Reserve Bank of Australia has decided to raise the cash rate target by 25 basis points to 4.35%

The Board of Reserve Bank of Australia has decided to raise the cash rate target by 25 basis points to 4.35%, whereas additionally growing the curiosity rate on Change Settlement balances to 4.25%. This determination was influenced by the persistently excessive inflation in Australia, which has been extra persistent than anticipated. Though the central forecast signifies a decline in inflation, it’s anticipated to stay round 3.5% by the finish of 2024, above the target vary of 2-3% by the finish of 2025.

The Board had beforehand maintained regular rates of interest to assess the affect of prior rate will increase on the economic system and monitor varied financial indicators. Nonetheless, the threat of inflation remaining elevated for an prolonged interval has elevated. Whereas the economic system has been stronger than anticipated, it’s presently experiencing below-trend development. Excessive inflation is affecting actual incomes, family consumption, and dwelling funding, whereas the labor market stays tight.

The Board’s major purpose is to return inflation to the target vary, as excessive inflation negatively impacts financial savings, family budgets, enterprise planning, and revenue equality. There are uncertainties in the outlook, notably concerning the persistence of companies worth inflation and the response of corporations and wages to slower financial development with a good labor market. The outlook for family consumption and international financial circumstances additionally carries uncertainty.

The Board will proceed to carefully monitor financial information and evolving dangers to decide whether or not additional tightening of financial coverage is critical to obtain the inflation target inside an inexpensive timeframe. Their dedication stays centered on returning inflation to target.

The Board’s determination to raise the cash rate target and the curiosity rate paid on Change Settlement balances has a number of impacts on the monetary markets and the broader economic system:

- Larger Curiosity Charges: The rise in the cash rate target signifies that borrowing prices for shoppers and companies will rise. This will lead to larger rates of interest on loans, together with mortgages and enterprise loans.

- Affect on Debtors: Debtors will face elevated prices, probably lowering their potential to tackle new debt and main to larger month-to-month funds for current loans, together with mortgages. This will affect client spending and enterprise funding.

- Forex Change Charges: Larger rates of interest can entice overseas capital, main to an appreciation of the home foreign money. This will have an effect on export competitiveness and worldwide commerce. A stronger home foreign money could make exports costlier for overseas consumers.

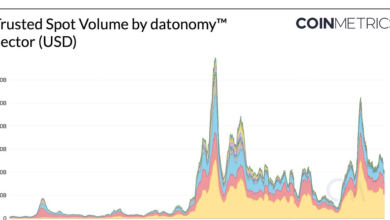

- Monetary Markets: The choice can affect inventory and bond markets. Larger rates of interest could make bonds extra engaging in contrast to shares, main to a shift in investor preferences. Inventory costs could also be pressured as firms face larger borrowing prices.

- Inflation Expectations: The central financial institution’s transfer to raise rates of interest displays considerations about inflation. The choice can have an effect on inflation expectations amongst buyers, shoppers, and companies. In the event that they anticipate inflation to be contained, it may affect spending and funding selections.

- Housing Market: The choice can affect the housing market. Larger rates of interest can cool demand for actual property, probably main to slower worth development and even worth declines.

- Enterprise Funding: Elevated borrowing prices could lead companies to rethink their funding plans. Larger rates of interest could make it costlier for companies to finance initiatives and enlargement.

- Shopper Spending: Larger rates of interest can lead to decreased client spending, notably on big-ticket gadgets that usually require financing, comparable to automobiles and houses.

- General Financial Progress: The choice can affect the total financial development trajectory. Larger rates of interest can act as a brake on financial enlargement, probably slowing down financial development.

- Investor Sentiment: Investor sentiment and market psychology might be affected by curiosity rate selections. The market could react positively if the central financial institution’s determination is seen as an indication of dedication to controlling inflation.

In abstract, the central bank’s decision to raise rates of interest can have wide-ranging results on the monetary markets, the housing market, client conduct, enterprise funding, and total financial development. The particular affect will rely on a range of components, together with the magnitude of the rate improve, the state of the economic system, and investor sentiment.

(*25*)