Futures Falter, Funding Flips

Get the very best data-driven crypto insights and evaluation each week:

By: Matías Andrade

Key Takeaways:

-

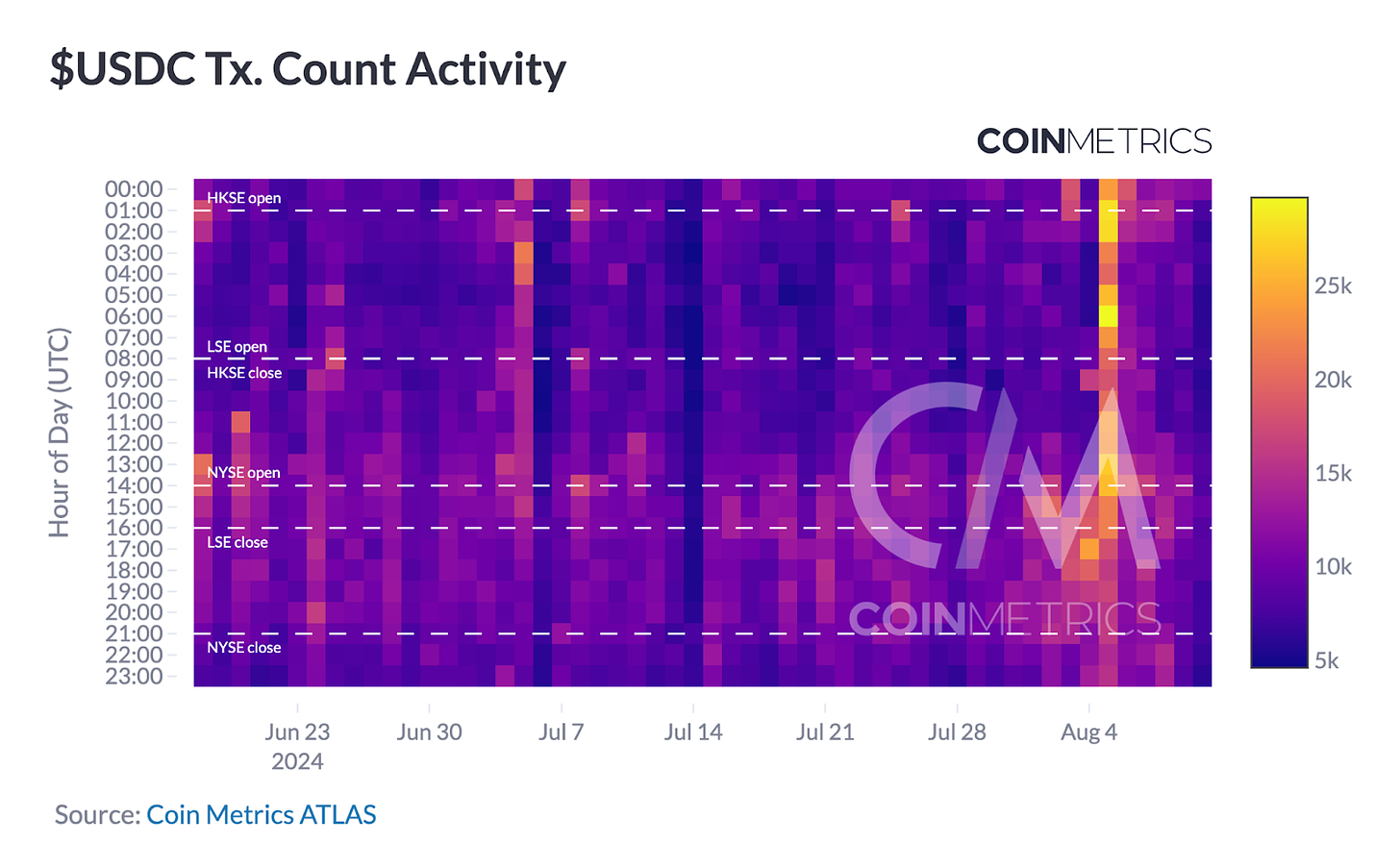

The Ethereum blockchain maintained constant transaction exercise through the crash, with USDC transaction exercise rising over the interval to virtually 30K txs/hour.

-

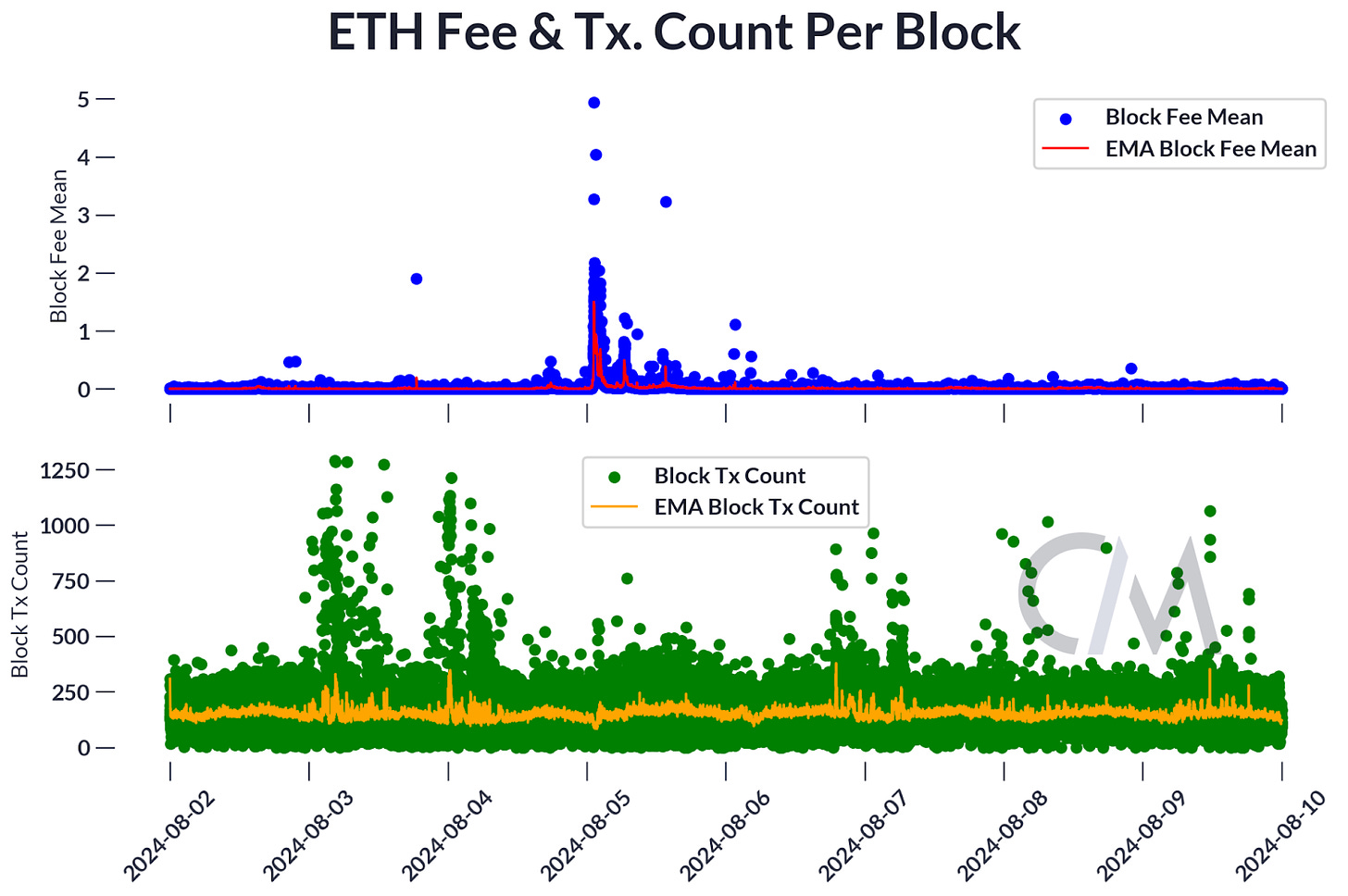

Nonetheless, on account of all this exercise gasoline charges spiked over 5 ETH per block, however the community remained purposeful, permitting trades at increased prices.

-

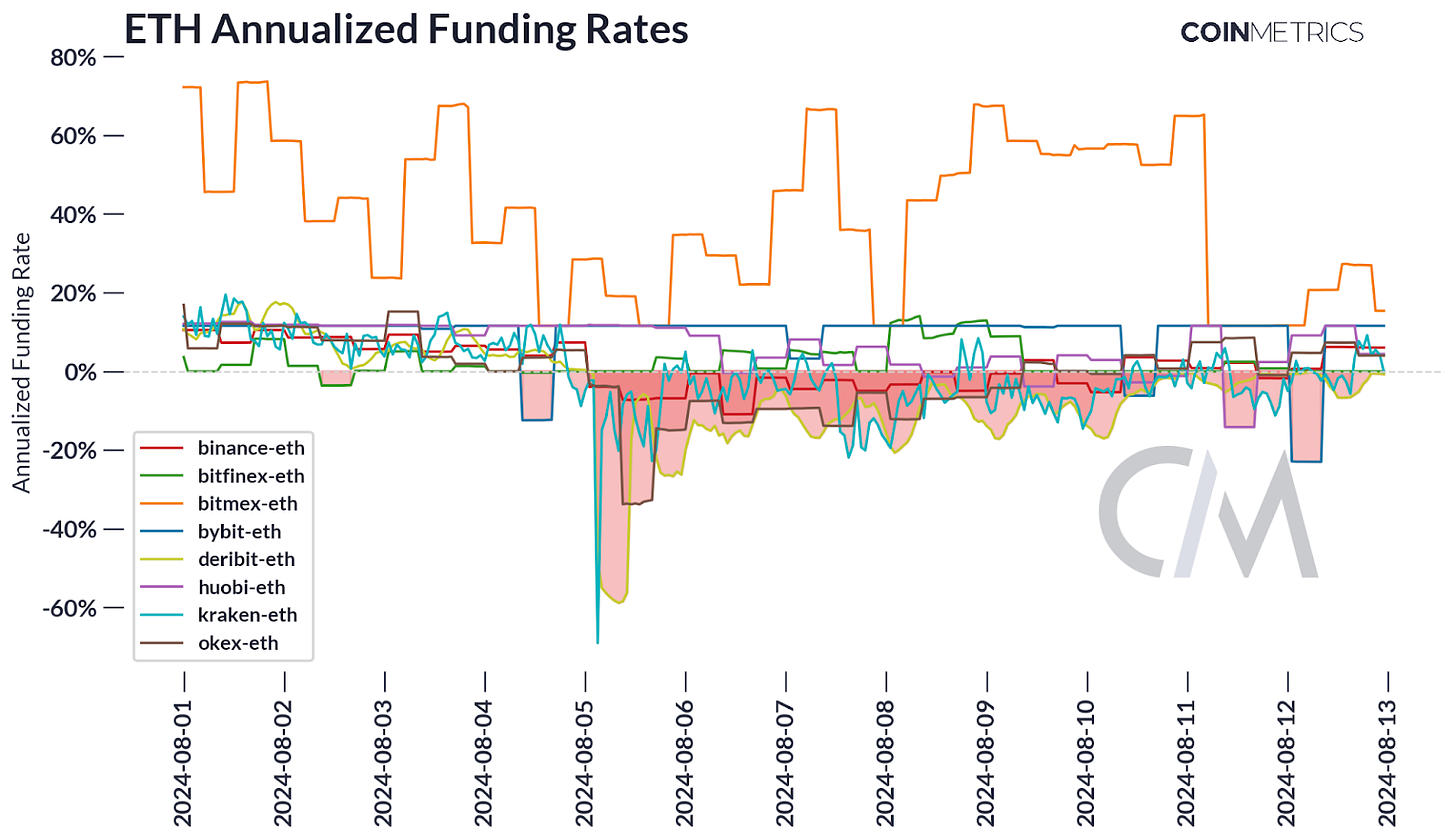

The $4.1 billion lower in Ethereum futures open curiosity offered insights into market sentiment and future value motion, significantly to merchants or property comparable to USDe that rely upon the profitability of the ETH carry commerce.

The current crash within the cryptocurrency market has introduced renewed consideration to the steadiness and resilience of the crypto ecosystem. On this week’s State of the Community, we consider the efficiency of varied components inside the crypto area throughout and after the crash, evaluating them to conventional monetary markets. We’ll give attention to two key areas: the robustness of decentralized methods and the steadiness of artificial monetary merchandise inside the crypto ecosystem.

Through the current market crash, a stark distinction emerged between the permissionless methods of cryptocurrencies, taking for instance Ethereum, and conventional monetary markets. The Ethereum blockchain operates on a 24/7 foundation, enabling uninterrupted buying and selling and transactions, in contrast to conventional markets with restricted buying and selling hours. Nonetheless, whereas sufficiently-motivated merchants are in a position to work together freely it comes at the price of paying for gasoline; equally, or analogous to slippage in conventional markets.

Source: Coin Metrics Stablecoin Dashboard

As we are able to see exemplified within the chart above by USDC’s transaction exercise, the Ethereum community maintained constant exercise all through the crash, with out skipping a beat. Customers might proceed buying and selling, albeit with increased charges on account of elevated community congestion. This accessibility stands in sharp distinction to many traditional financial brokers, who reported downtime and upkeep points throughout the identical interval.

Source: Coin Metrics Network Data Pro

The crash interval noticed a big spike in Ethereum gasoline charges, as proven within the chart above, with charges paid for a single block rising over 5 ETH. Whereas this improve in transaction prices was substantial, it is essential to notice that this improve in charges was momentary and, most significantly, the community remained purposeful, permitting customers to execute trades in the event that they have been prepared to pay the upper charges.

As completely different crypto monetary merchandise have matured, market members have developed new and revolutionary methods to generate yield for on-chain traders. In contrast to conventional stablecoins that will depend on off-chain collateral or centralized mechanisms to keep up their peg, Ethena’s USDe is primarily backed by on-chain property and protocols (albeit whereas nonetheless interacting with CEXs).

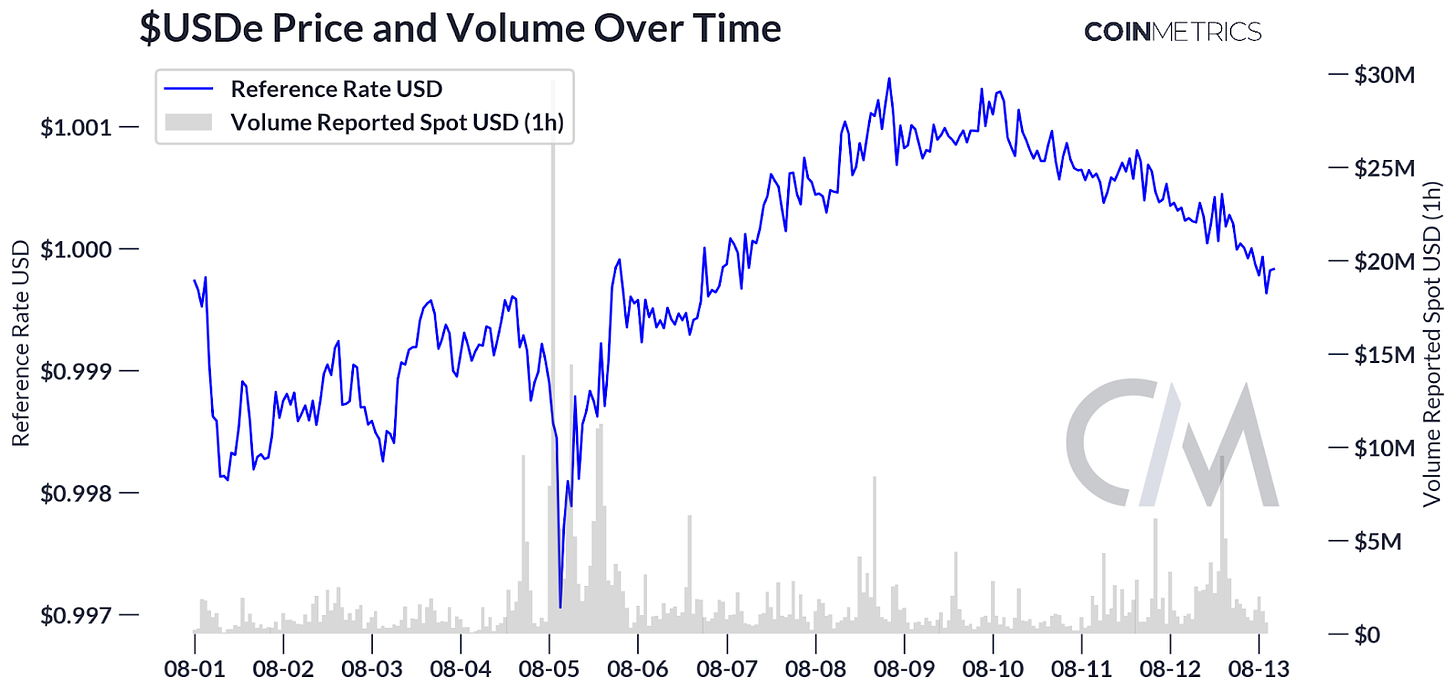

USDe is a synthetic stablecoin product created by Ethena on the Ethereum blockchain. In contrast to conventional stablecoins which can be backed by fiat forex reserves, USDe depends on a distinct strategy to keep up its peg to the US greenback. USDe depends on staking ETH and shorting perpetual futures to generate yield on a dollar-neutral portfolio, thus making a “synthetic dollar bond” that tracks the greenback whereas offering yield that’s at the least partially native to the Ethereum blockchain. We will see within the chart under the worth exercise of USDe over the previous couple of days of August, noting that the market revered the peg to inside 0.3% of its par worth of $1.

Source: Coin Metrics Market Data

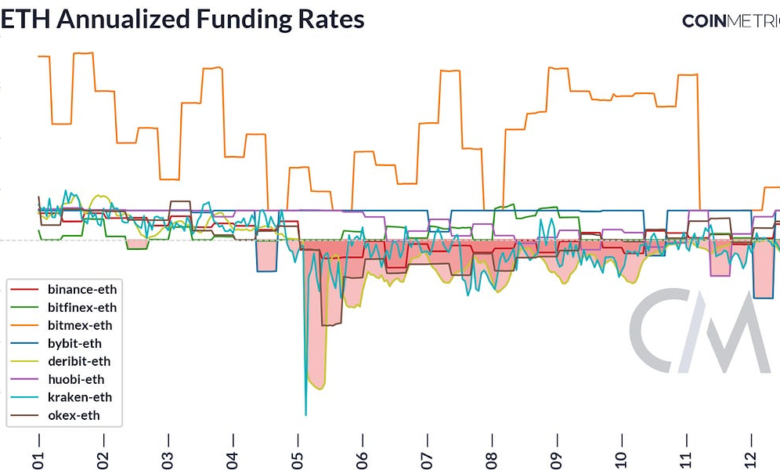

One of many main considerations relating to the USDe is its reliance on centralized management and the potential vulnerabilities this introduces, significantly the requirement of persistent optimistic funding charges that are important to the sustainability of their greenback peg. Nonetheless, over the weekend’s market correction, annualized funding charges went damaging throughout most ETH futures markets, though by August 13th most markets with few exceptions had flipped again to optimistic.

Source: Coin Metrics Market Data

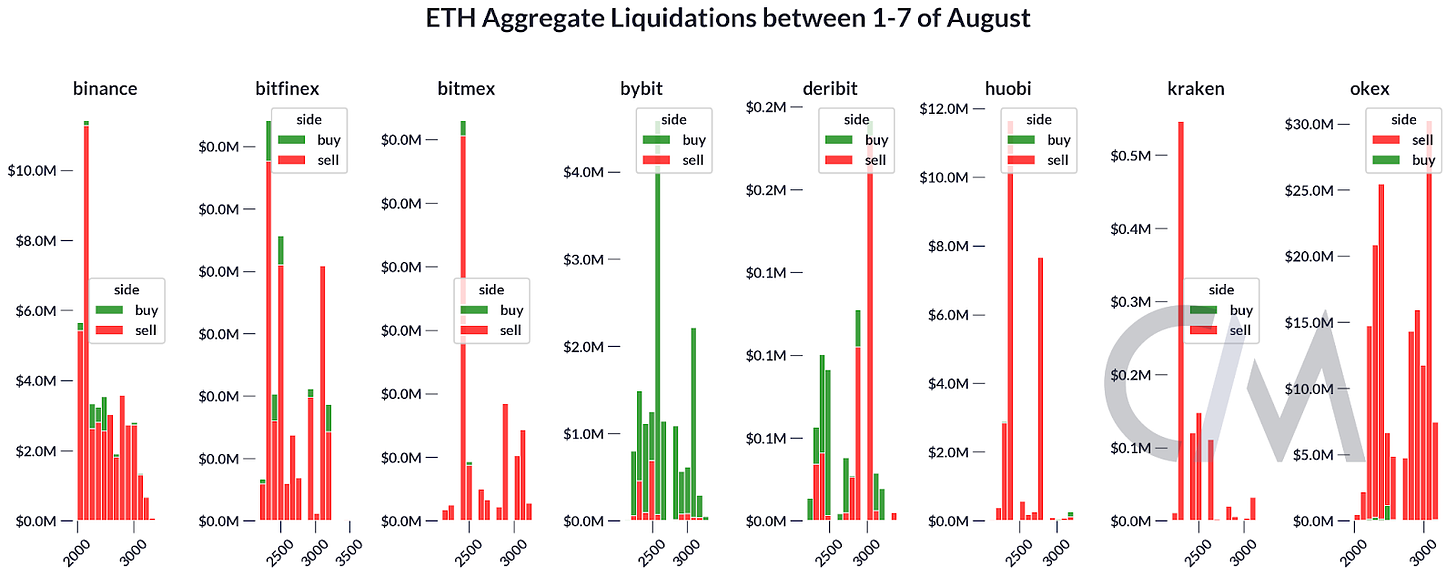

As seen within the chart under, market members decreased their lengthy publicity to ETH through the crash or have been liquidated. The pressured liquidations of those leveraged lengthy positions contributed to the additional decline within the open curiosity, because the excellent futures contracts have been closed out en masse. This self-reinforcing cycle of value drops, margin calls, and liquidations can exacerbate the sell-off available in the market. Savvy traders can reap the benefits of intently monitoring market liquidations to characterize the market and perceive the underlying dynamics driving the worth actions in digital property and modify their buying and selling methods accordingly.

Source: Coin Metrics’ Market Data

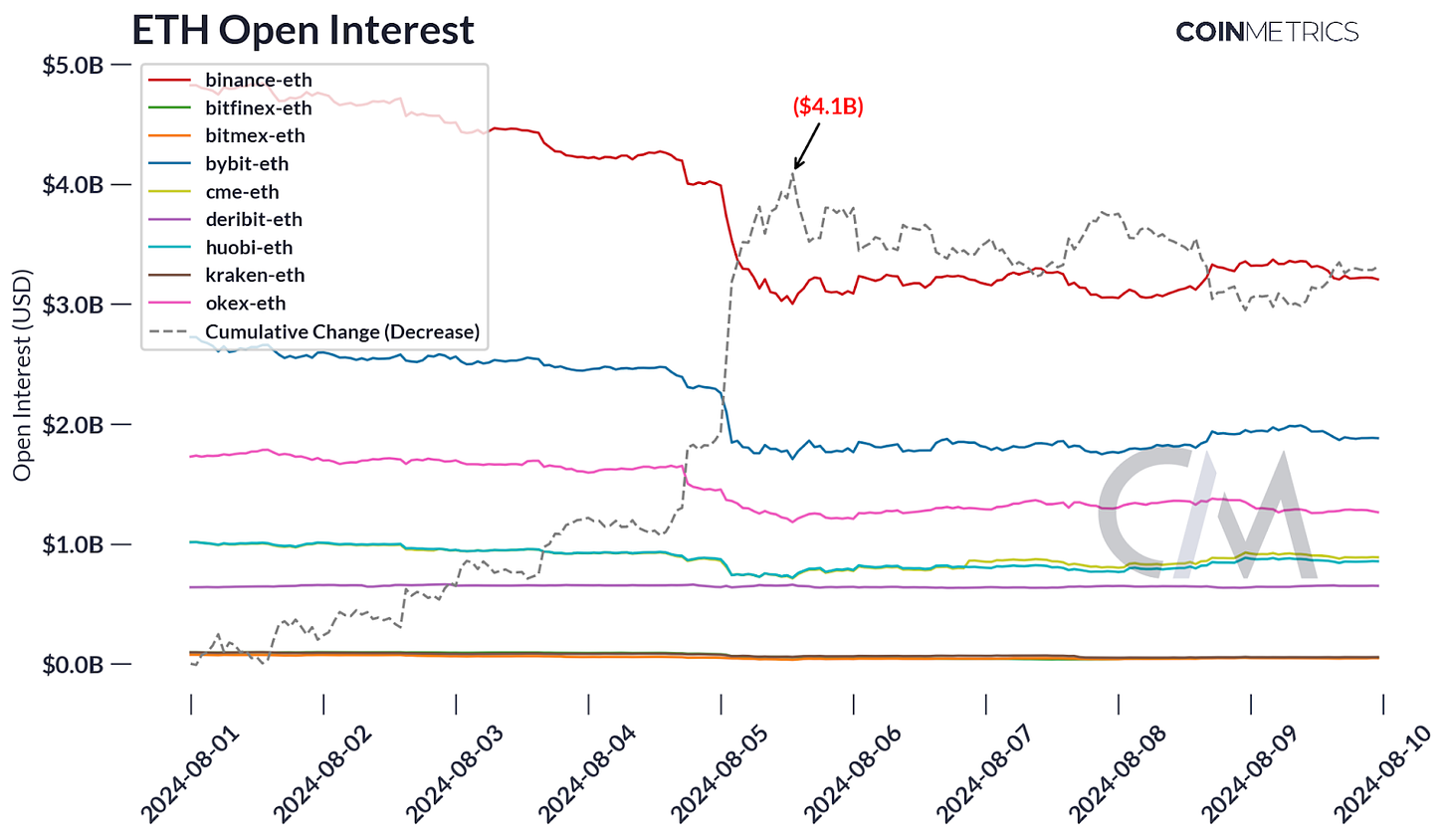

This lower in open curiosity usually accompanies or follows intervals of great value volatility or sell-offs within the underlying asset, as merchants turn into extra risk-averse and unwind their leveraged positions. The discount in open curiosity can present insights into the general market sentiment and the potential for future value actions. Within the chart under, we are able to see that the lower in open curiosity, measured by the grey dotted line, was roughly $4.1 billion.

Source: Coin Metrics’ Market Data

By analyzing the adjustments in open curiosity alongside the worth motion of ETH, one can acquire a greater understanding of the dynamics and sentiment within the Ethereum futures markets, which might inform buying and selling methods and danger administration choices.

The current crypto market crash has offered helpful insights into the strengths and weaknesses of the crypto ecosystem. Whereas permissionless methods demonstrated outstanding resilience by way of accessibility and performance, additionally they confronted challenges comparable to excessive transaction prices below stress. Artificial merchandise like USDE confirmed spectacular stability, highlighting the potential of well-designed DeFi devices whereas highlighting the significance of maintaining observe of the underlying portfolio’s efficiency when contemplating stability sooner or later. By harnessing the inherent yields accessible inside the blockchain ecosystem, these revolutionary monetary merchandise provide a compelling different to conventional yield-generating devices.

Source: Coin Metrics Network Data Pro

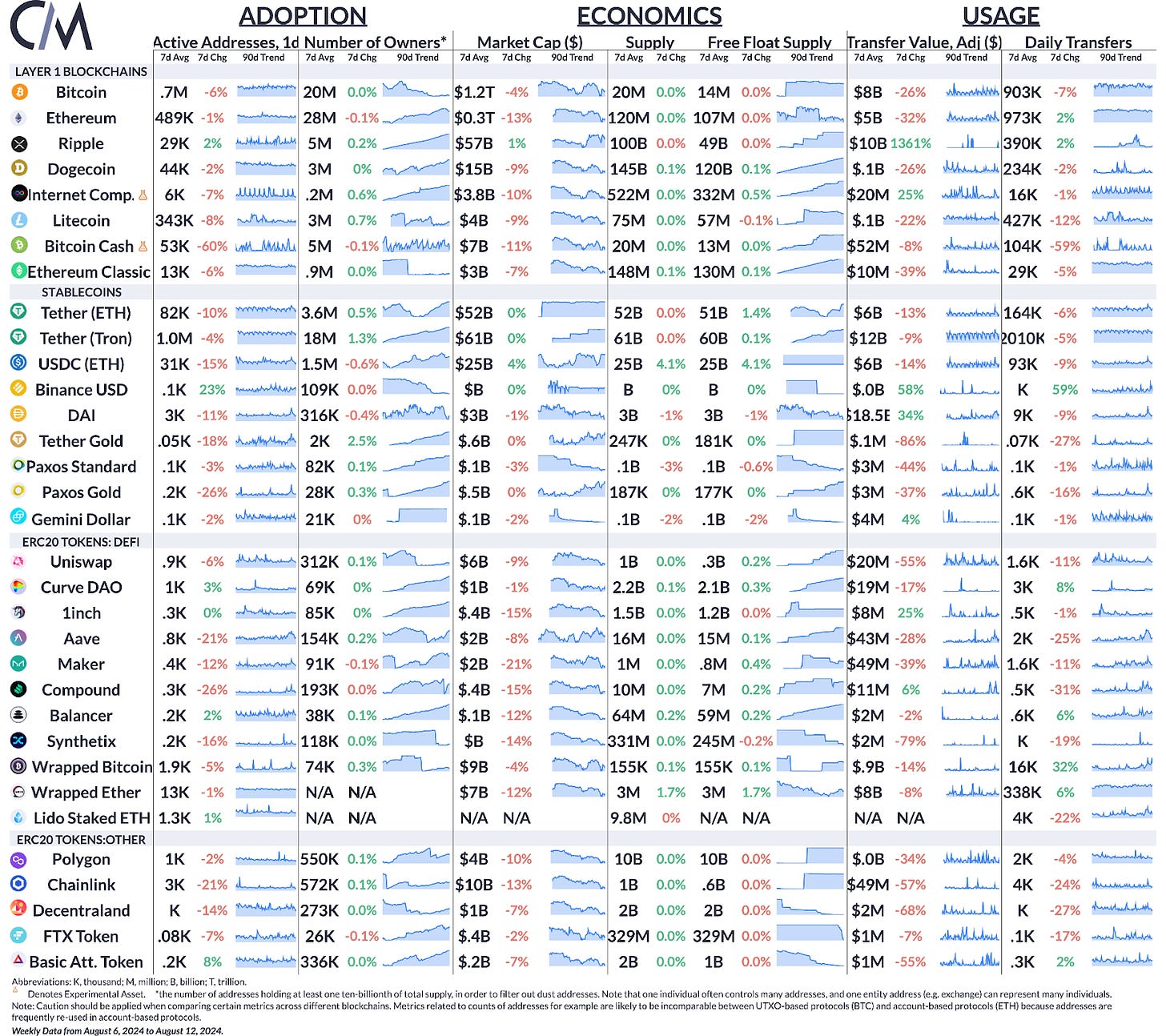

Following a busy weekend buying and selling exercise has slowed down, significantly throughout stablecoins that displayed important spikes in energetic addresses and switch values.

This quarter’s updates from the Coin Metrics group:

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, when you’ve got any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution will not be permitted with out consent. This article doesn’t represent funding recommendation and is for informational functions solely and you shouldn’t make an funding determination on the idea of this info. The publication is offered “as is” and Coin Metrics won’t be accountable for any loss or injury ensuing from info obtained from the publication.