Bitcoin Hits New Heights Between BlackRock Success and London Approval

The under is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin has had one other interval of intense and record-breaking success, spurred on each by optimistic developments in worldwide enterprise and by more and more massive commitments from the spheres of conventional finance.

It’s actually beautiful how properly Bitcoin has been performing all through the primary quarter of 2024. The 12 months started with Bitcoin’s valuation crossing the $40k mark, and March 1 noticed a persistent hover round $60k. Now, nonetheless, Bitcoin has gone as much as $72k, the very best valuation in its whole historical past. Though we nonetheless aren’t fairly on the stage the place “digital gold” is extra invaluable than gold itself, we have now even reached a brand new milestone: by market cap, Bitcoin is presently a extra valuable commodity than silver. Contemplating the immense position that silver has performed in world foreign money for 1000’s of years, that is actually a milestone to recollect.

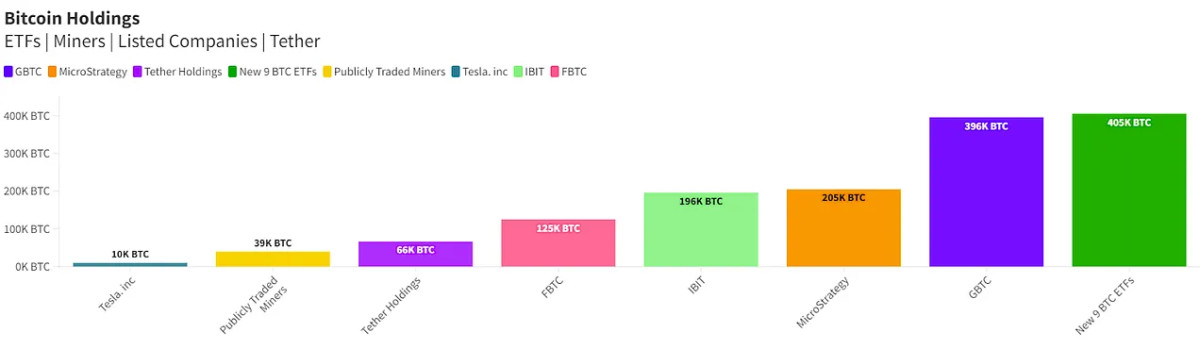

This era of success has been particularly noteworthy for the continued confidence it’s been having fun with from among the largest monetary establishments on this planet. On March 10, for instance, it was reported that BlackRock, the world’s largest asset supervisor and distinguished issuer of the Bitcoin spot ETF, had lastly acquired sufficient bitcoin that it surpassed even the holdings of MicroStrategy. Contemplating that its board chairman, Michael Saylor, is such a Bitcoin evangelist, this growth appeared particularly big. It was an excellent larger shock, nonetheless, when Saylor introduced that he was shopping for sufficient to reclaim its main place the very subsequent day. Lower than 24 hours handed between this unique announcement and MicroStrategy’s buy of 12k bitcoin, and this buy befell when Bitcoin was already having fun with a value level over $70k. This buy put MicroStrategy on the head of practically each different non-public bitcoin stockpile, from all publicly traded miners to a number of main exchanges and ETF issuers.

It’s a surprising show of confidence in Bitcoin that anybody is ready to make such main investments at a time when it’s by no means been dearer. Plainly the temper in these corporations is that the all-time highs of as we speak will appear to be a paltry sum in only a few years. Analysts from ETF issuer Bitwise, for instance, had been assured sufficient of their prediction that company entities representing trillions of {dollars} would start ramping up investments that Bitwise’s Chief Funding Officer launched an official memo on the topic. Claiming “serious due diligence” conversations with everybody from hedge funds to large firms, the memo predicts that Q2 will see much more large inflows than the primary three months of the 12 months. This simply leaves us with one query: The place does this sort of confidence come from?

The middle of the difficulty appears to be the runaway success of the Bitcoin ETF and, specifically, BlackRock’s dominating place over the primary issuers. Initially, it struggled with Grayscale, which had a number of pure benefits: it was a Bitcoin-native firm with a large stockpile, it was an actual chief within the authorized battle to really get SEC approval, its GBTC was a previously-existing fund that was transformed into an ETF, and it had different tips up its sleeve. However, BlackRock is the ETF that reached $10 billion quicker than every other in historical past, capturing forward of all different Bitcoin opponents and certainly all ETFs generally. A lot of this income got here from customers fleeing GBTC’s excessive charges, and it looks as if a assured business chief as we speak. Its success has even matured to the international stage, as Mudrex, a crypto funding platform primarily based in India, is opening up BlackRock ETF gross sales to institutional and non-public traders in a rustic with greater than 1 billion individuals.

This type of success from BlackRock specifically has additionally led a few of its opponents to alter up their tactical strategy. VanEck, for instance, made an announcement on March 11 that they had been waiving all charges on their Bitcoin ETF for a complete 12 months. It will solely proceed as long as their VanEck Bitcoin Belief is below $1.5 billion, however the charges after this window will nonetheless be among the lowest obtainable. Grayscale, for its half, can also be looking for to address the issue of excessive charges by spinning off a “mini-version” of its ETF, providing fractions of Bitcoin for a fraction of GBTC’s charges. Plainly BlackRock’s opponents aren’t but keen to concede a market with such large development potential.

Nevertheless, though the ETF market has been particularly scorching these days, that isn’t the one cause to imagine that Bitcoin’s doing so properly. ABC Information, for instance, credits some optimistic developments from the UK as a significant component in Bitcoin’s value bounce. Britain has beforehand been considered a very hostile regulatory setting for Bitcoin, particularly the ETF, trailing behind each Western Europe and a lot of the Anglosphere in official Bitcoin approval. It was fairly a shock, then, when the London Inventory Alternate (LSE) launched a brand new factsheet on exchange-traded notes (ETNs), deciding that this sort of monetary instrument can be provided on their platform.

ETNs do differ considerably from ETFs, even these just like the Bitcoin futures ETF, which has no direct hyperlink to Bitcoin itself. ETNs are a kind of debt safety and don’t even embrace the proviso that the issuer really holds the bitcoin in query. Nonetheless, they’re immediately tied to the worth of Bitcoin and provide traders a method to acquire publicity to the world’s main digital asset. Contemplating that these ETNs are topic to the stringent guidelines that govern securities, it’s notably attention-grabbing that the LSE has all of the sudden modified its tune on Bitcoin-related monetary merchandise. In different phrases, it appears that evidently the ocean change in authorized Bitcoin spot ETFs in the US has undeniably modified the calculus for companies worldwide. With all these billions flowing into the Bitcoin ETF, even an unfriendly regulator like Nice Britain should be part of within the bonanza if it needs to keep up relevance as a number one hub of worldwide finance.

These are only a few of the developments which have occurred on this planet of Bitcoin, because the intersection between decentralized foreign money and conventional finance has develop into each broader and deeper. Wanting ahead, there are nonetheless loads of upcoming occasions, just like the halving predicted in April, to maintain propelling the hype ahead. It might be tough to foretell precisely the place the following main growth and value bounce will come from, however proper now it appears as if there’s a rising religion coming from some true monetary giants. Bitcoin has come an extremely great distance for the reason that days of its whole pariah standing, and now there’s properly over a trillion {dollars} available in the market. With development like that, it’s a simple win to maintain betting on Bitcoin.