Curve founder hit with $27M liquidation as CRV drops to historic low

Michael Egorov, founder of Curve Finance, confronted liquidation earlier immediately after the CRV token plummeted to an all-time low of $0.219.

$27 million liquidated

On-chain analyst EmberCN reported that Egorov’s lending positions have been largely liquidated, totaling round 100 million CRV, valued at $27 million. Regardless of this, he nonetheless holds 39.35 million CRV, securing $5.4 million in stablecoins on a lending platform.

Nevertheless, these remaining belongings should not at fast threat of liquidation, as the mortgage well being charge has surpassed 1.

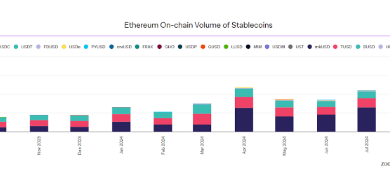

Blockchain intelligence platform SoSo Worth noted that Egorov’s state of affairs triggered widespread CRV liquidations throughout varied platforms. Though his actions didn’t create direct promoting strain, he reportedly profited rapidly in one other method, probably disadvantaging lenders and former CRV traders.

It added:

“Curve, as an established DeFi project, is known for its quality and long-term profitability. However, whether this incident will impact Curve’s standing and reduce community cohesion remains to be seen.”

Notably, Arkham Intelligence beforehand warned that Egorov’s CRV positions value $140 million throughout 5 protocols have been vulnerable to liquidation if the digital asset’s value dropped 10%. The corporate defined:

“$50 million of Egorov’s crvUSD borrows are on Llamalend, which currently costs him ~120% APY. This is because there is almost no remaining crvUSD available for borrowing against CRV on Llamalend. 3 of Egorov’s accounts already make up over 90% of the borrowed crvUSD on the protocol.”

In the meantime, this isn’t the primary time Egorov’s substantial borrowing on Curve has disrupted the market. Final yr, a hacking occasion resulted in sharp declines in CRV value, forcing a number of DeFi protocols to prohibit extra CRV borrowing, citing the contagion threat from Egorov’s actions.

Curve’s smooth liquidation

Amid the market turmoil, Egorov praised Curve Finance’s smooth liquidation mechanism on June 12 for efficiently dealing with a real-world check throughout the current UwU lending platform hack.

In accordance to LLAMMA documentation, new loans deposit collateral into a number of bands throughout the automated market maker (AMM). So, in contrast to conventional liquidation with a single value, LLAMMA has a number of liquidation ranges and constantly liquidates collateral if vital.

He stated:

“The system showed a fantastic performance. This gave time for liquidators to prepare funds and OTC-liquidate the hacker’s position. As a result, the system has no hacker’s funds left, no bad debts, everything operates well.”