Stablecoin distribution reveals liquidity patterns in DeFi

Stablecoins are the inspiration of the DeFi ecosystem. Given the comparatively excessive boundaries to entry for fiat currencies and the operational complexities related to bridging Bitcoin into DeFi protocols, they’re the essential conduits via which liquidity flows and fuels the sector.

Monitoring the distribution of stablecoins and their market caps throughout completely different blockchain platforms gives priceless insights into the liquidity distribution, threat publicity, and general well being of the DeFi ecosystem. As stablecoins symbolize a good portion of the liquid property inside DeFi, their distribution can point out each the vibrancy of financial exercise and the extent of consumer belief throughout completely different platforms.

Will increase in stablecoin market cap usually recommend rising confidence in DeFi as a secure and worthwhile enviornment for funding, indicating that extra capital is flowing into the market, able to be deployed throughout numerous protocols. Conversely, decreases may sign withdrawals or a possible shift in investor sentiment, presumably resulting from considerations over safety, profitability, or regulatory adjustments affecting the panorama.

Furthermore, the connection between stablecoins issued on a selected chain versus these bridged to it’s a refined indicator of the chain’s position inside the broader market. A blockchain with a better quantity of issued stablecoins than these bridged outward usually serves as a main hub for stablecoin creation and preliminary distribution, reflecting a sturdy, internally pushed DeFi setting. Then again, a series that has extra bridged stablecoins than issued may predominantly operate as a conduit or middleman between completely different networks, facilitating cross-chain liquidity and enabling broader interconnectivity inside DeFi.

This helps us see how interdependent the character of chains inside the DeFi ecosystem is and exhibits the significance of understanding stablecoin flows for predicting market tendencies and potential bottlenecks in liquidity distribution.

As of April 18, the entire stablecoin market cap is $154.752 billion. Diving deeper into the market cap reveals important variances in their distribution and utilization throughout numerous blockchain platforms.

Knowledge from DeFi Llama exhibits Ethereum and Tron are the dominant gamers in the DeFi area. Ethereum holds the most important share of stablecoins, with $80.479 billion, accounting for 52.02% of the entire market cap. It exhibits Ethereum’s dominant position in the DeFi ecosystem and cements its standing as the first platform for stablecoin issuance. The information exhibits that whereas a considerable quantity of stablecoin worth is issued on Ethereum, solely a minor portion ($16.21 million) is bridged to different networks, suggesting that it serves extra as a supply than a stablecoin economic system conduit.

Tron holds $55.538 billion or 35.9% of the entire market, with a exceptional 98.21% of this being Tether (USD). This focus alerts a particular desire or performance that customers discover interesting in Tron’s ecosystem, maybe resulting from its operational efficiencies or focused market methods that favor USDT. In contrast to Ethereum, nearly all of the stablecoin worth issued on Tron stays inside the ecosystem, displaying its closed nature.

Different chains like BSC, Arbitrum, Solana, Avalanche, and Polygon contribute to the stablecoin market however to a lesser extent, starting from 1.02% to three.16% of the entire market cap. The variations in issuance and bridging actions throughout these chains reveal their diversified roles. For example, BSC and Arbitrum, regardless of their smaller issuance quantities, see extra substantial bridging actions. This sample means that they operate as middleman networks, facilitating the motion of stablecoins slightly than being main issuance hubs.

| Rank | Title | 7d change | Stables Mcap | Dominant Stablecoin | Whole Mcap Issued On | Whole Mcap Bridged To | Stables Mcap/TVL |

|---|---|---|---|---|---|---|---|

| 1 | Ethereum | +2.06% | $80.479b | USDT: 54.98% | $88.842b | $16.21m | 0.72 |

| 2 | Tron | +1.23% | $55.538b | USDT: 98.21% | $57.709b | $0 | 6.9 |

| 3 | BSC | +2.04% | $4.898b | USDT: 75.12% | $626.81m | $4.279b | 0.72 |

| 4 | Arbitrum | -0.11% | $3.382b | USDT: 65.28% | $702.51m | $2.683b | 0.85 |

| 5 | Solana | +8.24% | $3.271b | USDC: 75.69% | $3.269b | $7.86m | 0.52 |

| 6 | Avalanche | +2.92% | $1.76b | USDT: 66.37% | $1.649b | $111.26m | 1.37 |

| 7 | Polygon | +3.27% | $1.585b | USDT: 52.96% | $227.65m | $1.359b | 1.6 |

The stablecoin market cap to whole worth locked (TVL) ratio gives insights into how a lot of a blockchain’s DeFi exercise is pushed by stablecoins. Chains like Tron, with a excessive ratio of 6.9, and Polygon, at 1.6, point out a major reliance on stablecoins inside their DeFi ecosystems, suggesting that stablecoin-based monetary merchandise are essential to their market. Conversely, decrease ratios in Solana (0.52) and Ethereum (0.72) level to extra diversified ecosystems the place different forms of property additionally maintain substantial significance.

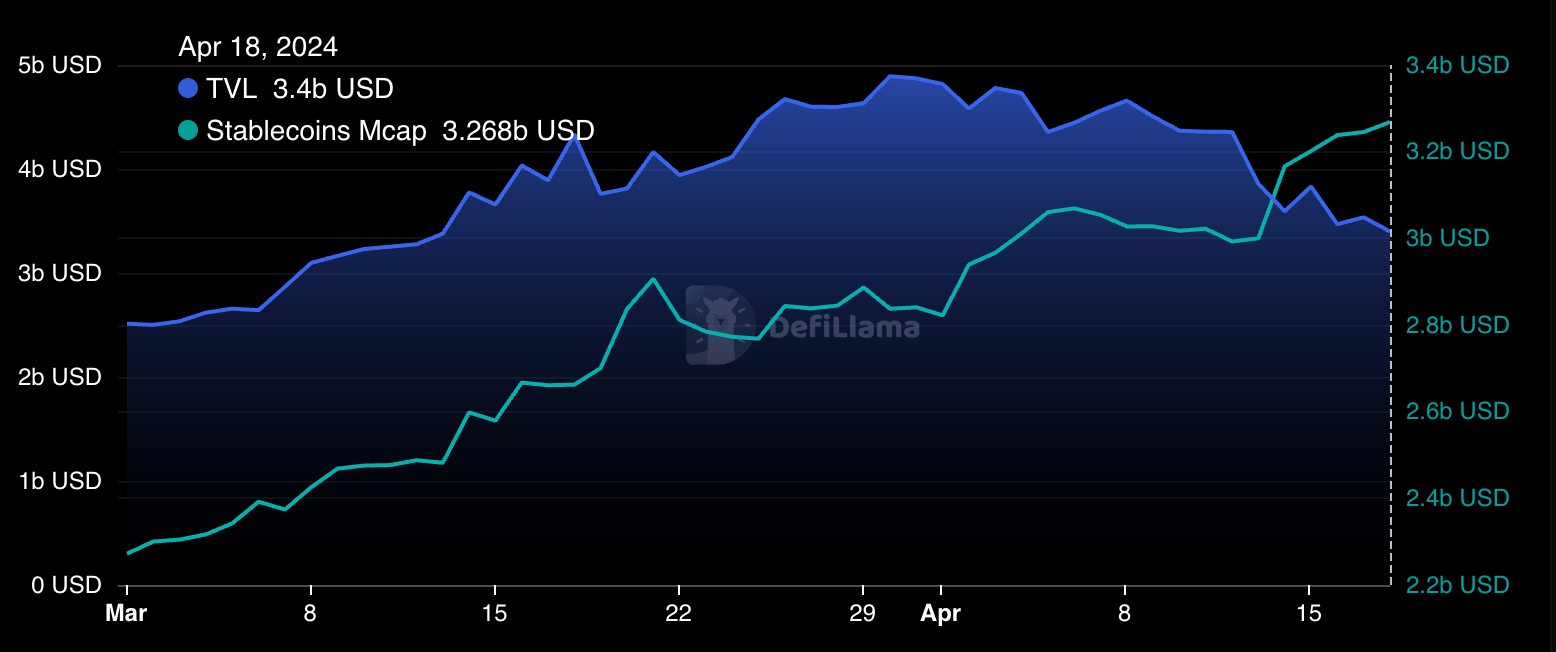

Solana has a novel profile in this broader context. Between April 13 and April 17, Solana’s stablecoin market cap elevated from $3 billion to $3.271 billion. Throughout the identical interval, the entire worth locked barely declined from $3.858 billion to $3.438 billion, displaying an rising focus of stablecoins relative to different property.

Inside Solana, the distribution is notably skewed in the direction of USD Coin (USDC), which noticed a major enhance of 30.11% over the previous month, reaching $2.474 billion. This progress contrasts with Tether (USDT), which holds a smaller share at $774.74 million and witnessed a slight lower. The presence of smaller gamers like UXD Stablecoin, though minor in comparability, signifies rising alternatives and area of interest purposes inside Solana’s DeFi panorama.

| Title | 1m % Change | Market Cap |

|---|---|---|

| USD Coin (USDC) | +30.19 | $2.475b |

| Tether (USDT) | -0.68% | $774.3m |

| UXD Stablecoin | +23.90% | $9.23m |

| Parrot USD (PAI) | -1.70% | $5.15m |

| USDH (USDH) | -15.73% | $2.68m |

Desk displaying the distribution of stablecoins on Solana and their 30-day change in market cap on April 18, 2024 (Supply: DeFi Llama)

The distinction in stablecoin distribution and utilization throughout chains exhibits a posh market the place every chain helps stablecoins in another way and displays the broader strategic and operational priorities inside the DeFi ecosystem. With its rising reliance on USDC, Solana has a particular method to stablecoin integration, which may have an effect on its positioning and strategic improvement in DeFi.

The submit Stablecoin distribution reveals liquidity patterns in DeFi appeared first on CryptoSlate.