Dollar-Cost Averaging Portfolio

Get one of the best data-driven crypto insights and evaluation each week:

By: Matías Andrade

Greenback price averaging (DCA) has change into a key technique for traders navigating the unpredictable realms of digital belongings. This method includes commonly investing a hard and fast quantity, whatever the present market cycle—a easy but highly effective technique that contrasts starkly with the chance and traumatic expertise that investing in unstable belongings can convey to novice traders. Due to this, DCA is commonly espoused as a realistic solution to handle funding dangers.

The rising entry to market information and a deeper understanding of those dynamics now permits for a extra knowledgeable utility of DCA. Whereas it is necessary to not rely too closely on any single technique in fluctuating markets, DCA offers a great tool for traders seeking to mitigate the affect of market volatility. On this week’s State of the Community, we goal to judge how greenback price averaging has carried out throughout the digital asset market, highlighting its function and effectiveness in at this time’s funding panorama.

Assessing any funding’s benefit includes a cautious evaluation of its risk-adjusted returns, evaluating varied belongings and techniques. With this in thoughts, we have crafted a technique to benchmark DCA’s effectiveness throughout over 200 belongings. By simulating a day by day $10 funding beginning on January 1st of 2019, 2021, and 2023, we will see how differing market phases affect outcomes. We are able to additionally consider how effectively DCA might function a stabilizing issue for these looking for to minimize the sting of market swings. Please observe that we didn’t bear in mind transaction charges on this simplified mannequin.

Return Efficiency Since 2019

As we will see within the chart under, DCA has carried out comparatively effectively, though maybe not in addition to we might have anticipated. We discover that though there are a couple of notable outliers, round 60% of the belongings we examined are under the breakeven threshold worth of the money invested. For the interval in query, this determine stands at $17,920.

Source: Coin Metrics Market Data

We eliminated the highest 5% of the pattern in order that we will higher respect the distribution of those returns—and we’ll think about these afterward, however this ought to be indicative that investing in high quality belongings is equally necessary when doing DCA, even when the volatility of our portfolio is decrease.

Return Efficiency Since 2021

Greenback price averaging (DCA) is ceaselessly really helpful as a method for traders who would possibly discover it difficult to remain disciplined throughout the fervor of a bull market—a situation the place even skilled traders can incur losses amid the crypto market’s volatility. Most new traders make their first funding throughout a bull market, pushed by heightened feelings and a urgent concern of lacking out. DCA is commonly touted as a way to assist mood these emotional responses and keep a extra balanced portfolio method. Right here we will look at some proof to assist set our expectations when utilizing DCA in our funding toolkit.

Source: Coin Metrics Market Data

As we will see from the chart above, nearly all of belongings haven’t totally recovered to the purpose the place day by day DCA would forestall an investor from taking losses. This highlights the necessity for warning when contemplating getting into the fray throughout a bull market, emphasizing that prudence doesn’t all the time equate to safety from the market’s uncertainties.

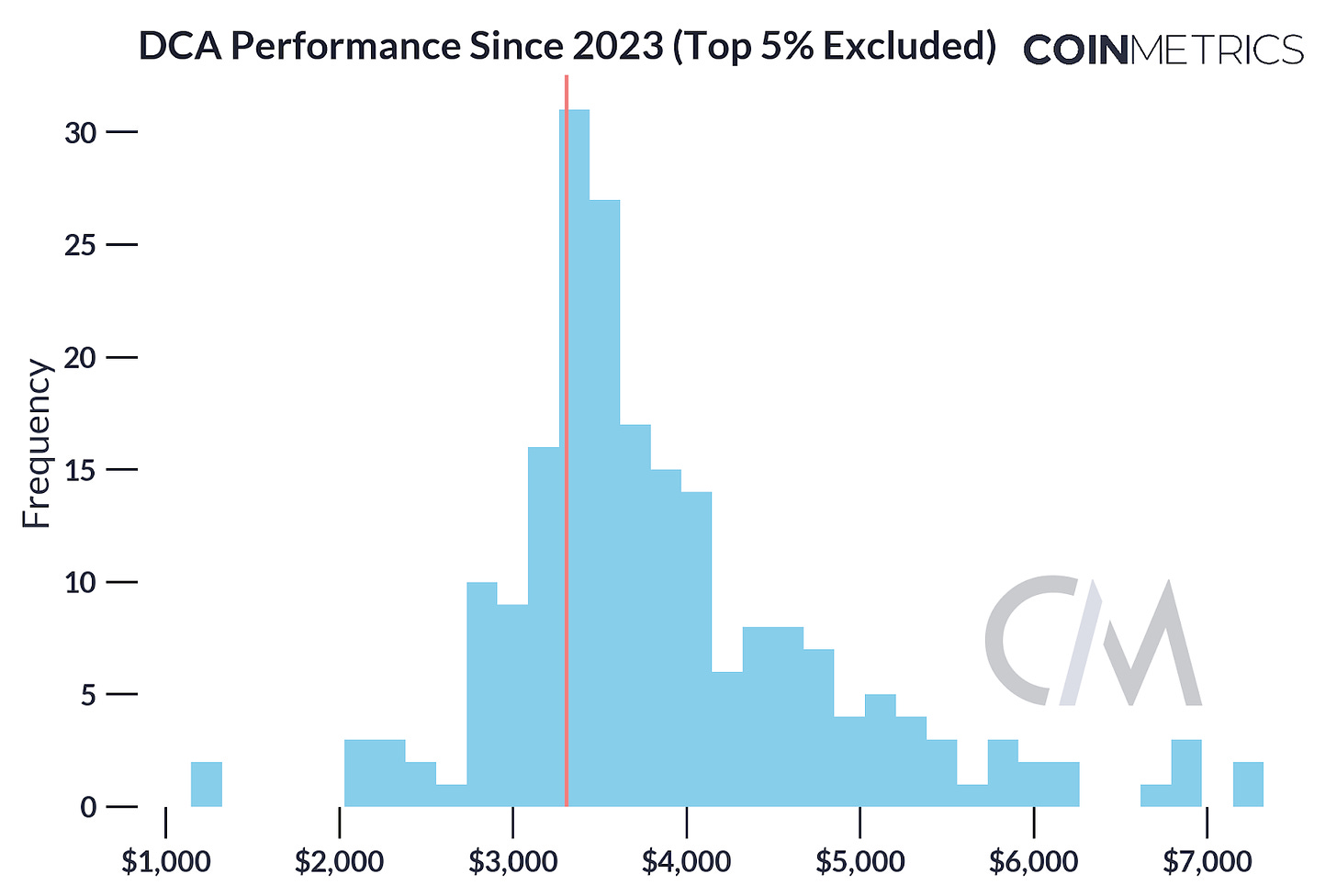

Return Efficiency Since 2023

2023 has marked a rejuvenating part for digital belongings, hinting on the onset of a possible new bull market, particularly with the anticipated Bitcoin halving occasion in 2024 drawing close to. This upswing has buoyed costs throughout the board, a development clearly mirrored within the chart offered under. It additionally serves as a reminder that whereas some belongings might expertise substantial appreciation, others might even see extra conservative development, with a big quantity not reaching the breakeven level of their preliminary funding when excluding the highest performers.

Source: Coin Metrics Market Data

Now that we perceive the return distributions over earlier time intervals, we will concentrate on the return distribution since 2021 and hone in on DCA asset efficiency. First, let’s look at the highest 15 belongings sorted by market capitalization. The chart under demonstrates that even amongst highly-capitalized belongings, DCA portfolios can lag behind their equal money worth. It is evident that the highest earners stand out—with SOL main the best way, intently adopted by MATIC—having yielded returns of 252% and 184%, respectively, over the modeled DCA portfolios.

Source: Coin Metrics Market Data

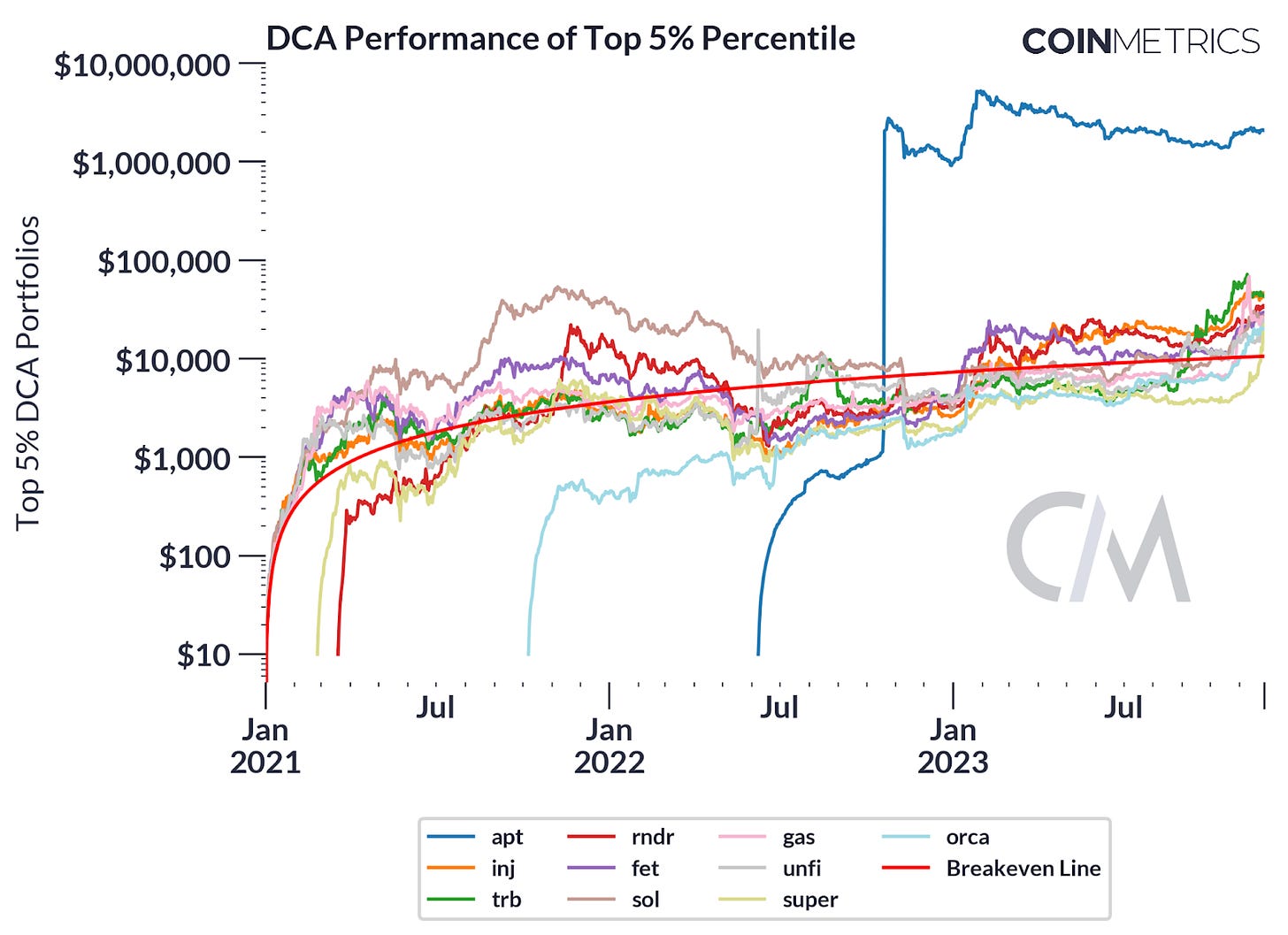

By sorting returns into percentiles, we acquire a extra granular understanding of which belongings lead the pack and their relative efficiency. The accompanying graph illustrates the DCA efficiency of belongings throughout the high 5% percentile plotted on a logarithmic axis, in order that outlier efficiency is extra simply discerned. Notably, a good portion of those frontrunners are latest market entrants. Amongst them, APT stands out, buying and selling at a formidable 194 occasions the money equal of the funding, which is roughly $10.6K.

Source: Coin Metrics Market Data

Though the returns of the highest portfolio appear engaging, it isn’t a practical or full view of the market, we must also have a look at the worst-performing belongings. There are additionally numerous new points within the backside 10th percentile, as demonstrated within the chart under, which ought to warn any investor pondering of taking a danger on a newly-issued token. Furthermore, the volatility of those belongings is so excessive that even a DCA technique isn’t sufficient safety from such drastic swings. Though we noticed a handful of belongings go on a tear and seemingly maintain up, there are a lot of extra which are briefly buoyed but sink simply as abruptly as they appeared.

Source: Coin Metrics Market Data

This chart is especially worthwhile for traders because it emphasizes the necessity for thorough analysis and danger evaluation when deciding on belongings for funding, particularly when utilizing a method like DCA. It additionally highlights the potential for volatility and the potential of belongings to underperform, even in a market that’s usually perceived to be on the rise.

Drawdowns in crypto could be harsh, and the interval from fall 2021 to fall 2022 was a troublesome one for holders of digital belongings. Nevertheless, bitcoin showcases the ability of a DCA technique with a considerably stunning discovering that if we start the day by day $10 DCA technique at BTC’s all-time excessive worth of $67.5K on November 8, 2021, the portfolio can be up about 33% at this time. The hypothetical portfolio would have precisely $7,500 invested and be value over $10,000 at this time (once more, ignoring buying and selling charges on exchanges). After spending most of 2022 within the pink, the portfolio really would have turned optimistic in spring of this yr.

Source: Coin Metrics Market Data

Whereas the previous success of this technique needn’t carry ahead, this instance highlights the good thing about avoiding efforts to time the market in favor of time in the market—even when ranging from the native high of a bull market.

The examination of greenback price averaging (DCA) throughout the digital asset market has proven that DCA helps handle volatility however doesn’t guarantee optimistic returns. The various outcomes, significantly the underperformance of many belongings regardless of a disciplined funding method, emphasize the technique’s limitations. DCA, whereas mitigating some dangers, isn’t a one-size-fits-all answer, neither is it resistant to the market’s complexities. In apply, traders want to include buying and selling charges and decide one of the best alternate(s) to execute their orders on.

DCA’s function in an funding technique ought to be knowledgeable by rigorous analysis and an understanding of market circumstances. Because the digital asset panorama evolves, notably with occasions just like the upcoming Bitcoin halving, it turns into more and more necessary for traders to remain educated, agile, and vigilant of their funding selections.

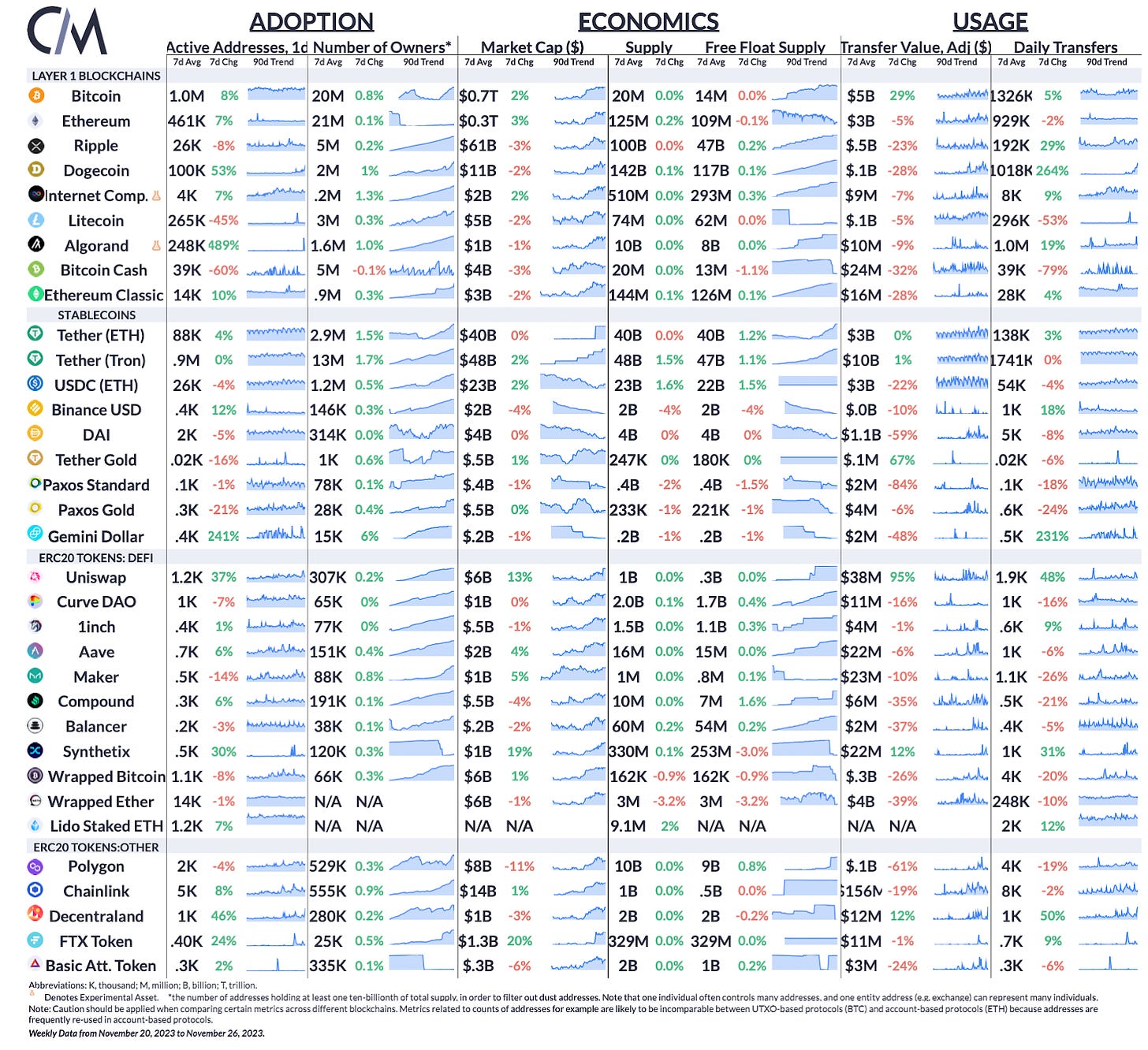

Supply: Coin Metrics Community Knowledge Professional

Bitcoin and Ethereum energetic addresses rose by 8% and seven% respectively over the week. Energetic addresses on Tether (ETH) grew by 4%, whereas USDC skilled a 4% drop in energetic addresses. USDC reversed its provide fall, with its market cap rising 1.6% week-over-week. The market cap of Tether additionally hit a brand new all-time excessive of ~$87B.

This week’s updates from the Coin Metrics workforce:

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary from the Coin Metrics workforce, wealthy visuals, and well timed information.

-

We not too long ago launched a beta model of our tagging information, take a look at the main points of the discharge here.

As all the time, when you’ve got any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.