Bitcoin and Ether Options Trading Reaches $20B in Activity

Bitcoin and Ether Options Activity Hits $20B

The notional open curiosity in bitcoin and ether choices contracts on Deribit, a number one change, has reached $20.64 billion, a file excessive since November 2021. This surge in open curiosity signifies a rising curiosity in crypto choices amongst buyers. The variety of excellent contracts has doubled in comparison with November, showcasing the numerous progress in the market. Deribit at present dominates 90% of the worldwide crypto choices exercise. Luuk Strijers, the chief business officer at Deribit, sees this achievement as a triumph for the change and a transparent indicator of the increasing market.

Title: Bitcoin and Ether Options Activity Hits File $20 Billion Amidst Market Surge

By [Author Name] [date]

In a exceptional flip of occasions, the choices marketplace for Bitcoin and Ether has skilled a surge in buying and selling actions, crossing the monumental $20 billion mark. This milestone comes amidst the speedy rise of cryptocurrencies, with each Bitcoin and Ether reaching new all-time highs.

The emergence of choices buying and selling has supplied buyers with extra avenues to revenue from the cryptocurrency market. Options buying and selling refers back to the apply of shopping for or promoting contracts that grant the holder the best, however not the duty, to purchase or promote an asset (in this case, Bitcoin or Ether) at a predetermined value inside a specified time-frame. This flexibility attracts a various vary of market individuals to discover their buying and selling methods and mitigate threat.

Bitcoin, the world’s largest cryptocurrency, skilled an explosive rally over the previous few months, reaching an astounding value of over $65,000 per coin. In consequence, the curiosity in Bitcoin choices has surged accordingly. The Chicago Mercantile Alternate (CME), one of many largest derivatives exchanges globally, reported a record-breaking buying and selling quantity of Bitcoin choices contracts on April twentieth, totaling over 22,500 contracts.

Ether, the native cryptocurrency of the Ethereum blockchain, has additionally skilled an amazing run, surpassing $3,000 per coin for the primary time. This landmark value propelled Ether choices buying and selling into the highlight, additional contributing to the general surge in choices exercise. Specialists predict that with the rising reputation of decentralized finance (DeFi) purposes and the approaching Ethereum 2.0 improve, Ether’s worth might proceed to rise, making it a gorgeous funding alternative for buyers.

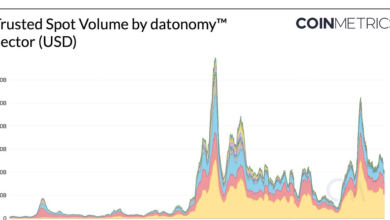

Market specialists have famous that the rising curiosity in choices buying and selling will be attributed to the rising maturity and institutionalization of cryptocurrencies. The inflow of institutional buyers, comparable to hedge funds and asset managers, has injected credibility into the market, driving up buying and selling quantity. The cautiously optimistic sentiment amongst establishments has additionally prompted many to discover derivatives buying and selling as a method to take part in the crypto markets with lowered threat publicity.

The surge in choices buying and selling exercise has not gone unnoticed by main monetary establishments. Quite a few conventional monetary companies, together with Goldman Sachs and JPMorgan, have lately introduced their plans to supply cryptocurrency choices and associated derivatives to their purchasers. This transfer is seen as a big step in direction of broader adoption of cryptocurrencies and indicators the rising acceptance of digital belongings inside conventional monetary techniques.

Trade insiders imagine that the choices market’s speedy progress will be attributed to elevated accessibility and user-friendly buying and selling platforms, comparable to Deribit, Bybit, and Binance. These platforms provide seamless and environment friendly buying and selling interfaces, enabling people from varied backgrounds to take part in choices buying and selling with relative ease.

Nonetheless, specialists additionally warning that choices buying and selling in cryptocurrencies isn’t with out dangers. The extremely risky nature of the crypto market can enlarge potential losses, as choices present merchants with leverage. It’s essential for market individuals to conduct thorough analysis, make use of threat administration methods, and solely make investments what they’ll afford to lose.

Wanting forward, analysts predict that the choices marketplace for cryptocurrencies will proceed to broaden as extra buyers search publicity to this quickly evolving asset class. This progress will doubtless be supported by regulatory developments and enhanced threat evaluation frameworks, offering a extra secure and safe atmosphere for choices merchants.

In conclusion, the milestone of $20 billion in choices buying and selling quantity for Bitcoin and Ether underscores the rising urge for food for cryptocurrencies amongst institutional and retail buyers. This surge displays the maturing nature of the market and the rising acceptance of digital belongings inside the conventional monetary system. As choices buying and selling turns into extra accessible and subtle, market individuals should stay vigilant in managing dangers. Whereas the longer term stays unsure, the continued growth of the choices marketplace for cryptocurrencies signifies a promising outlook for the evolving world of digital belongings.

I don’t personal the rights to this content material & no infringement supposed, CREDIT: The Authentic Supply: www.coindesk.com