Checking On-Chain Indicators for Green Shoots in the Digital Assets Market

Get the finest data-driven crypto insights and evaluation each week:

By: Kyle Waters & Matías Andrade

In macroeconomics, analysts have lengthy relied upon a set of established indicators to pinpoint the well being and trajectory of the financial system. The examine of macroeconomics is a well-trodden path, wealthy in historic precedent. In distinction, the crypto-economy, nonetheless in its nascent levels, requires creativity and area experience to search out acceptable indicators. However as the availability of crypto information and our understanding of it has grown, so has the out there set of indicators.

Whereas warning should be exercised in over-relying on any single metric in dynamic and unpredictable markets, sure indicators can present useful insights. On this week’s version of State of the Community, we current a number of indicators that provide us insights towards the backdrop of a current surge in valuations inside the digital belongings ecosystem.

The Community Worth to Switch Worth (NVT) ratio, which is the community worth (or market capitalization) divided by the adjusted switch worth, gives an fascinating view to begin with. Primarily, NVT compares a blockchain’s market capitalization towards its on-chain transactional exercise. A blockchain with a excessive NVT signifies low utilization relative to its market cap, serving as a counterpoint to the idea of velocity. Put merely, a excessive NVT implies that an asset’s valuation is rising a lot sooner than underlying exercise on the community. On account of inherent variations in how varied blockchains are used, direct comparisons of NVT throughout completely different belongings could be difficult.

As we are able to see under, NVT has risen sharply for each BTC and ETH, hinting that their valuations are at the moment rising sooner than underlying transfers. This is perhaps resulting from a lag in underlying exercise, which could decide up in the wake of current worth motion.

Source: Coin Metrics Network Data Pro

Shifting on to a different widespread indicator, market worth to realized worth (MVRV) has traditionally been one in all the most dependable on-chain indicators of bitcoin market tops and bottoms. MVRV is calculated by dividing bitcoin’s market capitalization by its realized capitalization. Realized capitalization may also be regarded as a gross approximation of bitcoin’s combination price foundation. Traditionally, a excessive ratio of market capitalization to realized capitalization has signaled that bitcoin worth was close to an area most, whereas a low ratio has indicated that worth is close to an area minimal.

Source: Coin Metrics Network Data Pro

The few occasions that MVRV has dropped under one have traditionally been a few of the finest occasions to purchase bitcoin. An rising MVRV signifies that present sentiment is rising quick relative to estimated combination price foundation, whereas reducing MVRV alerts the reverse. The MVRV of bitcoin has elevated lately, however remains to be under historic ranges at 1.8.

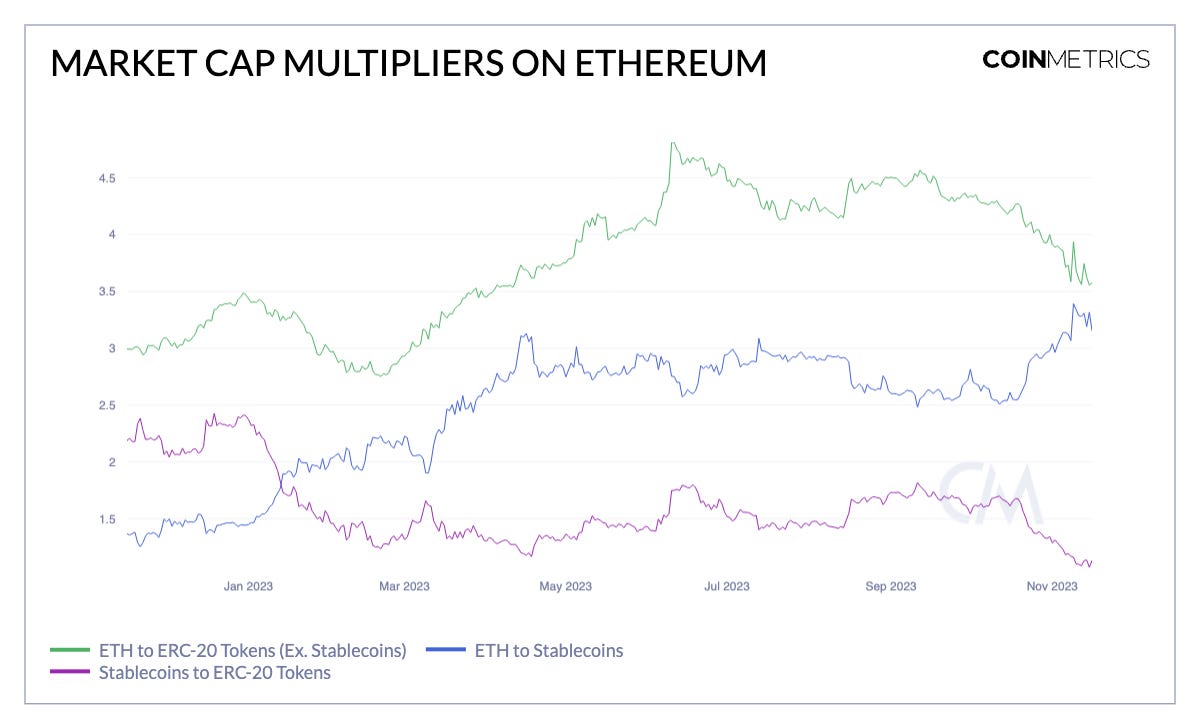

We are able to additionally look at the relative market capitalizations of various segments inside the ecosystem to gauge investor sentiment and tendencies. The chart under compares the relative market caps inside the Ethereum ecosystem, specializing in Ether (ETH), stablecoins, and different ERC-20 tokens in the datonomy™ universe.

Sources: Coin Metrics Community Knowledge Professional & datonomy™

A notable statement is the rising valuation of ETH and ERC-20 tokens in comparison with stablecoins. The market capitalization of stablecoins has not stored tempo with these different segments. This divergence might point out a shift in capital from stablecoins, perceived as safer belongings, to ETH and ERC-20 tokens, that are usually thought of riskier however with larger potential for appreciation in a bull market.

One other intriguing facet is the market cap ratio of ETH to ERC-20 tokens. There was a current decline in this ratio, suggesting that some ERC-20 tokens have skilled extra important positive factors than ETH. This development might replicate a rising urge for food for danger amongst traders, as ERC-20 tokens typically exhibit larger volatility and are extra delicate to market modifications (the next beta) in comparison with ETH. This motion in direction of riskier belongings may very well be propelled by traders chasing larger returns, fueled by optimistic sentiment surrounding the anticipated launch of a bitcoin spot ETF in the U.S., an occasion seen as a transparent catalyst for institutional re-evaluation of the digital belongings market.

An intriguing development is the relative underperformance of “meme” cash like DOGE and SHIB in comparison with BTC and ETH. The “majors-to-meme” ratio under, which compares the mixed market worth of Bitcoin and Ether to that of Dogecoin and Shiba Inu, now stands at 60x—the highest it has been in over a 12 months. This disparity could replicate a rising investor choice for belongings with extra established fundamentals and clearer funding theses.

Source: Coin Metrics Network Data

Whereas BTC and ETH are more and more considered as ‘high quality’ belongings resulting from their broader adoption and extra outlined roles in the digital financial system, meme cash, typically pushed by retail enthusiasm, lack related ranges of institutional acceptance and clear long-term worth propositions.

Exploring on-chain fundamentals gives one other useful perspective. This entails analyzing the real-time information from public ledgers, which gives a view of the adoption and utilization of blockchain networks. Whereas adoption usually unfolds over an prolonged interval, on-chain information will help us perceive if current valuation will increase are paralleled by a progress in the variety of customers becoming a member of or actively utilizing the community.

One metric we are able to take a look at is the progress in new addresses holding a non-negligible quantity of native models. The chart under, with a 30-day shifting common, exhibits that whereas there was an uptick in handle progress, it hasn’t been markedly important. When it comes to lively addresses, Bitcoin has seen a current enhance, however Ethereum has not skilled the same surge. Nonetheless, it is essential to notice that with the rise of layer-2 networks on Ethereum, the significance of lively addresses on its layer 1 as a basic metric could also be diminishing.

Source: Coin Metrics Network Data

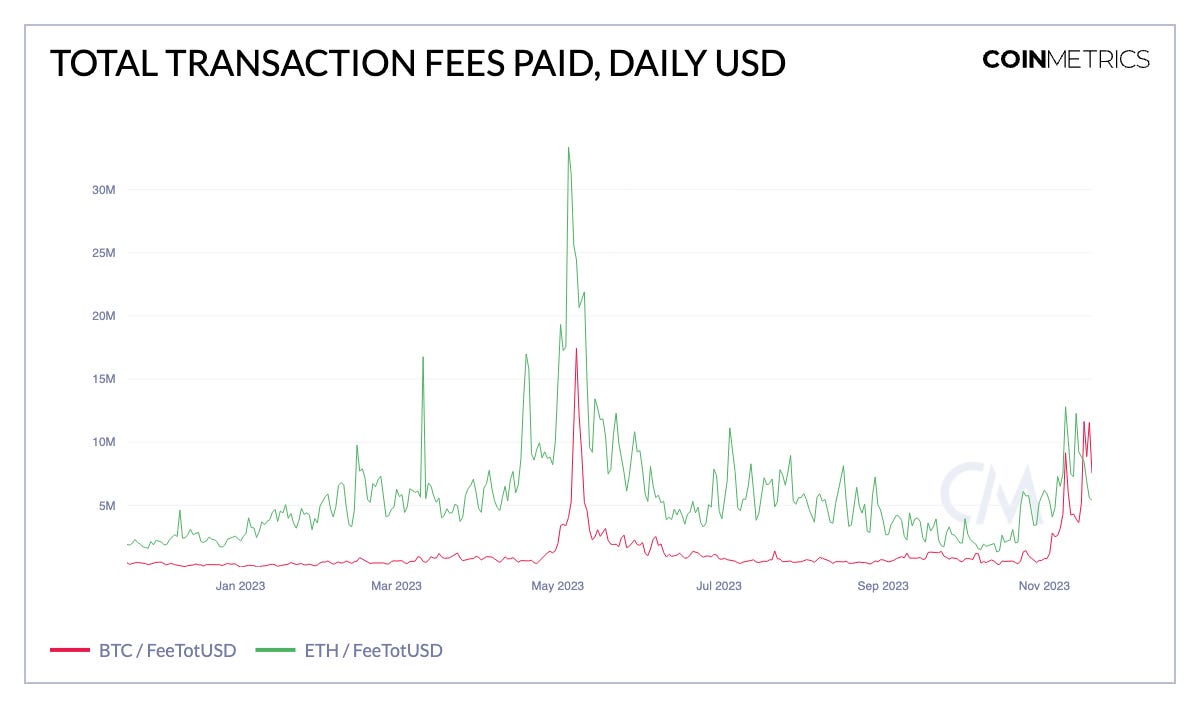

One other essential indicator is the charges paid by customers. Just lately, charges on each Bitcoin and Ethereum have escalated. On November sixteenth, customers paid over $11 million in transaction charges on Bitcoin, exceeding the whole charges paid on Ethereum for the first time since December 2020. A big driver of this enhance is the rising curiosity in ordinals and inscriptions on the Bitcoin community. This surge in exercise has resulted in the Bitcoin mempool reaching its highest stage of congestion in current occasions.

Source: Coin Metrics Network Data

The present digital belongings panorama presents a multifaceted image. Whereas the NVT ratio signifies that valuations are outpacing underlying community utilization, MVRV stays traditionally low. Including one other layer to this complexity is the liquidity of bitcoin in the market, with solely a small proportion, <30%, of BTC having been lively in the previous 12 months. This situation underscores the significance of not relying too closely on any single metric or ratio for an entire market evaluation.

Market capitalization tendencies recommend a rising choice for established and ‘high quality’ belongings, but there’s additionally noticeable momentum in some altcoins. The current enhance in the whole market cap of stablecoins, albeit at a slower tempo than the rise in asset costs, may very well be indicative of recent liquidity flowing into the crypto-economy. On-chain exercise gives further nuance. For example, handle progress is just starting to speed up, whereas transaction charges have seen a pointy enhance.

General, the market exhibits a mixture of bullish indicators. It is essential to method these indicators with some stability, however they may very effectively be indicators of a extra important development on the horizon.

Source: Coin Metrics Network Data

Bitcoin lively addresses declined 7% whereas Ethereum lively addresses fell 6% over the week. The market cap of Tether (USDT), continued to push larger to a brand new all-time excessive above $87B.

This week’s updates from the Coin Metrics staff:

-

Comply with Coin Metrics’ newest State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary from the Coin Metrics staff, wealthy visuals, and well timed information.

-

Final week we launched a beta model of our tagging information, try the particulars of the beta launch here.

As at all times, in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.