Polygon leads in EVM efficiency as DeFi users favor low transaction costs

Layer-1 blockchains are foundational networks supporting numerous purposes instantly on their protocol, whereas Layer-2 blockchains function atop these foundational layers, enhancing scalability and efficiency. Evaluating the utilization and efficiency of EVM-compatible L1 and L2 blockchains and facet chains helps us higher perceive the market values and the place many of the DeFi exercise comes from.

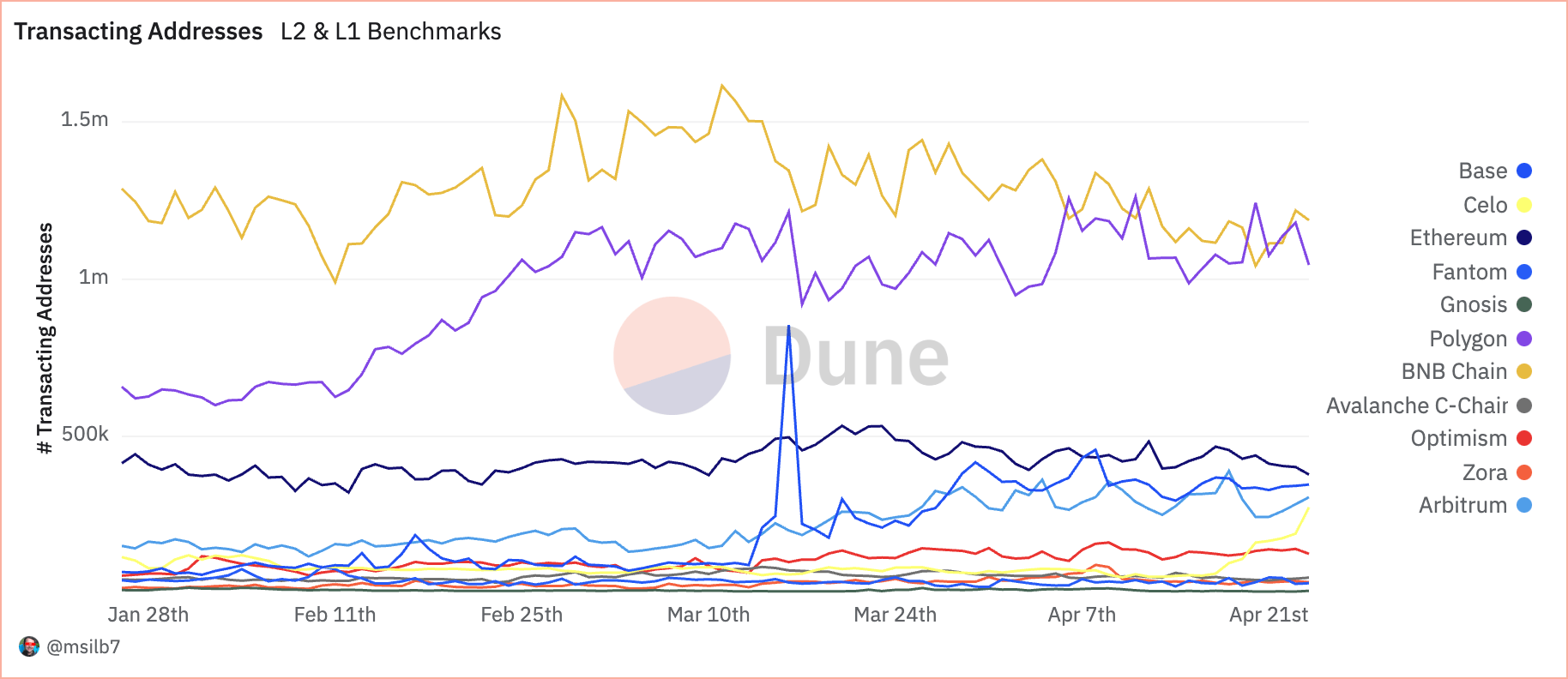

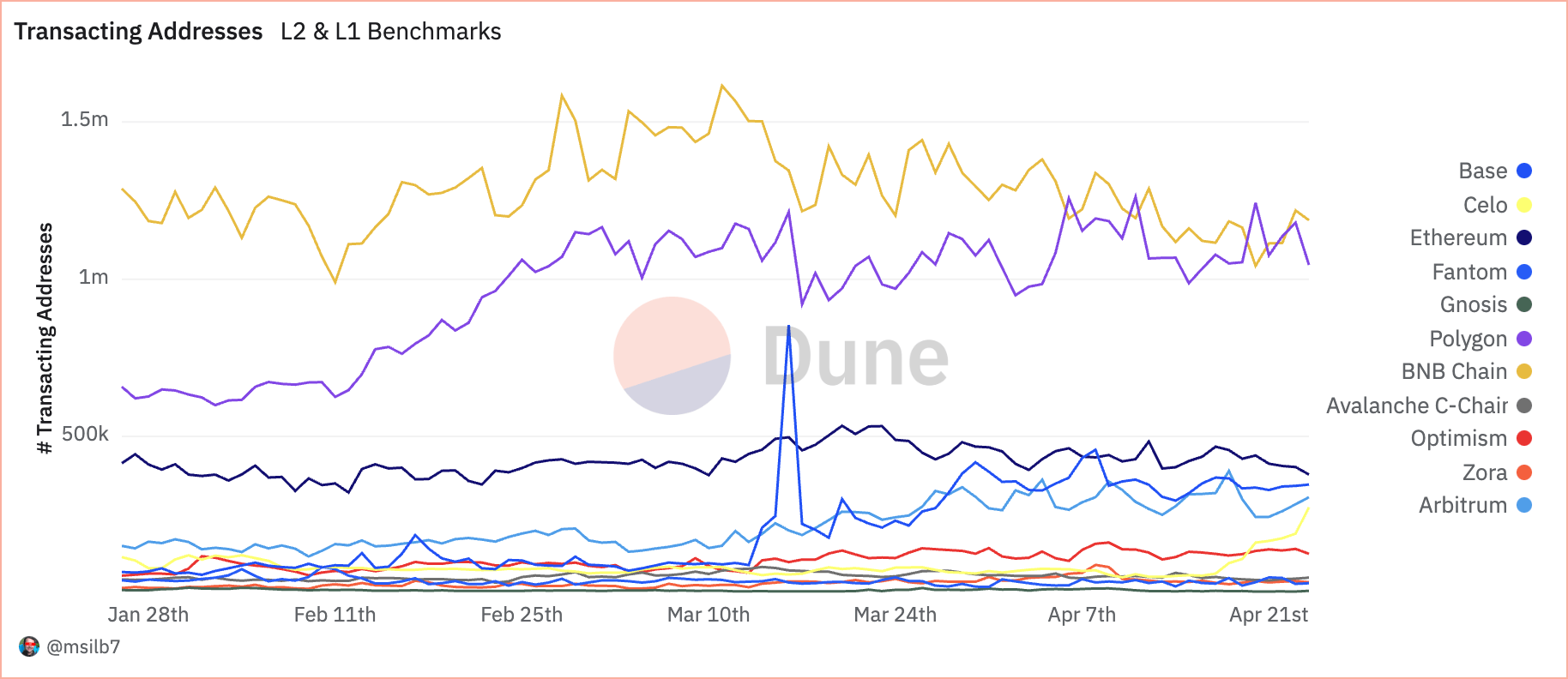

Dune Analytics knowledge analyzed by CryptoSlate confirmed Polygon, a Layer-2 sidechain, was the main determine in the DeFi ecosystem, carefully adopted by BNB Chain, an EVM-compatible Layer-1 blockchain.

One of the crucial necessary metrics when analyzing L1s and L2s is the day by day gasoline utilization—the computational effort required to execute operations on the blockchain. Gasoline charges are paid in native blockchain currencies, and excessive gasoline utilization sometimes signifies strong community exercise. Notably, when L2 options keep excessive gasoline utilization at low USD costs, it displays an environment friendly scaling answer that makes transactions reasonably priced with out sacrificing blockchain exercise.

Polygon makes use of a median of 579.97 billion models of native gasoline day by day, with related costs amounting to simply $65.48k. This interprets to a meager common of $0.76 in USD per second regardless of processing a excessive quantity of 48.37 transactions per second. Every transaction on Polygon costs about 138,782 gasoline models. BNB Mainnet, whereas additionally excessive in transaction quantity, exhibits a distinct price construction with 454.89 billion models of native gasoline used day by day and $1.02 million in day by day USD charges; the price per second soars to $11.81, far surpassing Polygon’s. The upper price per transaction, which averages 108,513 gasoline models, displays BNB’s heavier computational demand per transaction, suggesting a extra resource-intensive operation than Polygon.

| Chain | Avg Native Gasoline Used / Day | Avg USD Gasoline Charges / Day | Avg # Txs / Day | Avg Native Gasoline per Tx | Avg Native Gasoline Used / Second | Avg USD Gasoline Charges / Second | Avg # Txs / Second |

|---|---|---|---|---|---|---|---|

| Polygon Mainnet | 579.97b | $65.48k | 4.18m | 138,782 | 6.71m | $0.76 | 48.37 |

| BNB Mainnet | 454.89b | $1.02m | 4.06m | 108,513 | 5.26m | $11.81 | 47.03 |

| Arbitrum One | 273.96b | $250.05k | 1.14m | 241,207 | 3.17m | $2.89 | 13.15 |

| Base Mainnet | 222.37b | $378.72k | 1.26m | 174,229 | 2.57m | $4.38 | 14.59 |

| OP Mainnet | 213.30b | $160.26k | 490.83k | 429,129 | 2.47m | $1.85 | 5.68 |

| Gnosis Mainnet | 109.77b | $1.05k | 182.58k | 601,244 | 1.27m | $0.01 | 2.11 |

| Ethereum Mainnet | 108.14b | $12.63m | 1.19m | 90,758 | 1.25m | $146.20 | 13.79 |

| Fantom Mainnet | 94.86b | $4.89k | 248.93k | 372,521 | 1.10m | $0.06 | 2.88 |

Arbitrum makes use of 273.96 billion models of gasoline day by day, costing users $250.05k, which breaks all the way down to $2.89 per second and 241,207 gasoline models per transaction, indicating the next price efficiency than BNB however much less so than Polygon. Base Mainnet information comparable developments with 222.37 billion models and day by day charges of $378.72k, ensuing in a barely increased per-second price of $4.38 and 174,229 models per transaction.

Ethereum operates with the very best price affect, utilizing 108.14 billion gasoline models day by day, translating right into a hefty $12.63 million in charges. With costs skyrocketing to $146.20 per second, regardless of having a median of 90,758 gasoline models per transaction, it illustrates Ethereum’s strong safety and computational breadth and highlights its scalability challenges that L2 networks goal to handle.

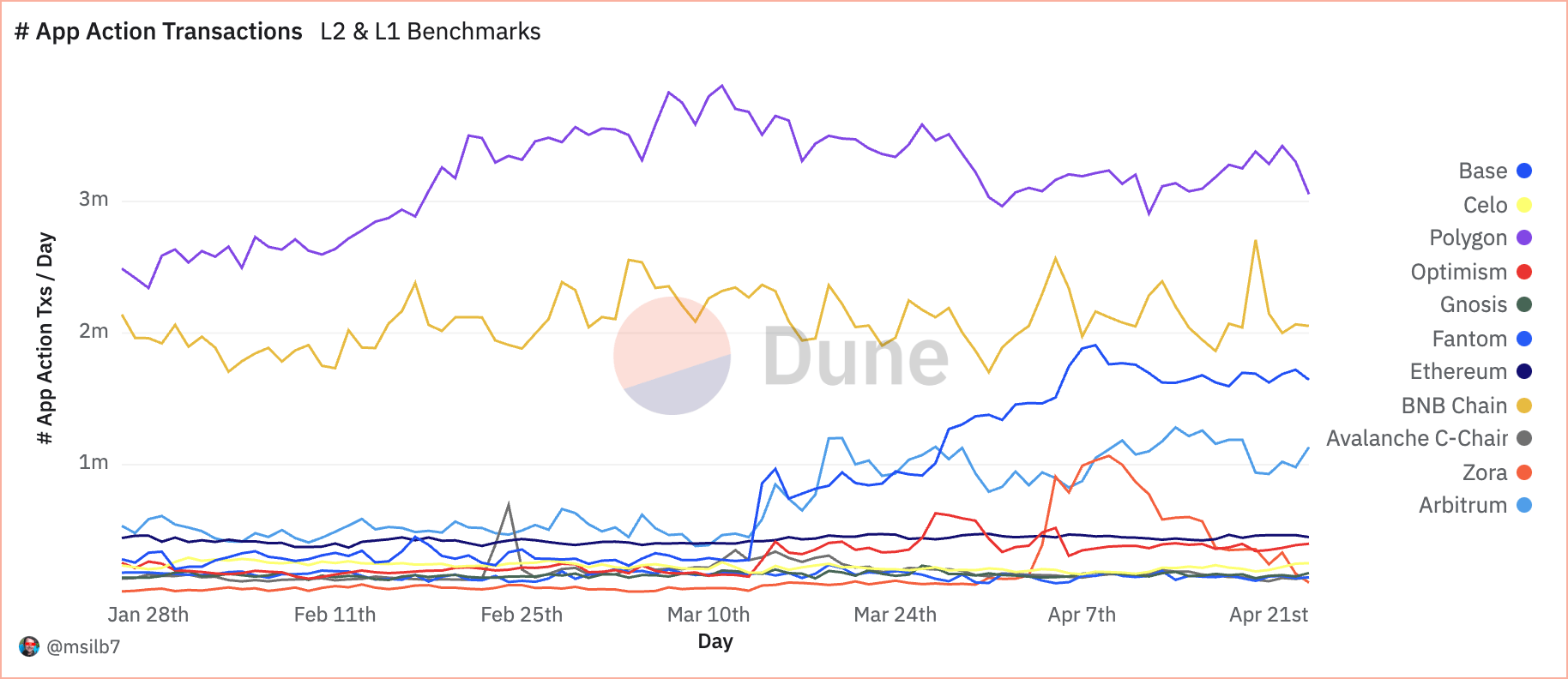

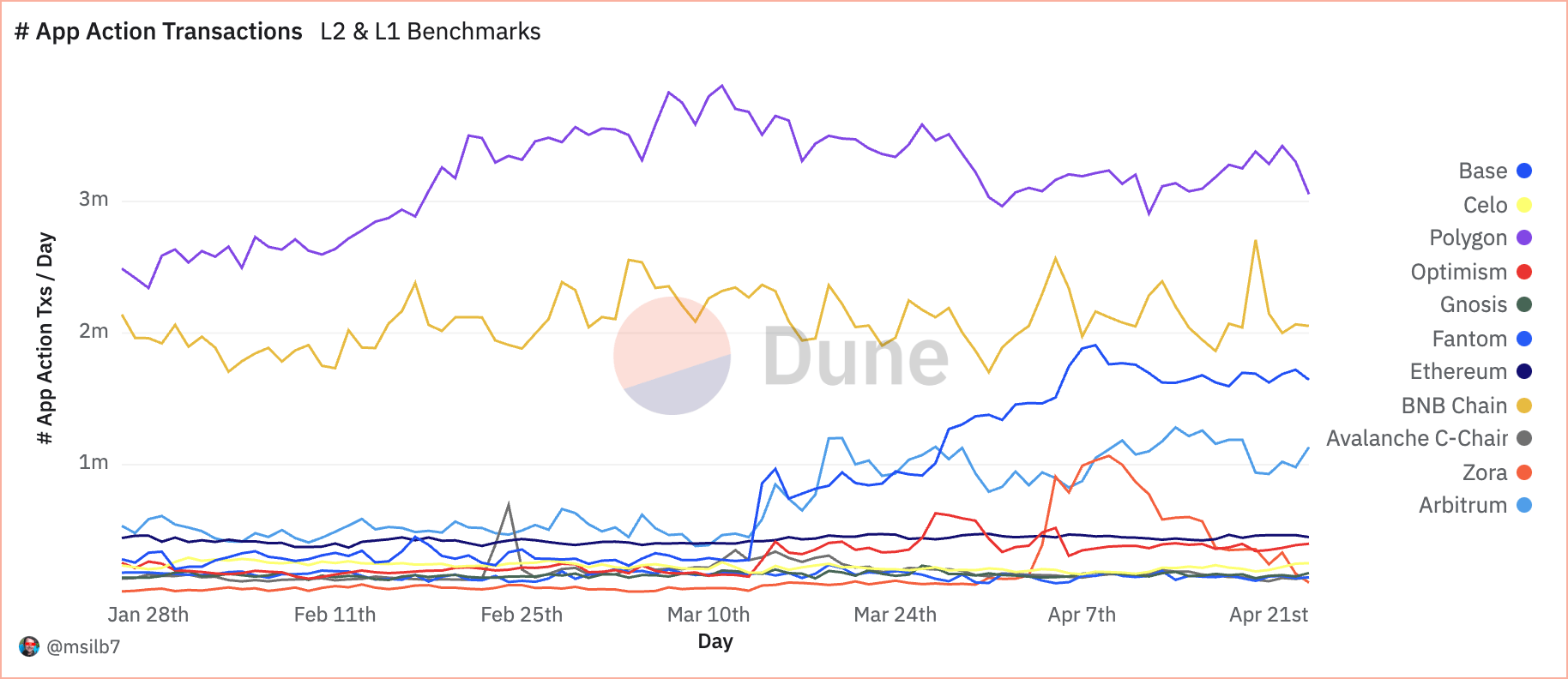

transaction metrics, knowledge from April 23 exhibits that Polygon led with 4.02 million transactions, adopted by BNB Chain with 3.9 million. These figures present sturdy person engagement and community utility, representing a respective 25.8% and 25.1% share of whole transactions (excluding recognized system transactions).

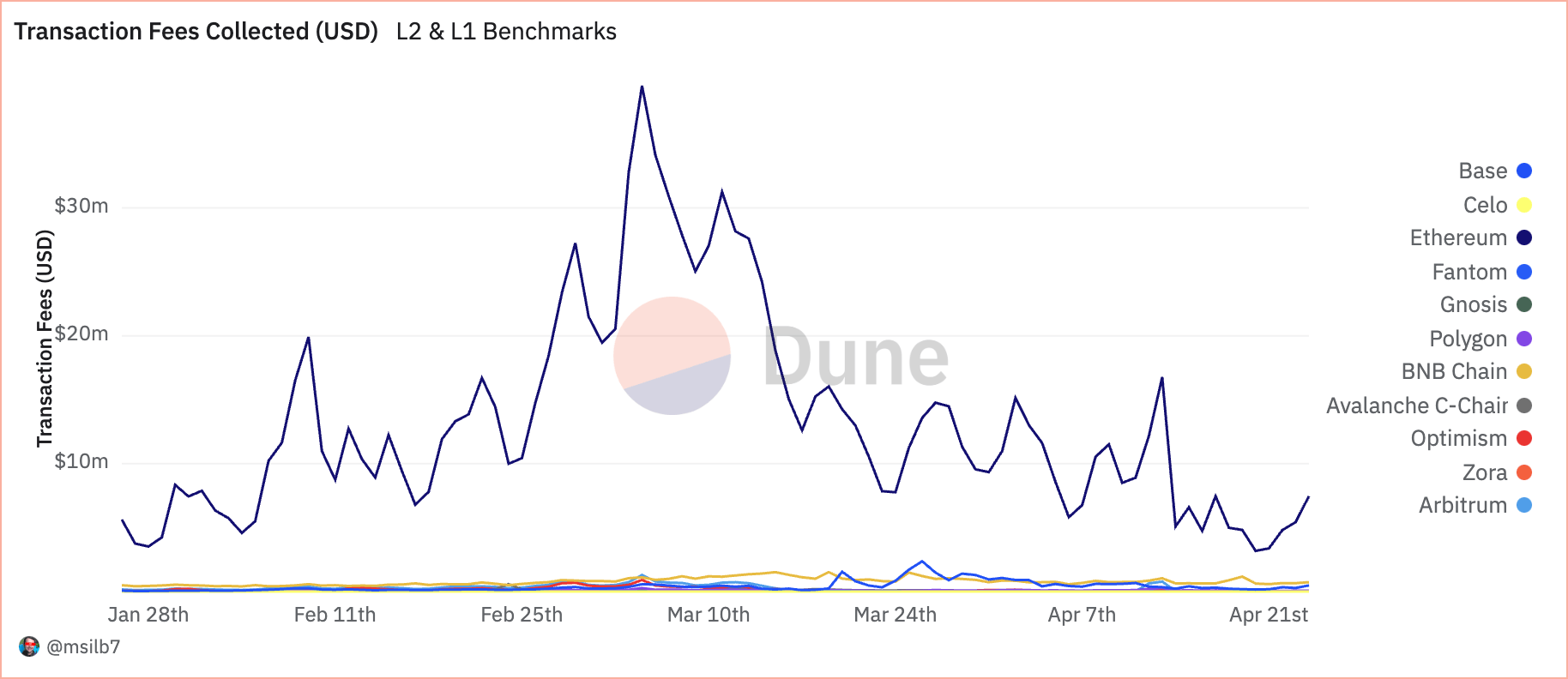

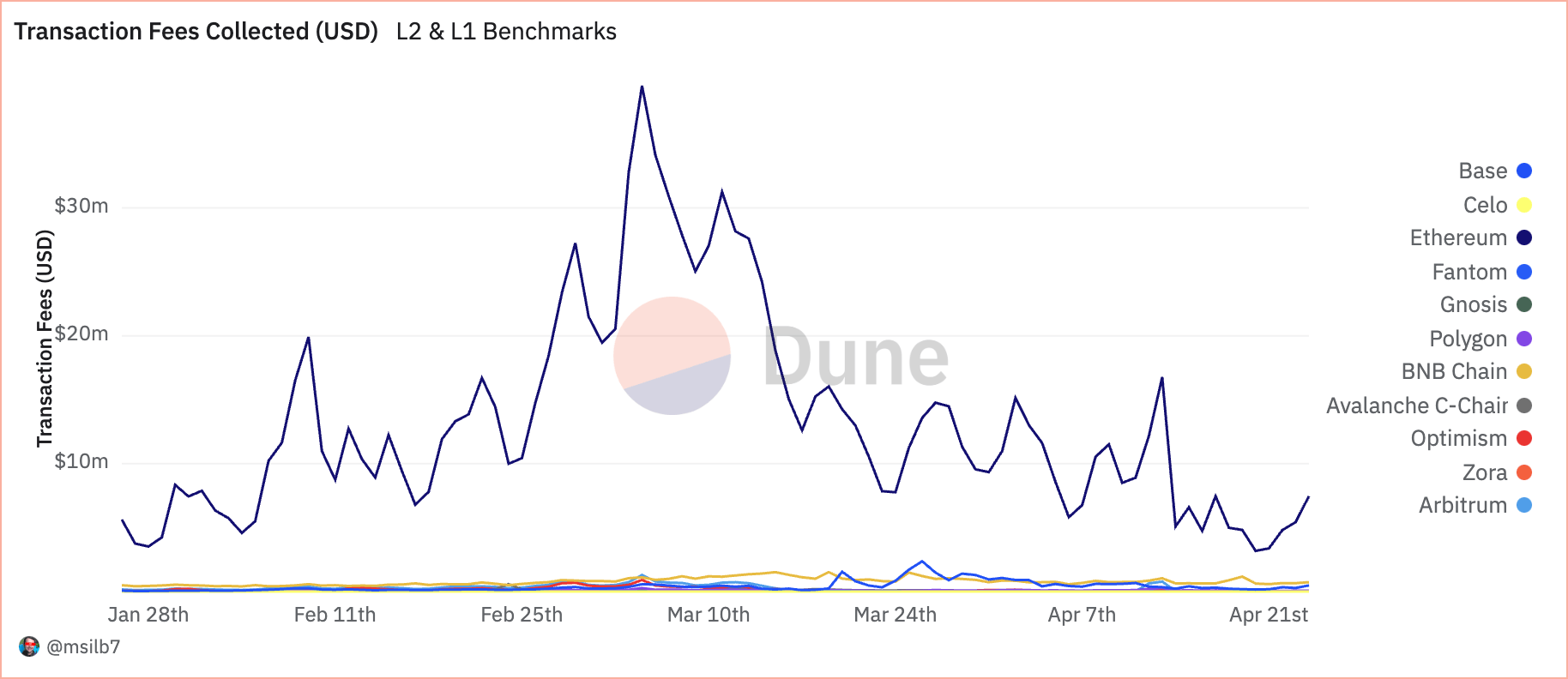

Nevertheless, when analyzing transaction charges, a distinct narrative emerges. Regardless of a decrease transaction depend, Ethereum amassed $7.46 million in charges, representing a staggering 83.9% of whole charges collected. This discrepancy means that whereas Ethereum processes fewer transactions, its increased transaction costs mirror its main layer standing and the intensive computational sources required for operations.

In terms of DeFi apps, Polygon once more leads the transaction numbers, with 3.3 million app transactions, displaying it’s a go-to platform for DeFi actions.

BNB Chain noticed 1.22 million transacting addresses, with Polygon barely behind at 1.18 million. These figures, contrasted with Ethereum’s 402.77k, counsel that different EVM-compatible networks have gotten most popular platforms for normal DeFi users attributable to their decrease price buildings.

Analyzing the efficiency of those blockchains side-by-side exhibits a battle between foundational safety and enhanced scalability. Whereas L1 blockchains like Ethereum proceed to safe high-value transactions with substantial charges, scaling options like Polygon seize the majority of day by day transactions and utility interactions, signifying a shift in direction of extra environment friendly and user-friendly blockchain infrastructures in DeFi.

It’s necessary to notice that regardless of being labeled as a Layer-2 blockchain by many, Polygon operates as an L2 sidechain for Ethereum, as it depends by itself set of validators and doesn’t rely upon Ethereum for safety. This permits Polygon to help extra experimental exercise than “true” L2 blockchains with out impacting Ethereum. One other truth value mentioning is that BNB Chain is an EVM-compatible Layer-1 blockchain however has positioned itself available on the market not as a competitor to Ethereum, one other L1, however to different L2s.