Measuring Exchange Quality And ‘Fake Volume’

By: Victor Ramirez

-

Centralized exchanges can differ broadly in high quality primarily based on transparency, resilience, information high quality, and different elements.

-

Commerce patterns, quantity correlations and worth discovery traits can check authenticity and well being of alternate exercise.

Centralized exchanges (CEX’s) function an important middleman between crypto market contributors and blockchain networks, facilitating billions of {dollars} of worth transferred every day. Many person’s first interplay with crypto is prone to happen by way of an alternate. Nevertheless, exchanges differ drastically in high quality throughout their major features. On this situation of Coin Metrics’ State of the Community, we’ll delve into how we assess alternate high quality.

Because the use-case for crypto information has expanded, the significance of exact, prime quality information has been additional emphasised. Coin Metrics created the Trusted Exchange Framework to vet which exchanges ought to be included to calculate exact market metrics in addition to choose the very best high quality constituents for indexes. We assess exchanges primarily based on the next classes:

-

Knowledge Quality: The extent of confidence that the alternate’s reported information is correct.

-

Transparency: The standard of publicly disclosed info from an alternate, equivalent to its high quality of its Proof of Reserves or its publicly disclosed steadiness sheets.

-

Resilience & Safety: How properly an alternate protects its customers towards market and safety dangers.

-

Regulatory Compliance: An alternate’s potential to satisfy regulatory necessities by way of its current licenses, adjusted by the relative of the regulatory surroundings it conducts enterprise.

-

API Quality: An alternate’s high quality for use as a programmable entity.

Primarily based on this standards, we arrive on the following alternate rankings under.

Source: Coin Metrics Trusted Exchange Framework

Particulars of the methodology may be discovered here.

Throughout the early levels of the crypto trade, it was frequent for exchanges to artificially inflate their buying and selling quantity with a purpose to appeal to prospects and falsely display legitimacy. In 2019, Bitwise carried out a comprehensive analysis of faux quantity in crypto exchanges wherein they claimed that 95% of quantity is “fake”. Impressed by Bitwise’s methodology, we created a sequence of exams for detecting and filtering out pretend quantity. Thus we are able to arrive at our best-guess estimate for crypto buying and selling quantity, which we name our “Trusted Volume”.

Source: Coin Metrics Market Data Feed

As of April 26th, 2024, trusted quantity on a rolling common weekly window is at $40 billion, about half of the $80 billion peak this yr and slightly over a 3rd from the all-time highs of Could 2021. For comparability, NYSE and NASDAQ each day buying and selling volumes hover on the order of $1-2 trillion in response to CBOE data. Word that this trusted quantity metric is a decrease certain estimate; DEXes and centralized exchanges outdoors of our protection universe should not included.

This raises the query of what share of all crypto quantity is pretend. It depends upon the way you depend all pretend quantity. Any alternate can theoretically generate an infinite quantity of faux quantity from wash-trading bots. Moreover, pretend quantity tends to not be evenly distributed throughout exchanges: regulated, respected exchanges have a considerably decrease proportion of its whole quantity as pretend, whereas much less respected exchanges are inclined to have the next and even majority of its whole quantity to be pretend. In actuality, the overwhelming majority of actual utilization occurs on exchanges the place most of its exercise seems natural. Factoring these altogether to calculate a share of faux quantity may thus result in deceptive conclusions concerning the legitimacy of crypto market exercise.

How can we filter out pretend quantity? By accumulating information instantly from exchanges, we are able to apply fake-volume exams developed by the trade to flag uncommon buying and selling exercise.

The sample of buys and sells for an alternate can reveal the presence of extremely uncommon market exercise. Reliable market exercise tends to closely skew in direction of a number of consecutive purchase or promote trades because of the presence of knowledgeable merchants which might be keen to cross the unfold and take liquidity in response to materials new info. Alternatively, exchanges which have traditionally fabricated quantity have an excellent distribution of buys and sells, resembling that of a random coin-toss, as shown by a report from DAR. That is probably as a consequence of wash buying and selling, non-economic buying and selling exercise, or different buying and selling exercise generated from a synthetic course of.

The chart under illustrates the distinction between well-behaved markets equivalent to binance-btc-usdt and coinbase-btc-usd versus markets that show uncommon buying and selling exercise. The x-axis represents the buy-sell sequences from trades information (b = purchase, s = promote) and the y-axis represents the frequency.

Source: Coin Metrics Market Data Feed

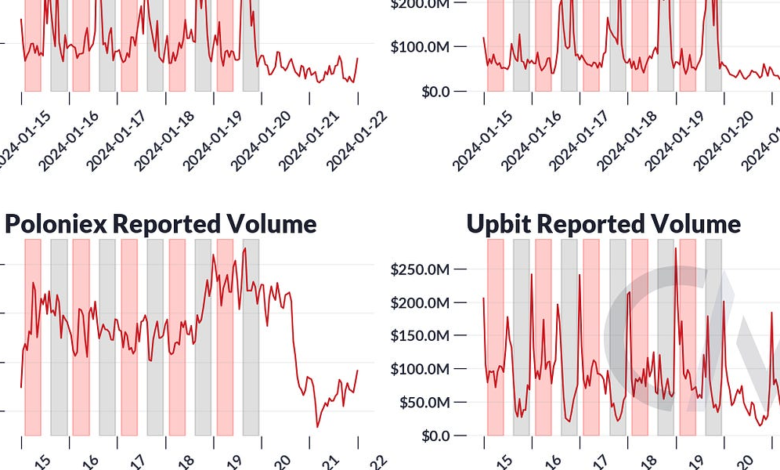

One other strategy to detect pretend quantity is to watch the correlation of the relative change in buying and selling exercise quantity throughout exchanges. Exchanges that exhibited pretend quantity tended to have quantity fluctuations which didn’t correlate to the remainder of the alternate volumes. Generally, well-behaved exchanges behave the identical means—by following the market—whereas ill-behaved exchanges misbehave in several methods.

We are able to illustrate this by trying on the quantity reported from a pattern of exchanges the week that the Bitcoin Spot ETF began buying and selling within the US. US enterprise hours are shaded in grey whereas APAC enterprise hours are shaded in crimson.

Supply: Coin Metrics Market Knowledge Feed

Word that there are some normal seasonality patterns: volumes are inclined to spike on the open of US enterprise hours, keep at some elevated degree till shut of enterprise, then fall off in the course of the weekend (1/21 to 1/22). Nevertheless, fluctuations are anticipated as a consequence of unexpected market occasions.

Within the reported quantity charts above, we see Coinbase and Binance comply with the identical quantity sample, noting that Binance follows this normal seasonality regardless of not being obtainable within the US. Importantly, the “amplitude” of the buying and selling quantity resets per day. Poloniex doesn’t comply with that very same intraday seasonality and normally exhibits comparatively small fluctuations all through the day. Upbit, a Singaporean alternate that’s one of many largest Asian exchanges by reported quantity, has a buying and selling quantity that can be uncommon however for a distinct purpose: its spikes in buying and selling quantity seem to not correlate with the most important exchanges, and there seems to be no dip in buying and selling exercise in the course of the weekend.

These patterns can be detected when trying on the p.c change in quantity over time.

Source: Coin Metrics Market Data Feed

Benford’s Regulation states that main digits are usually low and most frequent, and the frequencies lower because the main digit will increase. Benford’s Regulation is usually used to detect fraud in monetary (equivalent to commerce quantities in conventional markets) and non-financial purposes (equivalent to vote counts in elections). We are able to apply Benford’s Regulation to trades information from crypto exchanges by tallying the main digits of the commerce worth. If the distribution of main digits violates this sample, it is a sign of manipulated habits.

An instance of a market following (binance-btc-usdt-spot) and violating (bibox-btc-usdt-spot) Benford’s Regulation is proven under. Typically talking, a lot of the markets we studied (BTC-Stables, ETH-Stables, BTC/ETH-USD) have a tendency to suit Benford’s Regulation.

Source: Coin Metrics Market Data Feed

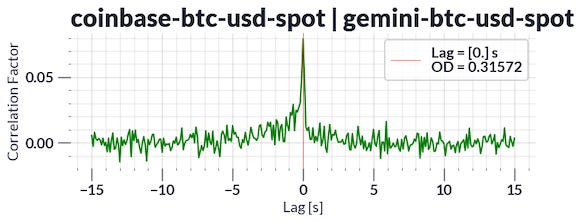

Value discovery is the method by which the market agrees on a worth. In an environment friendly market, we should always count on costs to be tightly coupled throughout market makers. Because of the variability in regulatory compliance, liquidity, and general market high quality throughout crypto exchanges, we see asymmetries in costs reported by these exchanges, resulting in potential arbitrage alternatives.

Value discovery throughout exchanges may be measured with a lead-lag evaluation utilizing the Hayashi-Yoshida estimator that Robertson and Zhang utilized to Bitcoin spot markets in 2022. On this technique, returns of an asset on one market are shifted forwards and backwards in time relative to the returns of the identical asset on a reference market. Estimating the correlation between these returns as a perform of time displacement permits you to observe how a lot a given market ought to be lagged for its costs to most strongly correlate with the adjoining reference market.

Think about the lag curves for the instance markets under. Coinbase and Gemini’s BTC-USD markets most correlate at 0 seconds, that means these markets are in sync. A counter-example is between Binance and Upbit, the place Upbit’s most correlation to Binance’s costs happen at –13.9 seconds. Which means that Upbit’s BTC-USDT market worth lags behind Binance’s costs by a median of 13.9 seconds.

Source: Coin Metrics Trusted Exchange Framework

You’ll be able to observe normal worth instability by trying on the worth charts on a 1-minute frequency. Beneath is a comparability of 1-minute costs for exchanges which might be usually used for reference charges in comparison with Upbit.

The auditability of information in crypto is among the trade’s most defining traits. By trying by way of patterns of brazenly obtainable alternate information, we are able to detect indicators of market irregularities and create a holistic evaluation on the standard of exchanges. Though the crypto market nonetheless exhibits indicators of immaturity, the clear nature of how crypto operates helps determine sources of market inefficiency and finally encourage enhancements in very important market infrastructure.

Source: Coin Metrics Network Data Pro

Bitcoin and Ethereum lively addresses declined by 1% and 4% respectively over the week, whereas exercise throughout a number of ERC-20 tokens additionally fell, with lively addresses dropping between 4% to 25%.

This week’s updates from the Coin Metrics staff:

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.