Chainlink Price Plunges, LINK Holders Accumulating Amid Market Turbulence – NewsBTC

Yesterday, August 5, LINK, the native forex of Chainlink, a decentralized Oracle supplier, plunged to a six-month low. Altering arms at round $8, LINK fell by 64% from March highs, breaking out from a bull flag, signaling weak spot. The correction was throughout the board, and main altcoins like Solana and Cardano additionally posted sharp losses.

Market Evaluation

The substantial drop in LINK’s value mirrored a broader pattern within the cryptocurrency market, with traders witnessing vital losses throughout numerous altcoins. The bearish sentiment was evident as key help ranges have been breached, pushing LINK to its lowest level in six months.

LINK Holders Accumulating, Outflows From Exchanges Spike

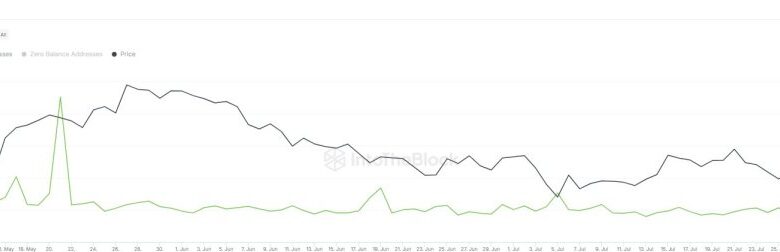

Amidst the market turmoil, savvy traders capitalized on the chance to build up LINK at discounted costs. Knowledge from IntoTheBlock indicated a notable improve in energetic LINK addresses, hinting at a powerful accumulation section unseen in months.

Associated Studying

The surge in energetic addresses aligning with a spike in outflows from exchanges signifies a shift in direction of accumulation quite than promoting. This strategic transfer by customers to carry onto their LINK tokens throughout a value dip might bode nicely for future value restoration.

The uptick in outflows from centralized exchanges like Binance and Coinbase is usually seen positively, indicating a powerful perception within the long-term worth of LINK as customers transfer in direction of non-custodial wallets for better management over their belongings.

Traditionally, such market downturns have paved the way in which for vital value recoveries, significantly amongst devoted LINK holders who view these dips as strategic shopping for alternatives. The resilience of LINK holders throughout previous crises, such because the COVID-19-induced crash in March 2020, underscores their dedication to the asset.

The present situation, characterised by value declines, elevated accumulation, and trade outflows, units the stage for a possible rebound in LINK’s worth as seen in earlier market cycles.

Most Holders Are In Pink, However Companions Are In Chainlink Options

Evaluation of LINK holder information from IntoTheBlock reveals {that a} majority of holders are at present at a loss, with solely a small fraction in revenue. Nonetheless, the resilience of long-term holders, who’ve held onto their tokens for over a yr, signifies a powerful perception in LINK’s future potential.

Lengthy-term holders, who account for a good portion of the LINK group, play an important function in stabilizing costs throughout instances of excessive market volatility.

Moreover, the market sentiment in direction of Chainlink stays optimistic, with the mission’s main place in offering decentralized oracle options to DeFi and NFT platforms. Chainlink Labs’ strategic partnerships, such because the latest integration of Proof-of-Reserve on Ethereum by 21Shares, underscore the rising curiosity in Chainlink’s know-how.

Associated Studying

The collaborative efforts of Chainlink’s ecosystem companions and the resilience of its group might pave the way in which for a resurgence in LINK’s worth because the market recovers.

Function picture from DALLE, chart from TradingView