Bitcoin Floor: CEO Predicts $38,000 Will Be The Lowest BTC Goes

Bitcoin (BTC) has been gathering some momentum within the crypto sphere recently, crossing the $60,000 mark in opposition to a number of analysts’ indicators. The world’s main cryptocurrency has been on a wild journey, with its value fluctuations going haywire through the previous few weeks.

Bullish Components Driving Bitcoin Worth

One main driver behind the current value surge in Bitcoin is the understanding {that a} spot Bitcoin ETF is more likely to be authorised by the SEC. With immense anticipation of such a call from the SEC, which is more likely to lastly open the door for elevated institutional investments within the cryptocurrency, many traders are risking an entrance on the present ranges.

One other issue that has been driving Bitcoin’s value has been the discount in new BTC provide following the halving occasion within the second half of 2024. Typically, costs for Bitcoin have soared after halving by multiples, for the reason that decreased provide instantly correlates with increased demand and value.

#bitcoin 200wma over $38k pic.twitter.com/olAw6BOjgz

— Adam Again (@adam3us) August 21, 2024

Bitcoin’s 200-Week Transferring Common Offers Sturdy Help

Blockstream CEO Adam Again defined that the 200-week shifting common of Bitcoin had risen previous $38,000, a degree that now gives stable assist for the cryptocurrency. Certainly, the 200MA has repeatedly been handled as probably the most necessary indicators in Bitcoin evaluation for the reason that cryptocurrency by no means went under this shifting common.

One other revealing metric so far as new Bitcoin positive factors are involved can be the holding patterns of the asset. In keeping with info printed by the net website BTCDirect, 69% of BTC supplying has not moved for a 12 months and even longer. After all, one other occasion of a lessening quantity of BTC in circulation helps to alleviate promoting stress on the asset additional, cementing a bullish thesis for Bitcoin.

Bearish Components To Contemplate

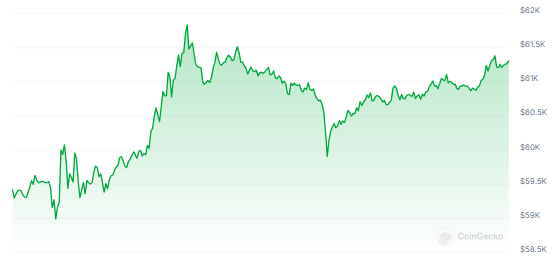

On the time of writing, Bitcoin was trading at $61,245, up 3.0% within the final 24 hours, and sustained a 4.7% acquire within the final seven days, information from Coingecko exhibits.

Regardless of the current value spike in Bitcoin, there are some bearish components that stay within the background, considered one of which is the Mt. Gox repayments which are more likely to put extra promoting stress into the market. Earlier within the week, the notorious alternate made one other whopping switch to Bitstamp, setting off potential promoting stress.

Different bear components are an absence of readily obvious bull catalysts close to time period for Bitcoin, with the next being the most recent from banking behemoth JPMorgan, advising shoppers to be very aware earlier than shopping for into Bitcoin’s current value restoration, because the cryptocurrency is more likely to face headwinds into the following a number of months.

Featured picture from Pexels, chart from TradingView