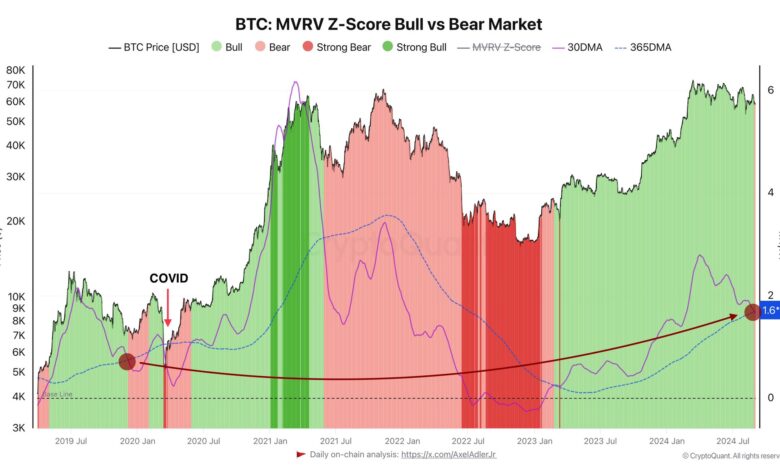

Bitcoin Market Value to Realized Value (MVRV) Z-Score Signals Bearish Trend for BTC Market

On-chain knowledge signifies that the Bitcoin Market Value to Realized Value (MVRV) Z-Score is at the moment bearish, suggesting a lower in investor profitability. The MVRV Z-Score compares the market cap to the realized cap, which displays the associated fee foundation of all circulating tokens. The current crossover of the 30-day shifting common under the 365-day shifting common signifies a possible bearish section for Bitcoin, comparable to patterns seen in previous market cycles. Whereas Bitcoin is at the moment buying and selling at round $57,700, down greater than 6% over the previous week, the MVRV Z-Score sign could both precede a wholesome market reset or a transition away from the present bull market cycle.

This text initially appeared on www.newsbtc.com

Bitcoin buyers have been on a rollercoaster journey in current weeks, with the worth of the favored cryptocurrency fluctuating wildly. And now, a key indicator has given a bear market sign that has some buyers anxious.

The MVRV (Market Value to Realized Value) ratio is a extensively adopted metric within the cryptocurrency house that measures the ratio of the market worth of Bitcoin to the worth of all Bitcoin ever purchased. When the MVRV ratio reaches a sure stage, it might point out that the market is overvalued and due for a correction.

Just lately, the MVRV ratio for Bitcoin has climbed to ranges not seen for the reason that final bear market in 2018. This has raised issues amongst some buyers {that a} main correction could possibly be on the horizon.

The MVRV ratio is only one of many indicators that buyers use to gauge the well being of the cryptocurrency market. Nevertheless, it has a observe file of precisely predicting market downturns previously, which has led many buyers to take discover of its current sign.

For many who are new to investing in Bitcoin, the current bear market sign from the MVRV ratio could also be a trigger for concern. Nevertheless, seasoned buyers perceive that the cryptocurrency market is extremely risky and that corrections are a traditional a part of the investing cycle.

It is vital for buyers to do their very own analysis and never rely solely on one indicator or sign to make funding choices. The cryptocurrency market could be unpredictable, and it’s at all times clever to diversify your funding portfolio to mitigate danger.

Whereas the MVRV ratio could also be indicating a bear market for Bitcoin, it’s important to do not forget that the cryptocurrency market continues to be in its early levels and has quite a lot of room for progress in the long run. It’s at all times a good suggestion to keep knowledgeable and keep disciplined in your investing technique.

In conclusion, Bitcoin buyers ought to concentrate on the current bear market sign from the MVRV ratio and take it into consideration when making funding choices. Nevertheless, it’s important to do not forget that the cryptocurrency market is extremely risky and corrections are regular. By staying knowledgeable and diversifying your funding portfolio, you’ll be able to navigate the ups and downs of the market with confidence.