Ethereum Price Soars To Over $2,300 – Is $3,000 Next?

The market efficiency of Ethereum has been steadily rising since October, marking a constructive and long-lasting pattern. Elevated shopping for exercise has been the primary driver of this constructive momentum that has continued over time, pushing the cryptocurrency past the vaunted $2,000 resistance mark and igniting a unbroken rally.

The worth of Ethereum has sharply grown as a direct results of this elevated demand and market optimism, with its sights set on breaking by way of the essential resistance area at $2,300. This upward pattern serves as one other proof of the growing investor belief and basic bullishness surrounding Ethereum, thereby solidifying its place within the altering cryptocurrency market.

Ethereum Hits 18-Month Highs, Targets $3,000

Ethereum, the second-largest cryptocurrency on this planet, is rising shortly and has reached ranges not seen within the earlier 18 months. With a market valuation of $285 billion, ETH is now buying and selling 5.7% increased at $2,375 as of the time of publication. Some speculators have even shared $3,000 worth predictions for ETH amid the newest market breakout.

Ethereum’s approaching resistance stage poses an enormous problem to consumers of the altcoin, together with the fastened barrier at $2.5K, which has often proven to be a major roadblock. But when the market is ready to recapture this vital space, Ethereum could go on to achieve the $2.5K – and even $3.000 — sooner or later.

Ethereum at present buying and selling at $2,358 territory on the every day chart: TradingView.com

As Ethereum breaks down additional obstacles, traders and market watchers are maintaining an in depth eye on the scenario. A notable indication of the elevated curiosity from institutional traders is the eagerness with which main gamers like VanEck, BlackRock, and Grayscale are awaiting clearance for Spot Ethereum ETFs.

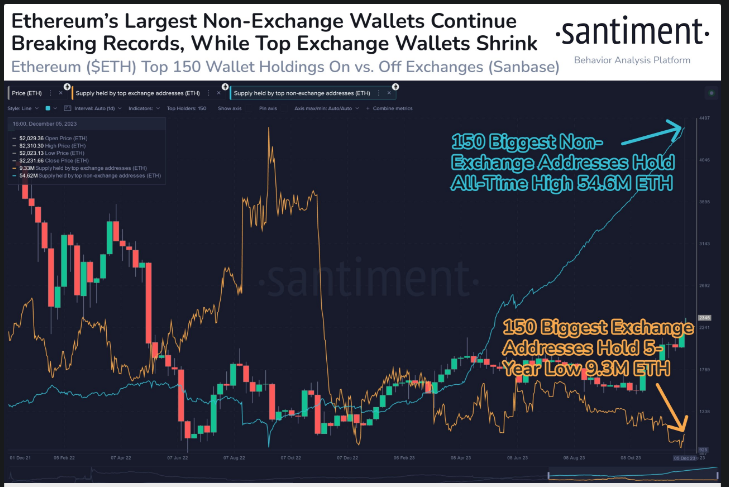

In line with Santiment, an on-chain knowledge service, Ethereum has reached $2,349, its highest worth since June 2022. The amalgamation of the constructive long-term pattern indicating an increase in wealth for the main non-exchange whale wallets and a lower in sell-off energy for the main trade whale wallets presents a propitious scenario for a gentle upward pattern.

Ethereum’s Non-Alternate Holdings Surge To 55M ETH

A latest tweet from Santinment highlights some intriguing variations in Ethereum’s pockets mechanics. Alternate wallets noticed a five-year low of 9.3 million ETH, whereas prime non-exchange wallets are constructing as much as a report 54.6 million ETH. This transfer factors to upward traits, with wealth constructing by way of non-exchange transactions and decreased promoting stress.

Over the course of two months, a bearish divergence between the value and the RSI indicator grew, pointing to a potential overvaluation of Ethereum at this level. Given the present traits of the market, even when consumers appear to be in cost and general sentiment is bullish, there’s a important chance of a short corrective part that includes consolidation and better volatility within the close to future.

In the meantime, a latest ACDE assembly supplied details about the approaching Dencun fork of Ethereum, which is ready to happen in January 2024. The Goerli community testnet fork was well-prepared for by improvement groups, opening the door for a bigger Goerli shadow community fork within the coming weeks.

ACDE#176 occurred earlier immediately: we mentioned the state of Dencun, timelines for testnets, and the right way to method planning the next community improve ⛓️

Agenda: https://t.co/ATVLQ7f9Xp

Stream:— timbeiko.eth ☀️ (@TimBeiko) December 7, 2023

Through the use of proto-danksharding, Dencun is anticipated to significantly enhance knowledge availability for layer-2 rollups. This enchancment ought to end in decrease rollup transaction prices, which is able to ultimately assist finish clients.

Dencun’s general results embrace rollups that enhance Ethereum’s scalability, fuel charge optimization, improved community safety, and the deployment of a number of housekeeping upgrades.

As Ethereum’s worth surges to surpass the $2,300 milestone, hypothesis intensifies in regards to the cryptocurrency’s potential to achieve the subsequent important threshold of $3,000. The latest upward trajectory displays the market’s confidence in Ethereum’s underlying know-how and its position within the evolving digital panorama.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. If you make investments, your capital is topic to danger).

Featured picture from Shutterstock