Coin Metrics’ State of the Network: Issue 220

Get the finest data-driven crypto insights and evaluation each week:

By: Lucas Nuzzi, Tadhg Papillaud Looram, and Kyle Waters

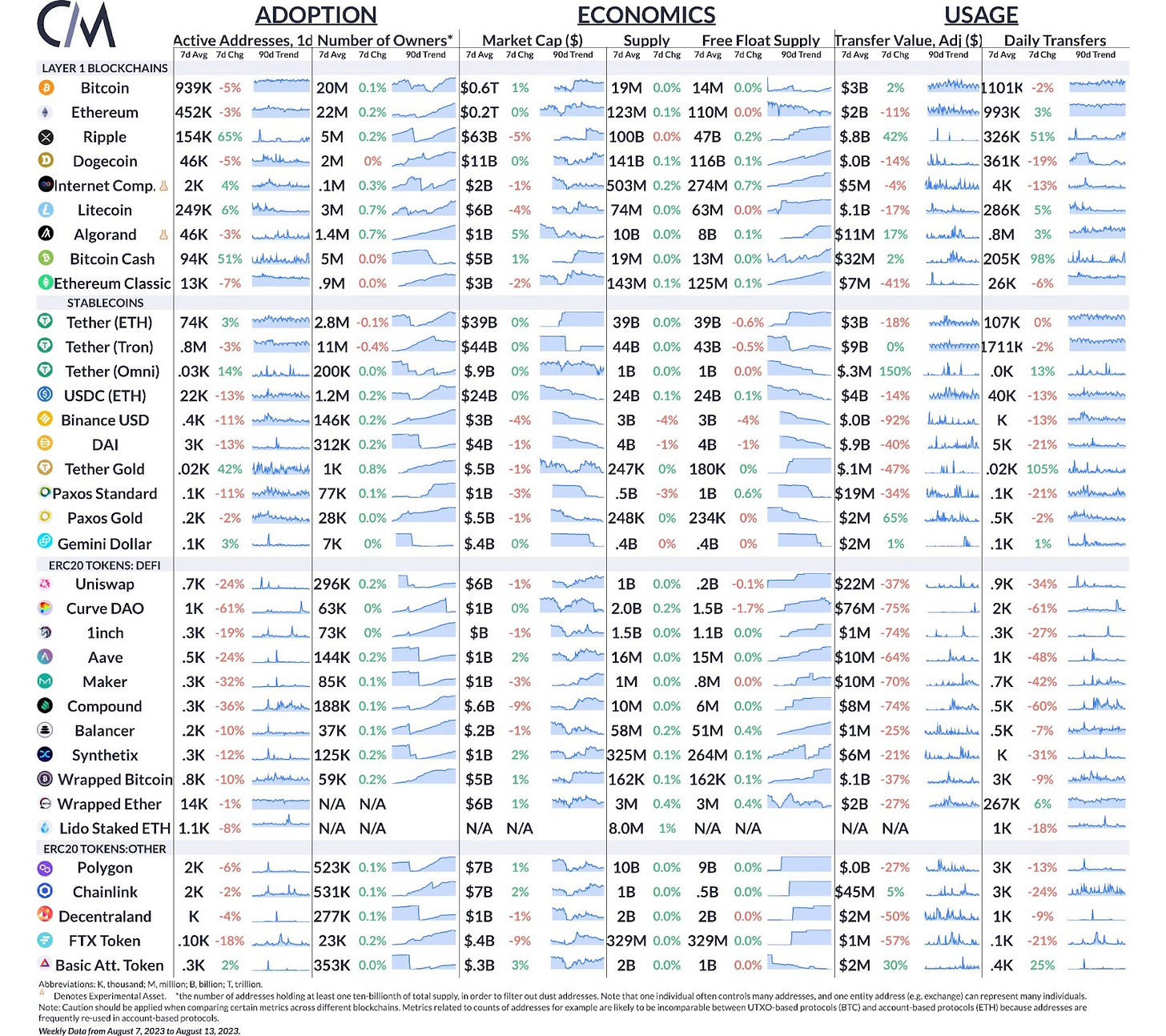

Final week, PayPal unveiled its plans to launch a USD-denominated stablecoin, PYUSD. This took the business abruptly with many hypotheses round what motivated the US funds big to do that. Undoubtedly, the launch of FedNow in July has despatched a message to cost processors like PayPal: the commoditization of cash transfers is coming. Based mostly on the firm’s messaging round PYUSD, they see crypto as a brand new avenue for providers and options beforehand unavailable. We count on extra service suppliers to observe go well with as their providers turn into commoditized.

Stablecoins supply a completely new method to banking providers. One might envision how neo-banks might leverage stablecoins to supply their customers half of the yield accrued from deposits. Though nonetheless area of interest, some present stablecoins, equivalent to TrueUSD (TUSD) and OriginUSD (OUSD), already implement that through rebasing, whereby half of the curiosity obtained on reservers is distributed to all customers by concurrently growing their balances. Past easy funds, stablecoins additionally grant their customers entry to a bunch of new providers that match into the web3 umbrella.

From an information perspective, this improvement is thrilling. PYUSD will probably be issued on the Ethereum community, which permits us to trace how, when, and the place the foreign money will get used. We have now written extensively about the aspects of stablecoin knowledge, and the way to consider their underlying risk and usership. On this report, we need to share a brand new method to estimate the geographical desire round stablecoins. Like earlier approaches (SOTN points: #50, #114, #165), we leverage one thing referred to as seasonality evaluation to estimate the adoption of a stablecoin in particular geographical areas.

Seasonality evaluation is an important instrument in understanding the cyclical nature of enterprise actions. Since completely different geographical areas have distinctive peak exercise occasions (enterprise hours), understanding the seasonality of these transactions will help reveal patterns and concentrations in on-chain quantity. This may present a greater understanding of how numerous market elements, equivalent to regional rules, financial well being, investor conduct, and technological penetration, affect stablecoin utilization. As well as, it could actually additionally present useful insights into the liquidity, transaction pace, and total well being of the stablecoin market.

Analyzing stablecoin quantity via a geographic lens can help in figuring out areas the place stablecoins are used extra often, suggesting the next acceptance or want for this kind of digital asset. It might additionally spotlight potential progress areas, regulatory challenges, and funding alternatives. Furthermore, figuring out geographical focus can allow blockchain builders, buyers, and coverage makers to make higher knowledgeable choices. For example, they’ll focus their advertising and marketing efforts, funding methods, and regulatory oversight on areas the place the quantity of transactions is excessive.

To successfully analyze the geographic distribution of stablecoin quantity, our methodology focuses on capturing transaction knowledge by UTC time zones and their corresponding enterprise hours. This method acknowledges the indisputable fact that whereas stablecoins function on public blockchains 24/7, peak buying and selling volumes are more likely to happen throughout typical enterprise hours inside every geographical location. Subsequently, the methodology revolves round accumulating hourly transaction knowledge for all UTC time zones, particularly throughout enterprise hours.

To attain this we leveraged CoinMetrics’ Atlas Transactions endpoint and extracted the exhaustive set of on-chain transactions for USDC and USDT. We then turned to the Atlas Balance-Updates endpoint to establish particular transactions associated to treasury operations, issuances, redemptions, and charges. By filtering out these particular transactions, we get hold of a clear dataset showcasing on-chain exercise. This refined method supplied a extra granular and exact interpretation of stablecoin utilization.

We then aggregated transaction volumes, grouped by hour that are anchored in the UTC+0 time-frame. We then translated the date-time of our base UTC+0 to embody all different UTC time zones, spanning from -12 to +14.

Lastly for every UTC offset, we parsed via all transactions that befell throughout enterprise hours (9am to 5pm, Monday via Friday), and as soon as extra grouped and summed transactions to get every day quantity by UTC. Repeating this course of throughout all UTC timezones, ends in an in depth, international image of stablecoin quantity distribution throughout geographical areas. This gives a holistic illustration of on-chain transaction quantity throughout international time zones, laying the groundwork for an intensive and expansive evaluation. This system permits for the mapping of every stablecoin and determines the place and when the quantity is most important, offering a extra granular understanding of the international stablecoin market.

USDT Aggregation Metric

In gentle of Tether’s (USDT) multi-chain framework, supplied throughout a number of blockchain networks, we formulated a unified asset, amalgamating Tether on Ethereum, Omni, and Tron (USDT_ETH, USDT_OMNI, and USDT_TRX). Mirroring the method delineated in the above methodology, we processed the particular property: “usdt_eth, usdt_trx, and usdt_omni”. Submit knowledge assortment, we aggregated every day on-chain consumer quantity, having methodically sieved out transactions related to the operational aspects described earlier. Lastly we calculated complete USDT quantity, by merging and aggregating the volumes of USDT_ETH, USDT_OMNI, and USDT_TRX. This culminated in a metric that captures the majority of USDT’s on-chain quantity.

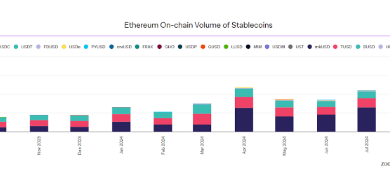

Our evaluation targeted on stablecoin quantity from January 2022 to July of 2023. As such, it encompasses some of the most disruptive occasions to happen in the business, equivalent to the collapse of Terra’s UST, the chapter of FTX, and subsequent failures, equivalent to Celsius, BlockFi, and sadly many others.

To proxy for geographical variation for areas of curiosity, we tracked quantity throughout inventory market working hours. We keyed into particular UTC time brackets comparable to main inventory markets and calculated regional quantity by averaging every day quantity throughout these UTCs. For instance, for Asia we targeted on the Tokyo, Hong Kong, Shanghai, South Korea Inventory Exchanges and the Nationwide Inventory Trade of India, which corresponds to UTC+9 , UTC+8, UTC+8 , UTC+9 , UTC+5.5, respectively. To establish main tendencies, we deployed a double smoothing 10-day common which applies a transferring common twice to iron out short-term fluctuations and detect underlying patterns.

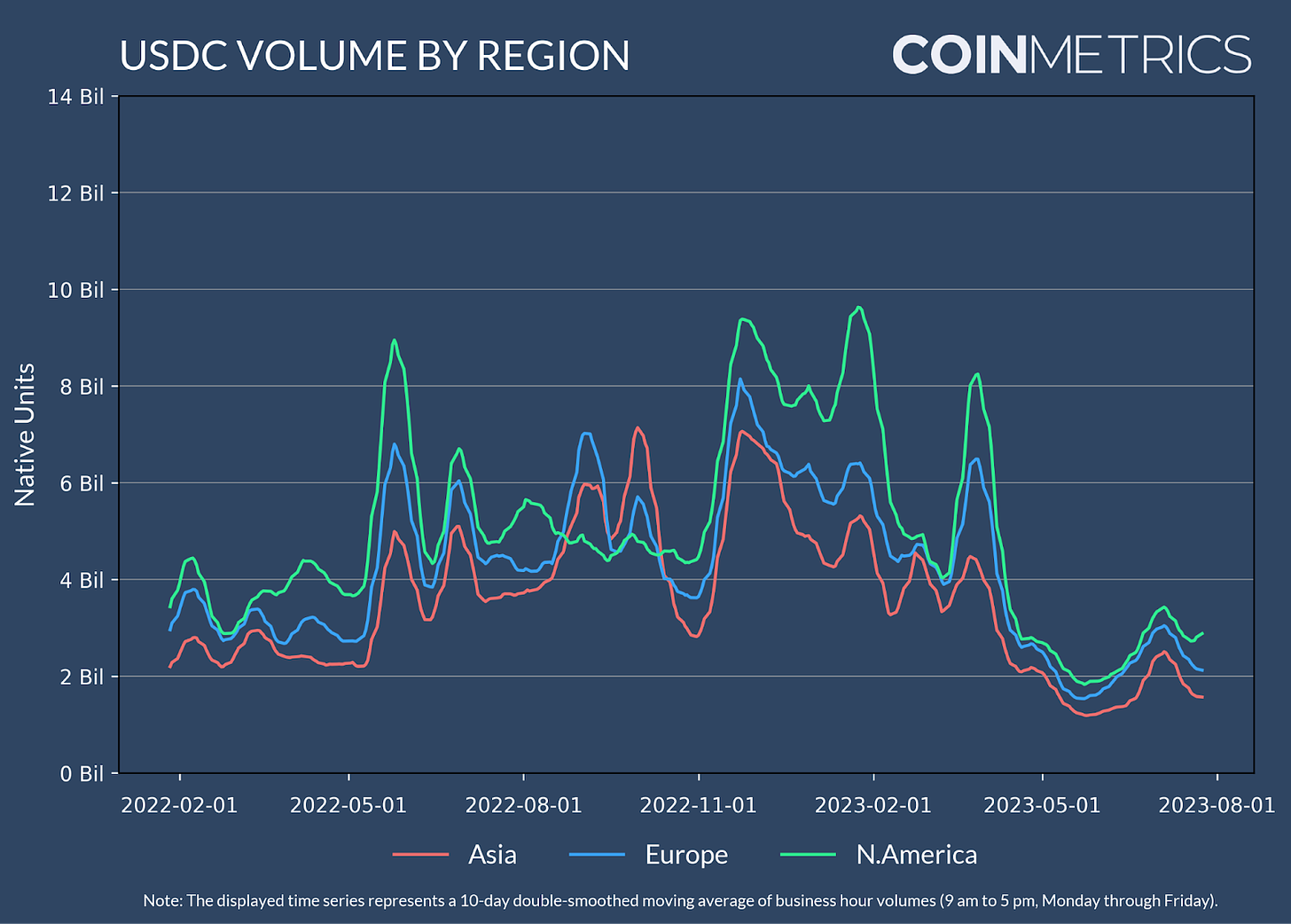

Circle USD (USDC), one of the hottest stablecoins in the present day, confronted so much of turbulence as these occasions unfolded. As a secure store-of-value, USDC confronted noticeable spikes in demand as these occasions push cryptoasset costs down. From a geographical desire level of view, the Americas area clearly has a desire for USDC over different areas, as evidenced by the constant quantity dominance. This won’t come as a shock given Circle is a US-domiciled firm primarily based in Boston, MA and naturally has higher recognition and enterprise actions targeted in the West.

The primary noticeable spike in Might of 2022 was pushed by the collapse of Terra USD (UST), one of the hottest stablecoins at the time. It’s attainable that, as UST started depegging from USD, customers transitioned their stablecoin positions to USDC. By the center of the yr and as the fallout of Terra was higher understood, USDC quantity predominance shifted, with Europe adopted by Asia respectively taking the lead. The FTX shockwave that adopted in This autumn was felt throughout jurisdictions. Volumes hit ATHs throughout and there was an total flight to security as contagion unfolded in all areas.

USDC volumes remained excessive heading into 2023 as the collapse of FTX impacted banks with publicity to crypto, equivalent to Silvergate. Its closure in early March meant the finish of the Silvergate Trade Community (SEN), which supplied crypto exchanges instantaneous settlement providers. Earlier than Silvergate’s closure, SEN facilitated $1.3B of volume per day in the fourth quarter of 2022. Then, the closure of Signature Financial institution in March ended institutional crypto clients’ entry to Signet—a cash switch system that served as an important linkage for conventional banking infrastructure and crypto-market contributors. The elevated friction between crypto exchanges and conventional banking infrastructure may need contributed to the sustained enhance in USDC quantity in 2023.

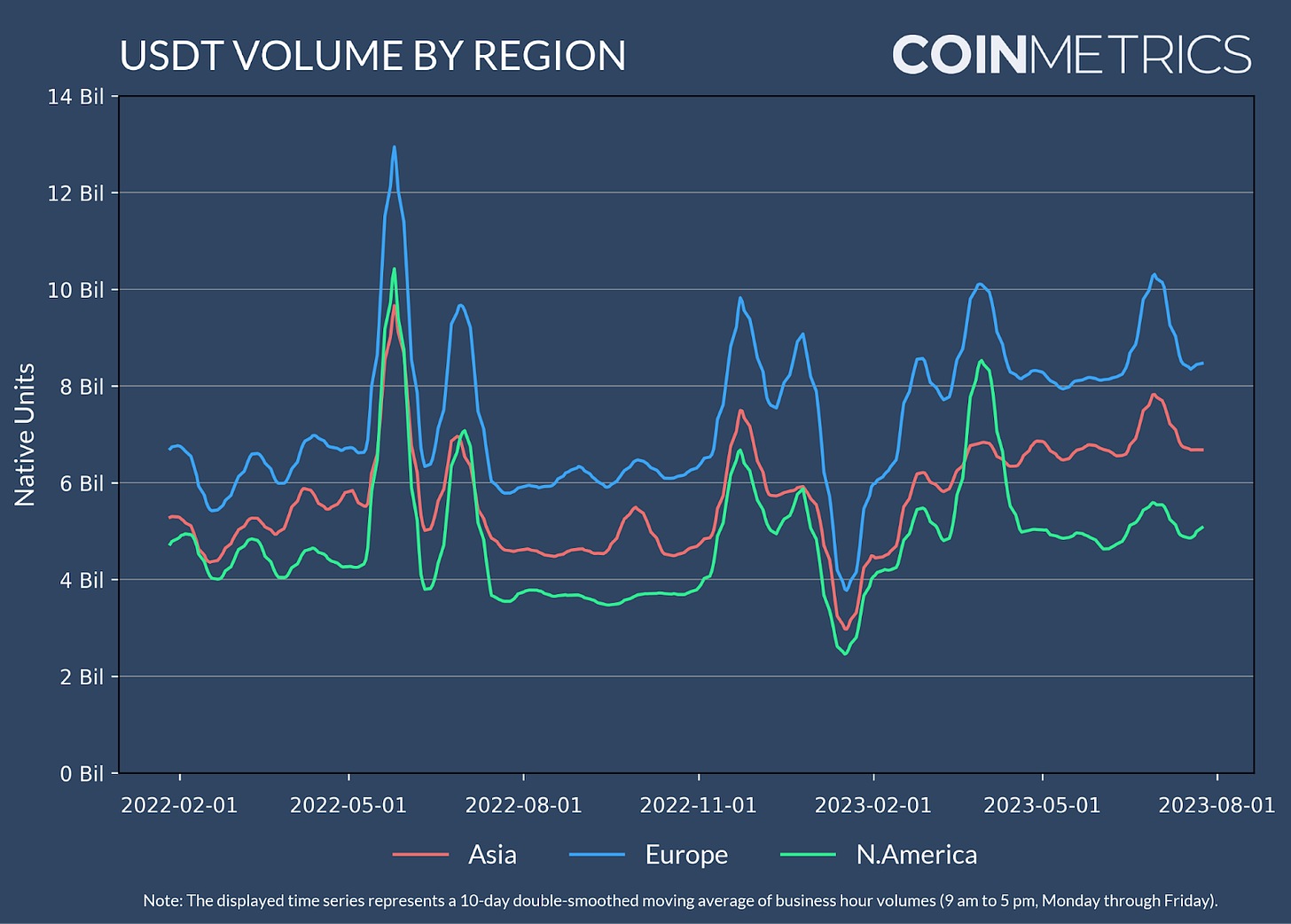

On the different hand, Tether (USDT)—the largest stablecoin in the present day by market cap—shows a strikingly completely different sample. Whereas the spikes in quantity happen roughly at the similar time, the geographic preferences are completely different. Quantity is predominantly dominated by the Europe-Africa area, adopted by Asia and the Americas. In contrast to USDC, the largest spike in quantity befell in 2Q22 with the collapse of Terra. Whereas the collapse of FTX did have an effect in quantity, it was temporal and never as pronounced as USDC.

One other significantly fascinating perception with USDT is that decreases in quantity seem to coincide with regional holidays equivalent to Orthodox Christmas and Chinese language New Yr. These happen in the months of January and February, which noticed quantity decreases in 2022 and, extra intensely, in 2023. We have now beforehand witnessed the influence of these holidays in Bitcoin’s on-chain quantity and it’s fascinating to see an identical development in USDT.

Additionally of be aware, in Q2 of 2023, a pointy enhance in quantity dominance in the Americas area was noticed. As alluded to earlier, this coincided with the banking disaster in the United States and the collapse of SVB. Elevated regulatory scrutiny of crypto in the US culminated with the preemptive and arguably unwarranted closure of Signature Financial institution. It’s attainable that the enhance in USDT quantity in the Americas displays considerations in the area round stablecoins with publicity to the US banking system, equivalent to USDC and TUSD.

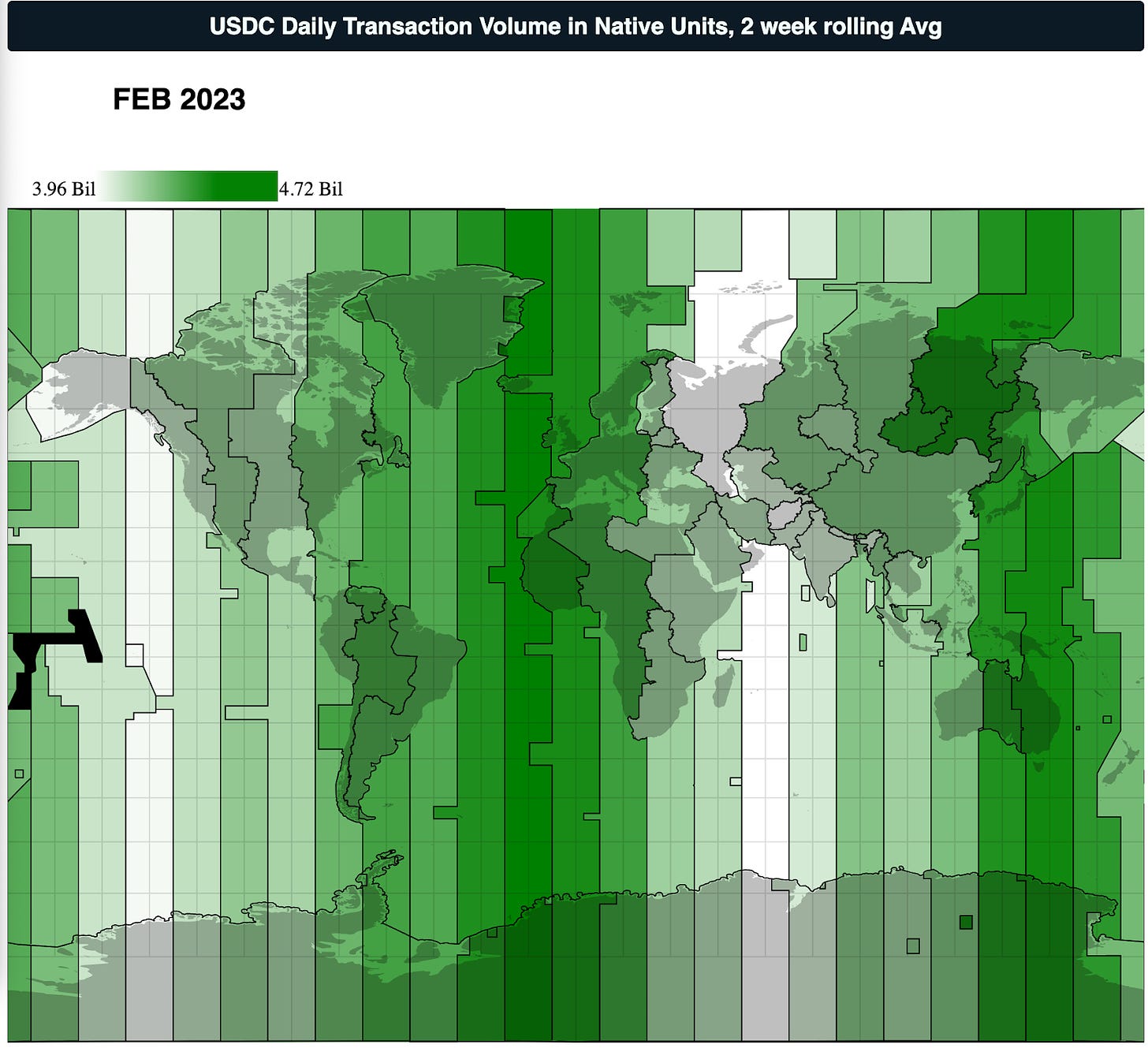

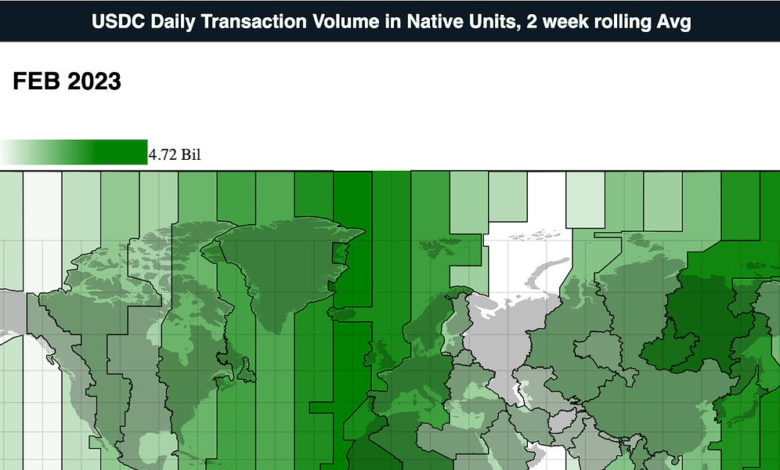

The cyclical nature of on-chain quantity on particular areas may also be visualized utilizing a mercator map projection. This makes it simpler to visualise quantity dominance on particular UTC time zones over time. As the dynamic visible under showcases, USDC has a transparent dominance in the West. Time zones in Europe-Africa and Asia not often lead USDC quantity, proven under on a inexperienced scale.

The quantity dominance of USDT in Europe-Africa may also be visualized this fashion. Time Zones in these areas are sometimes main on-chain quantity. Nonetheless, the swings in demand in the Americas, particularly in March of 2023 are additionally simply discernible.

As well as, this kind of map evaluation can permit for the identification of sudden anomalous deviations.

For example, all through February of 2023 we noticed sporadic upticks throughout the map, notably from the east, this aligns with determine 1, the place wee see an total enhance in USDC quantity in Asia whereas declines noticed in N. America throughout this time.

In February, Hong Kong launched progressive regulations for crypto-related operations, permitting non-accredited buyers to commerce sure digital property on licensed exchanges. As well as, Hong Kong can be making strides in direction of legalizing stablecoins demonstrated by KuCoin and Circle, unveiling a novel stablecoin linked to offshore Chinese language yuan (CNH). In tandem with these developments, USDC exercise picked up in the east.

On this report, we launched a brand new method to ascertain geographic dominance of stablecoins. Our evaluation of quantity dominance targeted on occasions from January 2023 to July 2023 and revealed distinct patterns and preferences as the business went via turbulent occasions. Notably, the Americas exhibited a marked desire for USDC, doubtless on account of its home roots, whereas USDT demonstrated stronger ties to the Europe-Africa areas. Exterior elements, from the collapse of notable crypto behemoths to regional holidays, clearly influenced buying and selling volumes and geographical predilections. As the stablecoin panorama evolves, with entities like PayPal coming into the fray and regulatory developments persevering with in the US and Europe (with MiCA), understanding these geographically-driven tendencies will probably be pivotal for stakeholders, from buyers to policymakers, to navigate the ever-evolving crypto panorama.

This week’s updates from the Coin Metrics staff:

-

Try our latest long-form experiences in our catalog of unique data-driven analysis.

-

Try final week’s issue of State of the Market.

As at all times, if in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier points of State of the Community right here.