, Coinbase—the largest publicly traded cryptocurrency trade and the custodian of 8 out of 11 bitcoin ETFs—has been solid underneath the highlight. The market has been rife with hypothesis and divided views concerning the potential influence of those merchandise on Coinbase’s enterprise. Some argue that Coinbase is poised to reap the rewards of an expanded market presence and new income channels as the digital asset business expands, whereas others argue that the aggressive payment panorama of ETFs might deter customers from Coinbase, decreasing buying and selling volumes and impacting payment revenues. In gentle of this, Coinbase stands at a pivotal juncture, going through a fancy mixture of challenges and alternatives amid the rollout of spot ETFs, regulatory battles with the SEC and an more and more exuberant digital asset market.

In the following part, we are going to zoom into Coinbase’s monetary outcomes, contextualizing our evaluation with community and market information to extract key insights from their newest earnings report.

Coinbase published its Q4 2023 earnings last week, reporting a complete income of $954M—a stellar beat on Wall Road’s expectations of $826M. Diving additional into their revenues, they are often damaged down into two main drivers: Transaction Income and Subscription & Companies Income, with every class taking part in a vital position in Coinbase’s enterprise.

One in all the main highlights from the earnings report was the progress in transaction income, rising from $322M to $529M, representing a 64% year-over-year enhance, comprising 55% of complete reported income. This rebound is especially noteworthy since transaction income had lagged behind subscriptions and companies income in Q2 and Q3 of 2023, impacted by compressed buying and selling volumes. The surge was catalyzed by a wide range of components, together with the bettering of market sentiment and elevated risk-on exercise in digital asset markets.

Source: Coin Metrics Market Data

Spot buying and selling quantity on Coinbase climbed to $3.5B main as much as the ETF launches, matching ranges seen in This autumn 2022 and solely surpassed by the frenzy surrounding Terra Luna’s collapse in the summer time of 2022. Whereas each shopper and institutional companies benefited, retail volumes had been a major contributor in This autumn, rising by 163% quarter-over-quarter.

Source: Coin Metrics Market Data

Past the composition of buying and selling volumes by consumer sort, one other intriguing facet was the asset breakdown of buying and selling volumes. In This autumn, the share of ‘Other’ belongings and Tether (USDT) traded on Coinbase grew relative to BTC and ETH. The bucket representing different belongings grew by 14% over the quarter, contributing 42% of complete buying and selling quantity and 57% of transaction income. Conversely, the share of BTC and ETH buying and selling quantity noticed a lower of 4% and 18% over the 12 months, respectively. This pattern not solely signifies the present section of the market cycle, but in addition highlights the rising affect of consumer-driven volumes mirrored in the heightened exercise in altcoins like Solana (SOL), Avalanche (AVAX) and different ecosystem associated tokens.

Source: Coin Metrics Market Data

This improvement additionally raises a vital query: will the debut of spot Bitcoin ETFs—and the anticipated introduction of spot Ether ETFs—result in additional compression in buying and selling quantity for these belongings? Whereas the full results stay to be seen, a noteworthy pattern is the concurrent rise in Binance’s share of BTC volumes following the ETF launches in January. The “Aggregate Volume” part of our weekly State of the Market publication will help monitor these dynamics.

Whereas buying and selling exercise stays the core aspect of the enterprise, Coinbase has expanded its presence in a number of different verticals. This contains the likes of staking companies, stablecoins at the side of Circle, Layer-2’s with the introduction of Base and the additional monetization of its custody enterprise as a main custodian for the spot Bitcoin ETFs. Altogether, spectacular enlargement in these classes has yielded a 33% year-over-year enhance in subscription and companies income, now accounting for 39% of Coinbase’s complete income combine.

Source: Coinbase Q4 2023 Shareholder Letter

Inside this class, income from stablecoins has traditionally been the largest contributor, although it skilled a decline in This autumn. These revenues stem from Coinbase’s income sharing settlement with Circle, the issuer of USDC stablecoin. Coinbase has garnered substantial revenue by holding USDC on its platform, with its earnings tied to the circulating provide of USDC and prevailing rates of interest—components that affect the curiosity revenue generated on USDC reserves. Regardless of the dwindling provide of USDC all through 2023, the hostile results on income have been mitigated by rising rates of interest.

One other main avenue of income progress has been via “Blockchain Rewards”. This encompasses Coinbase’s staking-as-a-service enterprise, permitting customers to stake their belongings with a view to safe proof-of-stake (PoS) networks like Ethereum, Solana and others. Regardless of going through regulatory scrutiny from the SEC over its staking enterprise, the blockchain rewards phase grew 53% year-over-year and 28% quarter-over-quarter. This progress could be primarily attributed to ETH staking, mirrored by an increase in staked balances, and the rising issuance of Coinbase’s liquid staking token—cbETH, which surpassed 1.4M in provide throughout This autumn. Together with rising asset costs, Coinbase’s 25% fee on ETH staking has considerably enhanced income from blockchain rewards.

Along with its core operations, Coinbase has a number of rising segments equivalent to its Layer-2 resolution Base, worldwide derivatives exchange and its enterprise portfolio, which will likely be realized at truthful worth following the adoption of FASB accounting requirements in Q1 2024. Moreover, Coinbase is properly positioned to capitalize on the sustained inflows into spot Bitcoin ETFs, proving additive to custody payment revenues over the long run. General, Coinbase has navigated the bear market adeptly, decreasing its reliance on buying and selling revenues by broadening its enterprise mannequin and income streams, whereas introducing new companies with excessive potential for progress. This strategic diversification, coupled with a proactive regulatory method and value reductions, have all boosted its stature in the digital asset panorama.

The primary two months have showcased spectacular inflows into Bitcoin ETFs, signaling a powerful market-wide reception. Alongside, Coinbase’s earnings spotlight a strengthened basis, properly poised for future progress. Whereas the long run implications of the ETFs on Coinbase trajectory are but to be grasped, their mutual affect underscores constructive momentum for the business. With Bitcoin rising above $1T in market capitalization for the first time since December 2021, rising anticipation round spot Ether ETFs and the forthcoming halving, a number of indications level in direction of an thrilling interval forward for the digital asset ecosystem.

The market capitalization of Bitcoin and Ethereum expanded additional this week, rising by 11% and 13% respectively. Ethereum noticed a ten% enhance in energetic addresses, whereas energetic addresses on Bitcoin skilled an 8% decline.

This week’s updates from the Coin Metrics staff:

-

The Coin Metrics Crew will likely be internet hosting a Data Challenge at ETH Denver! Be taught extra about the occasion & register for it here.

-

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, if in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.