Coin Metrics’ State of the Network: Issue 222

Get the finest data-driven crypto insights and evaluation each week:

By: Kyle Waters and Tanay Ved

One of the most fascinating facets of the $100B+ stablecoin section is the novelty public blockchains supply us in conducting financial knowledge evaluation on stablecoin adoption and use. On-chain knowledge is an undisputed supply of frequent reality that confirms the relentless rise of stablecoins. Other than the macro-level stats like whole addresses, provide, and switch quantity, we’re additionally given a chance to scrutinize holder habits with unprecedented granularity, one thing conventional monetary knowledge units seldom present.

It’s more and more evident that totally different stablecoins serve totally different functions and are in style for sure use circumstances. Additional, regardless of their nascent standing, some stablecoins carry their very own singular threat profile. With this in thoughts, an fascinating query emerges: how typically will we see an overlap in the person base of one stablecoin versus one other? The account construction of Ethereum gives an ideal testing floor for this sort of evaluation. In contrast to Bitcoin addresses the place customers are discouraged from tackle re-use, Ethereum accounts are extra akin to financial institution or brokerage accounts—reused time and again and sometimes maintain numerous property.

On this difficulty of State of the Community, we dive into the subject of stablecoin co-ownership utilizing knowledge sourced from Coin Metrics’ ATLAS blockchain explorer. We additionally showcase an early use case of Coin Metrics’ current tackle tagging endeavors.

We start by gathering each account that held some quantity of Tether (USDT), USDC, Pax Greenback, Dai, and Binance USD (BUSD) on Ethereum as of August 23rd, 2023. This proves to be exceedingly simple with the following question to the “List of accounts” CM API endpoint and CM Python API Client (for USDC for instance):

from coinmetrics.api_client import CoinMetricsClient

consumer = CoinMetricsClient(<CM_API_KEY>)

consumer.get_list_of_accounts_v2(asset=“usdc”,

page_size=10000

).to_dataframe()We collected ~7M accounts that at present maintain a non-zero steadiness. The cut up amongst them is 4.5M USDT accounts, 1.7M USDC accounts, 500K Dai accounts, 170K BUSD accounts, and eventually 100K Pax accounts. This mixture view might be confirmed with CM Community Knowledge, here.

Subsequently, we merge all of the accounts collectively utilizing their Ethereum tackle as the frequent key. This system gives us a dataset that information the steadiness of every stablecoin for each account, summing as much as 6.7M distinctive accounts.

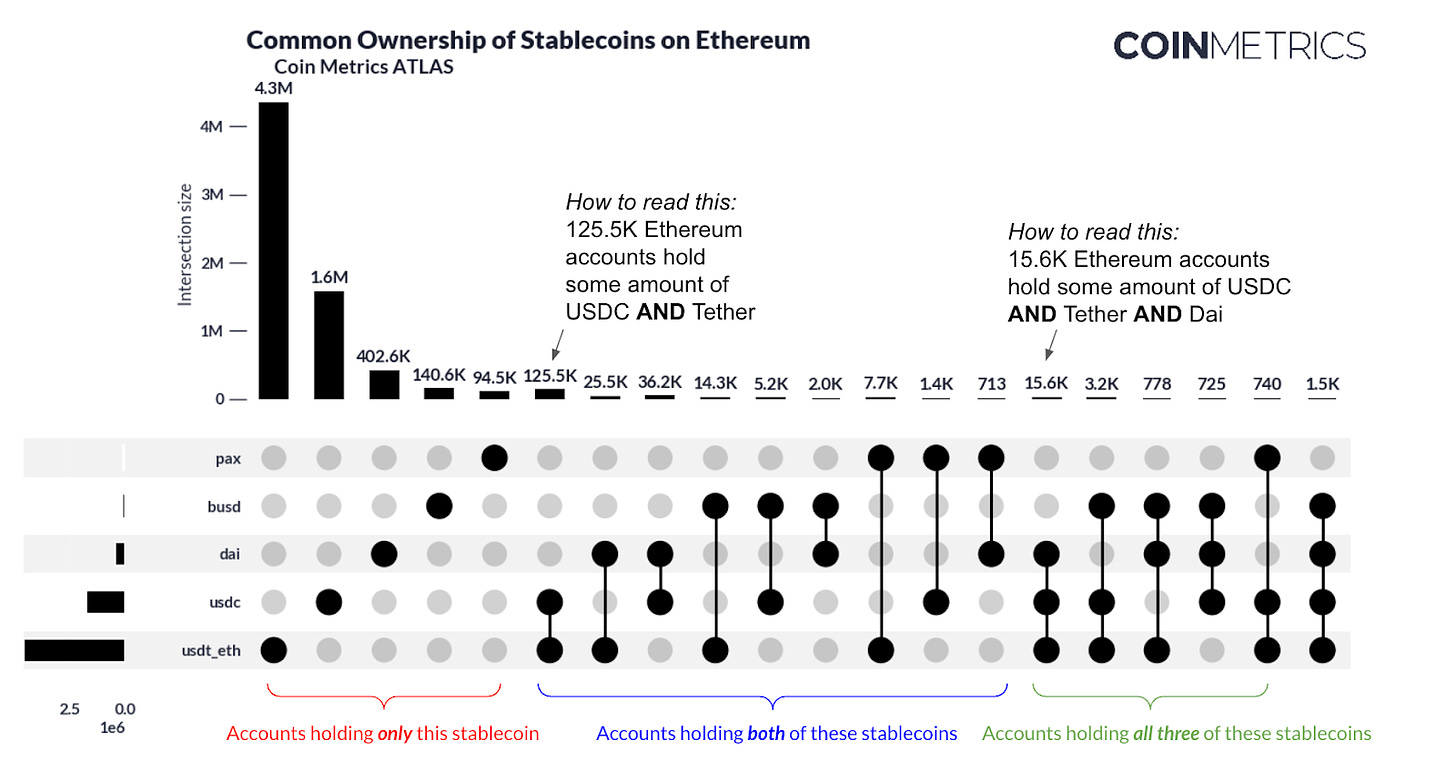

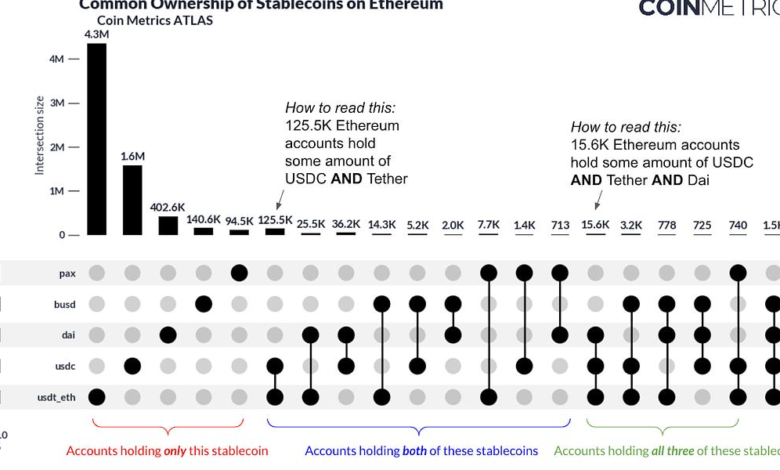

So as to illustrate the intersection in possession, we use a knowledge visualization methodology known as an UpSet plot. An UpSet plot is designed to obviously showcase how totally different teams, or units, overlap with one another—particularly when there are a lot of teams concerned. Most individuals are accustomed to Venn Diagrams, that are nice for visualizing the intersection of two teams. However Venn Diagrams get very messy with a number of combos and subsets. That is the place an UpSet plot proves most advantageous.

UpSet plots current this info in a grid, the place linked dots in a row reveal which teams share members. Vertical bars point out the quantity of members in these overlaps. By observing the place dots line up and the peak of the bars, you may perceive how and by how a lot teams intersect.

In the following sections, we create UpSet plots to grasp stablecoin possession tendencies. In every step, we additional refine the evaluation by eradicating sure account sorts, serving to us to higher study totally different person behaviors and preferences.

As a primary cross, we begin with all accounts that maintain a non-zero steadiness. As talked about earlier, there are simply round 6.7M distinctive accounts that maintain some quantity of the 5 stablecoins we’ve included.

The chart above reveals that overlap is definitely pretty unusual (observe we’ve solely included the high 20 subsets, combinatorially there are 31 whole). For instance, out of the 6.1M distinctive accounts holding some quantity of USDC or Tether, there are solely about 150K that maintain some of each (~2%). That is maybe not too shocking given previous analysis: we’ve proven that USDC and Tether are usually used at totally different instances of the day with USDC getting used throughout North American enterprise hours, and Tether getting used primarily throughout European and Asian market hours. It’d equally be a matter of comfort whereby a person would go for a single stablecoin over many. A remarkably small quantity of addresses (348) maintain some of all 5 stablecoins (not proven in the graph).

However that is only a first look—for a extra correct view we must always hone in on account sorts that finest replicate human customers.

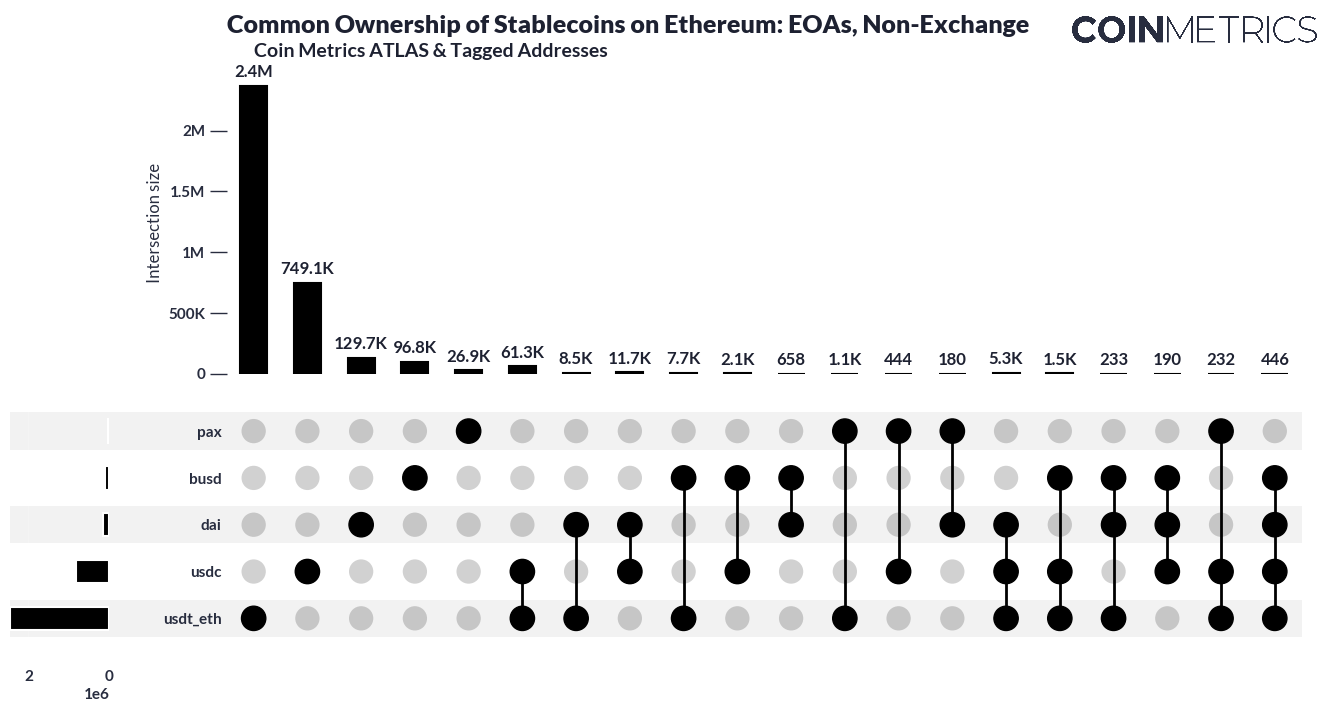

A standard downside confronted in on-chain evaluation is coping with mud addresses. Mud addresses maintain very small quantities of a token (lower than or equal to $10) such that after transaction charges, it’s normally not even price transferring. There are a lot of such small stablecoin addresses on Ethereum. A complete of 45% of addresses (~2M addresses) holding some quantity of Tether on Ethereum maintain lower than $10. Equally, this determine is about 50% for USDC. The chart above corrects for this by excluding all accounts holding lower than $10 in worth (e.g. if an account holds $1,000 of Tether and $2 of USDC, it’s counted as holding simply Tether).

Then, we use an early model of Coin Metrics’ tackle tagging knowledge to exclude sensible contracts (to exclude issues like DeFi protocols) and change addresses, to concentrate on simply singular customers. After all, you will need to observe that one tackle nonetheless could not essentially signify one human being (and sometimes customers have a number of addresses), however these changes get us nearer.

Right here, we see that holding a number of stablecoins remains to be pretty unusual. Solely 69K addresses maintain each USDC and Tether, out of the adjusted 3.2M distinctive externally-owned, non-exchange accounts holding larger than 10 {dollars} of both USDC or Tether (about 2% nonetheless).

One other means we will slice the knowledge is by making additional changes on an account’s whole steadiness. Right here, we limit accounts to have a complete steadiness (summing throughout all holdings) between $100 and $10,000 (nonetheless eradicating sensible contracts and exchanges). There are a complete of 1.2M such addresses. Many of the identical tendencies as above maintain, particularly for Tether and USDC.

One fascinating observe is that Dai holders are more likely to diversify their holdings. Of the ~50K accounts holding Dai, about 15K or 30% of them held one of the different 4 stablecoins. This may very well be because of the nature of Dai as a (largely) crypto-overcollateralized stablecoin.

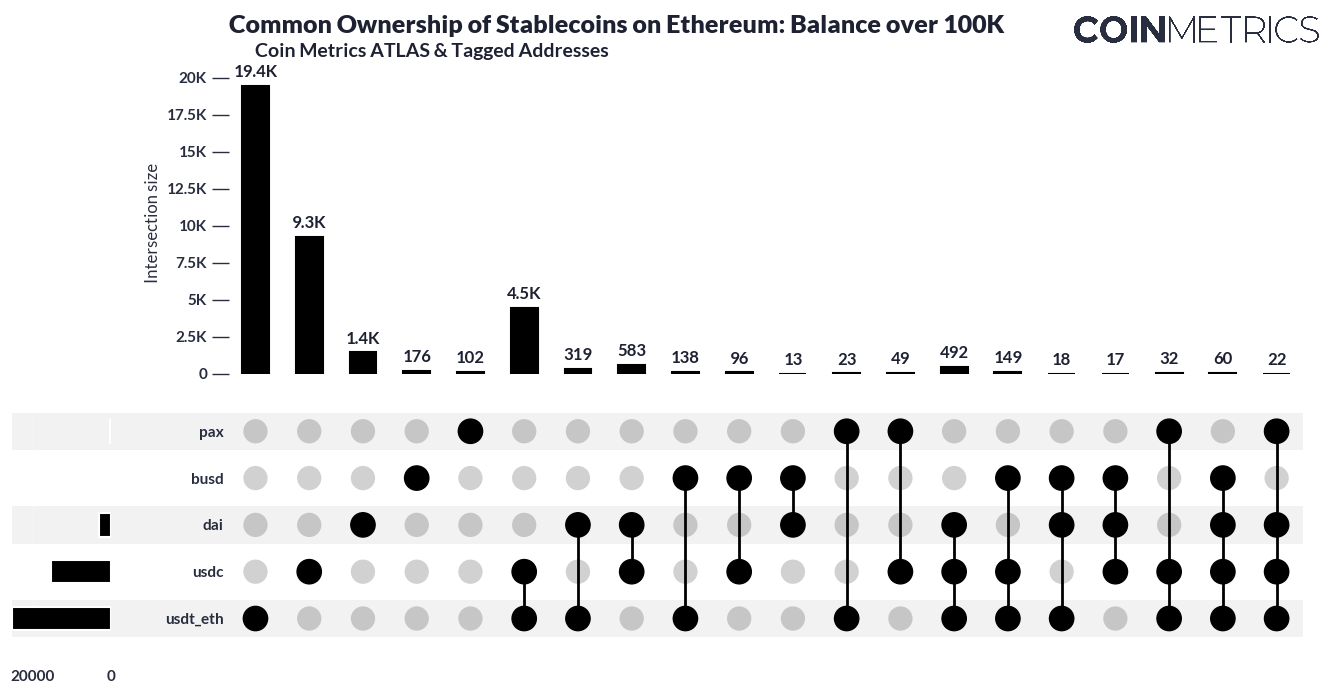

Subsequent, we will drill down to only these accounts with whole holdings of stablecoins over $100,000, and at the least a steadiness of $10K in any stablecoin to get a greater sense of any propensity to diversify (to keep away from counting intersections the place, say, an account holds $1M USDC however solely $200 of Tether). Throughout these 5 stablecoins, there are 37K such accounts.

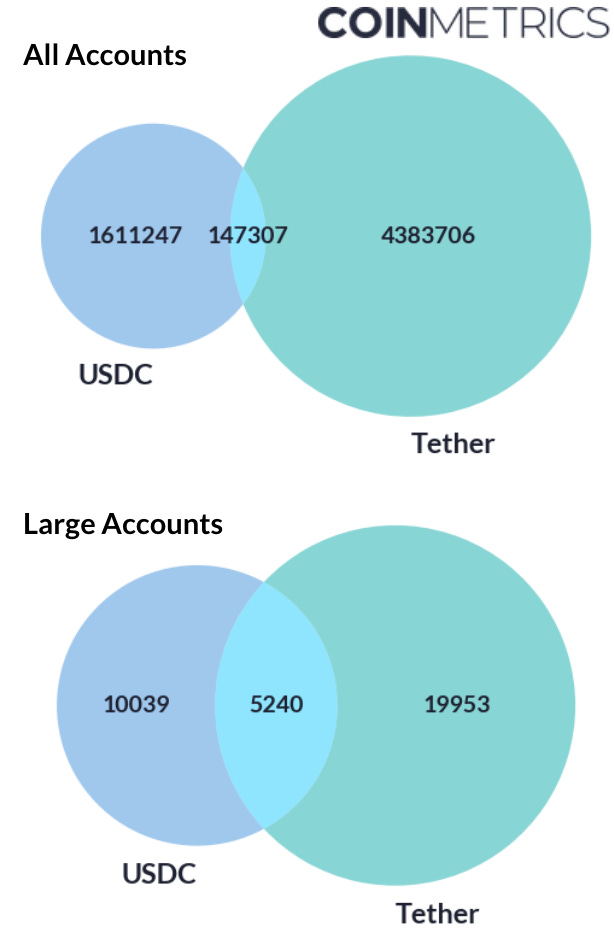

A really fascinating pattern emerges when massive accounts, the place the stakes are ostensibly increased. Now, we see that intersections are far more pronounced. First, we see {that a} whole of about 5.2K (4.5K+492+149+32+60+22) massive addresses maintain Tether and USDC. It is a a lot increased proportion than what we noticed with all addresses. This turns into much more clear a Venn Diagram:

Whereas solely 10% of all USDC addresses maintain some quantity of one other stablecoin, 40% of all massive USDC-owning accounts carry at the least $10K of one other stablecoin. That is additionally true to a lesser extent for Tether holders. Solely 4% of all Tether holders personal one other stablecoin, however 23% of massive holders personal one other stablecoin.

This is sensible from a diversification perspective. Massive holders, having extra at stake, ought to be incentivized to unfold their funds round if attainable. This final level is essential. If a holder is unable to entry the monetary rails to offramp from that stablecoin to fiat, it may not be of a lot worth to carry that stablecoin. This may clarify why some holders of Tether (an offshore stablecoin) are much less prone to diversify their holdings to an onshore stablecoin like USDC.

Lastly, current market occasions could have performed a key position in catalyzing holder diversification. The collapse of Silicon Valley Financial institution in March of this 12 months launched a short however risky shock to holders of USDC.

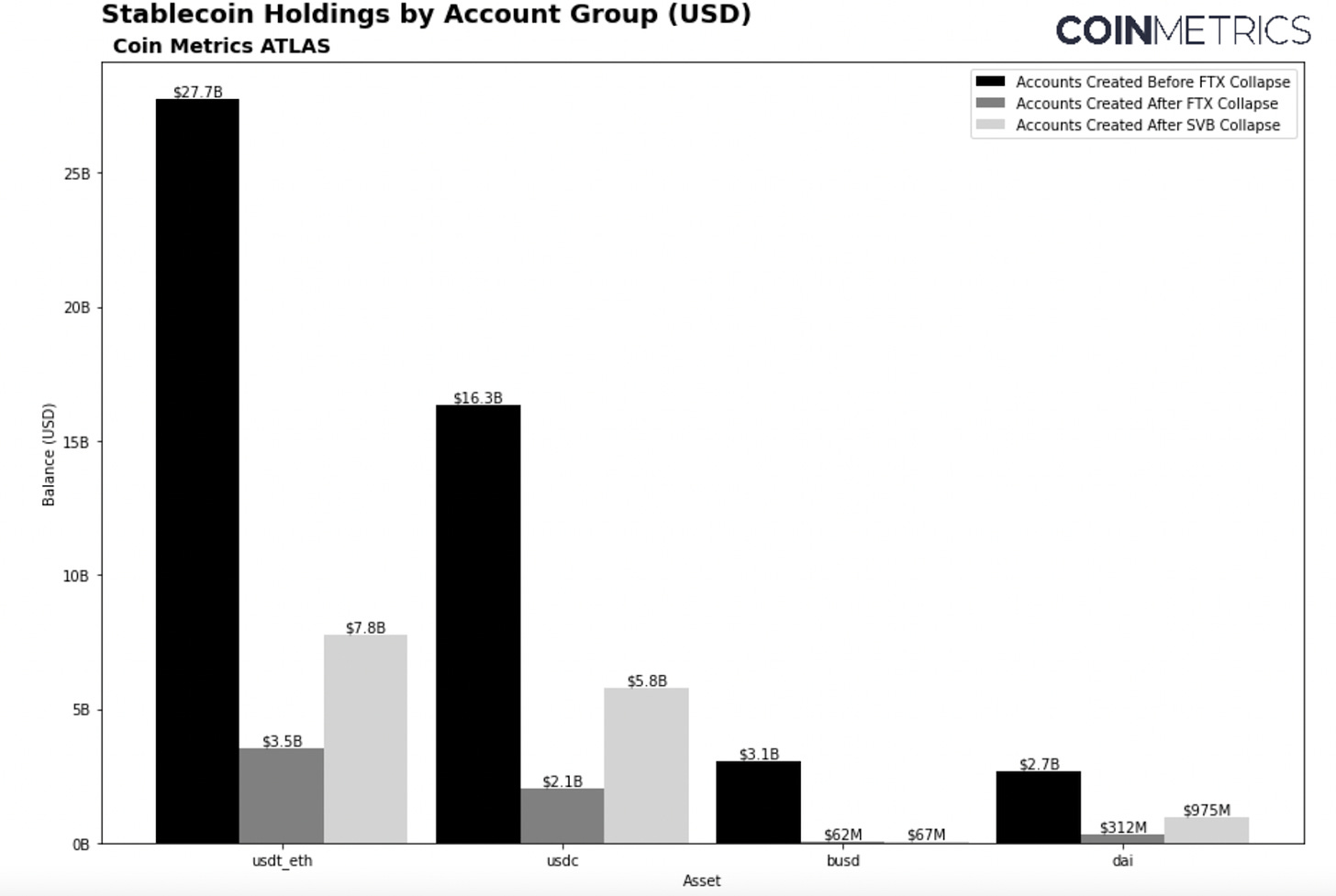

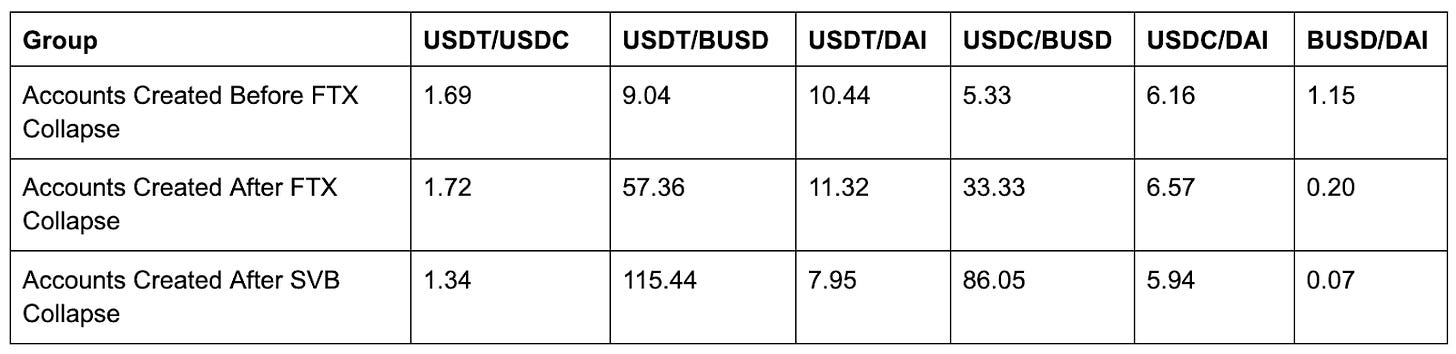

To evaluate how vital market occasions have influenced person preferences round stablecoins, we will divide all accounts into three distinct cohorts primarily based on their date of creation. This permits us to probe into the repercussions of main occasions like FTX’s collapse and the fallout of the Silicon Valley Financial institution (SVB) disaster. Accounts are grouped into these created earlier than November 11th, 2022, between November 11th, 2022 and March 10th, 2023, and accounts created after March 10th 2023—leading to a set of non-overlapping accounts.

The evaluation of relative adjustments in balances between these accounts offers invaluable perception into evolving person preferences. It turns into evident that accounts created earlier than FTX’s collapse had a stronger choice for holding USDT over USDC, with a ratio of 1.69. This choice seems to strengthen after FTX’s collapse, rising to 1.72, adopted by a decline to 1.34—suggesting that there’s a pattern in the direction of USDC for newer accounts created after March. Equally, the ratio of USDT to BUSD skilled a drastic bounce, going from 9.04 earlier than the FTX collapse to 115.4 following the SVB collapse. This signifies a relative decline in the adoption of BUSD in comparison with USDT. Curiously, compared to BUSD, DAI additionally seems to be drastically favored amongst newer customers. Despite the fact that this strategy has some limitation—together with neglecting dynamic shifts in older accounts and variations in preliminary capital—it nonetheless provides essential insights into the shifts in relative adoption, that are influenced by main market occasions that may tip customers’ notion of threat.

This report merely gives a short overview of stablecoin person evaluation potentialities. We may refine our person segmentation additional by contemplating extra behavioral traits. This might embody the frequency that the person transacts, whether or not they’re DeFi protocol customers, NFT holders, or personal different sorts of ERC-20s, together with their selection of change, amongst different components. As the stablecoin market grows and extra choices change into obtainable, we additionally achieve the capacity to look at extra particular subsets of co-ownership. All of this wealthy and detailed evaluation is made attainable in real-time by harnessing the energy of on-chain knowledge.

Supply: Coin Metrics Community Knowledge Professional

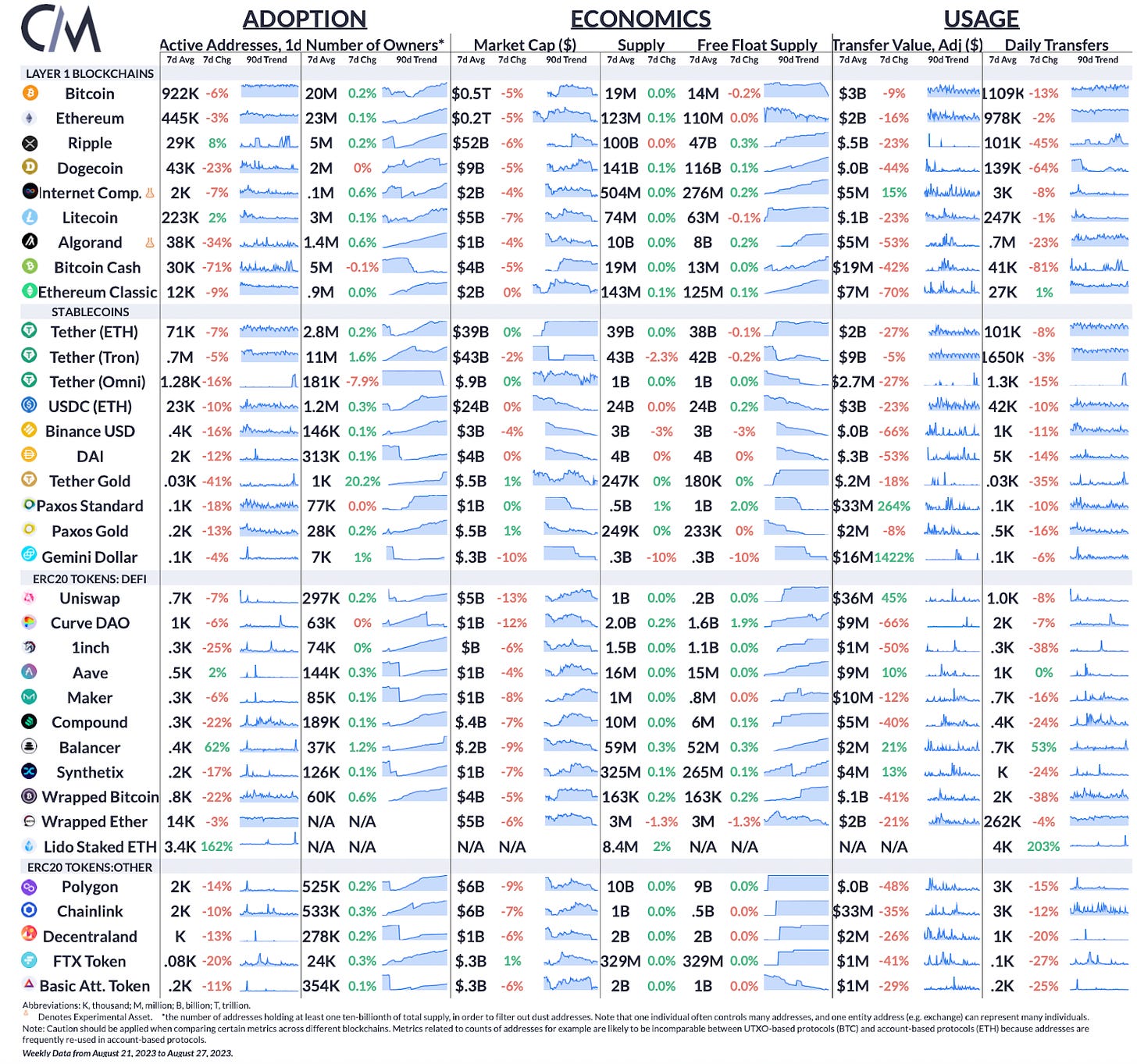

Each day lively addresses on Ripple rose by 8%, whereas exercise on Bitcoin and Ethereum slipped by 6% and three% respectively. In the meantime, Balancer skilled a 62% surge in exercise as the DeFi protocol was exploited for 900k, whereas lively addresses of Lido Staked ETH gained 162% as Mantle, a Layer-2 community struck a strategic deal with Lido.

This week’s updates from the Coin Metrics crew:

-

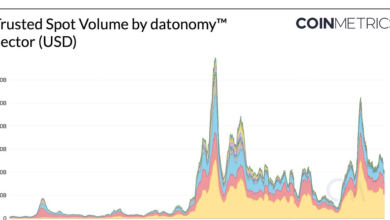

Take a look at the newest difficulty of Coin Metrics’ State of the Market for notable occasions from the previous week along with a brand new web page devoted to mixture BTC and ETH spot quantity

-

Discover the digital property ecosystem by means of our entire catalog of authentic data-driven analysis.

As at all times, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier points of State of the Community right here.