DeFi and social dApps lead in monthly unique wallets for August – DappRadar

DeFi and social dApps noticed a notable rise in each day unique lively wallets (dUAW) in August, as the general dApp business hit a report 17 million common dUAWs, up 9% from the earlier month, according to a DappRadar report.

DeFi

Decentralized exchanges Raydium and Uniswap v2 had 18.8 million and 4.8 million monthly unique lively wallets, respectively, in August, granting them the second and fourth most lively purposes in the blockchain sector in the interval.

Notably, Raydium posted 107% monthly progress in exercise, whereas Uniswap v2 fell 9%, highlighting the development of rising consumer exercise on Solana.

Regardless of having two out of 5 of probably the most interacted platforms final month and a virtually 10% enhance in monthly unique customers, DeFi purposes averaged 2 million dUAW and solely accounted for 12% of all exercise seen final month.

Social

In the meantime, the social sector accounted for 23% of business exercise with 3.9 million dUAW in August, solely bested by gaming purposes’ 24% dominance.

The opBNB-based social platform CARV was probably the most used utility final month, with 28 million unique lively wallets — a 2,331% monthly enhance.

Furthermore, the Web3-based purchasing utility KAI-CHING noticed 16.7 million monthly unique lively customers, making it the second-largest utility by utilization in August. This quantity is critical, because the app deployed on Close to Protocol managed this feat regardless of shedding 4% of its consumer base.

HOT Sport, additionally deployed on the Close to infrastructure, wrapped up the 5 most used blockchain purposes in August, with 4.1 million monthly unique lively wallets.

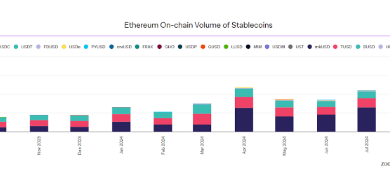

Falling TVL and income

Though DeFi purposes noticed a monthly enhance in exercise, the sector’s complete worth locked (TVL) and utility income haven’t grown in tandem.

DeFi dapps noticed a 15% stoop in August, falling to $124 billion as the broader crypto market skilled declines.

On the income aspect, DeFi purposes noticed certainly one of their worst year-to-date months, registering $65.4 million as per TokenTerminal data. It is a 13% drawdown from July’s roughly $75 million in income, which contrasts with the rising exercise seen final month.