Bitcoin's Halving Aftermath

Get the very best data-driven crypto insights and evaluation each week:

By: Parker Merritt & Tanay Ved

-

Between a record-breaking quantity of transaction charges and a large bid for the collectible “Epic Sat,” miner income for Bitcoin’s Halving block totaled $4.7M

-

The Runes protocol launch on block 840,000 triggered a surge in OP_RETURN transactions, with 518K OP_RETURNs on 4/20 & an all-time-high of 799K on 4/23

-

Adjusting miners’ earnings for energy consumption, miner income per megawatt now sits at $1.3K, approaching the bottom ranges because the FTX collapse in 2022

Adhering to its predetermined financial coverage, Bitcoin underwent its 4th Halving at block 840,000, reducing block rewards from 6.25 BTC to three.125 BTC. With far-reaching implications for miner economics, mining swimming pools, and the Bitcoin ecosystem as an entire, understanding the post-Halving panorama is essential. This week’s State of the Community examines the aftermath of Bitcoin’s most up-to-date block reward Halving, constructing on our earlier evaluation in SOTN Problem 255.

The Halving is probably the most well-telegraphed occasion within the crypto trade, with a hard-coded emissions schedule setting Bitcoin’s issuance fee in stone because the community’s genesis. Nonetheless, main as much as the Halving, there have been loads of open questions—can the mining trade climate the change? Will transaction charges offset the reduce in mining income? What are the implications for the broader Bitcoin group?

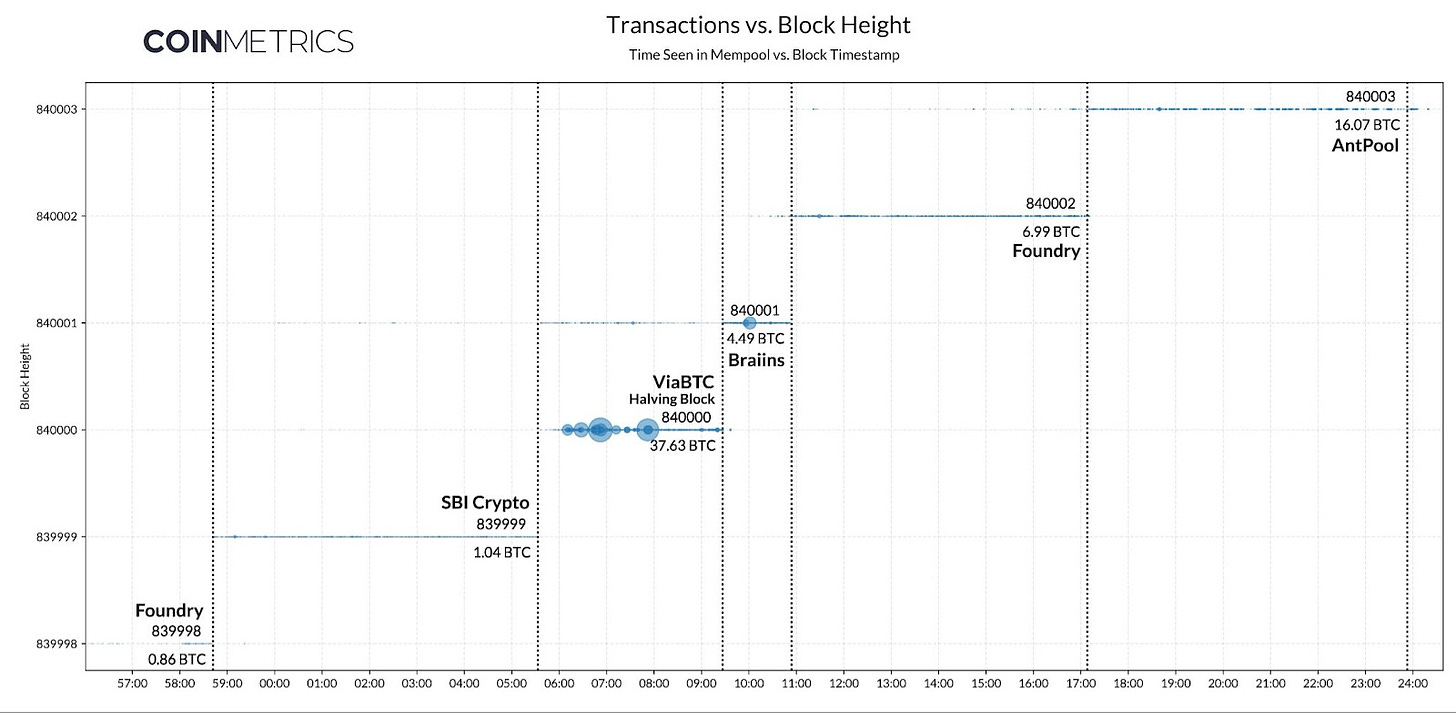

Although the block subsidy was predictably slashed 50% on block 840,000, mining income considerations had been quickly alleviated by the flurry of charges that adopted. Mining pool ViaBTC secured the most important prize, incomes 37.63 BTC in transaction charges due to a sudden inflow of bids to safe an allocation of the epoch’s earliest block.

Source: Coin Metrics ATLAS & Transaction Tracker

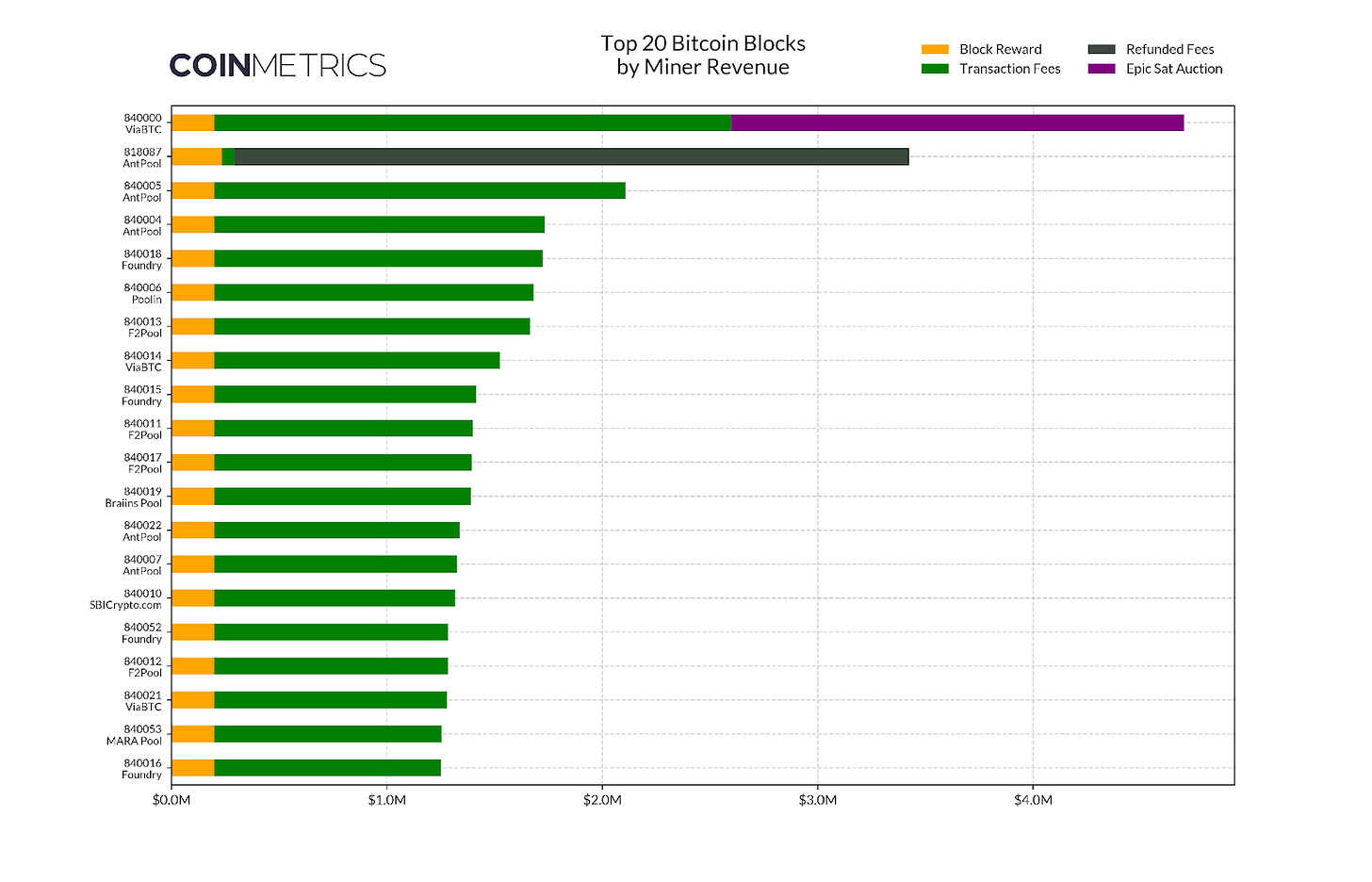

Between a 3.125 BTC block subsidy and 37.63 BTC in charges, ViaBTC had already raked in a substantial quantity of income by mining the Halving block—nevertheless, the block was particularly profitable due to the “Epic Sat.” Along with enabling NFT-style collectibles, the Ordinals protocol proposes a (considerably arbitrary) rarity score for particular person satoshis, the smallest subunit of Bitcoin at 0.00000001 BTC. Whereas the market worth of a person sat is a fraction of a penny, an “Epic Sat” is designated as the primary sat in a Halving block, giving it immense (subjective) worth, as solely 4 have been mined in Bitcoin’s historical past to date.

Because the fortunate pool to snag the Halving block, ViaBTC remoted the newly-minted Epic Sat and provided it for public sale on CoinEx, an change operated by ViaBTC’s CEO. After a 3-day bidding struggle, the collectible offered for 33.3 BTC (~$2.1M), making block 840,000 probably the most precious batch of transactions ever mined in Bitcoin’s historical past.

The Epic Sat made a serious contribution to ViaBTC’s earnings, however the string of blocks that adopted continued to climb the ranks when it comes to record-breaking miner income. Apart from a large “fat finger” charge mistakenly paid by Paxos in block 818,087—later refunded by AntPool— the highest 20 blocks by whole income (and 88 of the highest 100) had been all mined within the first day of Bitcoin’s fifth epoch.

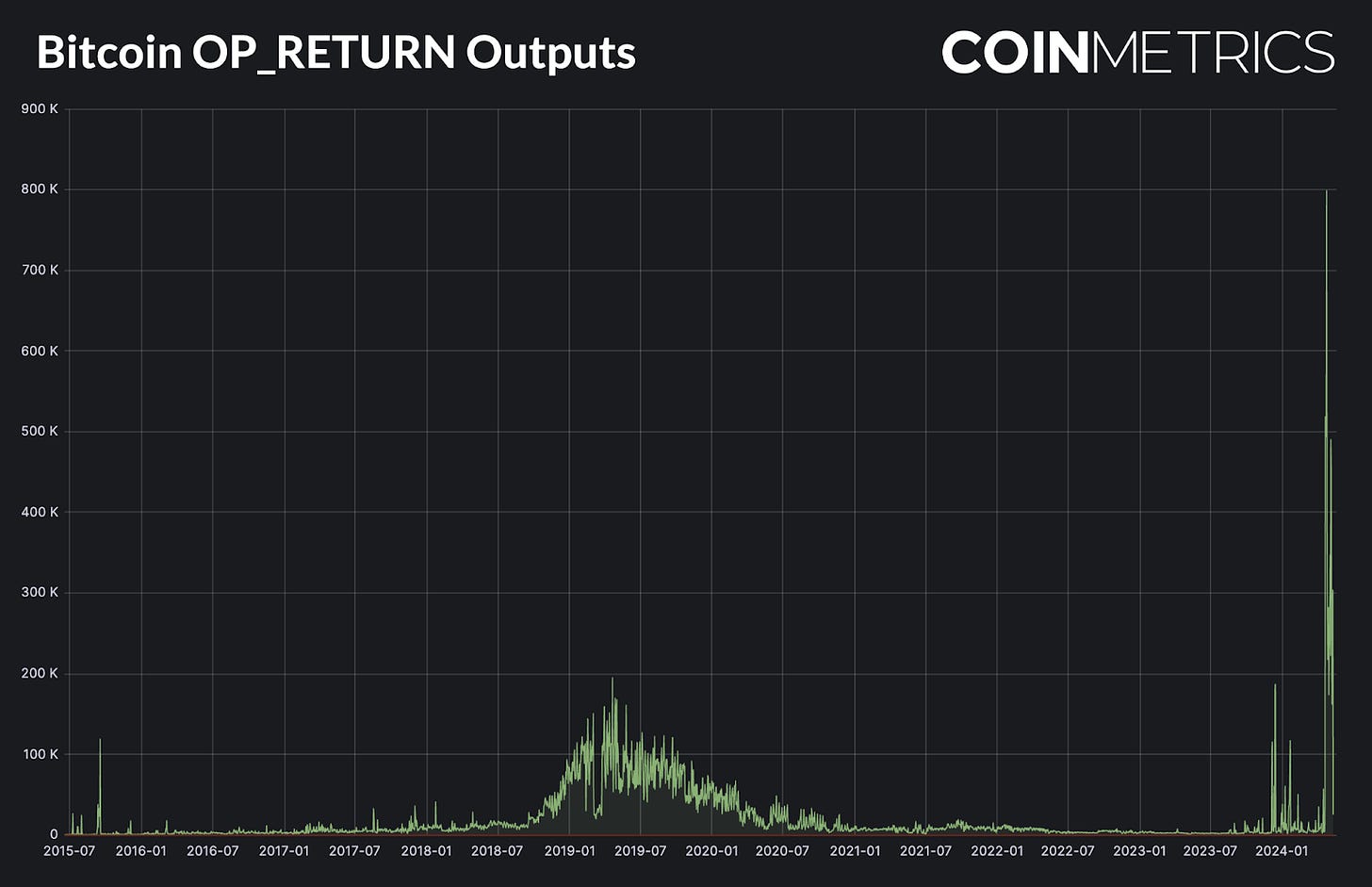

Since their introduction in 2023, Ordinals & Inscriptions have been the foremost drivers of miner transaction charge revenues. On the Halving block, nevertheless, a brand new metaprotocol entered the fray. The Runes token normal (one other invention of Ordinals creator Casey Rodarmor) formally launched on block 840,000, bringing a brand new wave of on-chain hypothesis to Bitcoin.

From a technical perspective, Runes try to enhance upon earlier efforts to bolt ERC-20 fashion fungible tokens onto the Bitcoin blockchain. Whereas Inscriptions had been initially designed to allow on-chain NFTs, tinkerers rapidly repurposed the tech to create “BRC-20s,” embedding JSON-formatted textual content into transactions as a crude mechanism for creating & transferring tokens. BRC-20s like ORDI quickly ballooned to billion-dollar market caps, incomes listings on buying and selling platforms like Binance & OKX.

Whereas widespread amongst speculators, BRC-20s had been extensively derided for technical inelegance, bloating the blockchain & requiring advanced indexing options. To bridge these gaps, Runes circumvent Inscriptions altogether, leveraging Bitcoin’s longstanding OP_RETURN subject to encode compact token protocol messages. Inside 24 hours of the Runes launch on March 20, Bitcoin hit a brand new day by day file of 518.6K OP_RETURN outputs, later topped by 798.7K OP_RETURNs on March 23.

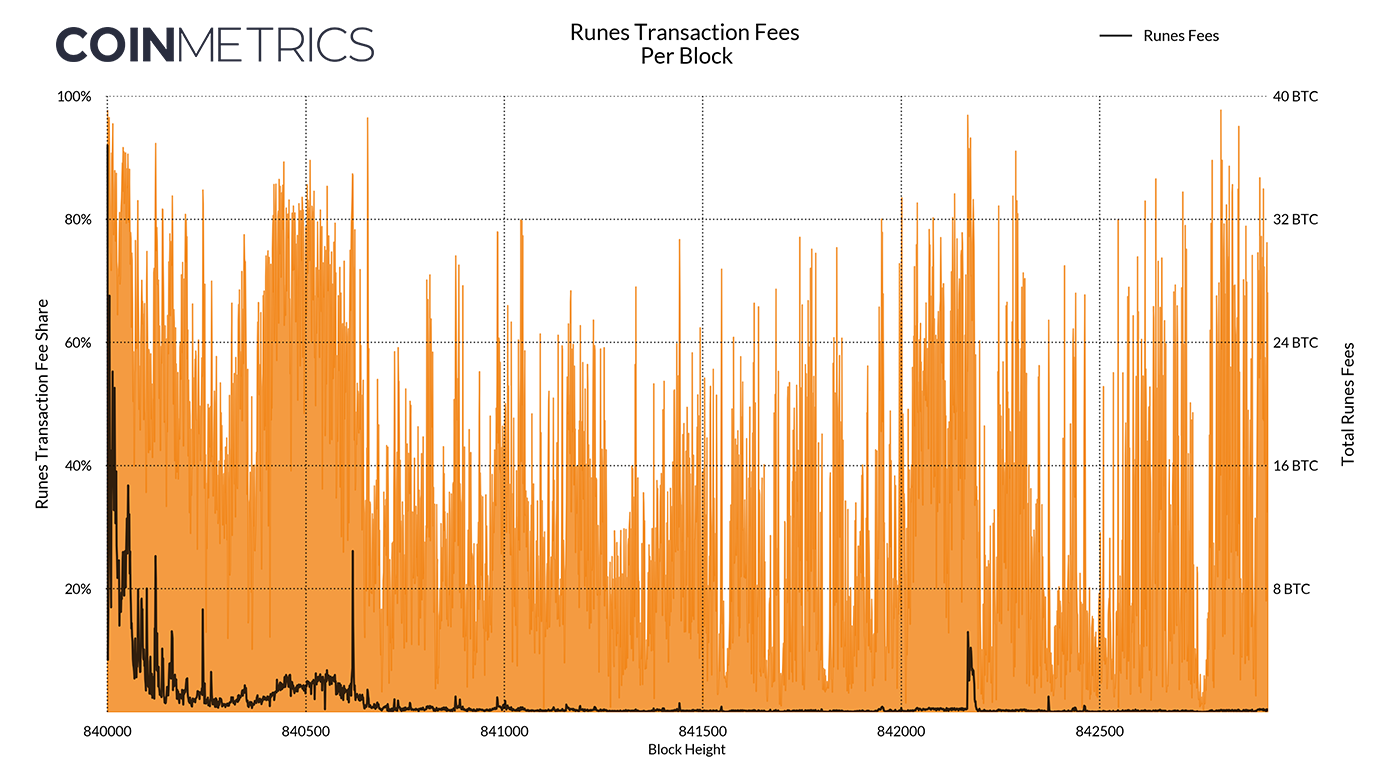

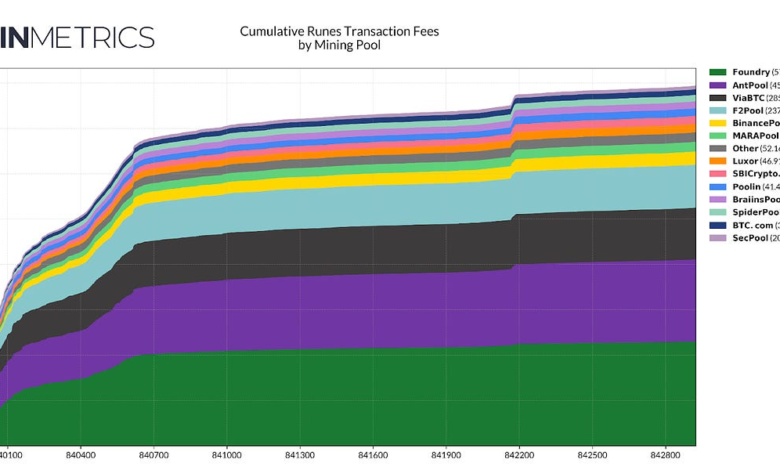

Runes pleasure was red-hot following the Halving, with 97% of charges in block 840,000 spent securing a spot as one of many earliest etchings. On the earth of on-chain collectibles, there’s an aura of status related to being one of many first initiatives to launch. The etcher of Rune 840000:1 (a.ok.a. Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z) tipped miners 6.73 BTC for the first slot within the Halving block. This guess seems to have paid off, as “FEHU” is now the highest-ranking Rune by market cap at a valuation of $2.4B. The magnitude of Runes income has since dwindled, however stays a considerable contributor to miner revenue, accounting for ~50% of charges per block over the previous week.

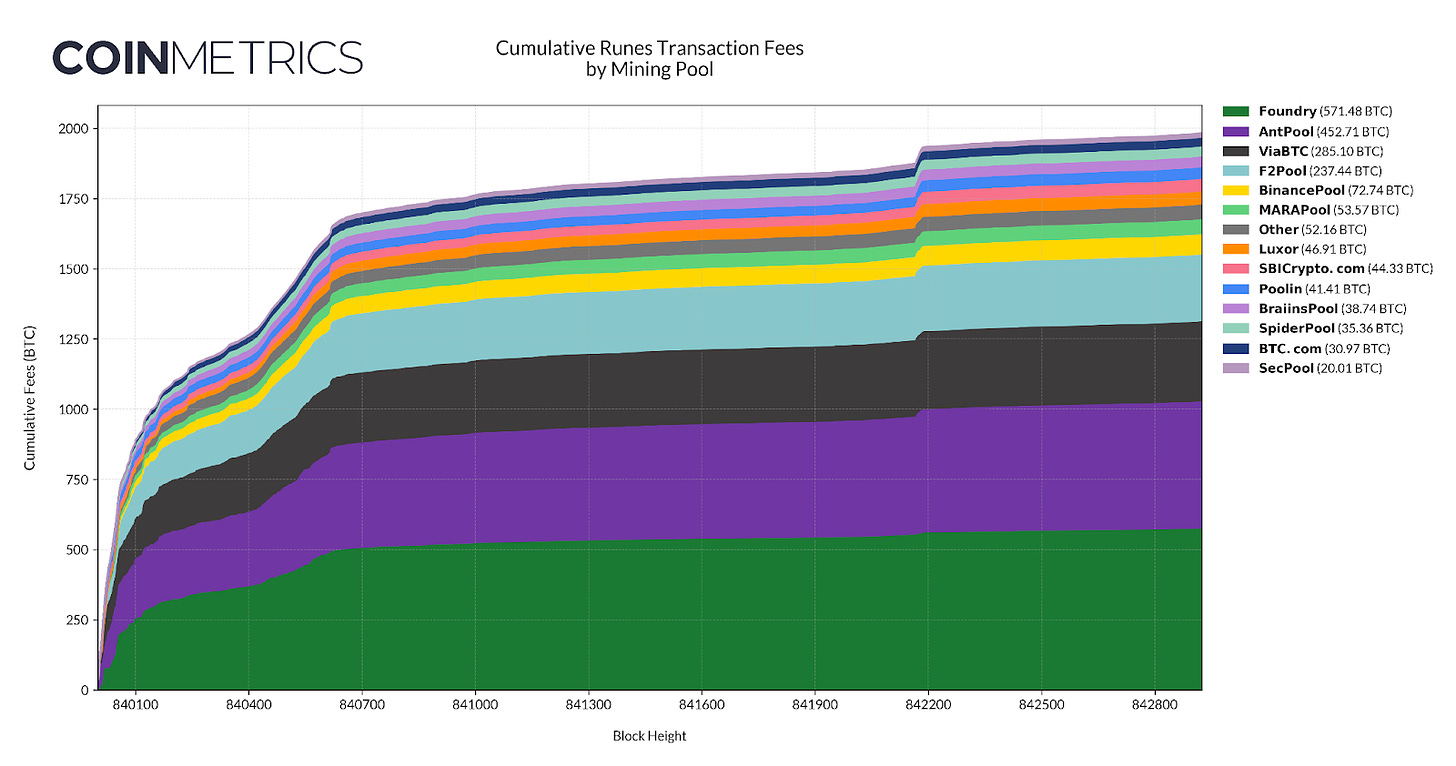

Miners have earned a complete of two,000 BTC by way of Runes charges because the protocol launched on the Halving block. Almost half of this whole got here within the first 24 hours of the Runes debut, with momentum plateauing lower than 5 days later. Nevertheless, Runes stay of their infancy, and miners have benefitted from small bursts in income as highly-anticipated initiatives come to market. On block 842,166, the winner of ViaBTC’s public sale linked the Epic Sat to a brand new Rune known as EPIC•EPIC•EPIC•EPIC, spurring a 4-hour spike in charges as speculators minted their share of 50M tokens.

Regardless of setting information for charges at launch, Runes have since been written off as a flop, with waning curiosity failing to match the hype main as much as the Halving. Nonetheless, the Ordinals ecosystem took months to construct out the infrastructure required for significant liquidity, and Runes are but to be validated within the type of listings on main exchanges, buying and selling largely on area of interest collectibles platforms. Within the meantime, miners can’t maintain their breath—income is declining to existential ranges, requiring the trade to revisit assumptions about forward-looking profitability.

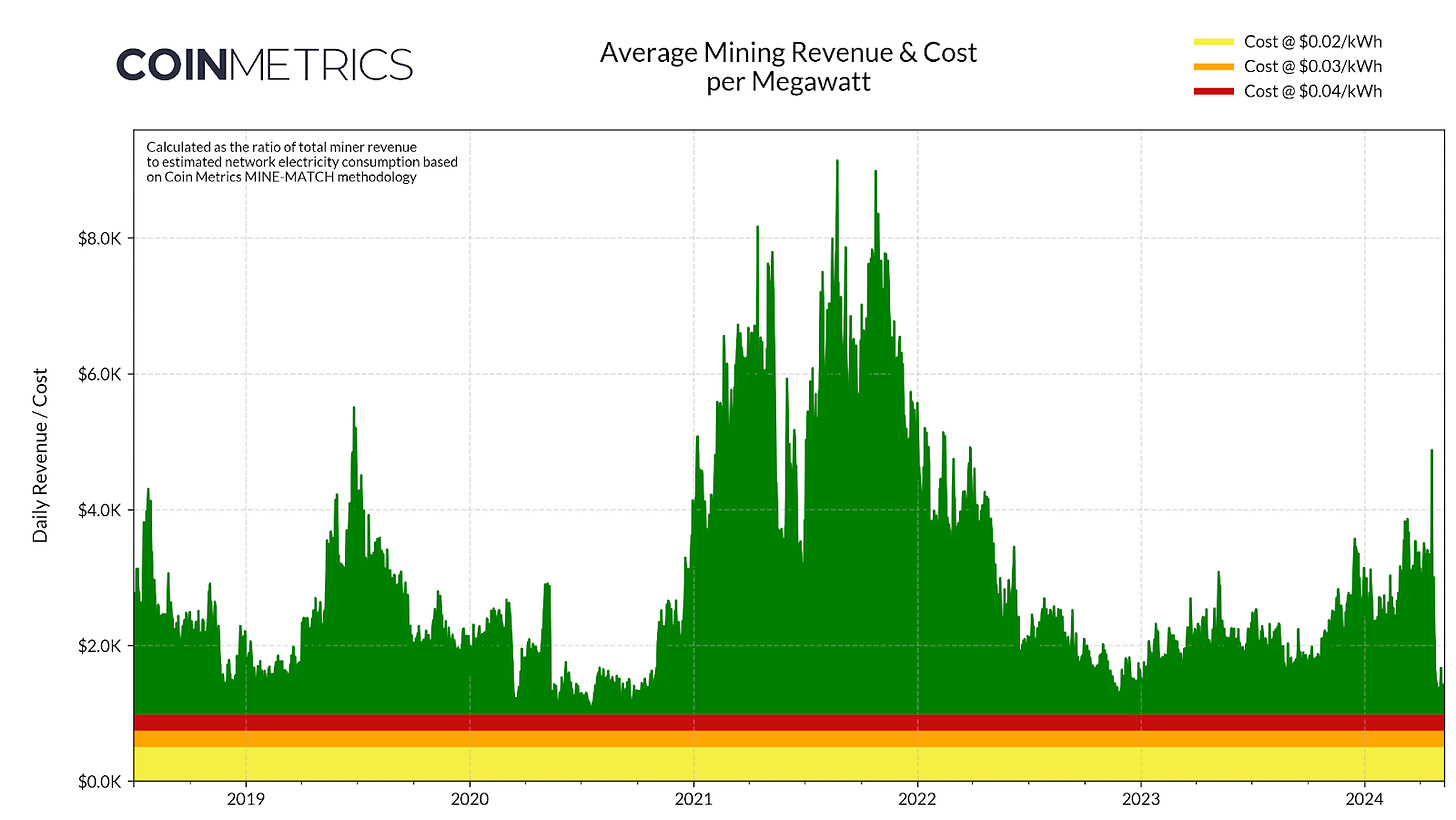

Within the wake of the Halving, easy measures of income point out the mining trade’s revenue stays comparatively elevated, averaging near $30M per day. Nevertheless, whole income leaves out an vital consideration—miners are additionally spending significantly extra on electrical energy. Based mostly on Coin Metrics ASIC fingerprinting estimates, the community now consumes ~21.5 GW in energy, up 2x over the previous 2 years.

Taking the ratio of mining income to energy consumption, we get a greater sense of miner revenue relative to their main operational expense. Mining income per megawatt (MRPM) now sits at ~$1.3K day by day, scarcely outpacing day by day prices of $960/MW at an ultra-low energy fee of $0.04/kWh. This locations electricity-adjusted income at ranges not seen since FTX’s collapse, underscoring simply how tight circumstances are for miners. Bigger miners earn extra income per MW (due to upgraded {hardware}) and have long-term contracts at decrease energy charges— nonetheless, MRPM signifies the “average” miner is experiencing immense monetary strain within the post-Halving period.

Source: Coin Metrics Network Data Pro & MINE-MATCH

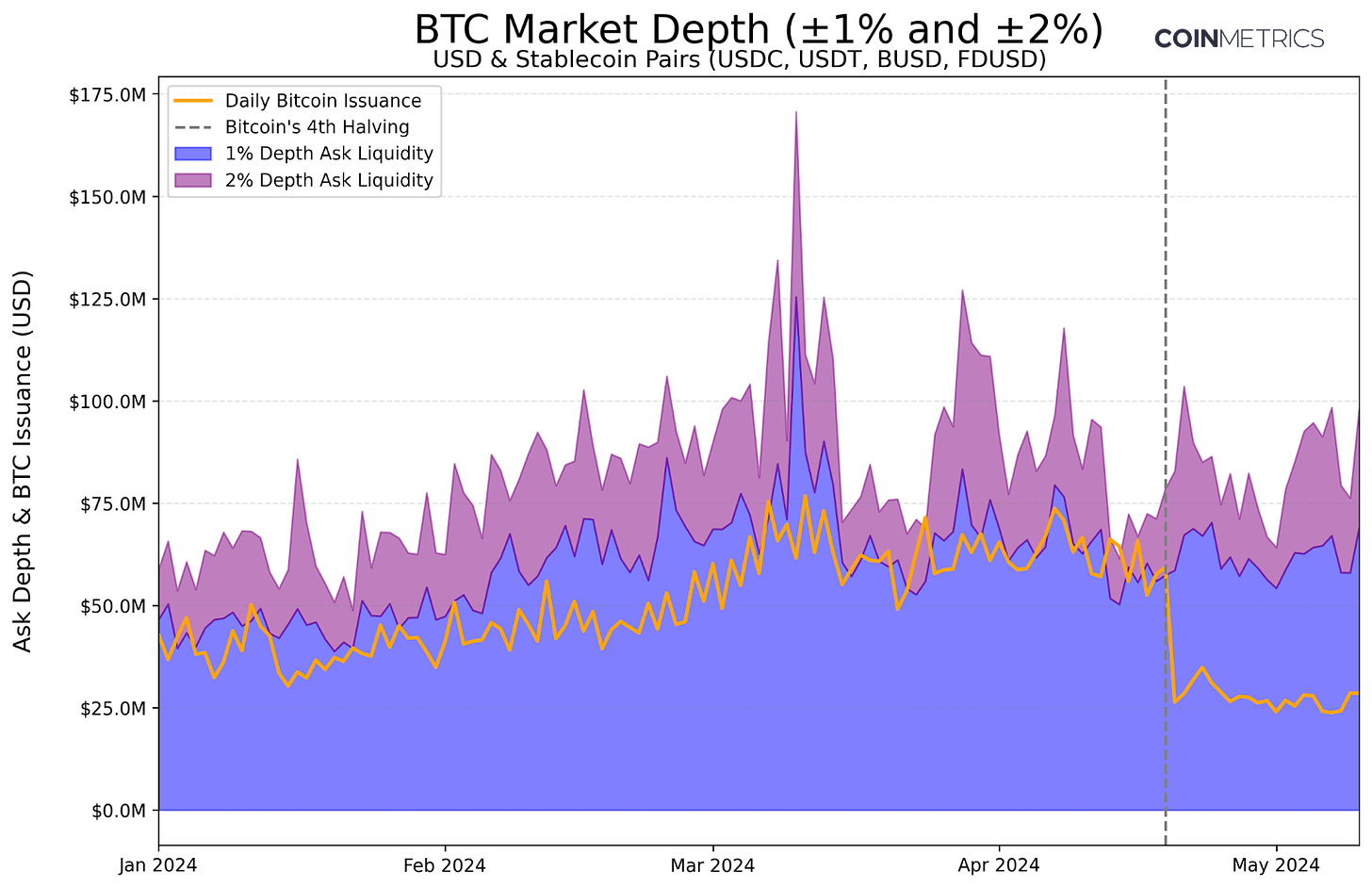

A serious concern main as much as each Halving is the promote strain miners might introduce into the market. With a direct impression on revenues, miners might must promote newly issued bitcoin or liquidate present holdings to cowl OpEx or fund growth efforts, such because the acquisition of extra environment friendly ASICs.

Nevertheless, Bitcoin’s day by day issuance gives us with a baseline for promote strain, dropping from 900 BTC to 450 BTC after the Halving. Notably, pre-Halving issuance of ~$55M carefully aligns with Bitcoin’s 1% ask liquidity, underscoring the market’s skill to soak up miner sell-offs. With a lowered issuance of ~$26M, Bitcoin’s sell-side liquidity stays sturdy, suggesting the market can comfortably take in extra promote strain from miners with out considerably impacting BTC value.

Source: Coin Metrics Network Data Pro & Market Data Feed

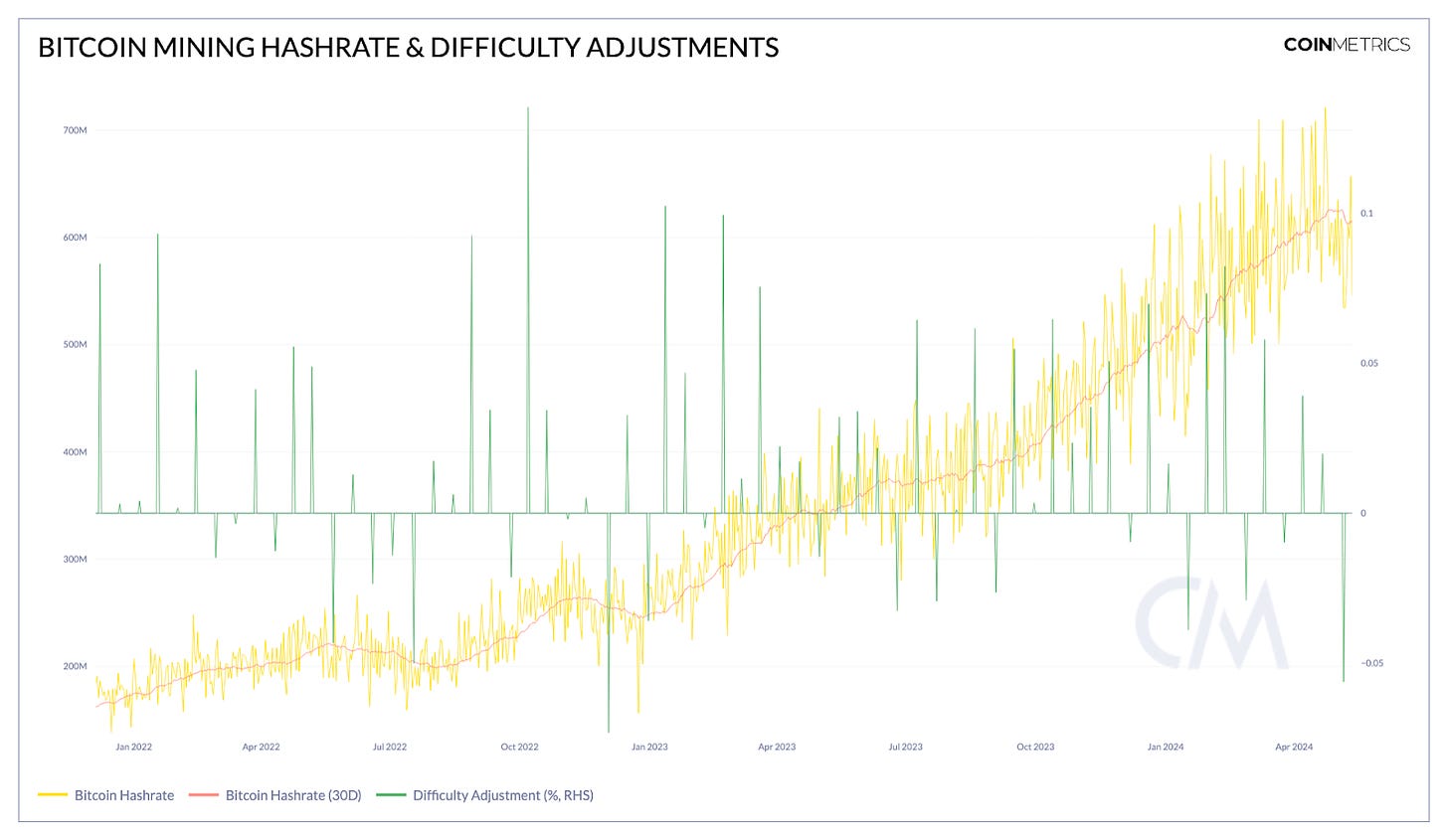

Between decrease income from halved rewards and elevated electrical energy prices, monetary strain on miners has heightened. As evidenced by an 11.2% drop in weekly hashrate from 650 EH/s to 577 EH/s, miners are assessing the viability of their operations beneath tighter margins. Nevertheless, Bitcoin’s latest -5.62% problem adjustment— the most important downward transfer since late 2022— will alleviate some strain by easing the work required for mining new blocks.

Source: Coin Metrics Network Data Pro

Bitcoin’s discount in issuance is crypto’s most predictable occasion, however the 2024 Halving was a notable affair for a lot of causes. Relative to previous Halvings, mining has reached unprecedented scale, with multi-million greenback investments throughout {hardware} & infrastructure. With charges failing to offset the drop within the block subsidy, it’s questionable whether or not many large-scale operations can stay afloat. New protocols like Runes supply a glimpse at catalysts for boosted income, however these markets stay immature, leaving vital gaps in mining profitability assumptions.

Concerning the Halving’s impression on market construction, the adjustment has arguably been “priced in” for years. Nevertheless, liquidity indicators present miner promote strain is now subdued, with issuance effectively beneath the edge required to meaningfully transfer BTC value. In any case, long-term impacts are but to materialize— whereas no assure of future efficiency, Bitcoin’s most vital durations of appreciation usually happen many months post-Halving. For now, the demand-side is again within the driver’s seat, with the Halving’s affect on crypto’s narrative receding into the rear-view.

For extra, be sure to take a look at our previous issues of Bitcoin mining experiences.

Supply: Coin Metrics Community Knowledge Professional

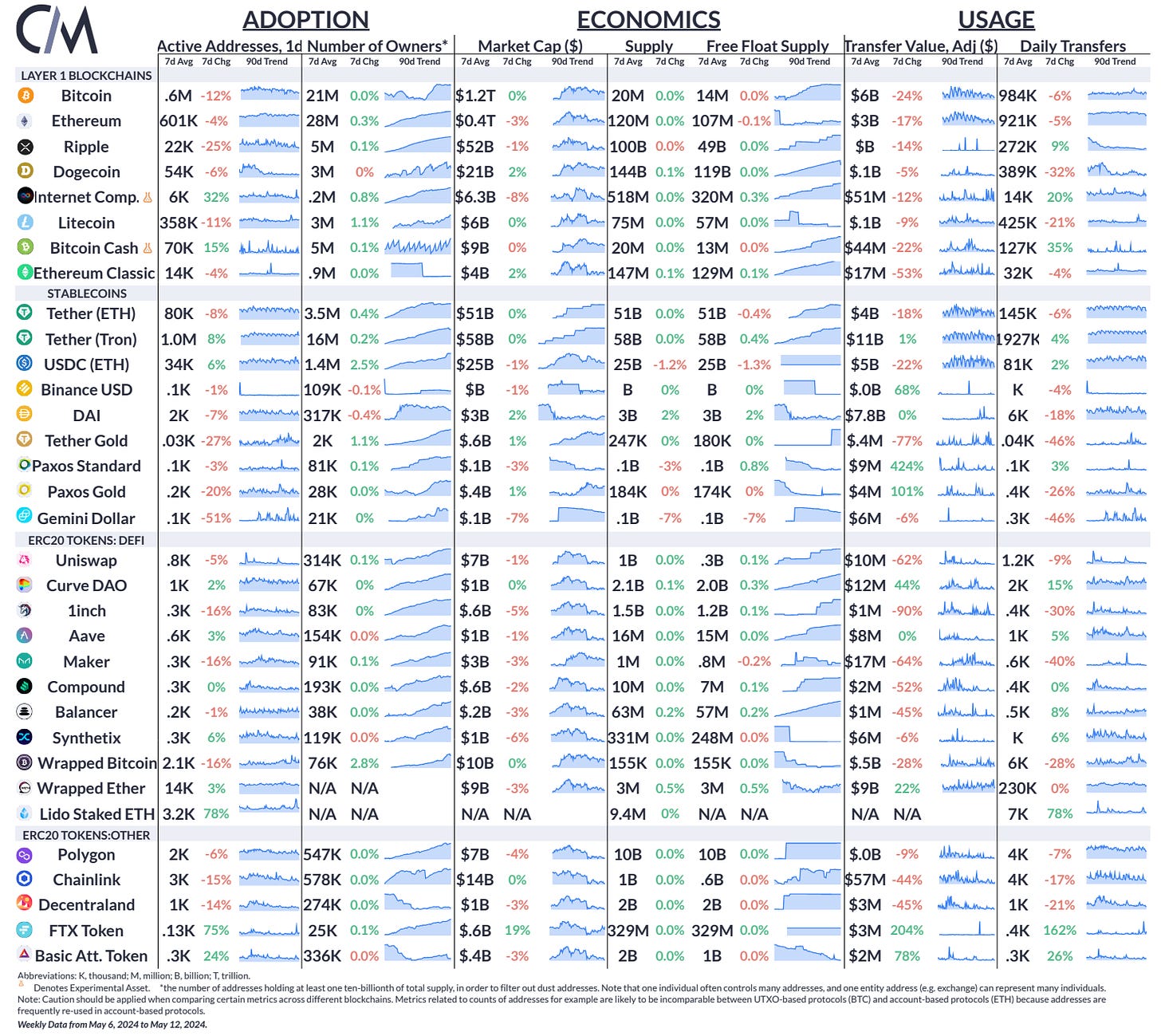

Over the previous week, the variety of energetic addresses for USDT on Tron elevated by 8%, whereas on Ethereum, it decreased by 8%. USDC on Ethereum witnessed a 6% rise in energetic addresses; nevertheless, provide declined by 1.2%, totaling 25B.

This week’s updates from the Coin Metrics group:

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As at all times, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.