Breaking Byzantine Fault Tolerance

Get the most effective data-driven crypto insights and evaluation each week:

By: Matías Andrade

The paper Breaking BFT: Quantifying the Cost to Attack Bitcoin and Ethereum authored by Lucas Nuzzi, Kyle Waters, and Matías Andrade presents a novel mannequin geared toward assessing the prices related to breaching Byzantine fault tolerance (BFT) thresholds inside the Bitcoin and Ethereum networks. Revealed earlier this month, the examine introduces the Whole Value to Assault (TCA) metric, which serves as a pivotal instrument in understanding the financial incentives that safeguard these blockchain networks towards potential threats.

The paper delves into the motivations of potential attackers, distinguishing between profit-driven and ideologically-motivated adversaries. It emphasizes the improbability of assaults being worthwhile given the substantial prices concerned, thus underscoring the significance of analyzing the financial feasibility of such endeavors. On this week’s State of the Community, we dive into the strategy and findings of this paper and assessment the significance of community safety and resistance to assault.

On the coronary heart of the paper lies the idea of Whole Value to Assault (TCA), which serves as a metric for quantifying the associated fee related to breaching BFT in each Bitcoin and Ethereum by a theoretical attacker. TCA is outlined because the summation of Capital Expenditures (CapEx) and Operational Expenditures (OpEx) incurred over time by an attacker making an attempt to breach the BFT threshold of fifty% in Bitcoin and 33% in Ethereum with the intention to carry out an assault.

TCA serves as a measure of blockchain community safety by enabling quantitative reasoning and comparative evaluation of safety. The paper emphasizes the significance of dissecting a community’s safety mannequin in calculating TCA, which reinforces understanding of particular price drivers and contributes to higher appreciation of safety mechanisms like Ethereum’s churn limit.

This paper additionally serves to focus on the variations between financial and non-economic or ideological assaults, the primary sort outlined as these attackers that search to revenue and the second as these attackers that search to destroy the community at a price with out looking for retribution or compensation. Though each forms of attackers are topic to related prices, the payoffs are essentially completely different and thus their motivations have to be regarded individually.

In making use of the Whole Value to Assault (TCA) mannequin to Bitcoin, the paper focuses on two important elements: OpEx (Operational Expenditures) and CapEx (Capital Expenditures).

As talked about earlier, OpEx goals to seize the operational prices borne by the attacker all through the period of the assault. Within the realm of Bitcoin mining, the first element of those prices is often the electrical energy required to energy the ASICs over time. Whereas there are further operational bills related to mining, reminiscent of cooling, facility leases, upkeep, and personnel, this paper focuses totally on electrical energy consumption on this evaluation on account of restricted publicly obtainable information on different operational prices. For brevity, we solely take into account one situation expounded by the paper, on this case assuming entry to a distribution of ASICs that’s much like the market, calculated utilizing the MINE-MATCH algorithm.

With the whole electrical energy consumption per hour of the assault decided, the subsequent step is to estimate the corresponding price of that electrical energy. Given the appreciable disparity in electrical energy costs globally, this paper calculates a median international fee for pricing functions. Information on electrical energy prices throughout 147 nations permits us to calculate a world common of USD 0.15 per kilowatt-hour as of March 2023. This common price is then utilized to the whole electrical energy consumed per hour of the assault to derive the OpEx, which is illustrated within the desk beneath.

Source: Breaking BFT (2024)

Having addressed OpEx, let’s now delve into the Capital Expenditures (CapEx) aspect of the mannequin. CapEx in Bitcoin represents the price of buying Bitcoin ASICs, specialised machines designed to compute the SHA256 hash perform. The paper makes use of the MINE-MATCH algorithm as an correct proxy for the distribution of the Bitcoin ASIC community, which allows the estimation of the dominance of particular ASIC fashions and thus the aggressive effectivity margin of the Bitcoin community over time.

Source: Coin Metrics’ MINE-MATCH

By monitoring ASIC distribution, the mannequin simulates what number of machines an attacker would wish to buy to surpass the 51% threshold required to assault the Bitcoin community for one hour, permitting attackers to double-spend. The paper makes use of market costs of ASICs to estimate CapEx, contemplating elements reminiscent of machine effectivity and elasticity of ASIC provide, in addition to the theoretical price to fabricate S9s. The price estimates akin to historic community hashrate values are illustrated within the chart beneath.

As we will see, on the present community hashrate and ASIC market, the associated fee to assault Bitcoin ranges from $5B to $20B, various in proportion to the elasticity of provide when buying ASICs by the attacker or, as an excessive situation, manufacturing these themselves. Nevertheless, the potential price might escalate additional relying on unprecedented market exercise and provide chain constraints, illustrating the complexity and dynamic nature of estimating the monetary funding required for such an assault.

In making use of the Whole Value to Assault (TCA) mannequin to Ethereum, the paper considers each CapEx and OpEx in the same manner, extending the evaluation to Ethereum’s Proof-of-Stake consensus design. Within the curiosity of brevity, we omit the evaluation carried out within the paper and deal with the ensuing TCA, highlighting among the assumptions given by the paper.

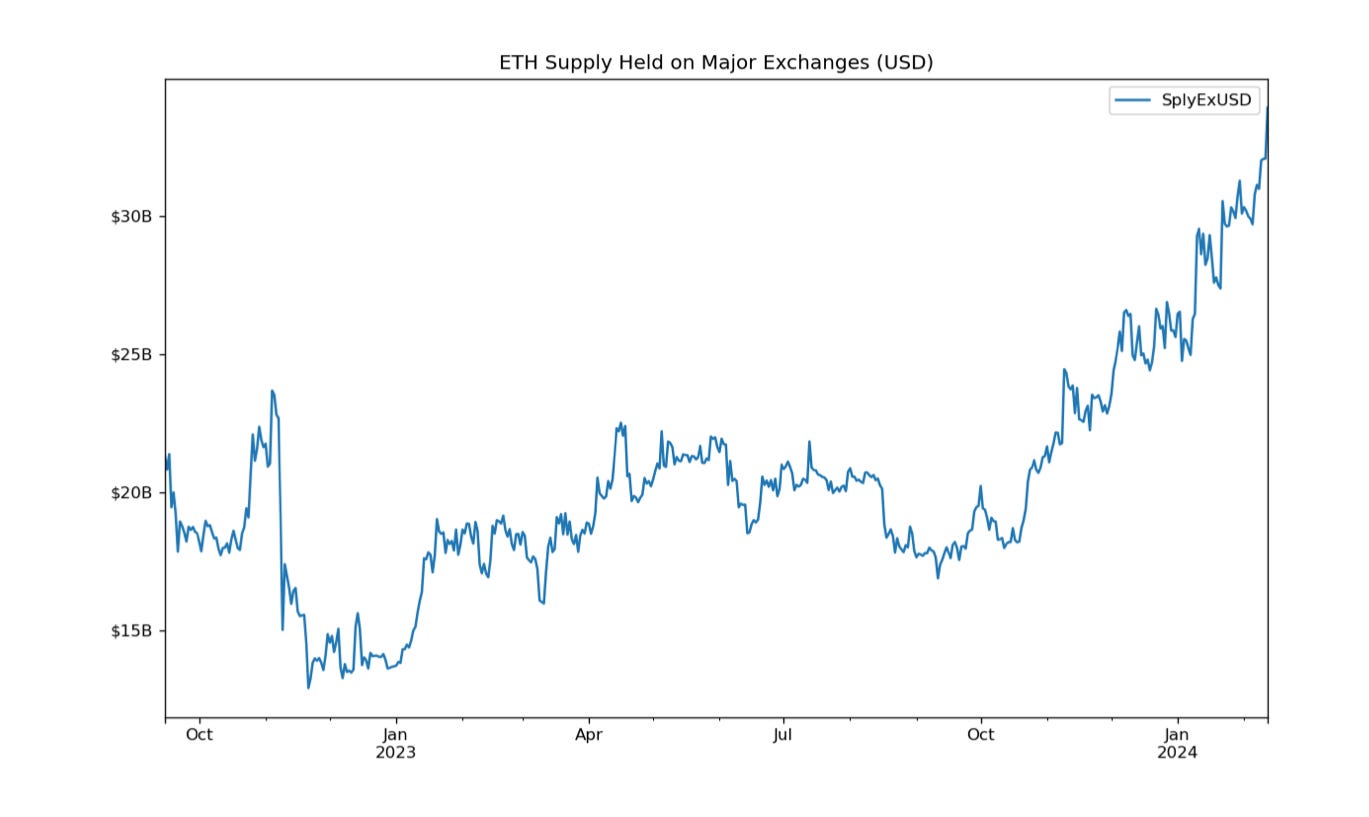

Provided that the attackers would wish ETH to carry out the assault itself, the paper first estimates obtainable liquidity in crucial exchanges, evaluating the feasibility of buying sufficient ETH to carry out this assault. With a purpose to estimate this worth, the Coin Metrics measure of Ethereum held by account wallets tagged as exchanges is used, which is inclusive of crucial centralized exchanges.

To efficiently breach the BFT threshold the attacker would wish to amass ~15 million ETH. This determine surpasses the whole ETH held by Bitfinex, Bitstamp, BitMEX, Binance, Bittrex, Gemini, Huobi, and Kraken mixed. Whereas different main markets like Coinbase, Uniswap, and decentralized lending platforms might doubtlessly present further ETH for the attacker, the chance of a liquidity shock rising earlier than such a far-fetched situation materializes is important.

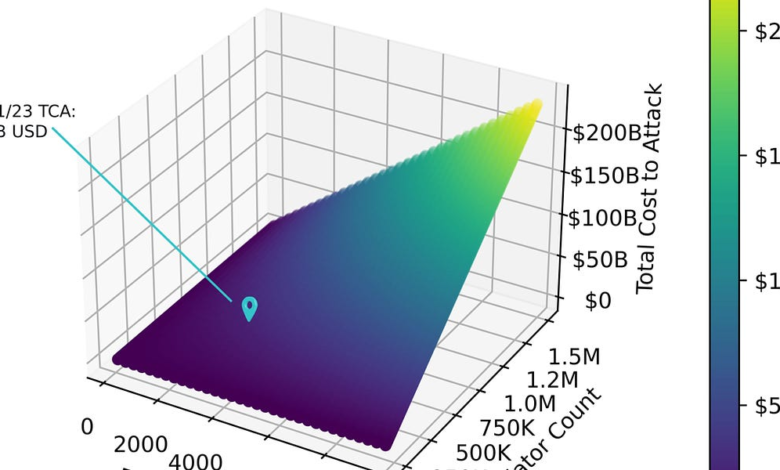

The determine above highlights the connection between Ethereum’s worth, the variety of validators, and the estimated complete price to execute a possible assault on the community, the TCA. It seeks to map out a three-dimensional house the place these variables work together, suggesting that because the Ethereum worth will increase, or because the variety of validators grows, the price of an assault additionally rises. The community standing as of Dec. 31st, 2023 means that the TCA may very well be estimated round $34 billion. This steep price serves as a testomony to the safety and resilience that the Ethereum community’s proof-of-stake consensus mechanism goals to make sure, successfully deterring all however probably the most resourceful adversaries.

In conclusion, the analysis performed by Coin Metrics and detailed in “Breaking BFT” supplies an in-depth evaluation of the robustness of Bitcoin and Ethereum towards potential assaults. The Whole Value to Assault (TCA) metric launched is a worthwhile instrument for assessing the financial viability of such threats. The examine’s findings recommend that the safety of those blockchain networks is underpinned by important financial disincentives for potential attackers. With the TCA for Bitcoin starting from $5B to $20B and Ethereum’s TCA round $34 billion, it turns into evident that the prices to compromise these methods are prohibitively excessive.

The milestone of Bitcoin’s market capitalization surpassing $1 trillion as soon as once more, coupled with the thrill surrounding the newly-minted spot ETFs and the approaching Bitcoin halving occasion indicators a dynamic and doubtlessly transformative section for digital property.The safety mechanisms of main blockchain networks seem like well-equipped to foster rising belief and development in these networks, which, alongside favorable market indicators, paint a promising image for the way forward for the cryptocurrency business.

Ethereum added 8% to its market cap, with the worth of ETH crossing $3K. Uniswap’s (UNI) market cap surged 25% following a proposal to reward holders who delegate or stake their tokens with protocol charges, resulting in a spike in energetic addresses and each day transfers.

This week’s updates from the Coin Metrics group:

-

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, when you’ve got any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.