Coin Metrics’ State of the Network: Issue 216

Get the finest data-driven crypto insights and evaluation each week:

By: Kyle Waters & Matias Andrade Cabieses

In a major growth for the digital belongings trade as a complete, the U.S. District Courtroom for the Southern District of New York issued a partial summary judgment on July 13th, favoring some of Ripple Labs Inc.’s protection in its protracted enforcement case with the U.S. Securities and Alternate Fee (SEC). The SEC had alleged again in December 2020 that Ripple’s XRP token was bought as an unregistered safety, a declare that has now been partially dismissed by the courtroom.

This ruling, coming slightly below two months after the SEC’s newest allegations towards digital asset exchanges Coinbase and Binance—which noticed a slew of tokens together with BNB ($37B) and SOL ($10B) alleged as securities—might doubtlessly present a supportive precedent for these circumstances. On this week’s State of the Community, we discover attention-grabbing slices of market and on-chain information in the wake of this milestone ruling.

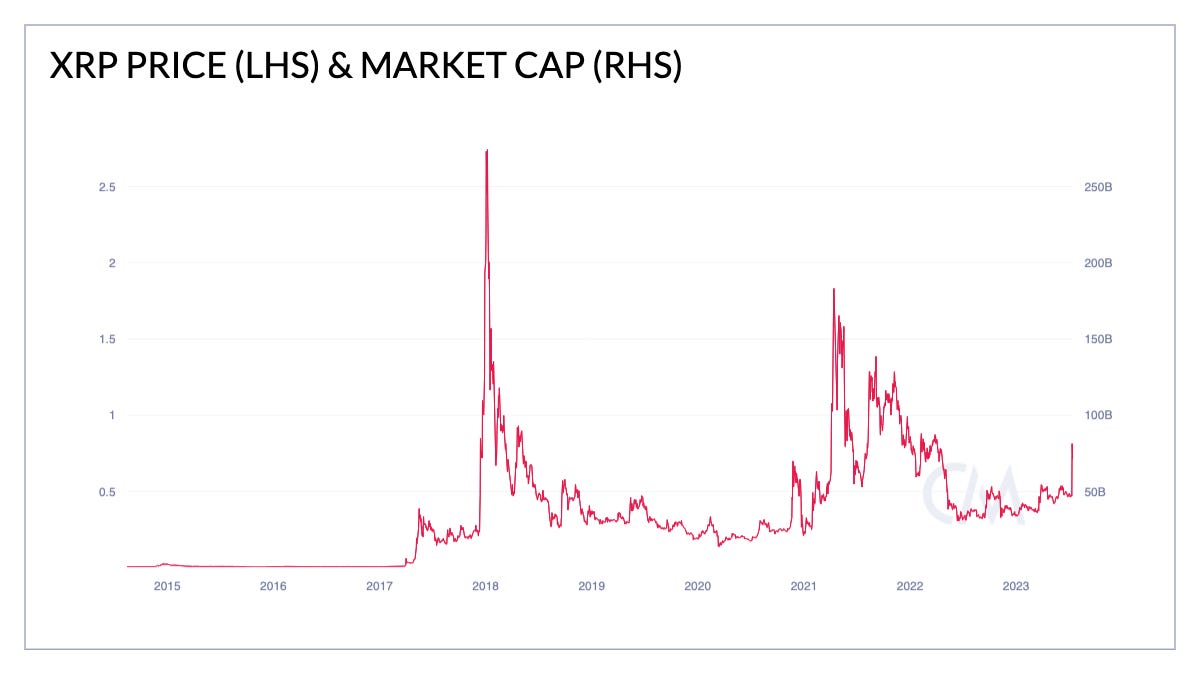

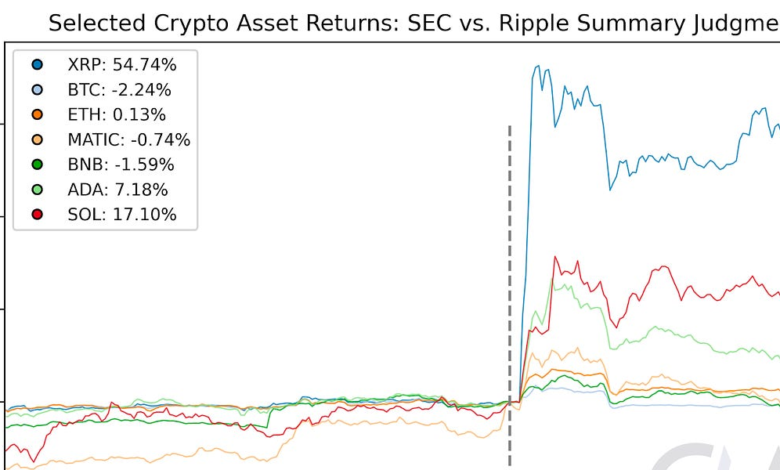

In a 12 months rife with regulatory developments deemed by some to be sweeping overreach, markets have been swift to react to this resolution’s change in the present. The response to the ruling was fast and decisive: XRP’s value surged by over 70% as members weighed the information. As of Monday afternoon, the value of XRP was at 75 cents whereas its market cap stood at round $75B, the highest in over a 12 months. Nonetheless, that is effectively under XRP’s all-time excessive of $2.74/$274B noticed in January 2018.

Source: Coin Metrics Charting Tools

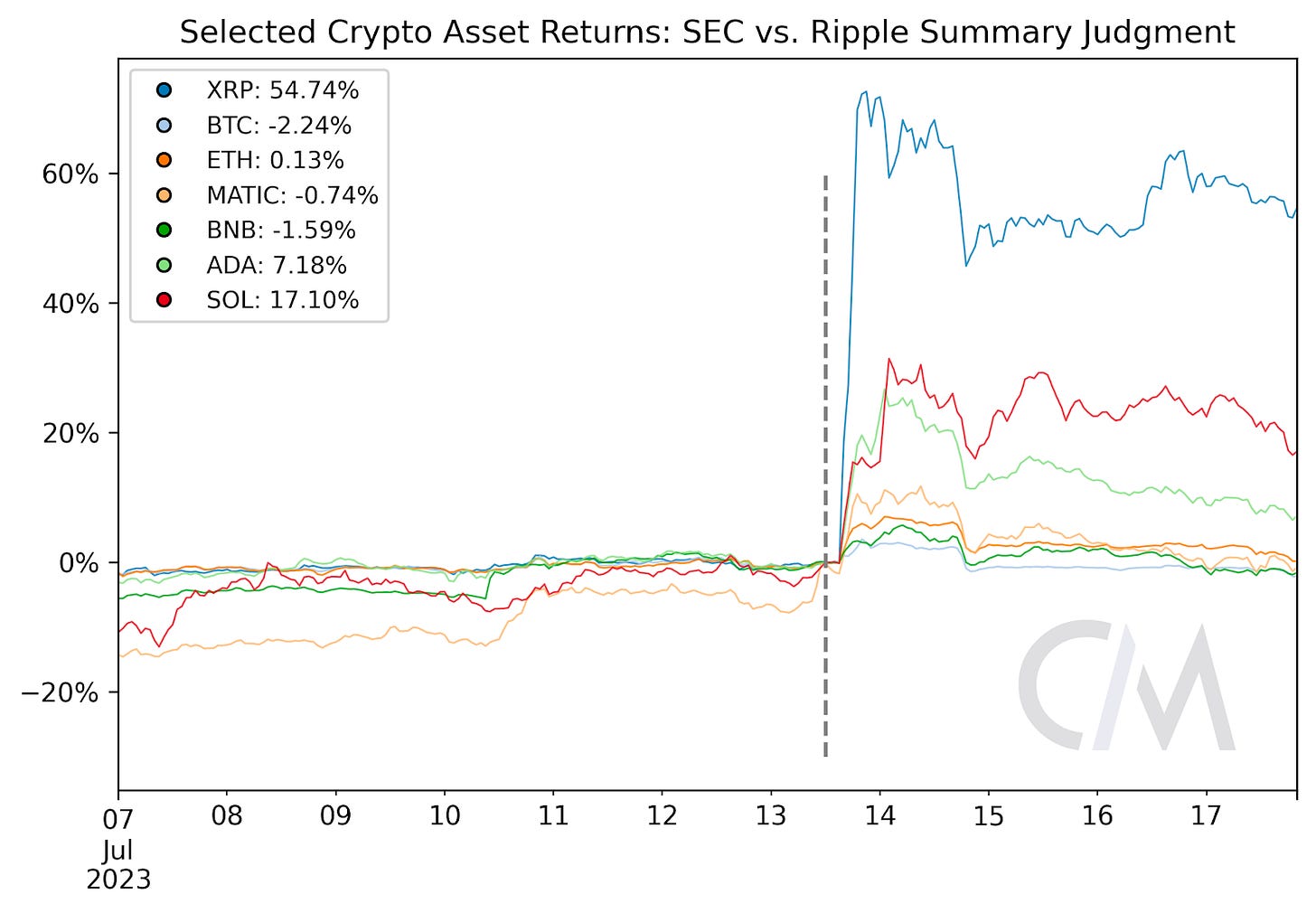

Different tokens alleged as securities additionally responded strongly together with Solana (SOL) which was up 17% by means of Monday afternoon (EDT). Regardless of pulling again barely on Friday, XRP was nonetheless up 55% as of Monday afternoon. The 2 market giants BTC and ETH, accounting for $800B in market capitalization, each moved barely increased on the information, earlier than receding going into the weekend.

Source: Coin Metrics Reference Rates

Nonetheless, amid the clamors to declare complete victory, it’s noteworthy that the courtroom’s resolution was not with out nuance. Whereas the courtroom struck down some of the SEC’s claims, it didn’t throw all the things out. Although gross sales of XRP on secondary markets have been not deemed as unlawful gross sales of a safety, the judgment argued that major gross sales of XRP on to institutional buyers did represent unlawful securities choices. This dual-sided resolution underscores the complexity of the regulatory panorama and the utility of securities legal guidelines to digital belongings. The ruling additionally provides a preliminary indication that token distribution fashions are an necessary piece of the puzzle. For instance, preliminary coin choices (ICO) and personal distributions could also be handled distinctly from extra decentralized actions like airdrops and mining.

Authorized nuance apart, the ruling supplied a much-needed enhance amid the on-going regulatory uncertainty, and likewise gave exchanges in the U.S. the confidence to re-list XRP to their platforms.

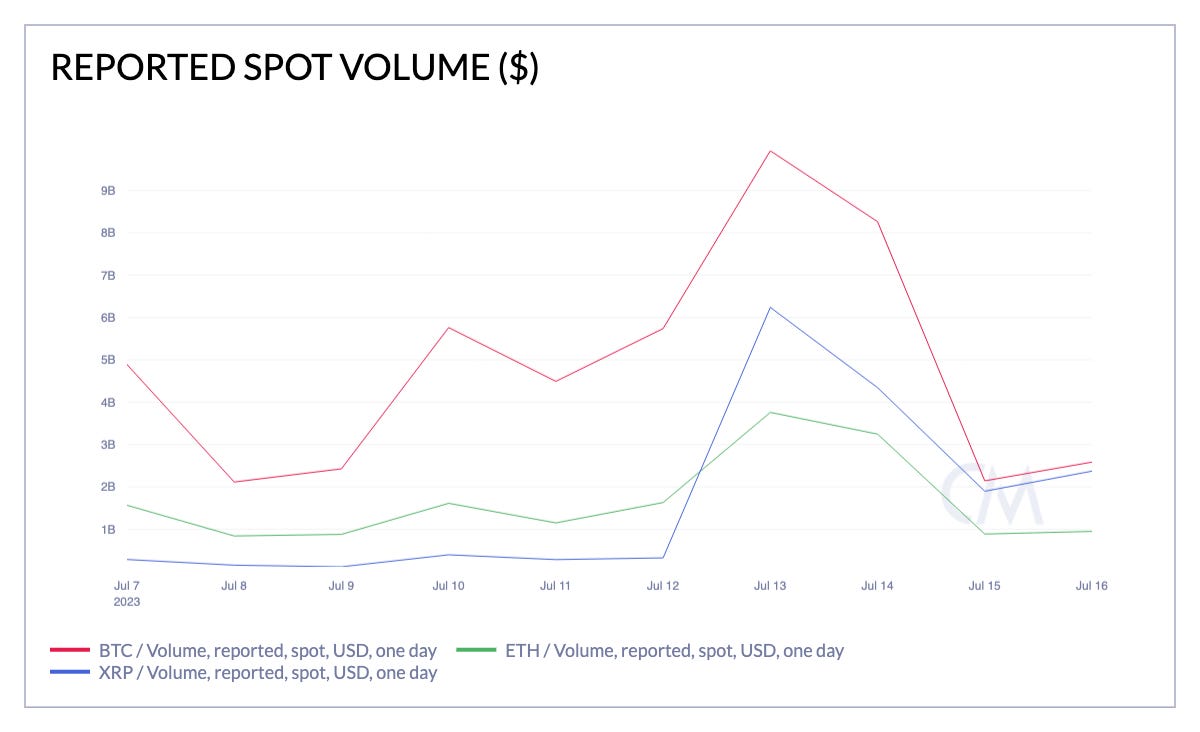

After the SEC filed its grievance towards Ripple on December 2020, US exchanges together with Coinbase shortly moved to de-list the token. Till final Thursday’s announcement, XRP buying and selling was targeting off-shore exchanges, with the majority of quantity on Binance. XRP quantity surged on Binance on July 13th, totaling $2.4B out of the $6.2B complete reported spot quantity throughout the exchanges Coin Metrics tracks. XRP reported spot quantity has even notably surpassed ETH in the days after the ruling.

Source: Coin Metrics Market Data Feed

However shortly after the Southern District of New York launched its submitting on Thursday and the sale of XRP on exchanges was judged to not meet the standards of an unlawful securities providing, U.S. digital asset exchanges together with Coinbase and Kraken moved to supply XRP buying and selling on their platforms, whereas Gemini mentioned it will discover itemizing XRP.

Coinbase processed a complete of $250M of XRP spot quantity between July 13th and July sixteenth, however this represents solely about 4% of the $5.7B in complete spot quantity recorded these days. For comparability, BTC and ETH had spot volumes of $1.9B and $1.1B on Coinbase over that time period, respectively.

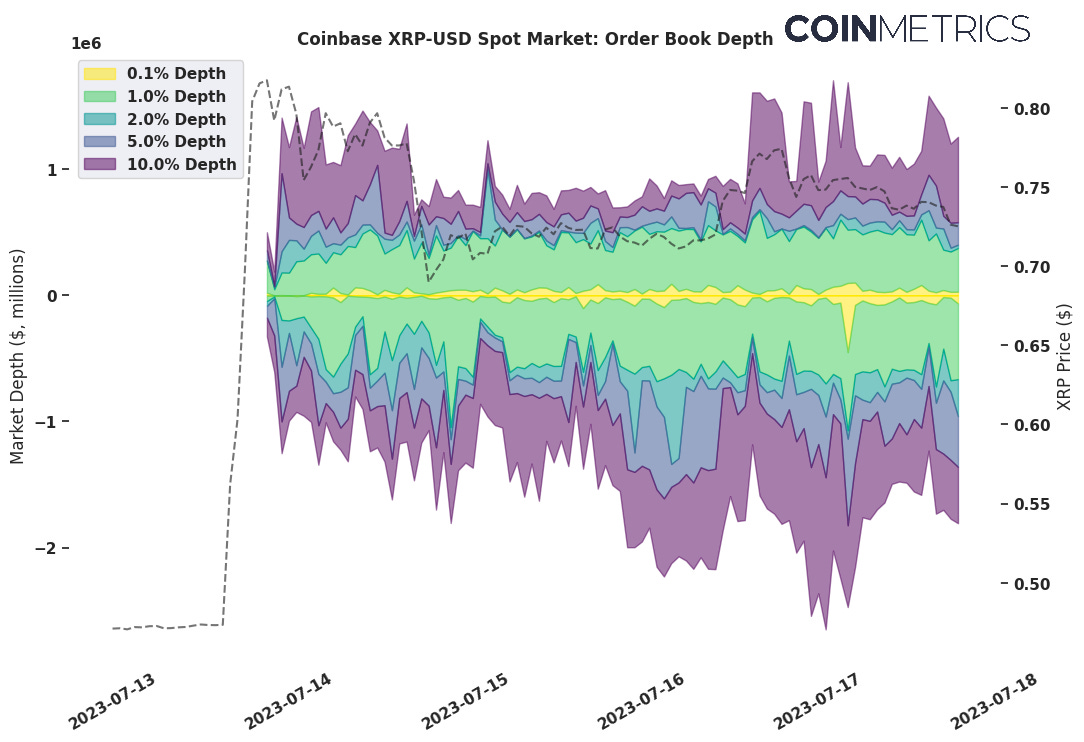

The depth of the XRP–USD spot order ebook on Coinbase has slowly been constructing as buying and selling exercise in the token has returned to the alternate.

Source: Coin Metrics Market Data Feed

Ripple was launched in 2012 with an original focus on cross-border transfers of cash and monetary funds infrastructure.

However over time, each rising competitors and the regulatory surroundings round XRP have made it harder for Ripple to attain this mission. The rise of sensible contract platforms, pioneered by Ethereum, supplied the authentic tooling for the growth of the nascent set of emergent decentralized monetary providers recognized collectively in the present day as DeFi. Furthermore, the ubiquity of token requirements like ERC-20 has helped gasoline the $100B+ rise of stablecoins, which are sometimes pitched as a contemporary providing for providers like cross-border settlement and fiat funds over borderless public blockchain infrastructure.

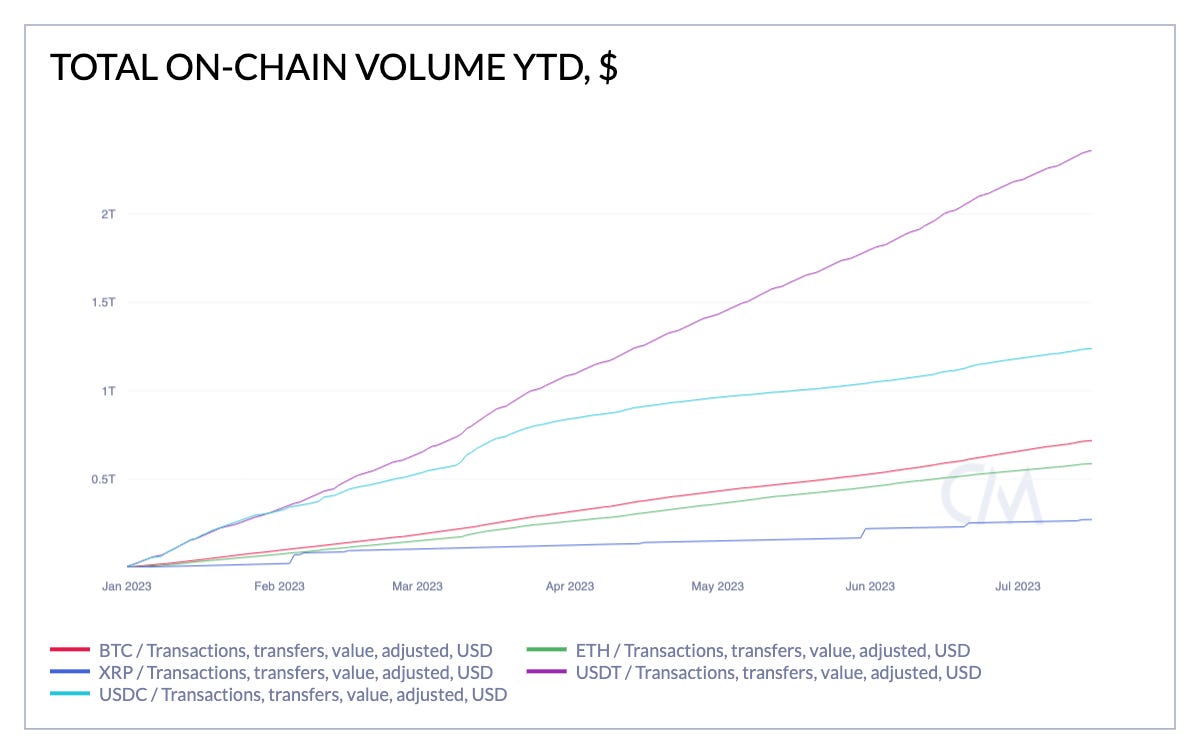

Coin Metrics’ adjusted on-chain volume, XRP has lagged behind BTC, ETH, and the main stablecoins USDC and Tether in phrases of complete greenback quantity settled on-chain year-to-date.

Source: Coin Metrics Network Data Pro

Nonetheless, boosted from a partial victory towards the SEC, Ripple’s supporters are actually hopeful that banks will start to undertake XRP for cross-border transactions and different providers.

Regardless of complexities in the ruling, the consequence is a victory for Ripple and holds many ramifications for the trade’s future at massive. Nonetheless, the battle is just not but over. Ripple is still headed to trial until a settlement is reached or the SEC decides to drop the remaining items of its case.

The ruling represents an important juncture in the ongoing tug-of-war between the crypto trade and regulators. The market’s rapid response to the ruling underscores the affect regulatory choices have on the future of the trade. Ripple is just not alone on this battle: $74 billion or 6% of the complete $1.1 trillion crypto market consists of belongings alleged as securities by the SEC, together with XRP, BNB, SOL and a handful of different multi-billion market cap initiatives. Almost $500 billion (43%) of the market consists of belongings with no clear classification.

Which belongings are categorized as securities and the way these choices are made stays an open query. Securities legal guidelines have been motivated by a must equalize info asymmetries. With blockchains permitting unprecedented transparency, it raises the query: can on-chain information reveal clues to determine which crypto belongings are securities?

Need to form the future of cryptoasset information analytics? Be part of our Consumer Analysis research to share your ideas on our latest concepts and supply priceless suggestions. Upon completion, members will probably be eligible for 1 of 5 unique API keys, usually solely obtainable to establishments, for entry to our skilled information units.

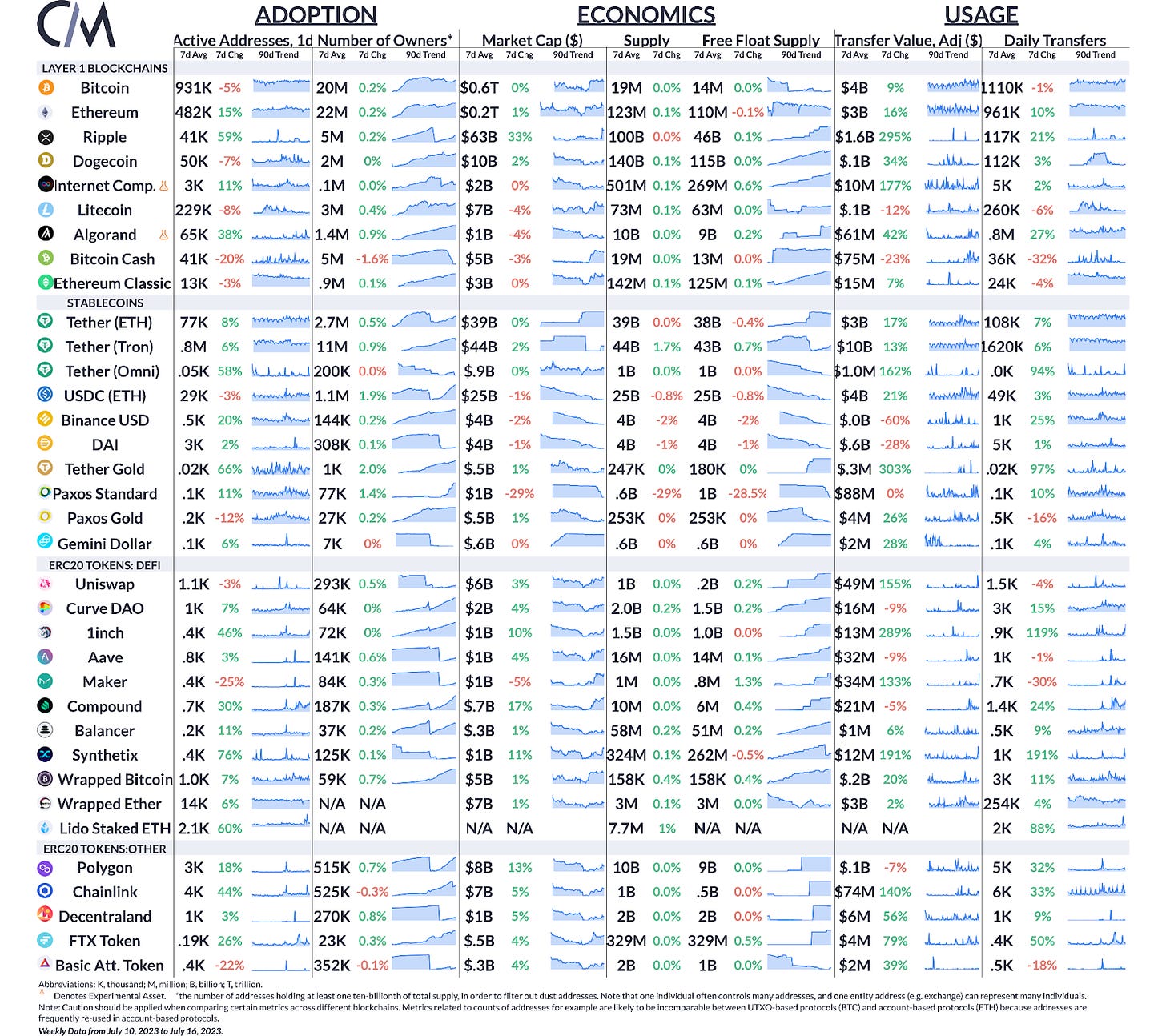

Markets rallied on the backing of the XRP ruling because it might set up a foundation for different digital belongings. This resolution led to a 59% improve in XRP lively addresses, and development in different on-chain metrics. Equally, different belongings like MATIC, COMP, and SNX, which have additionally been influenced by latest information, skilled a comparable surge in exercise.

This week’s updates from the Coin Metrics workforce:

As all the time, when you’ve got any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

When you’ve got any suggestions or requests please let us know here.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier points of State of the Community right here.