One Bitcoin now buys over 10,000 Big Macs, up from just 51 in 2015

Bitcoin’s buying energy, as measured by the Big Mac Index, has considerably increased over the previous decade. In 2024, one Bitcoin can purchase roughly 10,500 Big Macs, a considerable 20,488% rise from just 51 Big Macs in 2015. This progress highlights Bitcoin’s dramatic appreciation in worth relative to a client staple just like the Big Mac.

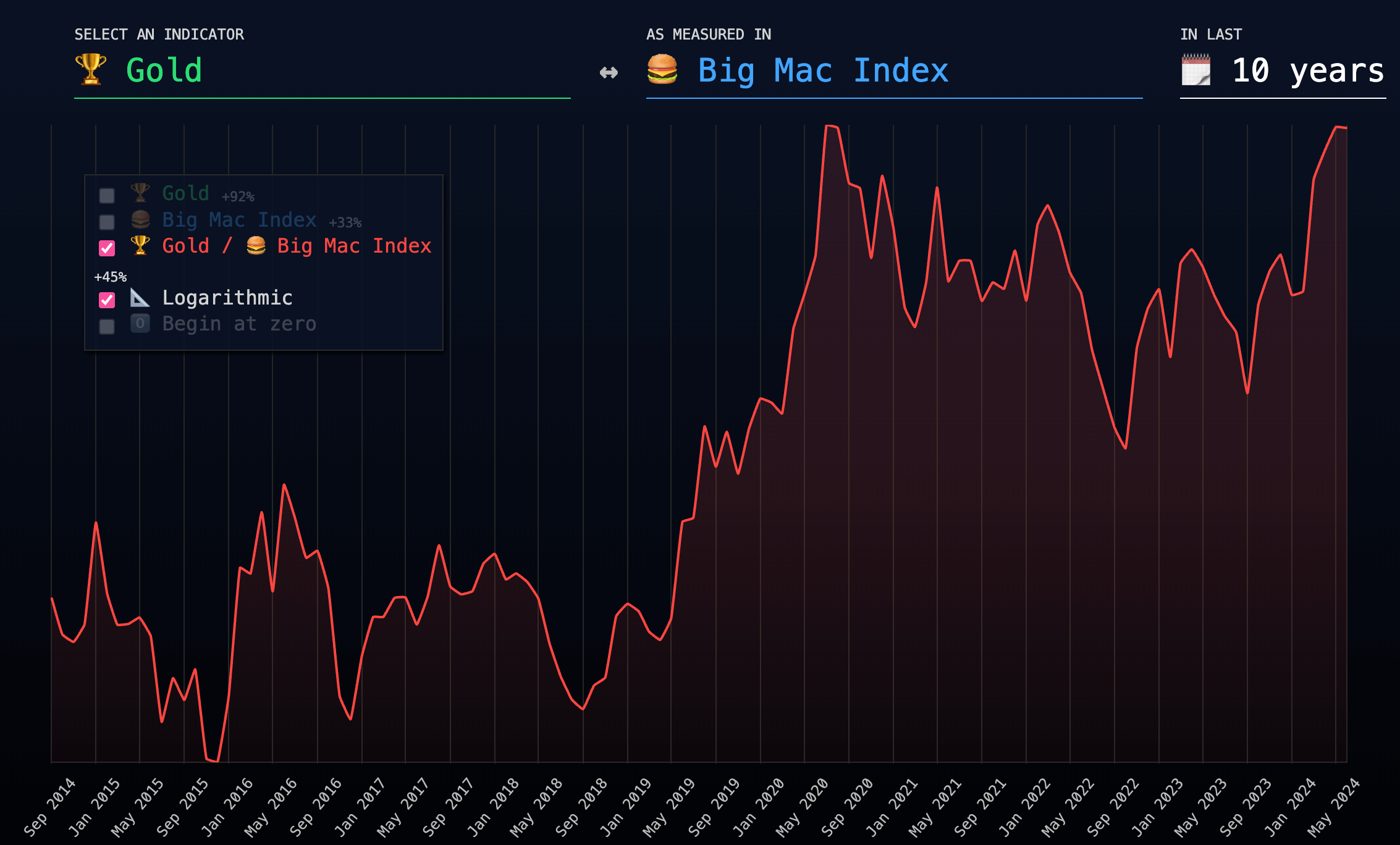

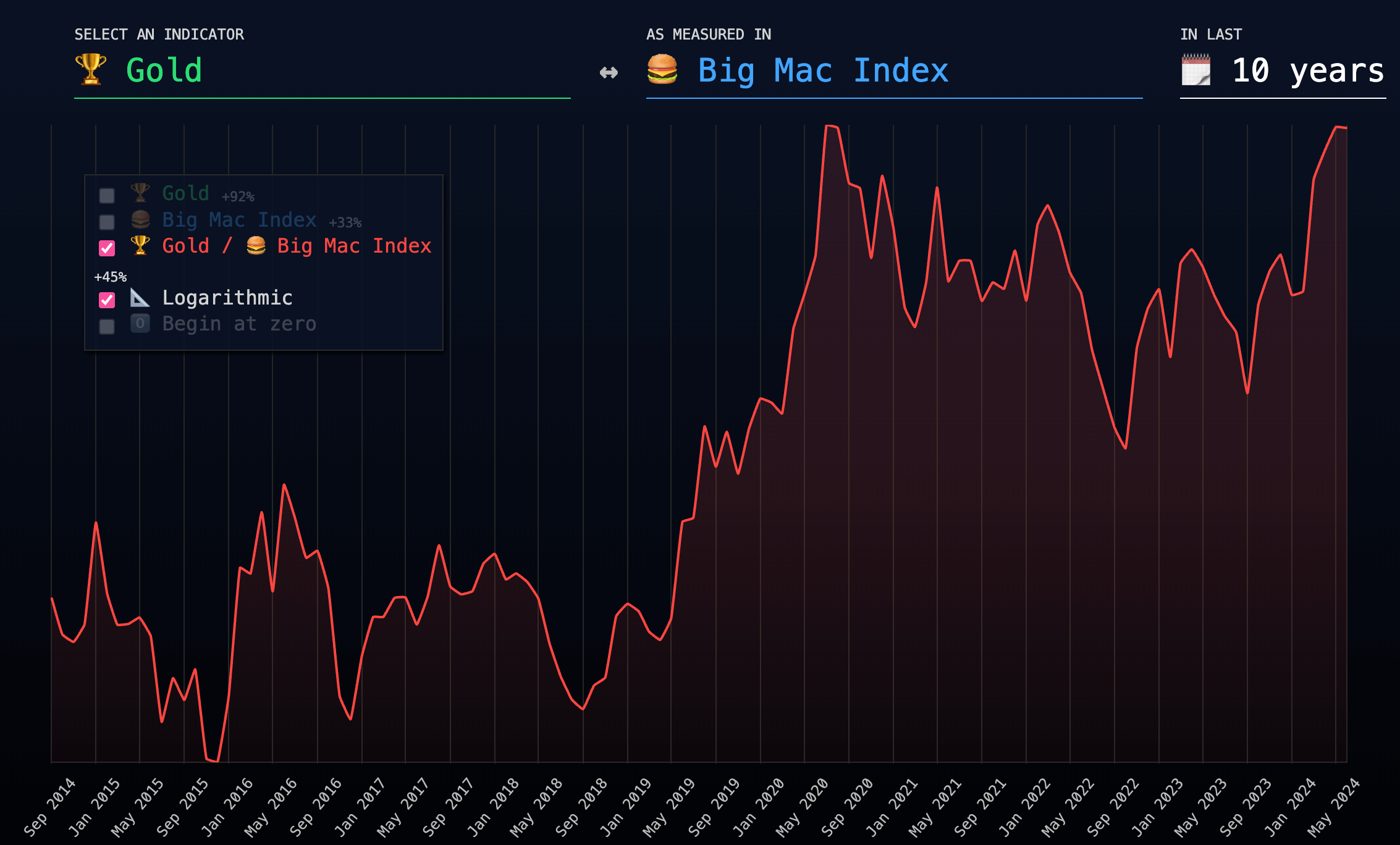

The Big Mac Index, initially developed by The Economist, serves as a casual gauge of buying energy parity, evaluating the worth of a Big Mac throughout completely different international locations to evaluate foreign money valuation. The index signifies that whereas Bitcoin’s worth has surged, conventional belongings like gold have additionally seen progress, albeit at a slower tempo. Over the identical interval, gold’s buying energy in phrases of Big Macs elevated by roughly 35%, showcasing a extra modest rise in comparison with Bitcoin.

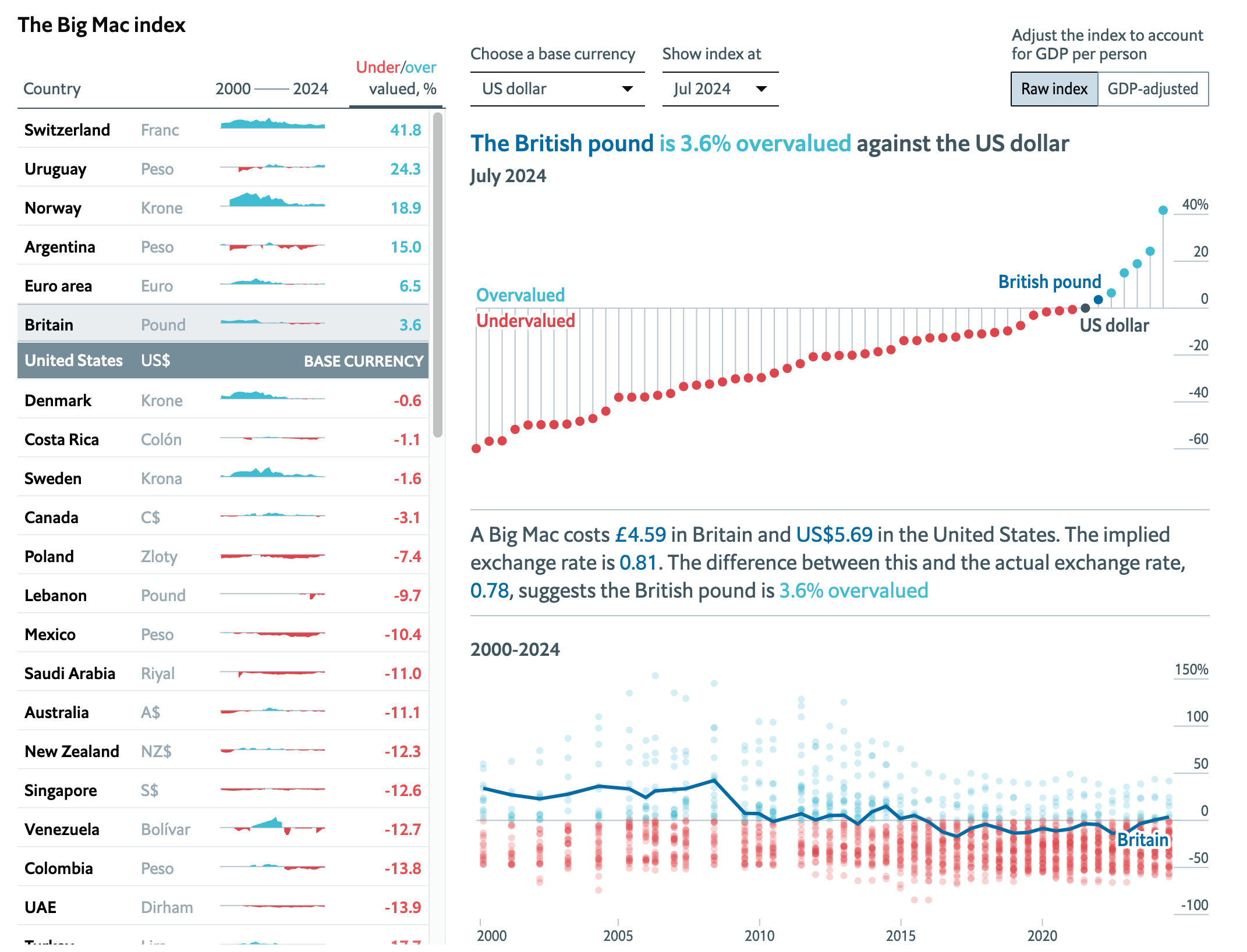

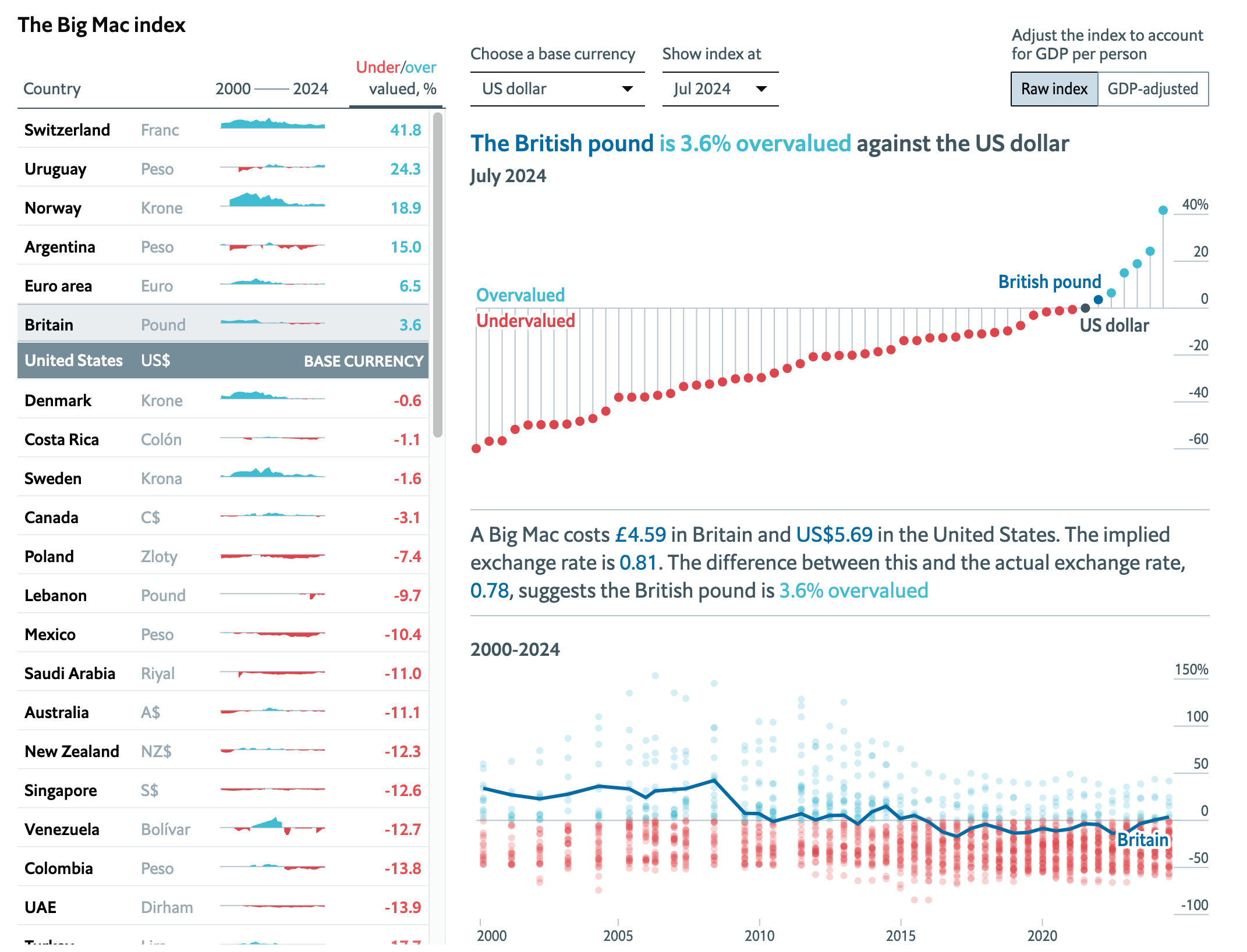

The official Economist Big Mac Index additionally reveals foreign money valuation developments, such because the British pound being overvalued by 3.6% in opposition to the US greenback as of July 2024. This index gives insights into international financial circumstances and foreign money fluctuations, reflecting broader market developments.

Of all currencies tracked, solely the British pound, Swiss franc, Uruguay peso, Argentine peso, Norwegian krona, and euro are at the moment overvalued in opposition to the greenback.

The info highlights Bitcoin’s risky but upward trajectory, positioning it as a novel asset class with substantial buying energy progress over the previous decade.

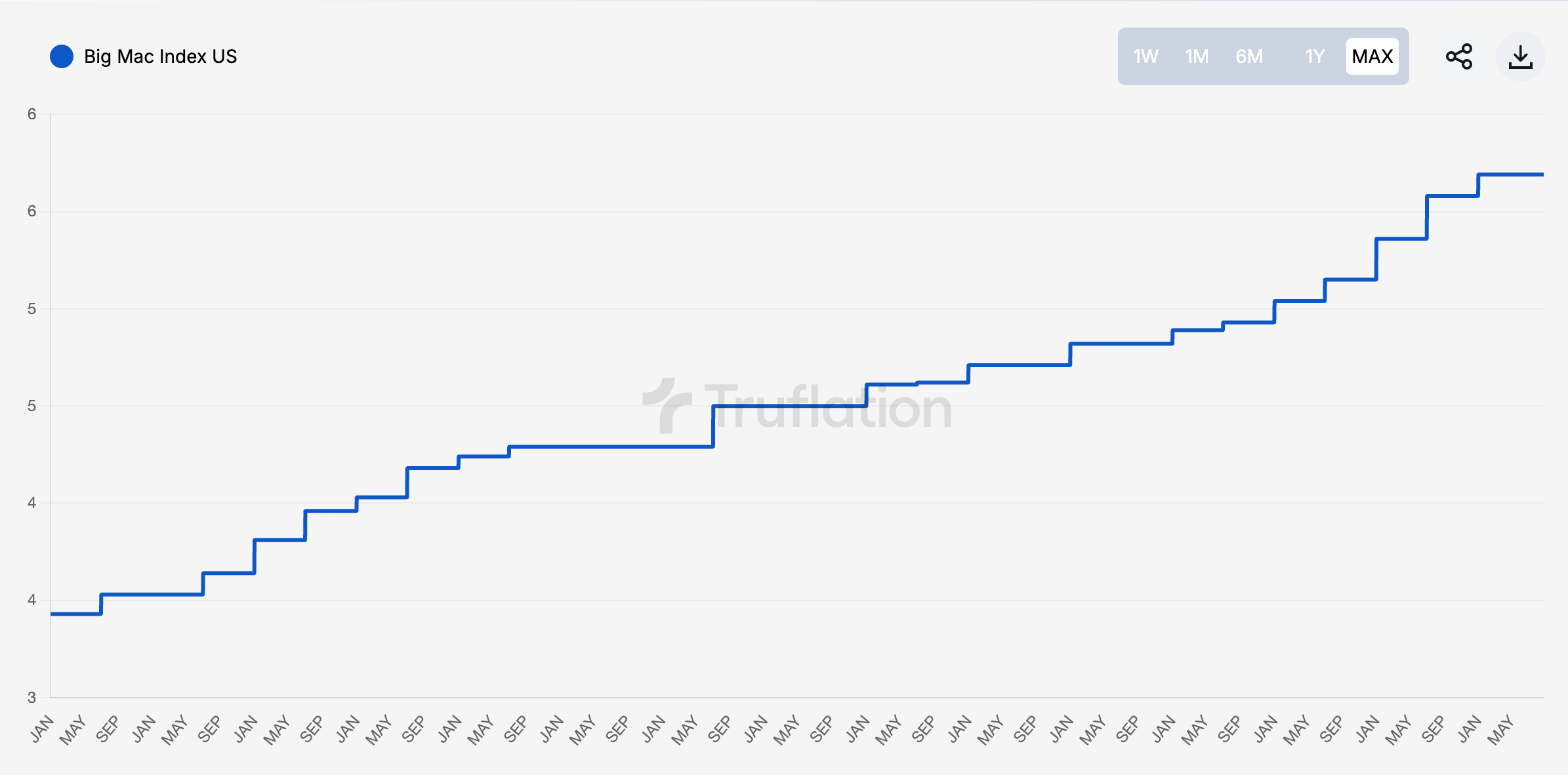

The cost of a Big Mac in the US was $4.29 in 2015 and is now $5.69, a rise of 32%.

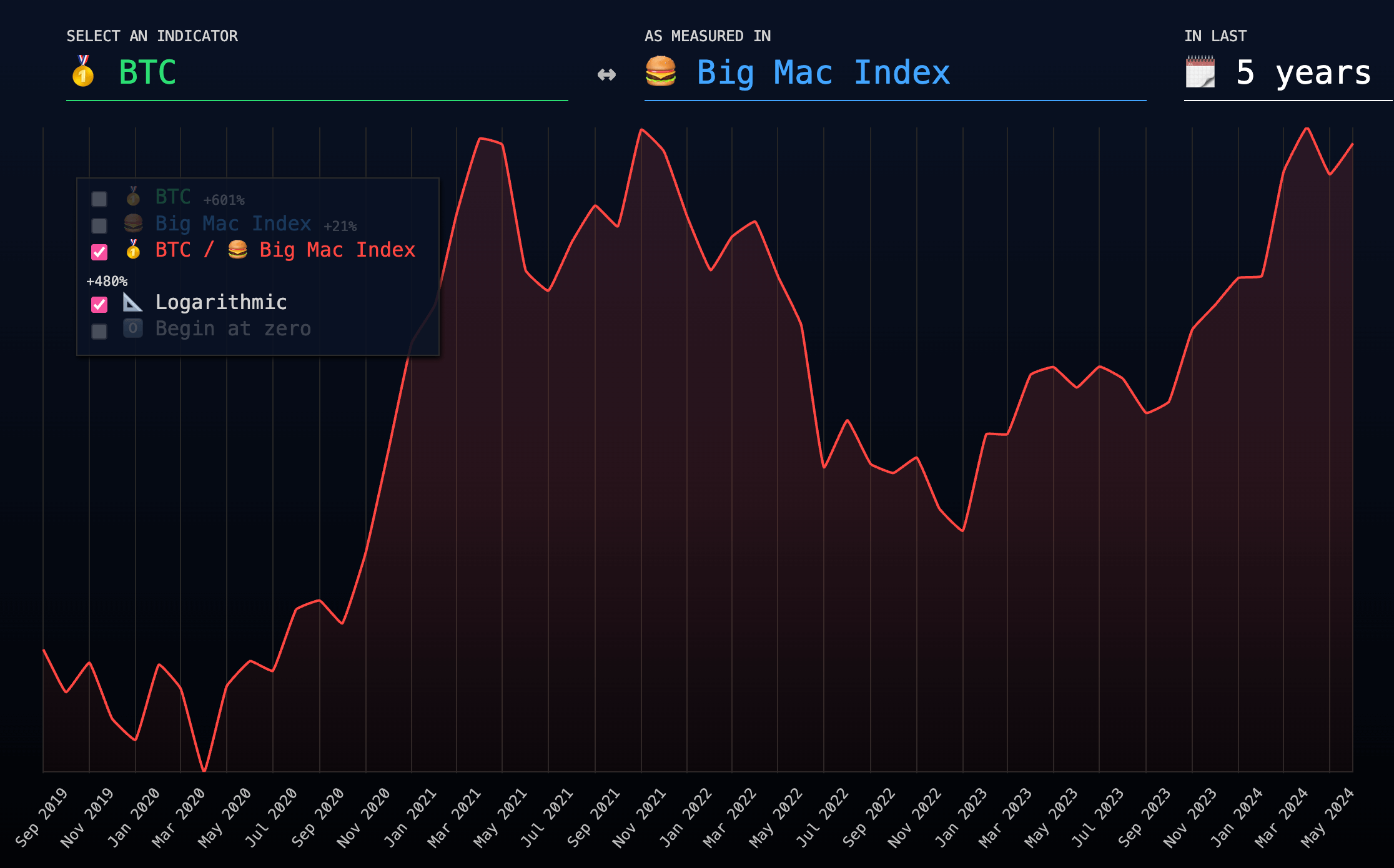

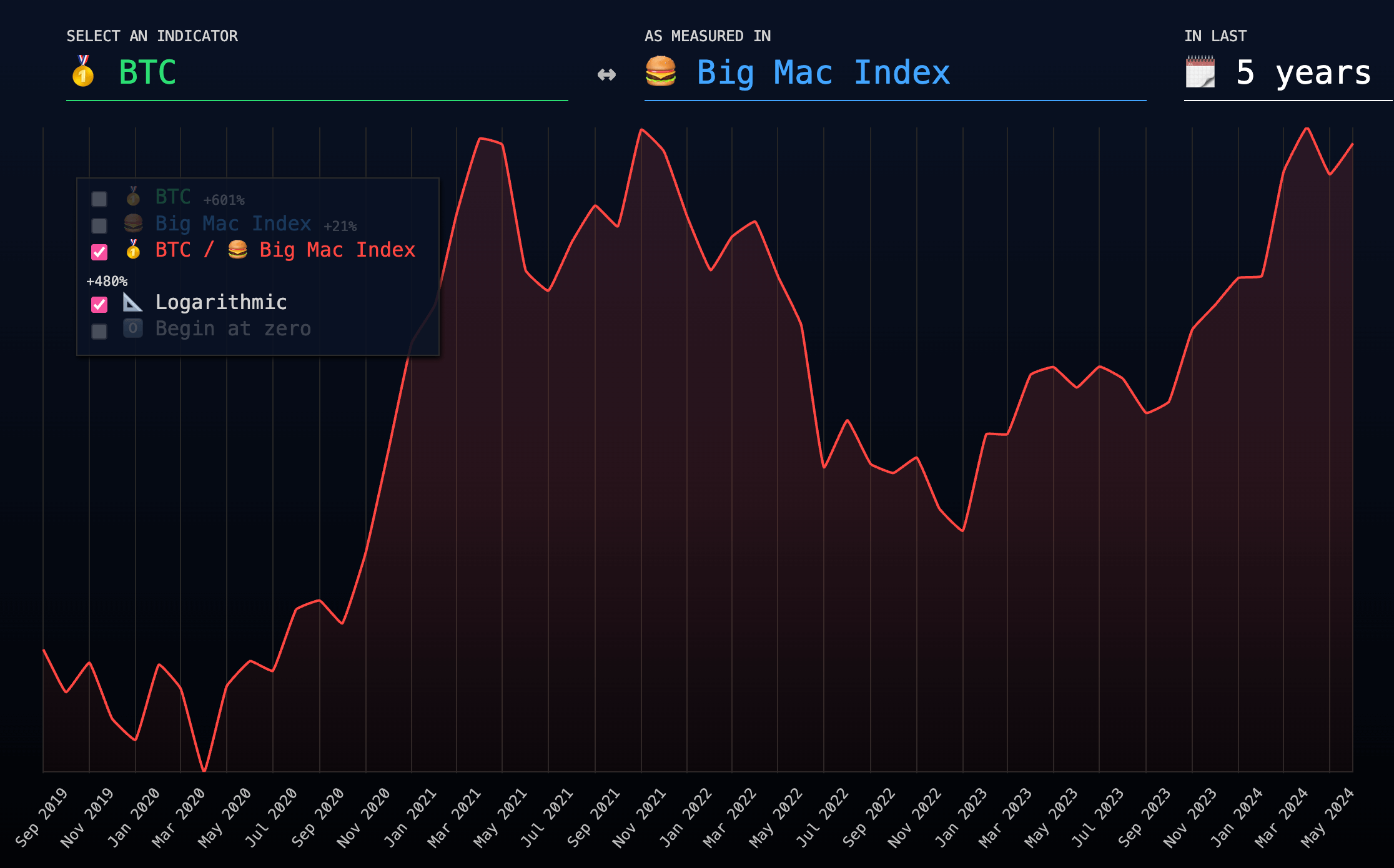

The argument that Bitcoin is just not a hedge in opposition to inflation is just legitimate when utilizing brief timeframes. Over a single day or month, Bitcoin hardly ever competes with extra secure belongings corresponding to US Treasuries and even many FIAT currencies. Nevertheless, over the previous ten years, even gold has not been in a position to compete with Bitcoin in phrases of uncooked buying energy.

If we scale back the timeframe to just 5 years, Bitcoin nonetheless buys 8,500 extra Big Macs per coin. Thus, whereas it’s a stronger argument to state that Bitcoin is a hedge in opposition to irresponsible central financial institution insurance policies, we are able to nonetheless keep that Bitcoin beats inflation—definitely in phrases of Big Macs.