How DeFi adoption varies between chains, the price of BTC affects speed

The “Summer of DeFi” 2020 was a turning point in the blockchain industry, as the season saw the debut of many DeFi projects, marking the dawn of a new era in finance.

The evolution of DeFi during this period didn’t just make waves. caused a paradigm shift, positioning himself as the bold pioneer of this unprecedented movement.

However, what does the momentum the industry felt in 2020 look like in terms of hard data?

Today, with token prices up to 90% as we navigate the murky waters of the current bear market, we look at the speed of DeFi adoption and the impact of market cycles on adoption.

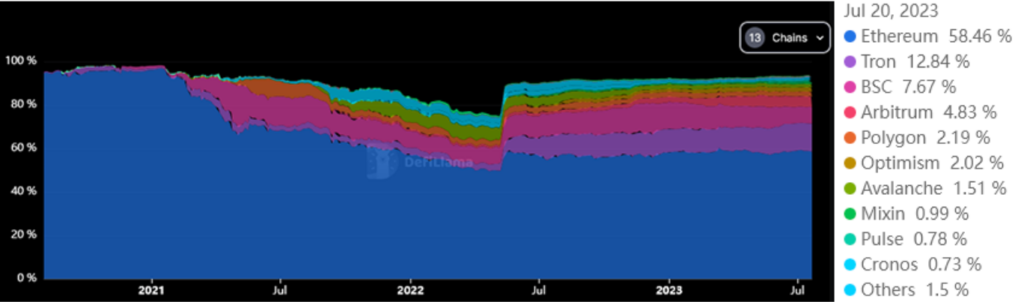

DeFi TVL breakdown by chain since 2017

In this context, our analysis focuses on data collected from 2018 to 2023, with a focus on adoption in chains such as Ethereum, Tron, BNB Chain (BSC), Arbitrum, Polygon, Optimism, Avalanche, Mixin, Pulse, Cronos , Solana, Cardano and Osmosis.

The table below shows the chains analyzed, the date the chain reached its all-time high for TVL (as tracked by DefiLlama), the time it took to reach its all-time high from launch (velocity), the all time high (ATH), and the current TVL.

| Chain | Start Activity* | ATH date | ATH TVL | Speed | Current TVL |

|---|---|---|---|---|---|

| Ethereum | November 2017** | November 2021 | $108.92 billion | 1280 days | $25.73 billion |

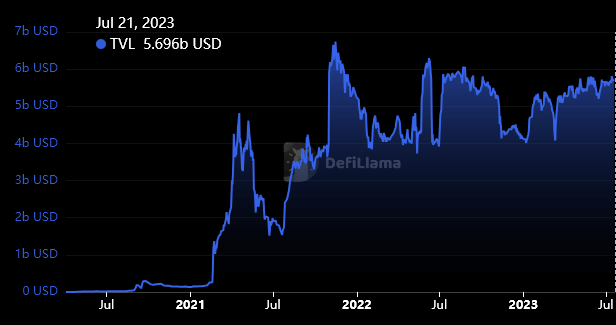

| Tron | August 2020 | November 2021 | $6.74 billion | 470 days | $5.69 billion |

| BSc | October 2020 | May 2021 | $21.94 billion | 186 days | $3.36 billion |

| Arbitration | August 2021 | May 2023 | $2.53 billion | 614 days | $2.12 billion |

| Polygon | October 2020 | June 2021 | $9.89 billion | 249 days | $0.97 billion |

| Optimism | July 2021 | August 2022 | $1.15 billion | 393 days | $0.92 billion |

| Avalanche | February 2021 | December 2021 | $11.41 billion | 302 days | $0.66 billion |

| Mixin | December 2021 | June 2022 | $0.59 billion | 182 days | $0.44 billion |

| Pulse | May 2023 | May 2023 | $0.49 billion | 5 days | $0.34 billion |

| Saturn | November 2021 | April 2022 | $3.22 billion | 145 days | $0.32 billion |

| Solana | March 2021 | November 2021 | $10.03 billion | 236 days | $0.31 billion |

| Cardano | January 2022 | March 2022 | $0.33 billion | 81 days | $0.18 billion |

| Osmosis | June 2021 | March 2022 | $1.83 billion | 253 days | $0.13 billion |

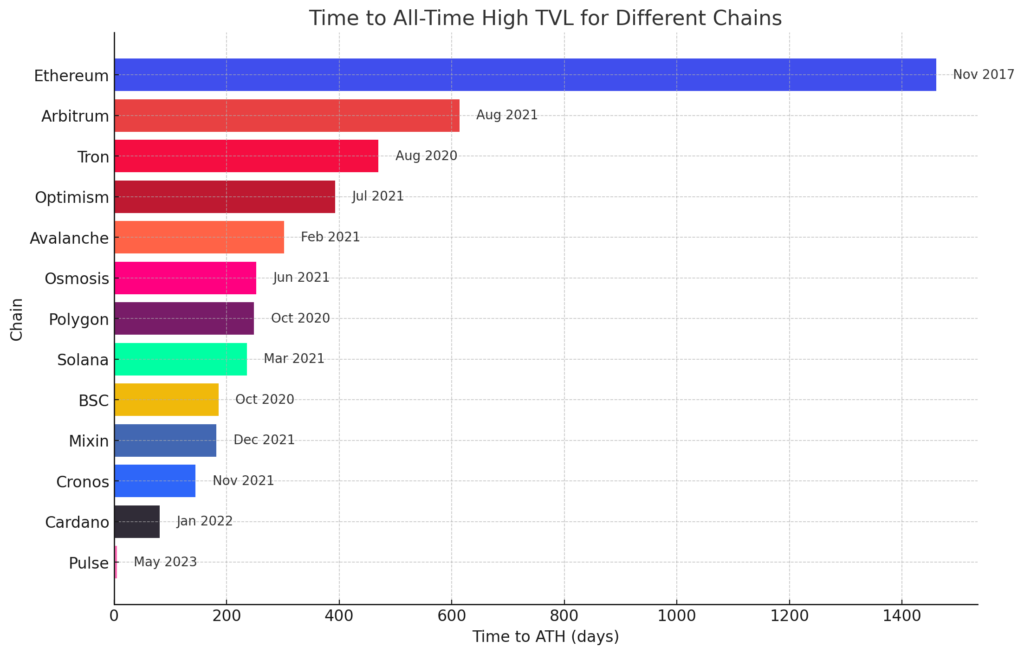

The chart below depicts the speed of each chain to reach an all-time high in TVL. DeFi pioneer Ethereum has technically had DeFi activity since 2017, and thus stands out as the slowest adopter since its all-time high was not reached until November 2021.

Interestingly, November 2021 coincides with the all-time high for Bitcoin and likely influenced DeFi in Tron and Solana, which also saw peaks at this time.

Custom Bitcoin Speed

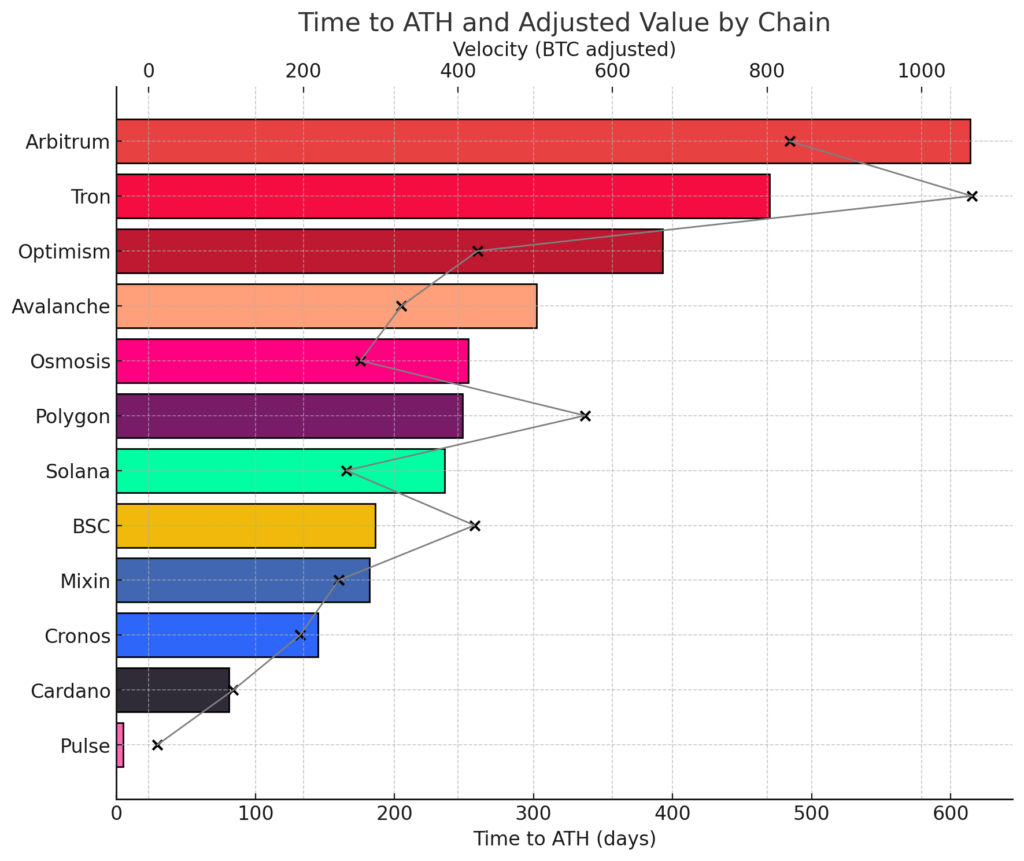

As Bitcoin is considered a barometer for the overall health of the cryptocurrency market, the speed of DeFi adoption was adjusted based on the price of Bitcoin at each chain’s DeFi launch.

CryptoSlate cross-referenced Bitcoin price with all-time high data to generate a Bitcoin-adjusted velocity (BaV) for each chain.

The gray line and plot points in the diagram below represent the BaV for each chain. The chart reveals that the DeFi ecosystems of Tron, Polygon and BSC were positively impacted by the price of Bitcoin and the supportive bullish market sentiment.

Chain speed analysis

Ethereum was removed from the chart above for readability, as it recorded a whopping speed score of 7,936 compared to subsequent closes, with Tron at 1,065 and Arbitrum at 829.

Considering the bear market, Pulse’s velocity has decreased, giving it a score of just 10.98, as it reached its ATH in just 5 days. The next lowest was Cardano at 109, about ten times higher.

Using the BaV metric, it appears that the best performing chains were Pule, Cardano, Cronos, Solana and Osmosis. While Ethereum, Tron and Arbitrum stood out as having the slowest speed.

Tron is one of the chains currently closest to its ATH, with a strong performance in 2023. If it surpasses its ATH of $6.47B from the current level of $5.6B, it may overtake Ethereum in BaV and standard speed measures.

The different trajectories of DeFi adoption on different blockchain networks highlight the importance of timing, market conditions, and the inherent advantages of being a first mover in the space. However, as the remarkable case of Pulse shows, even newcomers can achieve rapid growth with the right factors aligned.

Understanding the data

The speed at which you reach an all-time high in TVL is a complex metric. Some might argue that the faster you go up, the faster you go down, and that’s certainly true of some chains.

However, the fundamental factors analyzed here are momentum and adoption. Additionally, all of the projects listed recorded at least $330 million locked in, with most over $1 billion. These are not projects with low market capitalization and low liquidity.

The projects analyzed in this article are critical in identifying the strengths and weaknesses of the historical DeFi mainstreaming process. The average time it took for a chain to reach its ATH was around 338 days, meaning that, barring extremes, most chains take almost a year to peak in DeFi activity.

* Release date refers to the date of the first data tracked by DefiLama for each chain**

** Using MakerDAO’s DAI release as date for Ethereum DeFi release and data according to CoinmarketCap historical data.

*** Additional data included due to DefiLlama 2020 deadline.