[Report] Coin Metrics’ State of the Network: Version 229

![[report] Coin Metrics' State Of The Network: Version 229](https://dailyblockchain.news/wp-content/uploads/2023/10/Report-Coin-Metrics-State-of-the-Network-Version-229-780x470.jpeg)

Get the best data-driven crypto insights and analysis every week:

With Counting coins ⨉ Bitcoin Suisse

In an industry as dynamic and boundary-defying as digital assets, the contribution of two leading research groups—each hailing from a different corner of the globe, just as decentralized networks work—marks an opportunity for both celebration and intellectual intrigue. This collaboration between a US-based institutional cryptocurrency analytics firm, Coin Metrics, and Bitcoin Suisse, a Swiss arm deeply embedded in the innovative spirit of Crypto Valley, reveals the borderless nature of digital assets, confirming them as a truly global asset class.

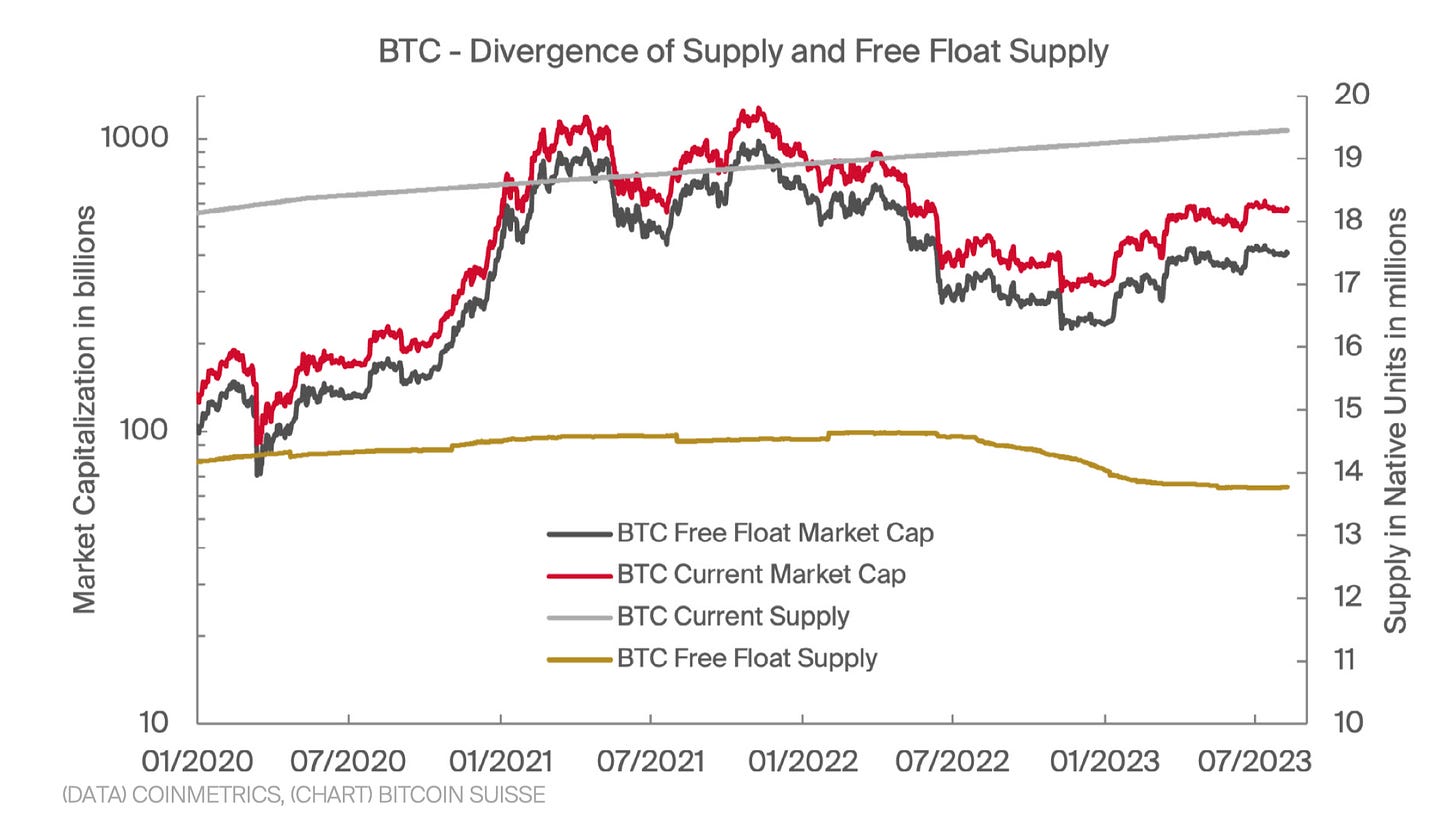

Our partnership is based on our respective strengths. Coin Metrics’ data-driven approach blends seamlessly with the market acumen and decade-long historical perspective provided by Bitcoin Suisse. With Bitcoin Suisse steering the research outline, conceptual framework and token selection, and Coin Metrics providing high-caliber datasets and metrics, we have turned our collective attention to a topic of increasing relevance: token supply transparency and its relation to liquidity.

For the first time in financial history, the transparent architecture of public blockchains allows us to track the flow of funds between crypto wallets in real time, offering unprecedented insights into supply dynamics and liquidity across multiple dimensions and granularity. What follows is the fruit of this synergistic effort. we think you’ll find it as enlightening as we found the process of creating it.

One of the key insights explored in this report focuses on the information provided by the Coin Metrics Free Float Supply metric, which can be used to understand the percentage of an asset’s liquid supply. We apply this framework to offer insights into how a bullish catalyst can manifest across various digital assets by identifying the assets’ comparative advantage based on their supply liquidity.

Source: Coin Metrics Network Data & Bitcoin Suisse

The partnership between Coin Metrics and Bitcoin Suisse marks an important step forward in enhancing our understanding of the digital asset space. This research provides insight into the relationship between token supply transparency and liquidity, a topic of utmost importance to the evolving dynamics of the cryptocurrency market.

If you want to read the full report, you can find it here.

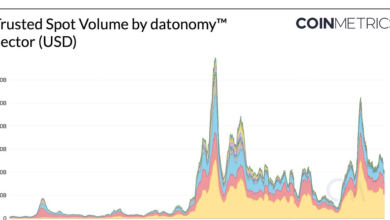

Source: Coin Metrics Network Data Pro

Bitcoin’s active addresses remained steady at 9 million, while Ethereum saw a 24% increase in active addresses, both in a relatively stable price environment. On-chain activity for Bitcoin, as highlighted by its daily transfers, was down 7%, while daily transfers for Ethereum were up 10%.

This week’s updates from the Coin Metrics team:

-

Check out the latest issue of Coin Metrics’ market situation for more market data on Coinbase and other exchanges.

-

Explore the digital asset ecosystem through us the entire directory of original data-driven research.

Coin Metrics’ State of the Network is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.