SEC Officially Approved Spot Ethereum ETFs

The US Securities and Trade Fee or SEC made a groundbreaking announcement on July 22, 2024 to approve Ethereum ETFs. Crypto fans could be fast to identify that the Ethereum ETF approval was introduced in Might 2024. You will need to be aware that the companies which had acquired approval for Ethereum ETFs required legitimate registration statements. The SEC supplied approval for the revised registration statements of issuers to launch ETFs on exchanges.

Market consultants believed that the official approval for Ethereum would come by July 2, 2024. Nonetheless, the US SEC returned the S-1 varieties to the ETF issuers for revisions. After the approval for up to date S-1 filings by issuers, Ethereum ETFs might be out there for buying and selling from July 23, 2024. Allow us to unravel extra particulars in regards to the approval for Ethereum ETFs and what it means for the crypto market.

The most important sale of the 12 months is stay! Save as much as 50% on Accredited Certifications and Studying Plans, use code MIDYEAR.

Notable Gamers within the Ethereum ETF Race

The ultimate approval for Ethereum ETFs has propelled them into the limelight. One 12 months of battle for acquiring approval for ETH exchange-traded funds from the US SEC has lastly became some constructive information for the crypto panorama. Ethereum ETFs would allow conventional buyers to faucet into the potential of cryptocurrency investments. Bitcoin ETFs have proved the identical by drawing greater than $10 billion of funding after their launch in January 2024.

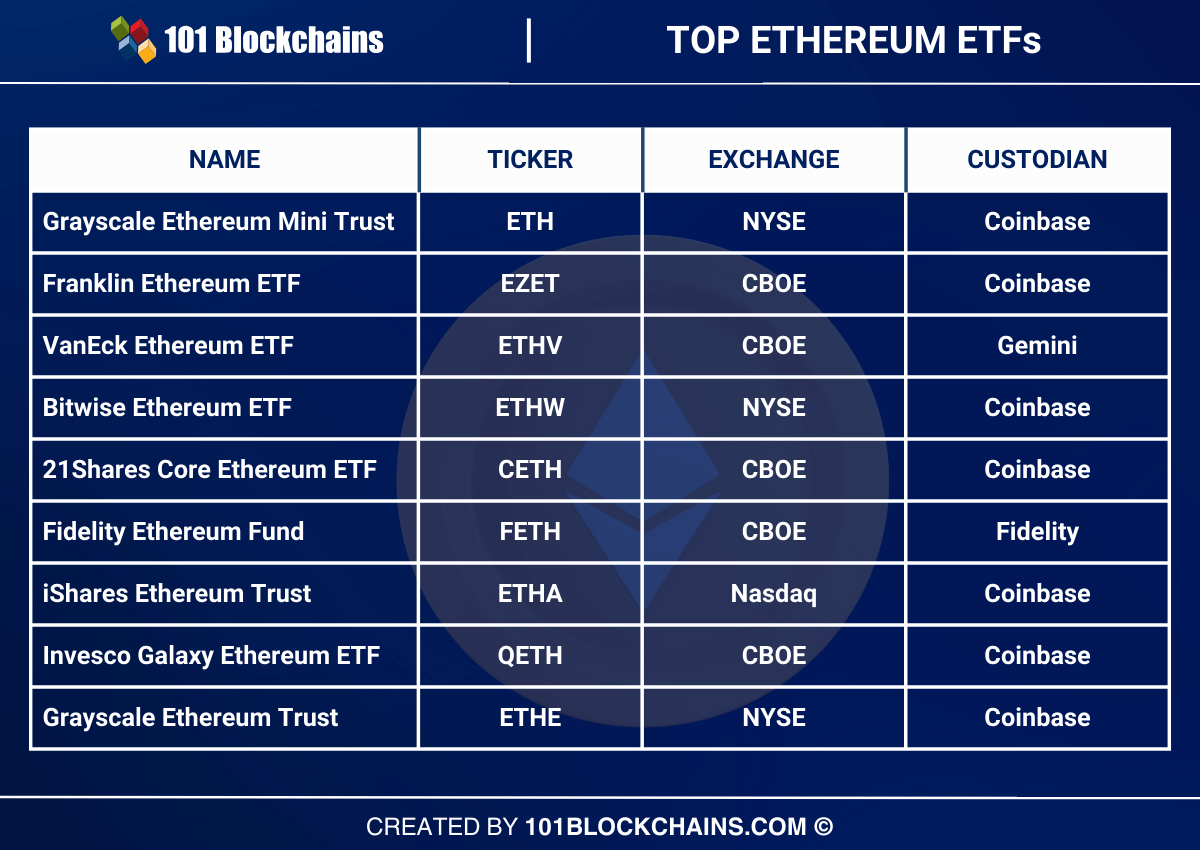

The spectacular potential of Ether ETFs creates alternatives in addition to the concern of dangers. Which gamers took the initiative to launch ETH ETFs? The SEC has supplied approval for eight ETFs by totally different issuers similar to Constancy, 21 Shares, Franklin Templeton, Bitwise, VanEck, BlackRock, Grayscale, Constancy and Invesco Galaxy. Grayscale takes an enormous leap by developing with two ETFs which have distinctive pricing ranges.

Study in regards to the fundamental ideas of Ethereum, similar to transactions, addresses, consensus, blocks, and vital instruments with the Ethereum Expertise Course.

The place Will You Discover the New Ethereum ETFs?

The approval for Ethereum ETFs is clearly thrilling information for conventional buyers. ETFs may help buyers profit from cryptocurrencies with out the inherent dangers and technical challenges. You may need some doubts concerning the locations to entry Ethereum ETF of your selection. The brand new spot ETH ETFs have every part to garner the eye of conventional buyers in the direction of alternatives within the crypto market.

The success of Bitcoin ETFs can be one of many causes for which you’d be inquisitive about platforms the place you’ll be able to entry Ether ETFs. Bloomberg has reported that you can find listings for many of the new Ether funds on the CBOE alternate. In style exchanges such because the New York Inventory Trade will even listing ETFs such because the Bitwise Ethereum ETF, Grayscale Ethereum Belief and Grayscale Ethereum Mini Belief. You too can select NASDAQ for BlackRock iShares Ethereum Belief ETF listings.

Familiarize your self with the favored blockchain community, Ethereum, and guarantee total, complete talent improvement with Ethereum Ability Path

Will Ethereum ETFs Keep within the Shadows of Bitcoin ETFs?

Bitcoin ETFs arrived in January 2024 and Ethereum ETFs are late to the get together. First movers within the ETF market have a aggressive benefit with a bigger market share within the early phases. Many wealth managers, advisors and buyers put their capital within the crypto area after the launch of Bitcoin ETFs. The launch of Ethereum ETF choices on exchanges is unquestionably a shock for a lot of buyers who’ve been following the ETF market intently.

You will need to be aware that the profitable debut of Bitcoin ETFs has created issues for the expansion of ETH ETFs. Ethereum ETFs can not turn out to be as well-liked as Bitcoin ETFs as Bitcoin enjoys a bigger market share. Then again, buyers who’ve invested capital in Bitcoin ETFs are much less more likely to shift to Ether funds. Many buyers have reached the utmost restrict of capital they’ll allocate to crypto with Bitcoin ETFs.

Buyers additionally select to chorus from promoting Bitcoin ETFs to purchase ETH ETFs as they wish to keep away from short-term capital good points taxes. The chances could also be in opposition to Ether funds in the intervening time, contemplating the dominance of Bitcoin ETFs out there. Trade consultants consider that Ethereum ETFs would nonetheless have a formidable impression as they might be larger than different ETFs. Buyers would have the chance to realize extra publicity within the crypto market by holding each Bitcoin and Ether funds.

Enroll now within the Bitcoin Expertise Course to study Bitcoin mining and the knowledge contained in transactions and blocks.

How Will Ethereum ETFs Have an effect on the Worth of Ether?

The pricing of ETH is among the notable issues for buyers and the crypto market after ETH ETF approval. You could find a common impression of the impression of Ethereum ETF approval on ETH pricing by trying on the instance of Bitcoin ETFs. The success of Bitcoin ETFs made historical past because the exchange-traded funds garnered billions of {dollars} as funding in just a few months. The pricing of Bitcoin reached new highs after the value elevated by over 58% in two months.

Analysts consider that Ethereum ETFs might not be as profitable as Bitcoin ETFs when it comes to inflow of investments. The pricing of Ether decreased by 1.5% after the announcement of approval by SEC to listing ETH ETFs on public exchanges. Skilled predictions level out that the value of ETF might develop as much as $6,500 in the long term. Analysis companies additionally recommend that the brand new Ether funds might garner round $15 billion to $20 billion in funding within the first 12 months.

Ethereum ETFs and the Barrier to Staking

One of the vital vital highlights of the newly launched ETH ETFs is the restriction on staking. Ethereum exchange-traded funds couldn’t stake the Ether they’re investing in. Staking can permit buyers to earn extra returns on their ETH belongings for securing the Ethereum blockchain. Nonetheless, the regulatory issues associated to staking have been a significant level of concern for regulatory our bodies whereas contemplating approvals for ETH ETFs. The barrier to staking reduces the potential of Ethereum ETFs to supply vital returns to buyers.

Last Ideas

The approval for Ethereum ETFs marks a revolutionary milestone within the evolution of the cryptocurrency panorama. Buyers can use any Ethereum ETF on a public alternate to profit from crypto investments with out worrying about possession or technical challenges of cryptocurrencies. The brand new Ether funds have lots of challenges to beat, particularly from Bitcoin ETFs, to turn out to be a major attraction for buyers. Ethereum ETFs have the potential to turn out to be well-liked as one of many early movers within the ETF market and with their various benefits.

*Disclaimer: The article shouldn’t be taken as, and isn’t supposed to supply any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be liable for any loss sustained by any one who depends on this text. Do your personal analysis!