Record high realized cap shows unprecedented economic investment in Bitcoin

Bitcoin’s realized cap is a nuanced and revolutionary metric for assessing the valuation of Bitcoin that differs considerably from conventional market capitalization.

Not like the market cap, which merely multiplies the present market worth of Bitcoin by the entire variety of cash in circulation, the realized cap affords a extra granular and economically significant perception into the Bitcoin market.

It does this by aggregating the worth of all Bitcoins on the worth they had been final moved reasonably than the present worth. This method can present a extra steady view of the market’s valuation, much less vulnerable to the volatility related to speculative buying and selling and short-term market actions.

To calculate the realized cap, one should take the worth of every Bitcoin on the time it final moved after which sum these particular person values throughout all Bitcoins. This implies if a Bitcoin was final moved when its worth was $10,000, that particular Bitcoin contributes $10,000 to the cap, whatever the present market worth.

The realized cap reveals issues in regards to the Bitcoin market that aren’t instantly obvious by the market cap.

Firstly, it might present insights into the investment habits of Bitcoin holders. For instance, a rising realized cap means that Bitcoins are transferring at increased costs, indicating constructive sentiment amongst traders. Conversely, a steady or declining realized cap can sign that almost all Bitcoins are usually not altering palms, presumably implying holder conviction or an absence of recent investment at increased worth ranges.

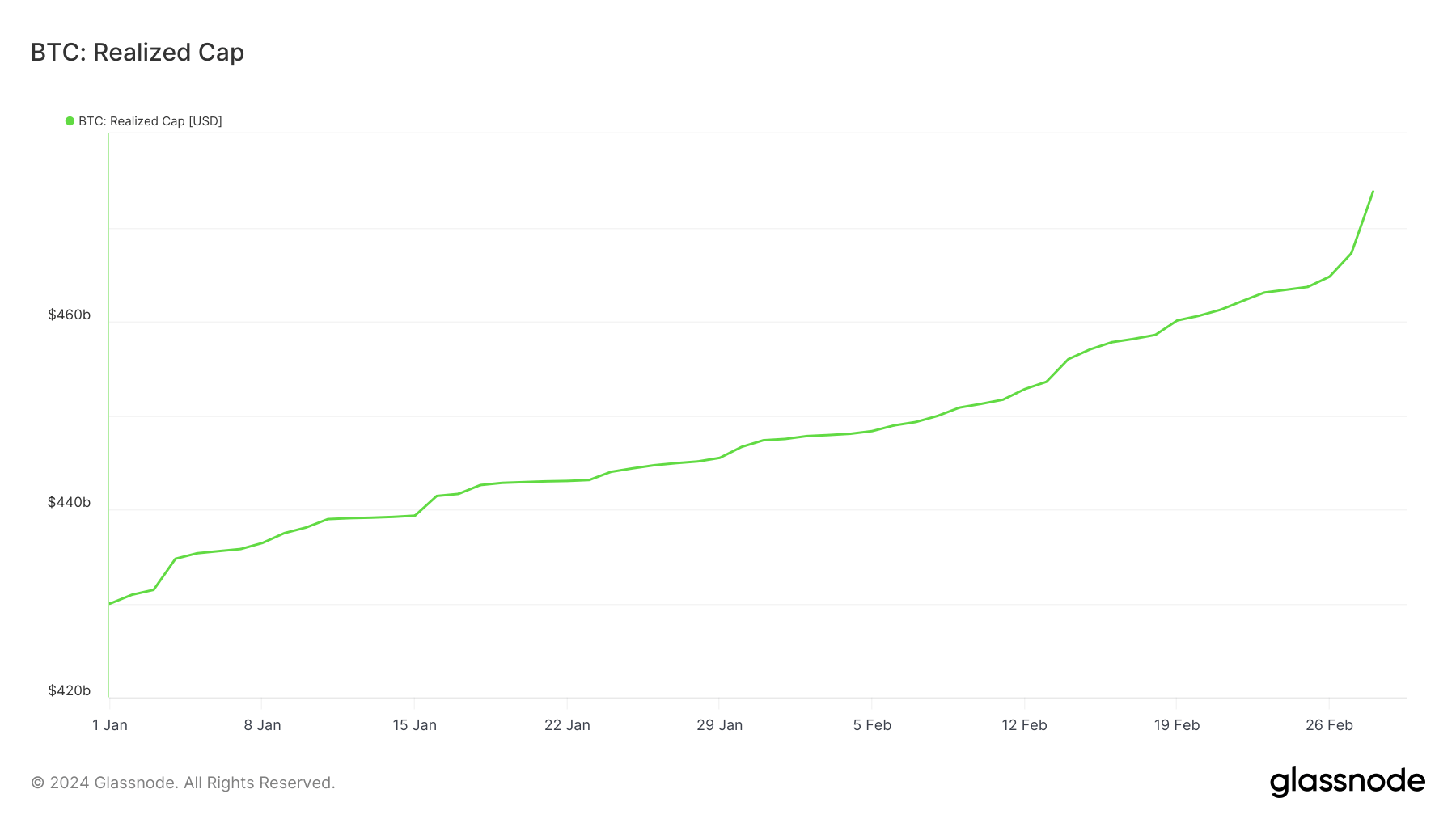

Furthermore, it might function a proxy for the invested capital that’s much less delicate to speculative swings. In durations of high volatility, the market cap can fluctuate wildly, however the realized cap tends to maneuver extra easily, as seen in the graph beneath, reflecting a extra grounded evaluation of the Bitcoin market’s price. This stability makes it a invaluable device for traders seeking to gauge the market’s underlying well being past the noise of day by day worth actions.

Bitcoin’s realized cap reached its all-time high on Feb. 28, topping at $473.8 billion. This signifies that, on common, the Bitcoin community and its contributors have by no means been as economically invested in BTC as they’re now, based mostly on the costs at which most Bitcoins had been final transacted.

Reaching an ATH in the realized cap signifies a broadening and deepening of the market’s basis.

Not like market cap, which might quickly inflate with speculative fervor, the realized cap grows because of transactions that replicate precise transfers of wealth and, by extension, a extra sturdy perception in Bitcoin’s worth. Due to this fact, this ATH may very well be seen as a extra significant indicator of Bitcoin’s growing acceptance and integration into the monetary portfolios of a wider array of traders.

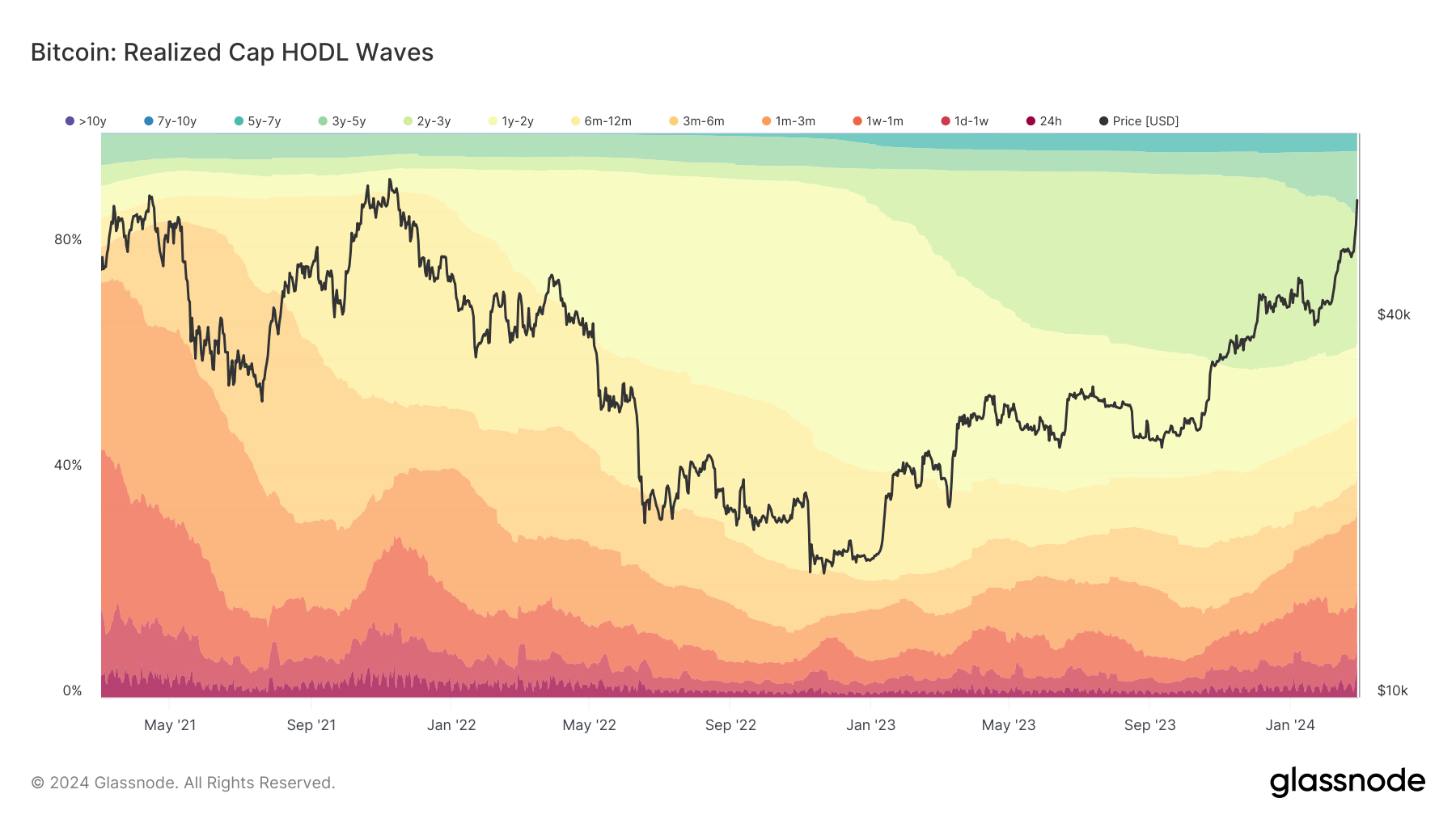

The Realized Cap HODL Waves knowledge offers an enchanting perception into the habits of Bitcoin holders and their contribution to the realized cap’s enhance. By analyzing the modifications in the distribution of Bitcoin holdings throughout completely different time-held cohorts in the previous three days, we are able to decide which group is essentially the most energetic and the way their actions influenced the realized cap.

On Feb. 25, the distribution was as follows:

- Bitcoins held for lower than 24 hours accounted for 0.856% of the realized cap.

- Bitcoins held between 1 day and 1 week contributed 5.8%.

- The 1-week to 1-month cohort represented 15.571%.

- Bitcoins held for 3 to six months made up 6.318%.

- The 6-month to 1-year group accounted for 11.818%.

- Lastly, Bitcoins held for 1 to 2 years contributed 12.438%.

By Feb. 28, there was a notable shift:

- The share of Bitcoins held for lower than 24 hours surged to five.828%.

- Holdings between 1-day and 1-week dropped to 4.851%.

- The 1-week to 1-month cohort decreased considerably to eight.543%.

- The three- to 6-month group was barely decreased to six.209%.

- The 6-month to 1-year holdings fell to 11.338%.

- The 1-year to 2-year cohort decreased to 11.975%.

From this knowledge, essentially the most important shift occurred in the under-24-hour cohort, which dramatically elevated from 0.856% to five.828%. This implies a considerable inflow of recent investment or buying and selling exercise, the place a big quantity of Bitcoin modified palms rapidly and was possible bought or transferred at increased costs, contributing to the rise in the realized cap. Such short-term holding signifies speculative buying and selling or instant responses to market circumstances.

The lower in percentages for the 1-day to 1-week and 1-week to 1-month cohorts, alongside slight declines in the longer-term holding classes, suggests a consolidation or a shift from these teams into both the very short-term holding (<24h) because of buying and selling or into longer-term holdings not specified right here. This might point out a reallocation of belongings throughout the market, the place some brief to medium-term holders determined to take income or reallocate their investments, contributing to the realized cap enhance.

Due to this fact, the rise in the realized cap seems to be considerably influenced by short-term market exercise and buying and selling reasonably than long-term holding methods, as evidenced by the dramatic enhance in the <24h cohort. Whereas there may be exercise throughout all cohorts, the predominant contribution to the realized cap’s rise in this era comes from these partaking in short-term buying and selling.

This habits displays a market the place worth actions and instant buying and selling alternatives affect the realized cap greater than the buildup methods of longer-term traders.

The publish Record high realized cap shows unprecedented economic investment in Bitcoin appeared first on CryptoSlate.