Crypto PnL API – How to Track Wallet Profit & Loss

Searching for the simplest means to observe pockets revenue and loss (PnL)? You’ve come to the correct place! On this information, we’ll introduce Moralis’ crypto PnL characteristic, offering complete insights into pockets and token profitability. With this characteristic, you possibly can seamlessly get the general profitability of a given handle, achieve perception into the PnL standing of particular person tokens, and fetch the highest worthwhile wallets for a given ERC-20 token!

Are you keen to dive into the code? Right here’s our Wallet PnL Abstract endpoint in motion:

import fetch from 'node-fetch';

const choices = {

technique: 'GET',

headers: {

settle for: 'software/json',

'X-API-Key': 'YOUR_API_KEY'

},

};

fetch(' choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Calling this endpoint returns the required pockets’s complete buying and selling quantity, complete PnL, PnL share, and different key metrics. Right here’s an instance of what it appears like:

{

total_count_of_trades: 12,

total_trade_volume: '3793782.5812942344',

total_realized_profit_usd: '-20653.121064896484',

total_realized_profit_percentage: -1.350177388165031,

total_buys: 8,

total_sells: 20,

total_sold_volume_usd: '1509006.703335308',

total_bought_volume_usd: '2284775.8779589264'

}

That’s it; monitoring pockets revenue and loss doesn’t have to be tougher than this when utilizing Moralis. For a extra in-depth tutorial on how this works and additional data on our different endpoints, be a part of us on this article or try the Wallet API documentation web page!

Prepared to use our crypto PnL characteristic? Join free with Moralis and achieve rapid entry to our industry-leading improvement instruments!

Overview

Crypto PnL is a vital monetary metric used to decide a portfolio’s internet revenue or loss. Merchants, buyers, and analysts depend on this metric to assess asset efficiency over particular durations. As such, it’s basic for creating instruments resembling cryptocurrency wallets and buying and selling platforms because it offers customers with a transparent overview of their portfolios’ efficiency.

Historically, acquiring this data requires in depth handbook information aggregation, together with monitoring trades and cryptocurrency costs. Nevertheless, this course of can now be streamlined utilizing a Web3 information supplier like Moralis.

With Moralis’ crypto PnL characteristic, you possibly can simply decide the general profitability of a given handle, analyze the PnL standing of ERC-20s, and establish the highest worthwhile wallets for particular tokens. To study extra about how this characteristic works and the way it can profit you, comply with our complete information. Let’s dive in!

What’s PnL in Crypto?

Crypto PnL, quick for “profit and loss,” refers to the monetary end result of your buying and selling actions. It’s calculated primarily based on the distinction between the shopping for and promoting costs of your cryptocurrency tokens. As such, crypto PnL offers an outline of how your belongings are performing over a given interval.

Crypto PnL is an important metric for merchants and analysts alike, providing a complete overview of portfolio efficiency. Merchants depend on it to assess the effectiveness of their methods, whereas analysts use it for varied functions, together with tax reporting.

When you’re constructing decentralized finance (DeFi) platforms, cryptocurrency wallets, decentralized exchanges (DEXs), portfolio trackers, or different Web3 platforms, incorporating crypto PnL is essential. This characteristic will give your customers a transparent indication of how their belongings are performing immediately inside your platform, boosting each engagement and retention.

Nevertheless, calculating crypto PnL from scratch may be advanced and time-consuming. It requires monitoring all trades a person makes and monitoring costs at particular instances, a course of that may be tedious if executed manually.

Fortuitously, a Web3 information supplier like Moralis can streamline this course of. It eliminates the trouble of handbook calculations, permitting you to give attention to enhancing your platform’s options and person expertise!

Introducing Moralis – The Business’s Main Crypto PnL API for Monitoring Wallet Profit & Loss

With Moralis’ realized crypto PnL characteristic, you possibly can seamlessly question the revenue and loss standing of any pockets. As such, this characteristic provides complete insights into pockets and token profitability, making it simpler to observe and analyze earnings/losses throughout tokens and establish probably the most worthwhile wallets for any ERC-20 token!

The realized crypto PnL characteristic consists of three endpoints:

Wallet PnL Abstract

Fetch the general profitability of a given handle over a selected time interval, together with complete buying and selling quantity, complete revenue/loss, and different key metrics:

import fetch from 'node-fetch';

const choices = {

technique: 'GET',

headers: {

settle for: 'software/json',

'X-API-Key': 'YOUR_API_KEY'

},

};

fetch(' choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Instance Response:

{

total_count_of_trades: 12,

total_trade_volume: '3793782.5812942344',

total_realized_profit_usd: '-20653.121064896484',

total_realized_profit_percentage: -1.350177388165031,

total_buys: 8,

total_sells: 20,

total_sold_volume_usd: '1509006.703335308',

total_bought_volume_usd: '2284775.8779589264'

}

Wallet PnL Breakdown

Get an in depth breakdown of buys, sells, and revenue/loss for every ERC-20 token traded by a pockets. This endpoint helps you perceive the efficiency of particular person tokens in a portfolio:

import fetch from 'node-fetch';

const choices = {

technique: 'GET',

headers: {

settle for: 'software/json',

'X-API-Key': 'YOUR_API_KEY'

},

};

fetch(' choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Instance Response:

{

end result: [

{

token_address: '0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2',

avg_buy_price_usd: '1250.89117636677242138858',

avg_sell_price_usd: '1217.57108487456170834445',

total_usd_invested: '765334.18465647742708110434311858',

total_tokens_bought: '611.831148157427433472',

total_tokens_sold: '611.831148157427433472',

total_sold_usd: '744947.914822087616974748507047918740485538176519383',

avg_cost_of_quantity_sold: '1250.89117636677242138858',

count_of_trades: 5,

realized_profit_usd: '-20386.26983438981010635958779520045817511936',

realized_profit_percentage: -2.663708252302914,

total_buys: 3,

total_sells: 18,

name: 'Wrapped Ether',

symbol: 'WETH',

decimals: 'WETH',

logo: '

logo_hash: '0a7fc292596820fe066ce8ce3fd6e2ad9d479c2993f905e410ef74f2062a83ec',

thumbnail: '

possible_spam: false

},

//...

]

}

High Worthwhile Wallets by Token

Fetch the highest worthwhile wallets which have traded a sure token, offering insights into probably the most profitable merchants for that asset:

import fetch from 'node-fetch';

const choices = {

technique: 'GET',

headers: {

settle for: 'software/json',

'X-API-Key': 'YOUR_API_KEY'

},

};

fetch(' choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Instance Response:

{

title: 'Wrapped Matic',

image: 'WMATIC',

decimals: '18',

emblem: '

possible_spam: false,

end result: [

{

address: '0x202bb2fab1e35d940fde99b214ba49dafbcef62a',

avg_buy_price_usd: '0.9183155718922578201779330700749389942841',

avg_sell_price_usd: '1.59952463158282389246',

total_tokens_bought: '50.425564410689794636',

total_usd_invested: '46.30658101979248190652763127006057463808',

total_tokens_sold: '50.423563438810080581',

total_sold_usd: '80.6537317325558427356221252383435353256',

avg_cost_of_quantity_sold: '0.91831557189225782928',

count_of_trades: 2,

realized_profit_usd: '34.34898823639942076774324344951973710758',

realized_profit_percentage: 74.18027969262069

},

//...

]

}

This overview covers our crypto PnL characteristic. Subsequent, we’ll stroll you thru a tutorial on how to use these endpoints to observe pockets revenue and loss!

3-Step Tutorial: How to Track Wallet Profit & Loss

We’ll now present you ways to observe the revenue and loss standing of any pockets. And thanks to the accessibility of our premier API, you may get the information you want in three easy steps:

- Get a Moralis API Key

- Write a Script Calling the Wallet PnL Abstract Endpoint

- Run the Code

Nevertheless, earlier than we get going, you’ll want to maintain a few stipulations!

Conditions

Earlier than transferring on, be sure you have the next put in and arrange:

Step 1: Get a Moralis API Key

Click on the “Start for Free” button on the high proper to join an account with Moralis:

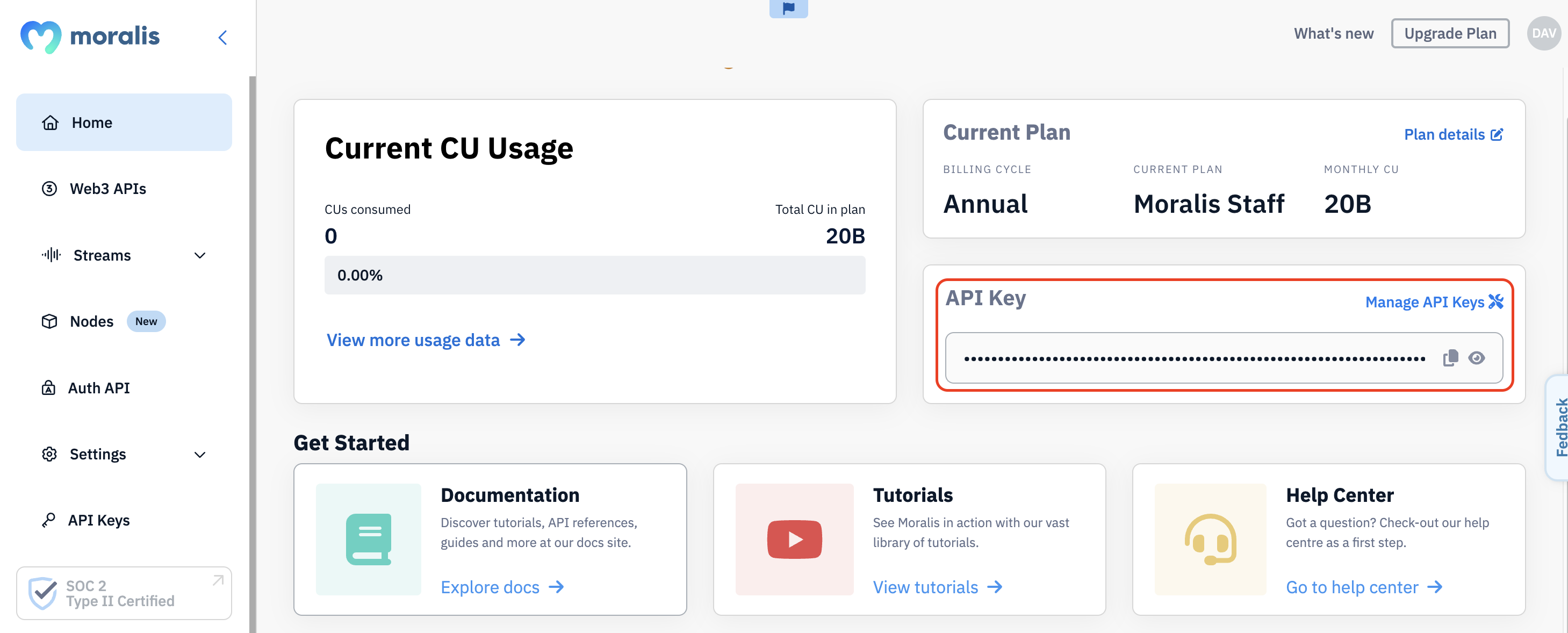

From there, you’ll discover your API key immediately underneath the “Home” tab:

Copy and maintain the important thing for the second, as you’ll want it in the course of the subsequent step!

Step 2: Write a Script Calling the Wallet PnL Abstract Endpoint

Open your most well-liked IDE, arrange a folder, launch a terminal, and initialize a undertaking with this command:

npm init

Set up the wanted dependencies with this terminal command:

npm set up node-fetch --save npm set up moralis @moralisweb3/common-evm-utils

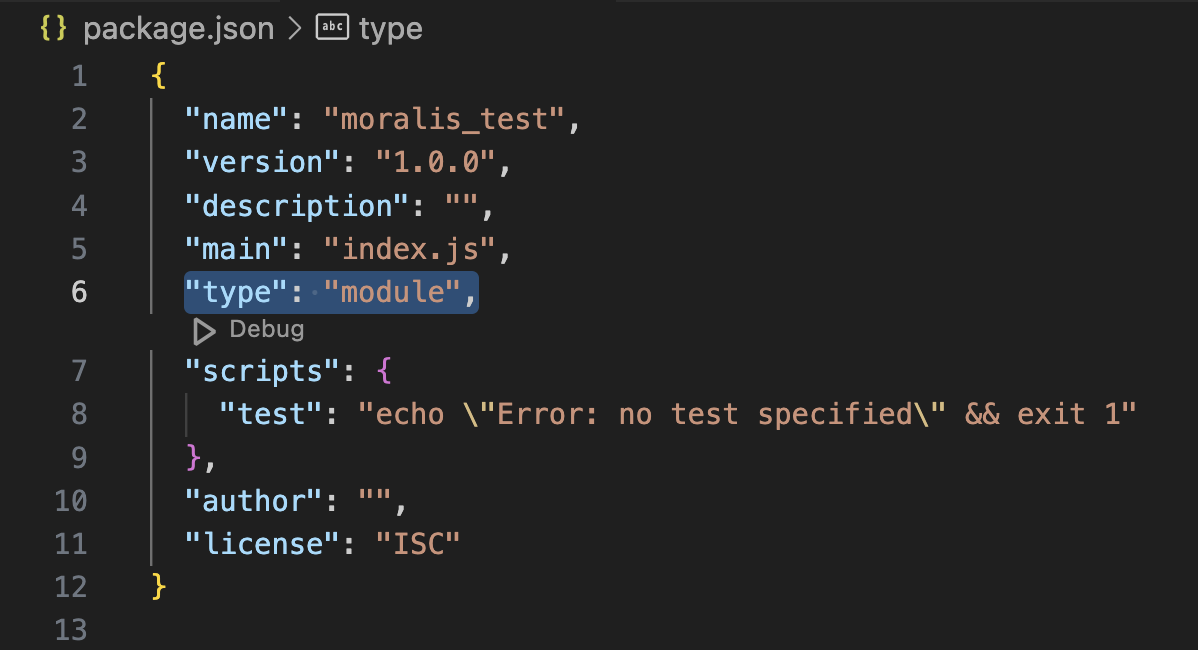

From right here, open your “package.json” file and add “type”: “module” to the checklist:

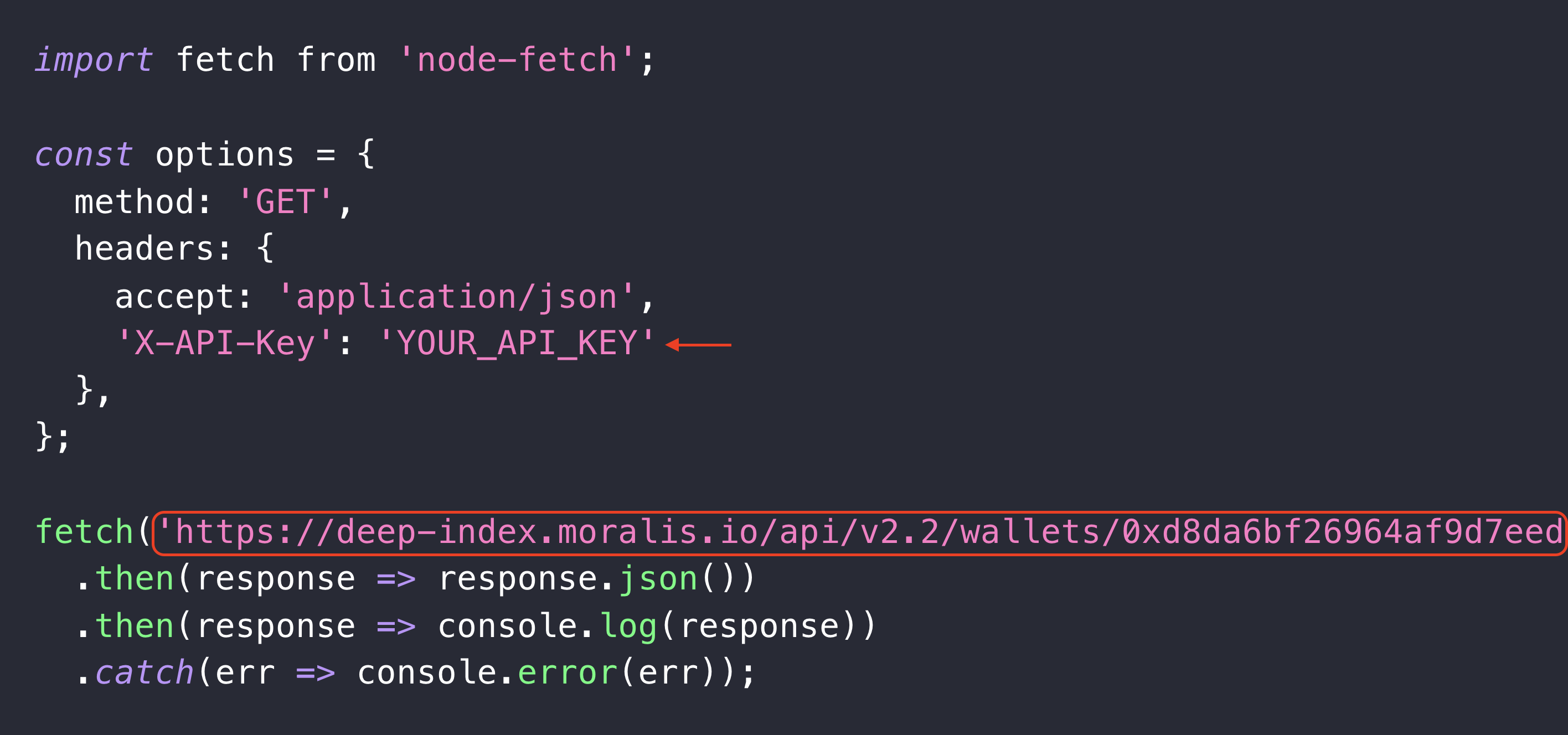

Create a brand new “index.js” file and add the next code:

import fetch from 'node-fetch';

const choices = {

technique: 'GET',

headers: {

settle for: 'software/json',

'X-API-Key': 'YOUR_API_KEY'

},

};

fetch(' choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Subsequent, you want to configure the code barely. Firstly, add your Moralis API key by changing YOUR_API_KEY. Secondly, configure the handle and chain parameters to suit your question:

That’s it for the code. All that continues to be now’s to execute the script!

Step 3: Run the Code

Open your terminal, go to the basis folder of your undertaking, and run this command:

node index.js

In return, you’ll obtain a response showcasing the pockets’s complete buying and selling quantity, complete realized revenue/loss, realized revenue/loss share, and extra. Right here’s an instance of what it would appear to be:

{

total_count_of_trades: 12,

total_trade_volume: '3793782.5812942344',

total_realized_profit_usd: '-20653.121064896484',

total_realized_profit_percentage: -1.350177388165031,

total_buys: 8,

total_sells: 20,

total_sold_volume_usd: '1509006.703335308',

total_bought_volume_usd: '2284775.8779589264'

}

That’s it! Monitoring pockets revenue and loss doesn’t have to be tougher than this when utilizing Moralis!

Use Case – Construct a Crypto PnL Tracker

Now that you know the way to observe pockets revenue and loss, you possibly can leverage this information to construct instruments like a crypto PnL tracker. A crypto PnL tracker is a platform or software that helps customers monitor their portfolio efficiency successfully!

Key options of a crypto PnL tracker embody:

- Actual-Time Portfolio Monitoring: Monitor the efficiency of a portfolio in real-time, together with the revenue/loss standing for particular person ERC-20 tokens.

- Historic Information Evaluation: Entry historic efficiency information to analyze how investments have carried out over particular durations.

- Tax Calculations: Make the most of PnL information to help customers with their cryptocurrency taxes.

A crypto PnL tracker may be built-in into varied platforms, resembling portfolio trackers, cryptocurrency wallets, DEXs, and extra, to enhance the general person expertise of your dapps!

Past Crypto PnL & Monitoring Wallet Profit & Loss – Diving Deeper Into Moralis

Moralis stands because the {industry}’s main Web3 information supplier, providing an in depth suite of Web3 APIs and RPC nodes past the crypto PnL characteristic. With Moralis, you possibly can entry all crypto information in a single place, making it simple to develop refined platforms like cryptocurrency wallets, portfolio trackers, and extra.

However why select Moralis’ Web3 APIs and RPC nodes?

- Complete: Moralis delivers probably the most detailed API responses within the {industry}, offering extra information with fewer calls. This effectivity allows you to construct dapps quicker and extra successfully.

- Cross-Chain Compatibility: Moralis helps over 30 chains, together with Ethereum, Polygon, BSC, and Optimism, providing full characteristic parity throughout all networks. This implies you solely want one supplier for all of your crypto wants.

- Safe: Profit from enterprise-grade information safety as Moralis is Web3’s first SOC 2 Sort 2 licensed information supplier.

To totally grasp the capabilities of Moralis, let’s delve deeper into our suite of improvement instruments, beginning with our Web3 APIs!

Web3 APIs

In our suite of Web3 APIs, you’ll discover ten use-case-specific interfaces. Beneath, we’ll introduce three outstanding examples:

- Wallet API: With the Wallet API, you possibly can effortlessly retrieve any pockets’s crypto PnL, token balances, transaction historical past, internet price, and rather more. By leveraging this software, you possibly can seamlessly combine pockets performance into your dapps.

- Token API: The Token API permits you to entry token balances, metadata, costs, and extra with only a few traces of code. This makes the Token API a superb software for dapps requiring ERC-20 information, together with DEXs, portfolio trackers, and extra.

- NFT API: With the NFT API, you possibly can effortlessly question NFT balances, metadata, costs, and extra. When you’re wanting to construct NFT marketplaces, Web3 video games, or comparable platforms, make certain to try the NFT API.

- Streams API: With the Streams API, you possibly can effortlessly arrange Web3 information pipelines on the click on of some buttons to stream information immediately into your initiatives. As such, this highly effective software is right for organising real-time alerts, populating databases, or enhancing dapps with up-to-date insights on tokens, wallets, and good contracts.

- Value API: The Value API allows seamless retrieval of costs for any ERC-20 token or NFT. This superior software helps batch requests, permitting you to question the costs of a number of tokens concurrently. It’s good for constructing DEXs, token trackers, or any platform requiring correct pricing information.

Go to our official Web3 API web page to study extra concerning the examples above and our different interfaces!

RPC Nodes

Moralis offers RPC nodes for over 30 blockchains, together with Ethereum, Polygon, BSC, and lots of others. And our user-friendly, point-and-click interface makes organising nodes a breeze!

However what units our RPC nodes aside?

- Pace: Take pleasure in lightning-fast response instances beginning at simply 70 ms, making certain you obtain the information you want immediately.

- Reliability: Our nodes are designed for max dependability, with a formidable 99.9% uptime.

- Safety: Profit from top-notch information safety because the {industry}’s first SOC 2 Sort 2 licensed information supplier.

To study extra, please go to our official RPC nodes web page or try one of many following guides, the place we discover Fantom RPC nodes and Blast RPC nodes!

Abstract: Crypto PnL API – How to Track Wallet Profit & Loss

Crypto PnL is a vital monetary metric used to decide the web revenue or lack of a cryptocurrency portfolio. Merchants, analysts, and buyers depend on this metric to observe asset efficiency over particular time durations, making it important for constructing the whole lot from wallets to portfolio trackers.

Nevertheless, calculating the revenue and lack of a pockets from scratch generally is a tedious and complicated job, requiring fixed monitoring of person transactions, token costs, and extra. Fortunately, now you can seamlessly question the crypto PnL of any portfolio with a single line of code utilizing a Web3 information supplier like Moralis.

Moralis’ crypto PnL characteristic consists of three core endpoints:

- Wallet PnL Abstract: Receive the general profitability of a given pockets over a specified interval. This consists of complete buying and selling quantity, complete revenue/loss, revenue/loss share, and different key metrics.

- Wallet PnL Breakdown: Fetch an in depth breakdown of buys, sells, and revenue/loss for every token traded by a pockets. This endpoint offers an in-depth understanding of the efficiency of particular person tokens in a portfolio.

- High Worthwhile Wallets by Token: Determine the highest worthwhile wallets which have traded a selected token, providing insights into probably the most profitable merchants for that specific asset.

As such, when utilizing Moralis, you possibly can seamlessly observe pockets revenue and loss with out breaking a sweat!

When you discovered this crypto PnL tutorial useful, think about exploring extra content material on our weblog. For instance, try our article on the DeBank API for data on our DeFi positions characteristic, or examine our Alchemy Webhooks information for extra data on streams.

Moreover, if you want to observe pockets revenue and loss your self, join with Moralis. You’ll be able to create an account freed from cost and achieve rapid entry to our suite of industry-leading instruments.