Institutions look to deploy Bitcoin as liquidity to Lightning Network to earn yield

Bitcoin Lightning Network liquidity supplier LQWD Applied sciences has partnered with Amboss Applied sciences to set up additional institutional liquidity on Lightning. The collaboration positions LQWD to contribute liquidity to Amboss’s market, enabling the success of market demand for Lightning Network liquidity whereas producing a yield on LQWD’s Bitcoin holdings.

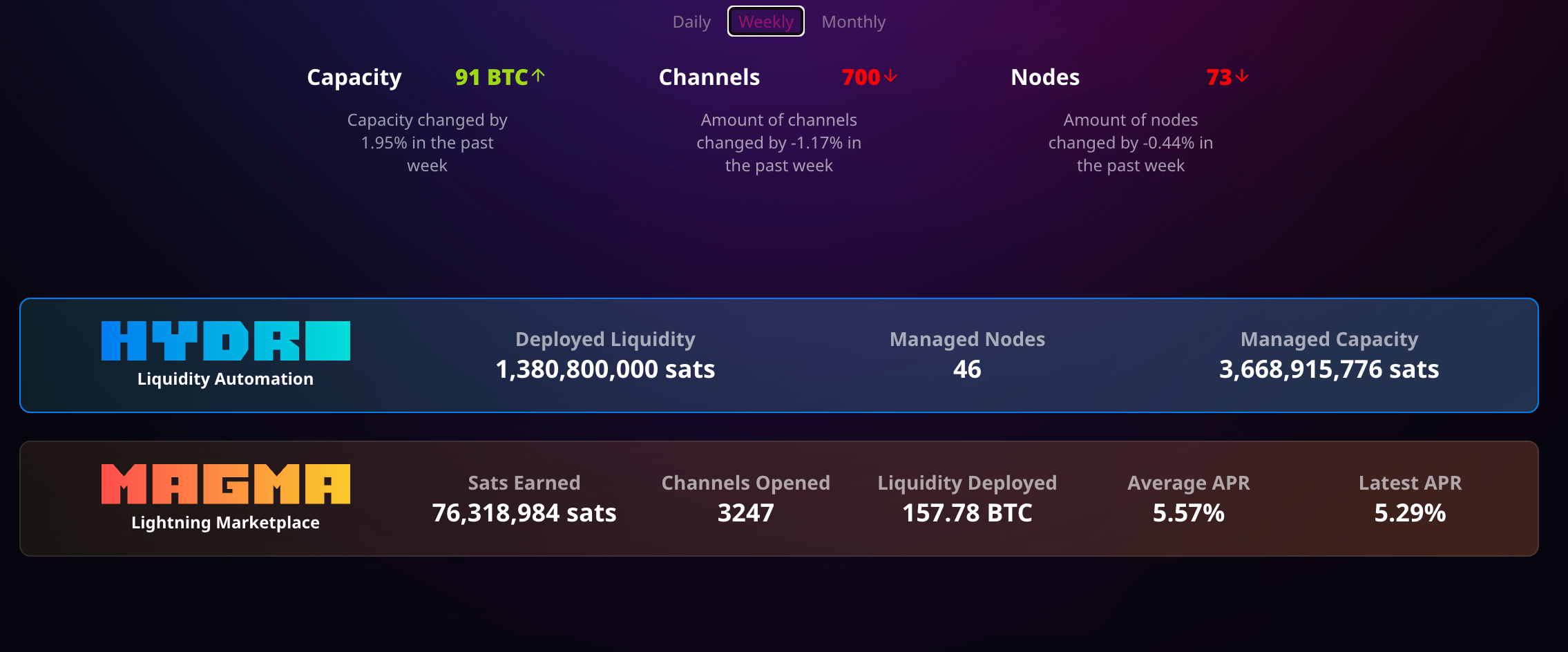

Amboss, a supplier of knowledge analytics options and funds operations on Lightning, affords specialised merchandise such as Magma, a liquidity market, and Hydro, a sophisticated liquidity automation device. These merchandise purpose to create an orderly market and facilitate funds on the Lightning Network. As a liquidity supplier, LQWD will launch an preliminary tranche of Bitcoin to Amboss, with plans to deploy further Bitcoin all through the partnership.

LQWD has seen consistent growth in its Lightning Network transactions since 2022, not too long ago surpassing 400,000, in accordance to self-reported knowledge.

Amboss shoppers will purchase liquidity from LQWD, permitting the latter to earn preliminary and routing charges for transactions over the Lightning Network. Shone Anstey, CEO of LQWD, emphasised the importance of the partnership, stating, “This strategic alliance signifies a significant step forward for both LQWD and Amboss as we work together to enhance liquidity and efficiency within the Bitcoin Lightning Network ecosystem.”

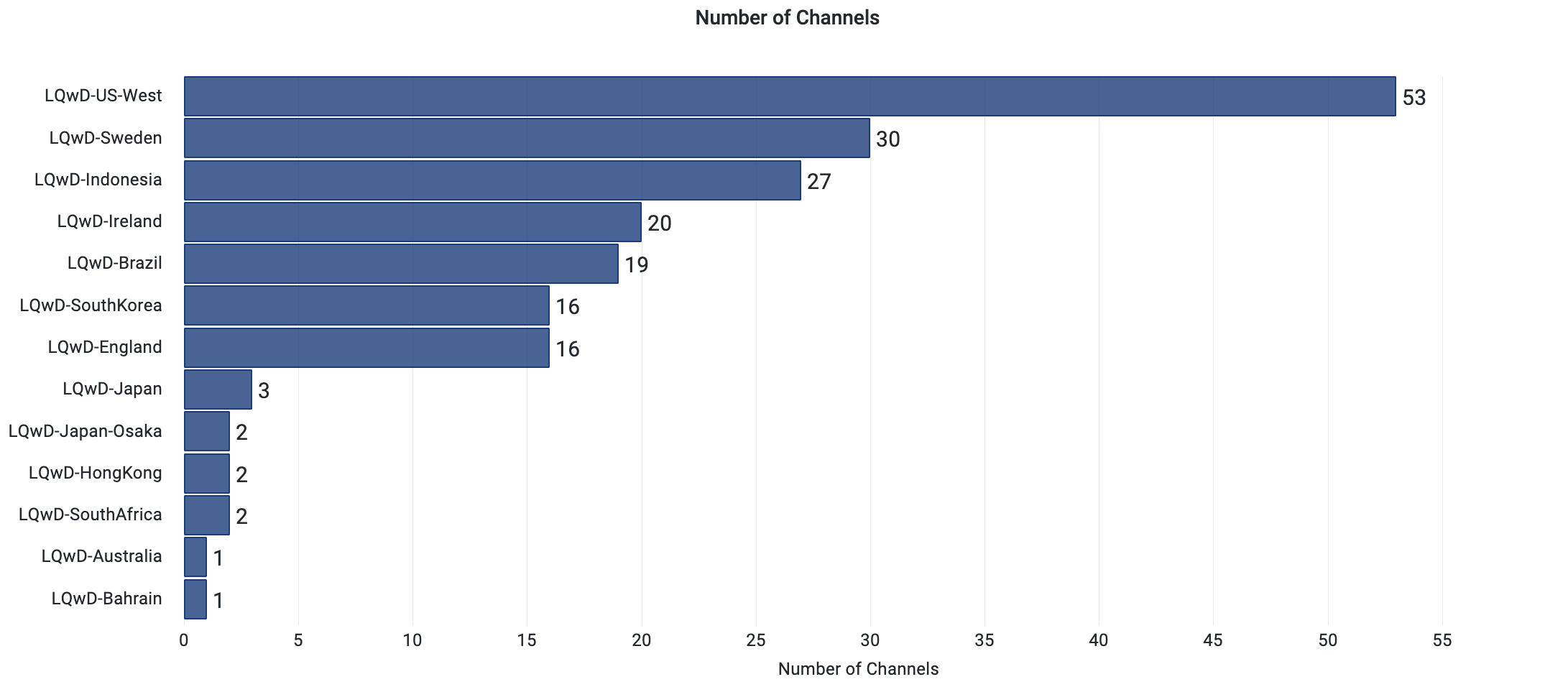

LQWD additionally affords Lightning channels in a number of geographies, with the bulk being on the West Coast of the US. Curiously, after the US, Sweden, Indonesia, Eire, and Brazil have probably the most lively channels.

The partnership allows LQWD to deploy its company-owned Bitcoin whereas probably capturing important transaction quantity and producing yield on its holdings. Importantly, LQWD maintains full sovereignty and custody all through the method, aligning with its give attention to creating cost infrastructure and options accelerating Bitcoin adoption via the Lightning Network.

Amboss’ market presently affords a 5.57% APR on Bitcoin deployed via Lightning Channels with whole liquidity of 157 BTC, roughly $10 million as of press time.

Jesse Shrader, Co-Founder and CEO of Amboss, highlighted the advantages of the collaboration, stating,

“Partnering with LQWD ensures that Amboss’s global customers have direct access to institutional-grade liquidity for Bitcoin payments, allowing LQWD to generate additional yield through their nodes on the Lightning Network. Additionally, this partnership increases the supply side of Amboss’s liquidity marketplace.”

LQWD additionally makes use of its personal Bitcoin as an working asset to set up nodes and cost channels on the community. With the partnership between LQWD and Amboss, each firms are wanting to contribute to the expansion and effectivity of the Bitcoin Lightning Network ecosystem, offering enhanced liquidity options for companies and shoppers alike.