Bitcoin volatility sees futures slump, while options open interest spikes

The volatility Bitcoin skilled this week had a very fascinating influence on the derivatives market. Between June 23 and June 27, BTC misplaced its comparatively secure assist at above $64,000 and dropped to $60,000, with a short dip under $60,000 earlier than recovering on June 25.

While the value drop won’t appear that important when taking a look at long-term value motion, a drop under $60,000 is a crucial psychological milestone for merchants. This is the reason the 6% drop had a notable influence on derivatives. Open interest in Bitcoin futures dropped from $33.33 billion on June 23 to $31.39 billion on June 27, reaching its lowest level since Might 17.

The first purpose for this lower was pressured liquidations. As the value fell sharply, a major variety of merchants with leveraged lengthy positions seemingly confronted margin calls. Unable to satisfy these calls in time, their positions have been liquidated, which may have added to the promoting strain and led to an additional drop in open interest.

This typically creates a suggestions loop, exacerbating the value decline as liquidations set off extra sell-offs. Moreover, the declining value seemingly prompted merchants to develop into extra risk-averse. With heightened volatility and uncertainty, merchants might need been discouraged from opening new futures contracts, opting as a substitute to scale back publicity till the market stabilizes.

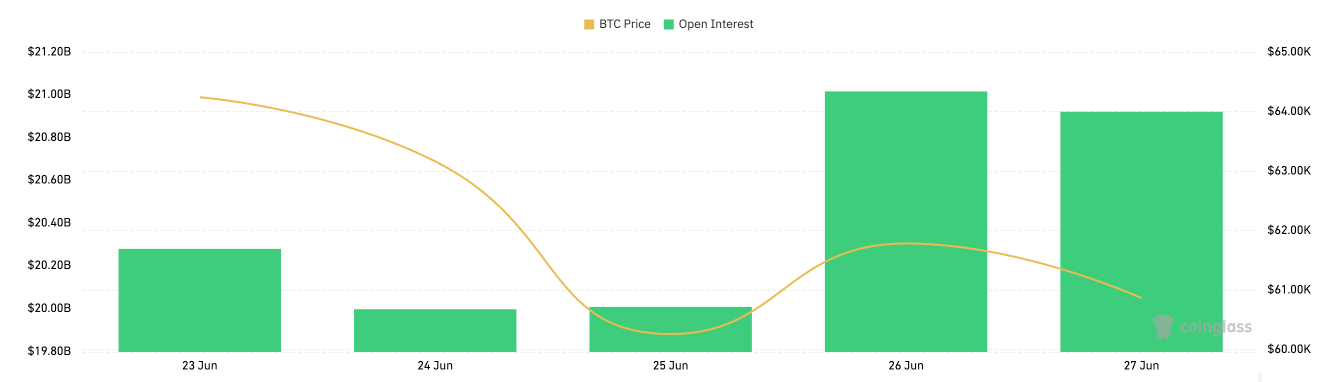

While the futures market contracted, the options market grew. Open interest in Bitcoin options elevated from $20.28 billion on June 23 to $21 billion on June 26, regardless of a short dip to $20 billion on June 25.

The rise in options OI throughout this era means that merchants turned to options as a hedge in opposition to potential value volatility. Options are a versatile device for managing threat, permitting merchants to guard their positions and speculate on value actions with out the identical threat related to futures. The rise in OI, notably in a interval of value decline, exhibits that merchants have been seeking to mitigate threat and place themselves for extra volatility.

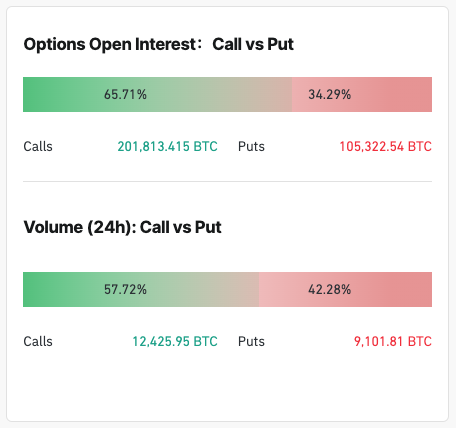

CoinGlass knowledge exhibits that the majority merchants are making ready for upward volatility. As of June 27, 65.71% of the options open interest consisted of name options, with the 24-hour quantity favoring calls at 57.72%. The clear dominance of name options exhibits a bullish sentiment prevailing, and merchants are positioning for value restoration or seeking to capitalize on decrease costs with restricted draw back threat.

Arbitrage alternatives between spot, futures, and options markets may have elevated options buying and selling exercise. Institutional involvement, with establishments utilizing options for threat administration and portfolio changes, seemingly contributed to increased options open interest.

Volatility buying and selling, the place merchants revenue from anticipated modifications in market volatility, additionally attracted extra exercise within the options market throughout this era of elevated value swings.

The shifts seen in futures and options open interest present how merchants make use of completely different threat administration methods in response to cost declines. Futures merchants seem to have diminished their publicity on account of liquidations and elevated threat aversion, while options merchants elevated their publicity for hedging and hypothesis.

The put up Bitcoin volatility sees futures droop, while options open interest spikes appeared first on CryptoSlate.