Bitcoin vs. Real Estate: Which Is The Better Store Of Value In Times Of Conflict ?

Introduction

We dwell in a extremely digitalized world, however most of humanity nonetheless makes use of bodily items to retailer worth. The most used retailer of worth on the planet is actual property. It is estimated that approximately 67% of global wealth is held in property. Lately, nevertheless, macroeconomic and geopolitical headwinds have highlighted the weaknesses of actual property as a bodily retailer of worth. What to do if a struggle breaks out? What occurs if a house that was used as a retailer of worth is destroyed?

In German, actual property interprets to “Immobilie,” which accurately means “to be immobile.” Proudly owning actual property creates a neighborhood dependency that may pose an issue in a world of ever-increasing battle and radicalization. In the occasion of struggle, you can’t take actual property with you and it may be simply destroyed.

This may increasingly sound like a dystopia, however I consider that if you’re severe about long-term wealth administration, it’s best to think about the worst-case situation and the doable world affect.

Battle And Destruction Of Wealth

Because the starting of the twenty first century, war has never cost humanity so much. Over 238,000 individuals had been killed in battle final 12 months. Syria, Sudan, Ukraine, Palestine, Israel, Lebanon – the worldwide sources of battle are growing. A few of these areas have already suffered huge destruction. There aren’t any extra properties there and the worth saved in them has actually evaporated. It is onerous to think about the monetary setbacks individuals have needed to endure, other than the struggling and grief that struggle brings.

Real property is used as a retailer of worth all over the world, though there are some exceptions, reminiscent of Japan. With the specter of destruction growing, the fruits of the labour of thousands and thousands, presumably billions, of individuals are at stake. Alongside inflation and taxation, bodily wealth destruction has traditionally been one of many biggest threats to total prosperity. Already in historical occasions, armies ruthlessly plundered cities and destroyed the residents’ belongings.

Bodily vs. Digital Store Of Value

Luckily, with Bitcoin there’s a resolution to the specter of destruction of wealth saved in bodily property. As a digital, near-perfect cell retailer of worth, it’s troublesome to destroy and simple to maneuver.

The introduction of Bitcoin in 2009 challenged the position of actual property as humanity’s most popular retailer of worth, because it represents a greater different that permits individuals worldwide to guard their wealth with relative ease.

You should purchase very small denominations of bitcoin, the smallest being 1 satoshi (1/100,000,000 of a bitcoin) for as little as ≈ $ 0.0002616 (on 2/12/2024). All you might want to retailer it safely is a fundamental laptop with out web entry and a BIP39 Key generator — or simply purchase a {hardware} pockets for $50. In case you might want to relocate, you’ll be able to memorise 12 phrases, the backup (seed phrase) on your pockets, and “take” your bitcoin with you

Digitalization

Digitization optimises nearly all value-preserving features. Bitcoin is rarer, extra accessible, cheaper to take care of, extra liquid and most significantly, it means that you can transfer your wealth in occasions of disaster.

Bitcoin is wealth that really belongs to you. With the specter of struggle looming all over the world, I consider it’s higher to carry wealth in a digital asset like bitcoin than in bodily property like actual property, gold or artwork, which might simply be taxed, destroyed or confiscated.

Property Confiscation

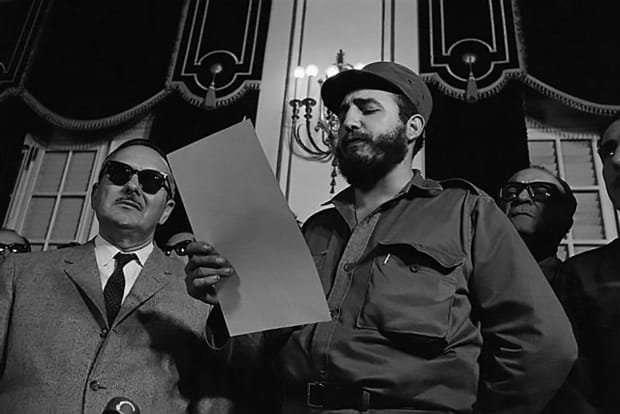

If we take a look at historical past, it’s clear that bodily shops of worth have left individuals weak to authorities overreach. A historic instance is the expropriation of Jews in Nazi Germany. Sadly, these repressions weren’t an remoted case in historical past. It occurs on a regular basis. Many lost their property in Cuba when Fidel Castro took over, as Michael Saylor likes to level out.

These painful historical past classes underscore the importance of safeguarding wealth in a digital asset reminiscent of bitcoin, which proves difficult to confiscate, tax or destroy and simple to maneuver.

Macroeconomic Modifications

Moreover, shifts within the macroeconomic panorama can swiftly devalue actual property. Sometimes, actual property is bought via a mortgage. Subsequently, elevated rates of interest translate to diminished affordability for financing, leading to a decreased demand and subsequently reducing property costs. We are able to see this situation taking part in out globally proper now, the conjunction of increased interest rates and reduced demand is contributing to the decline in property values around the globe.

Bitcoin vs. Real Property

Bitcoin is much less affected by the issues of the standard fiat monetary system than actual property. Because it operates independently of the system. Variables reminiscent of rates of interest, central financial institution choices, and arbitrary governmental actions have restricted affect on bitcoin. The value is predominantly decided by its provide, issuance schedule and adoption fee.

Bitcoin follows a disinflationary mannequin that means a gradual discount in its provide over time till a tough restrict is reached in 2140. Roughly each 4 years, the bitcoin awarded to miners for efficiently ordering transactions (each 10 minutes) are halved.

The upcoming halving, set for Friday, April 19, 2024, is anticipated to halve the block reward from 6.25 bitcoin to three.125, which interprets to a every day issuance of 450 bitcoin as an alternative of 900.

At present, bitcoin has an annual inflation fee of round 1.8%, which is anticipated to drop to 0.9% after the upcoming halving. After that, the inflation fee shall be nearly negligible. In addition, a lot of bitcoin had been misplaced and we are able to anticipate that many shall be misplaced sooner or later. The steady decline in finite provide will increase the deflationary stress of the Bitcoin community. As more and more people (and machines) are using bitcoin, growing demand is countered by reducing provide.

This extraordinarily sturdy deflationary motion can’t be noticed in actual property. Though actual property can also be scarce because of the restricted provide of constructing land, there isn’t any onerous cap. New constructing land may be developed and zoning legal guidelines can, for instance, allow the development of upper flooring.

Absolute Shortage

For many, it’s troublesome to think about the affect of a set provide on the worth of an asset. Previous to Bitcoin, there was no idea of an inherently scarce commodity. Even gold possesses an elastic provide. Elevated demand prompts extra intensive mining efforts, a flexibility not relevant to bitcoin.

Consequently, with every halving occasion, signifying a discount in provide, the worth of bitcoin ascends and continues to take action perpetually. This everlasting enhance persists so long as there’s a corresponding demand, a chance attributed to bitcoin’s distinctive financial properties.

This dynamic is anticipated to proceed even within the midst of a worldwide financial disaster. The provide of bitcoin will proceed to lower and the worth will most probably proceed to rise. Because of the anticipated continued demand in occasions of disaster, as defined. Even inflation can have a optimistic affect on the worth of bitcoin because it results in elevated availability of fiat currencies that may be invested in Bitcoin.

Conclusion

In a world marked by rising radicalization and a monetary system present process a profound disaster, bitcoin emerges as a superior selection for storing worth, particularly during times of macroeconomic fluctuations. The significance of bitcoin is anticipated to rise throughout these turbulent occasions, doubtlessly overtaking actual property as humanity’s most popular retailer of worth within the distant future.

The aspiration is that an growing variety of people will acknowledge some great benefits of Bitcoin, not just for wealth preservation however, in excessive circumstances, for securing their livelihood.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B

This can be a visitor publish by Leon Wankum. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.