Ethereum Burn Rate Hits Yearly Low: What This Means For ETH’s Future

In current weeks, Ethereum has displayed refined indicators of restoration amidst a usually bearish crypto market, with the altcoin mimicking Bitcoin’s modest uptrend.

Regardless of Ethereum’s value rising barely by 0.2% over the past 24 hours, a parallel development which may considerably have an effect on Ethereum’s financial mannequin has been unfolding beneath the floor.

Decline In Community Exercise Reduces ETH Burn

April witnessed Ethereum’s ETH burn fee hitting an annual low, primarily attributable to a major lower in community transaction charges.

These charges have usually fluctuated slightly below 10 gwei this 12 months, however current weeks have seen them dip to among the lowest ranges, straight influencing the speed at which ETH is burned.

This diminished burn fee is evidenced by the stark drop in each day burned ETH, which reached a low of 671 ETH previously day a notable lower from the each day figures of two,500–3,000 ETH seen earlier within the 12 months.

Such a decline in burn fee will not be merely a statistical anomaly however a mirrored image of broader shifts throughout the Ethereum community.

A big issue contributing to the lowered fuel charges is the elevated migration of network activities to Layer 2 solutions, which improve transaction speeds whereas reducing prices.

Furthermore, improvements like blob transactions, launched in Ethereum’s current Dencun improve, have additional optimized prices on these secondary layers.

Notably, Blobs are a characteristic launched to boost Ethereum’s compatibility with Layer 2 options like zkSync, Optimism, and Arbitrum by effectively managing information storage wants. This performance is a part of the Dencun improve, which integrates proto-danksharding by way of EIP-4844.

Whereas helpful in decreasing transaction charges, these technological strides pose challenges to Ethereum’s deflationary mechanisms.

This improve launched a brand new price construction wherein part of each transaction price, the bottom price, is burned, probably decreasing the general ETH provide. Nevertheless, with decreased transaction charges, the anticipated deflationary stress by way of burning has softened, signaling a shift to a extra inflationary development within the quick time period.

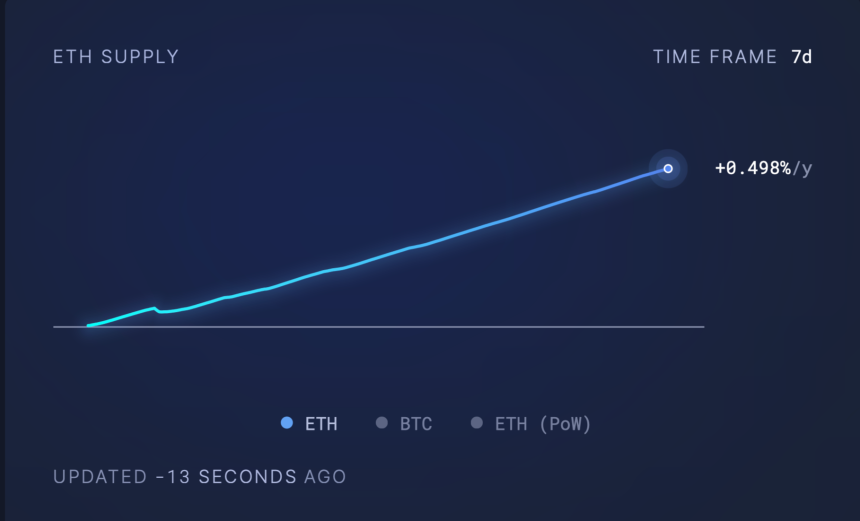

Based on Ultrasoundmoney, Ethereum’s provide dynamics have swung to a mildly inflationary mode with a development fee of 0.498%. This shift might realign if community exercise intensifies, resulting in elevated transaction charges and, consequently, greater burn charges.

Ethereum Market Response

Regardless of these underlying community dynamics, Ethereum’s market value has struggled to regain its former highs above $3,500. The asset trades round $3,085, reflecting a slight downturn over current weeks.

This value habits underscores the broader market’s response to inside community adjustments and exterior financial components, similar to regulatory struggles from the US Securities and Trade Fee (SEC) and macroeconomic uncertainties.

Trying forward, the trajectory of Ethereum’s fuel charges and subsequent ETH burn fee can be essential in figuring out the sustainability of its financial mannequin.

Featured picture from Unsplash, Chart from TradingView