Coin Metrics’ State of the Network: Issue 217

By Victor Ramirez, Uriel Morone, Kevin Lu, and the Coin Metrics Crew

As we speak we’re excited to be releasing a sweeping new report that provides a strategy to translate the present authorized language of securities frameworks into goal, measurable standards derived from blockchain (“on-chain”) knowledge. Under, we give a high-level introduction to the report adopted by a obtain hyperlink to learn it in its entirety.

As a response to rampant risk-taking and fraud in the capital markets of 1920’s America, the United States Congress was compelled to enact legal guidelines aimed toward safeguarding traders from data disparities and fostering clear markets. This rule-making response not solely established the disclosure necessities for publicly issued securities but in addition led to the creation of the Securities and Alternate Fee (SEC), the chief regulator of American securities markets.

100 years later, crypto markets are mirroring the increase and bust cycle of the 1920’s, equally inciting debate over how markets should be regulated. At the coronary heart of this public-private tug-of-war is the essential job of figuring out which digital belongings fall underneath the class of securities—a query that has remained foggy for years in the US.

However a latest string of occasions has introduced this long-standing query to the forefront. The SEC’s complaints filed in opposition to Coinbase and Binance US in June 2023, by which the fee has alleged that over a dozen belongings are provided on the exchanges as unregistered securities, have formally laid out some of the present regulatory physique’s arguments. That is all taking place in opposition to a backdrop of lawmakers in Congress engaged on a renewed effort to move a Market Construction Invoice, aiming to create clear guidelines of the street for the digital belongings ecosystem.

Then, simply in the final two weeks, the New York Southern District Courtroom struck down some of the SEC’s claims in opposition to Ripple Labs for allegedly promoting XRP as an unregistered safety—a landmark choice that preceded a multi-billion greenback transfer greater in some crypto-asset market valuations. This ruling has not solely set a possible precedent but in addition highlighted the excessive stakes of this difficulty.

Sources: Coin Metrics Community Knowledge, SEC Filings

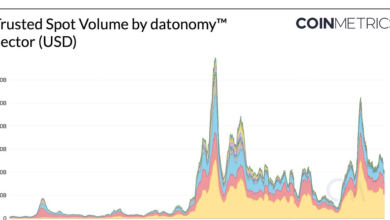

Once we speak about excessive stakes, the numbers converse for themselves. A complete of $74 billion, or 6% of the total $1.1 trillion crypto market, is attributable to belongings that the SEC alleges are securities, together with XRP, BNB, SOL, and different multi-billion market cap initiatives. However notably, practically $500 billion (43%) of the market consists of belongings with no clear classification.

A key prong of the dialogue is the extent to which crypto belongings match cleanly underneath present securities legal guidelines. Whereas that is up for debate, a transparent novelty of crypto belongings versus conventional monetary belongings is in the knowledge transparency they provide. Public ledgers enable knowledge suppliers like us to build metrics and analyze the actions of tokens on-chain in real-time. We discovered that on-chain knowledge can present goal and measurable supporting proof that would assist decide which belongings are securities.

With this in thoughts, it’s doable that on-chain metrics can present supporting proof that would assist decide which belongings are securities. Our new report goals to make clear this precise topic. Utilizing Coin Metrics’ full suite of knowledge, we define a number of key areas of knowledge evaluation to translate the authorized language of present frameworks into goal, measurable standards.

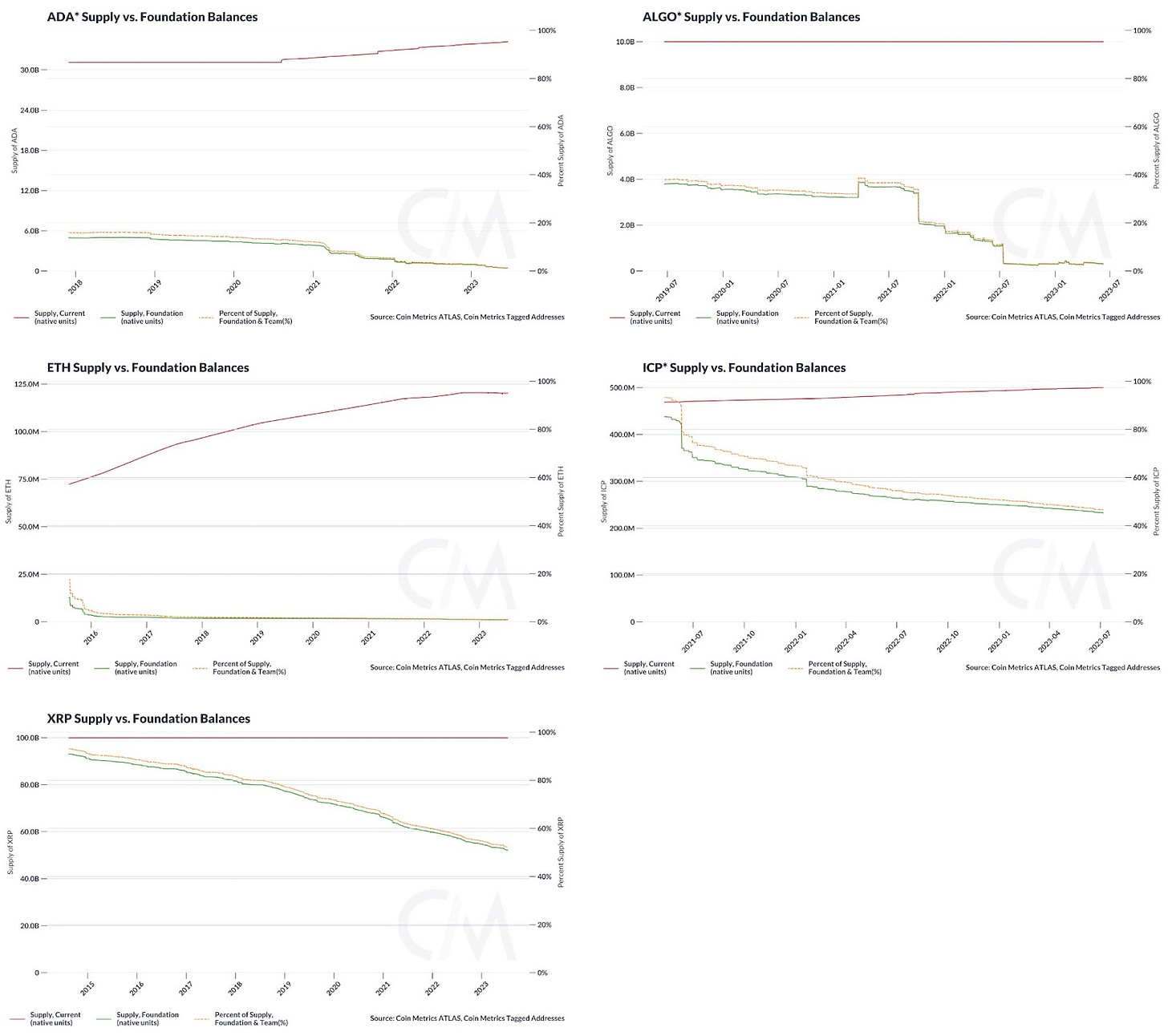

For instance, we study the token balances of groups and foundations for a sampling of crypto initiatives in comparison with their complete issued provide to try to gauge the “common enterprise” prong of the Howey Take a look at—the eponymous set of standards rising from the 1946 case of SEC v W.J. Howey which famously concerned funding contracts in Floridian orange groves managed by W.J. Howey’s firm, Howey-in-the-Hills Service Inc.

Whereas on-chain metrics might supply precious insights, they don’t seem to be a definitive device for classifying belongings as securities. The SEC’s enforcement actions and framework don’t level to a single “smoking gun” metric. As a substitute, a complete authorized evaluation is required, with knowledge seemingly serving as only one piece of the puzzle.

Clear guidelines will enable the business to be extra clear. With clearer securities laws, compliance could be extra simply measured on-chain, a novel property of blockchains. New securities frameworks which precisely replicate the realities of blockchain expertise have the alternative to permit for clear measurements of compliance. Forging a path to compliance for protocol initiatives will enable the business to function in the US with extra readability. On-chain knowledge might very properly have an vital position to play on this excellent multi-billion greenback query.

Learn the full report, From Orange Groves to Orange Gold, under.

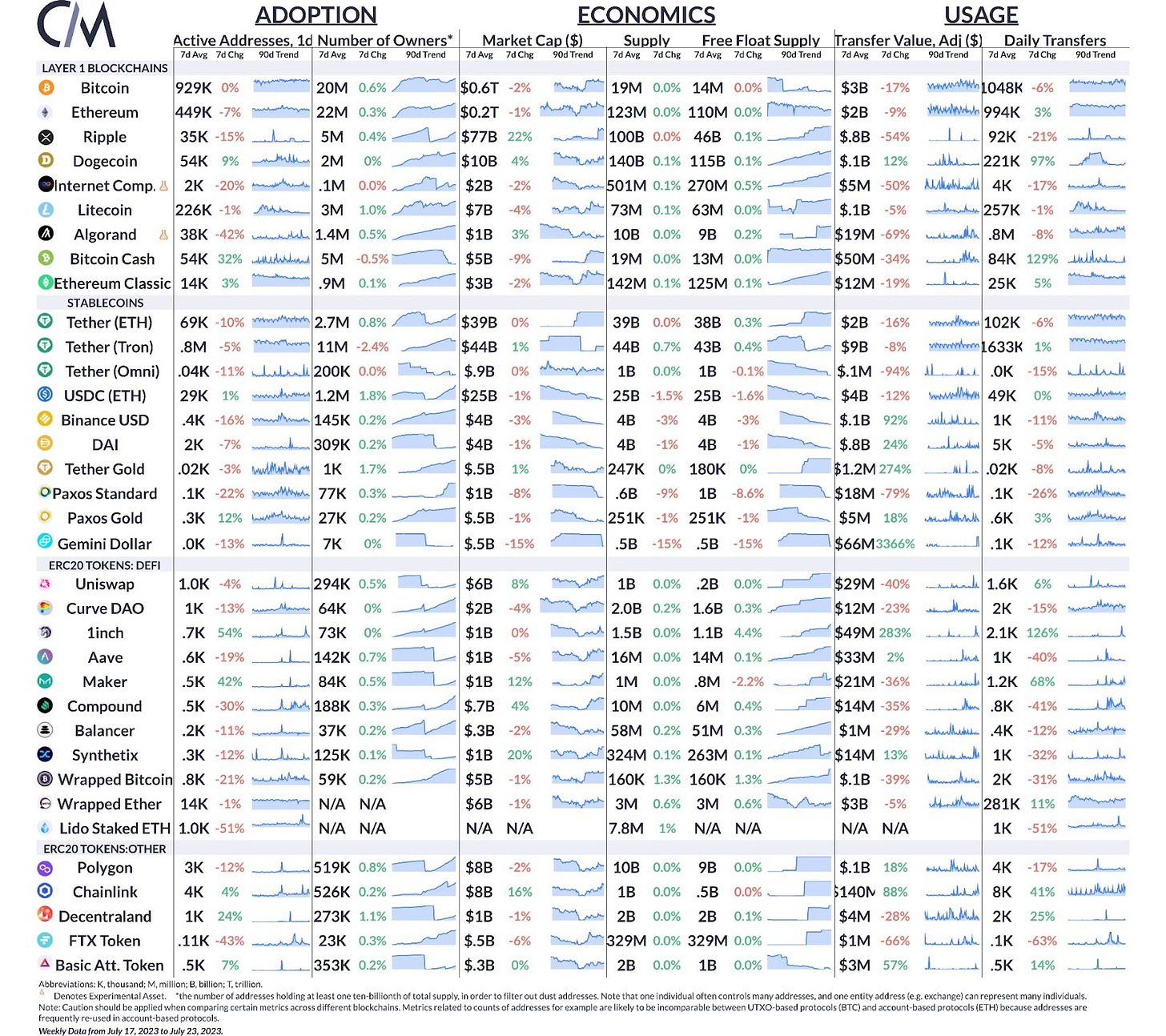

Source: Coin Metrics Network Data Pro

Exercise throughout the main L1 blockchains was flat or down over the week with Bitcoin and Ethereum energetic addresses unchanged and down 7%, respectively. Stablecoin provide contracted barely over the week, with USDC provide on Ethereum round 25B. Exercise in Chainlink’s LINK token surged, as the platform’s Cross-Chain Interoperability Protocol (CCIP) launched final week.

This week’s updates from the Coin Metrics workforce:

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

You probably have any suggestions or requests please let us know here.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier points of State of the Community right here.