Decoding the Digital Dollar

Get the finest data-driven crypto insights and evaluation each week:

By: Matías Andrade & Tanay Ved

-

Market Development: The stablecoin market has grown from under $10B in 2020 to over $160B at the moment, with important contributions from USDT and USDC.

-

Utilization and Adoption: Stablecoins are extensively used for transactions, with various switch sizes influenced by blockchain transaction charges. Weekly adjusted switch quantity exceeded $50 billion as of April.

-

World Utility: Evaluation of hourly transaction information exhibits that USDC on Ethereum sees reasonable exercise round the Hong Kong Inventory Trade (HKSE) and London Inventory Trade (LSE) buying and selling hours. In distinction, USDT on Tron reveals greater and extra evenly distributed transaction exercise.

The US greenback has lengthy dominated as the world’s reserve foreign money. Nevertheless, this standing is now being contested as BRICS international locations like China, Brazil and Russia discover options for worldwide commerce and central banks diversify their reserves into assets like gold, versus US Treasuries. In distinction, the emergence of stablecoins—digital tokens issued on blockchains, collateralized by fiat currencies, money equivalents or crypto-assets—are bolstering the demand for US {dollars} and treasuries throughout the monetary ecosystem.

The adoption of stablecoins just isn’t solely pertinent to the US, but additionally vital for dollar-starved economies and rising markets going through financial instability or restricted entry to monetary companies. Now exceeding a staggering $160B, the market gives a various vary of stablecoins and supporting infrastructure for each consumer applications equivalent to cross-border payments, and business applications, and exceed all however the top 15 countries’ demand for Treasuries.

On this week’s concern of State of the Community, we assess the development and utilization patterns of stablecoins, offering an in-depth evaluation throughout Coin Metrics’ in depth suite of stablecoin protection by means of the lens of our newly developed dashboard.

The worldwide footprint of stablecoins has expanded remarkably, rising from under $10B in whole market capitalization in 2020, to over $160B at the moment. Whereas the provide of stablecoins fell in 2023 amid the broader liquidity crunch from central financial institution tightening and ripple results of the Terra Luna implosion, the latest rise could also be reflective of a renewed demand for crypto belongings, buoyed by the launch of bitcoin spot ETFs in the US.

USDT—a fiat-backed stablecoin issued by Tether, continues to take care of its dominance, with $51B (44%) of provide circulating on Ethereum, $58B (52%) on the Tron community with the remaining issued on Solana and Avalanche. Tether’s Q1 2024 attestation revealed a staggering web revenue of $4.52B, doubling from the earlier quarter. This spectacular feat highlights the power of stablecoin issuer enterprise fashions like that of Tether and Circle, issuing tokens backed by reserves of low-risk belongings like US Treasury payments and money, whereas additionally holding investments like bitcoin or gold that may generate revenue in the prevailing rate of interest surroundings. As of March 2024, Tether and Circle maintain $10B and $74B, respectively, in US Treasuries as a part of their reserves, with Cantor Fitzgerald custodying Tether’s Treasury holdings and BlackRock managing Circle’s reserves inside a cash market fund.

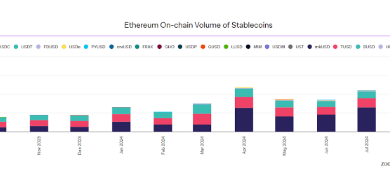

Source: Coin Metrics Network Data Pro

Whereas Tether, an offshore entity, has capitalized on the regulatory ambiguity in the US which posed challenges to Circle final 12 months, USDC has began 2024 off on a powerful footing. Its development seems to stem from deepened strategic ties with Coinbase, in addition to cross-chain expansions to networks like Solana and Ethereum Layer 2’s, enhancing its market presence and liquidity. Moreover, Circle’s integration with BlackRock’s BUIDL tokenized fund permitting buyers to off-ramp their shares to USDC, are some initiatives that would broaden USDC’s ecosystem and drive better adoption.

The stablecoin market stays dominated by fiat-collateralized choices like USDC and USDT, catering to the widespread demand for dollar-pegged belongings. The success of established issuers has prompted notable new entrants, equivalent to PayPal’s PYUSD on Ethereum. Crypto-backed stablecoins like MakerDAO’s Dai, collateralized by a basket of crypto-assets and real-world belongings (RWAs), have additionally gained traction. Moreover, artificial or algorithmic stablecoins like Ethena’s USDe have emerged, using dynamic hedging methods to take care of their greenback peg with out overcollateralization. This class additional consists of stablecoins issued by DeFi protocols, which have turn into central to their enterprise fashions, equivalent to Aave’s GHO and Curve’s crvUSD. These diverse approaches span a spectrum of reserve backing fashions, every with its personal distinctive threat and return traits.

Supply: Coin Metrics Community Dats Professional (Notice: The chart doesn’t embody stablecoins issued on Ethereum Layer-2’s)

The lion’s share of stablecoin provide—55% or $81B in circulating provide resides on Ethereum at the moment. Probably the most extensively adopted and liquid stablecoins gained traction on Ethereum early on, leveraging its safety and huge developer base round the Ethereum Digital Machine (EVM) ecosystem, deepening its community results.

Tron has additionally established a powerful place in the stablecoin market, capturing a 39% market share, whereas others like Solana and Avalanche are gaining floor. Attributes like quicker transaction speeds and decrease transaction charges on chains like Solana are making them enticing for high-frequency and decrease worth stablecoin use-cases, equivalent to funds as revealed in Stripe’s latest announcement. Equally, Ethereum layer-2’s like Arbitrum and Base are witnessing stablecoin development as decrease charges drive a shift in cohorts of consumer exercise in the direction of these scalability options.

Whereas the burgeoning rise of stablecoins is obvious, a number of questions round the nature of stablecoin utilization and adoption stay. As an illustration, to what extent are stablecoins facilitating actual financial worth? Are stablecoins being held as a retailer of worth, or getting used for transactional functions? What’s the typical dimension of a stablecoin switch and what demographics are being served? Whereas these questions are difficult to pinpoint definitively, the transparency of blockchain information may help us higher contextualize such patterns in stablecoin exercise.

Source: Coin Metrics Network Data Pro

The weekly adjusted switch quantity involving transfers of native models between distinct stablecoin addresses exceeded $50B in April. 48% of this exercise stemmed from USDT on Ethereum and Tron, whereas Dai additionally noticed a document switch quantity of $22B on April 19th. Whereas this metric has seen a number of spikes, it conveys stablecoins’ utility as a way of settling numerous types of financial worth.

When switch quantity is considered relative to its circulating provide, we get a greater sense for stablecoin velocity, or the price at which models are being turned over. Nevertheless, it is vital to interpret this metric in the proper context. USDC on Tron shows the highest velocity, probably as a result of Circle’s determination to section out its assist which has contracted provide, however elevated USDC transfers to different blockchains.

Whereas its provide has declined, Dai notably hit a peak in velocity as a result of its robust on-chain footprint and rising utilization of the Dai Financial savings Price (DSR)—a sensible contract successfully functioning as a financial savings account for deposited Dai. MakerDAO’s governance usually implements strategic changes to drive utilization of Dai, equivalent to the recent hike in curiosity earned on the DSR. The speed for USDC on Ethereum and USDT on Tron are at present at comparable ranges, whereas USDC is prone to see better turnover on networks like Avalanche, Solana and Layer-2’s.

Source: Coin Metrics Network Data Pro

We are able to additionally discern the extent to which stablecoins are being held as a retailer of worth or getting used on-chain by taking a look at supply held by smart-contracts and externally owned accounts (EOA’s). As an illustration, whereas $41B of USDT (Ethereum) is held by EOA’s, its presence in sensible contracts has greater than doubled since January 2023 to $9.6B. The truth is, it now additionally exceeds USDC in sensible contracts by $2.3B. General, this means stablecoins’ elevated position in facilitating transactions on public blockchain infrastructure equivalent to decentralized finance (DeFi) purposes, along with serving as a retailer of worth or hedge in opposition to inflation.

Source: Coin Metrics Network Data Pro

The median transfer value of stablecoins helps contextualize the typical dimension of a switch. This metric is very influenced by the charges and transaction capabilities of the blockchain they’re issued on. As an illustration, USDC and USDT on Ethereum have the highest median switch values averaging $500 per switch, to amortize greater transaction charges on mainnet. On the different hand, the median transaction dimension of USDT on Tron is $230. Equally, stablecoins on Solana show the smallest switch worth, indicating the prevalence of high-frequency, low-value transfers—a direct consequence of charges being as little as $0.01.

Certainly one of the most vital worth propositions of stablecoins is their international utility for twenty-four/7 worth alternate. Our previous evaluation on the geographic dominance of stablecoins revealed the choice for USDC utilization in North America and Western Europe, whereas USDT has traditionally seen its highest buying and selling volumes in Asia, Africa and Latin America. Nevertheless, leveraging 1h transaction information from Coin Metrics ATLAS, we are able to additionally discern time-based patterns in exercise, revealing hours throughout which exercise is most pronounced.

Supply: Coin Metrics ATLAS, Coin Metrics Stablecoin Dashboard

These heatmaps show hourly transaction rely exercise for USDC on Ethereum and USDT on Tron over the final 3 months, overlaid with main inventory market buying and selling hours. USDC exercise appears to be comparatively dispersed, with reasonable exercise round Hong Kong Inventory Trade (HKSE) and London Inventory Trade (LSE) buying and selling hours. Probably the most distinguished peaks are noticeable round the New York Inventory Trade (NYSE) open and shut, suggesting a stronger affect in the US market.

Supply: Coin Metrics ATLAS, Coin Metrics Stablecoin Dashboard

On the different hand, transaction exercise for USDT on Tron is considerably greater in magnitude, and seems to be extra evenly distributed. USDT persistently shows a progressively excessive focus of exercise ranging from the HKSE open, which intensifies throughout LSE buying and selling hours into the NYSE closing bell. Notably, each stablecoins have seen greater focus of exercise over the previous week.

As the major base foreign money for digital asset transactions, stablecoins play an outsized position on conventional spot and derivatives exchanges, in addition to decentralized exchanges (DEX’s). At their peak in March 2024, stablecoins added $75B in spot buying and selling volumes (7-day common) throughout trusted centralized exchanges. USDT contributes to 90% of spot buying and selling volumes at the moment, with USDC and FDUSD comprising a further 5% every, whereas BUSD’s market share has shrunk.

First Digital USD (FDUSD), a stablecoin issued by the Hong Kong-based digital asset custodian First Digital Belief Restricted, has gained important market share and liquidity on Binance. The market presence and liquidity of USDC-related pairs has additionally improved alongside the launch of Coinbase’s Worldwide Trade, with market share of spot volumes rising from 0.6% in October to just about 5% at the moment.

Source: Coin Metrics Market Data Feed

Whereas facilitating comparatively decrease volumes than its conventional counterparts, stablecoins are a vital part of DEX liquidity swimming pools and buying and selling exercise throughout layer-1’s and layer-2’s. Stablecoin-stablecoin and altcoin-stablecoin liquidity swimming pools like Uniswap v3’s ETH-USDC market and Curve Finance’s 3Pool facilitate a substantial portion of on-chain transactions. In distinction to conventional exchanges, USDC holds a forty five% market share of quantity on DEX’s, whereas USDT’s share has risen to 42% of late.

Source: Coin Metrics DEX Market Data

Stablecoins have gotten an important a part of the international monetary system, facilitating transactions and serving as shops of worth. Their adoption patterns, influenced by blockchain transaction charges, underscore their utility in cross-border funds and DeFi purposes. As stablecoins evolve, their significance in the monetary panorama will proceed to develop. It’s crucial to intently monitor their improvement and integration to totally perceive their impression and potential inside the monetary ecosystem.

Make sure you try our past research on stablecoins, expanded stablecoin coverage and our complete Stablecoin Dashboard.

This week’s updates from the Coin Metrics crew:

-

Coin Metrics is happy to announce our expanded stablecoin and ERC-20 coverage, that includes main and rising stablecoins on Solana, Avalanche, Tron and Ethereum.

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.