State of the Network’s 2023 Year in Review

Get the greatest data-driven crypto insights and evaluation each week:

By Kyle Waters & Tanay Ved

On this particular subject of State of the Community, we revisit the main tales that formed the digital property trade in 2023 by way of a data-driven lens.

After a difficult 2022, this previous 12 months introduced a quantity of optimistic developments throughout the ecosystem, from new institutional entrants to key technical upgrades. Whereas the regulatory atmosphere was arguably the most difficult it has ever been, particularly in the US, the new battles ought to pressure readability on a quantity of excellent questions. With a interval of financial tightening seemingly coming to an finish, each crypto and equities surged in 2023, with many digital property posting beneficial properties above 100%, together with bitcoin (BTC), which has risen 150% in 2023. The desk beneath exhibits the efficiency of all property in the datonomyTM universe with a market cap above $1B.

Supply: Coin Metrics DatonomyTM and Reference Charges (as of December 17th, 21:00 UTC)

The beginning of 2023, nonetheless shadowed by the FTX collapse, noticed a swift turnaround in digital asset markets, with BTC climbing from $16K to $23K in January—an increase that may set the tempo for the complete 12 months. A rising sentiment began to emerge that the worst was over, and that FTX’s downfall, as a centralized entity, didn’t tarnish the core rules and potential of public blockchain know-how.

Nevertheless, occasions early in the 12 months additionally launched a recurring theme for 2023: escalating regulatory strain in the United States. A collection of enforcement actions in Q1 demanded the digital property trade’s consideration, together with the SEC’s Wells discover to stablecoin operator Paxos over Binance’s stablecoin BUSD, resulting in the halting of BUSD issuance. BUSD’s provide plummeted from a peak of $16B to $1B over the 12 months, dropping $4B in the week after the discover. The BUSD enforcement marked the starting of a broader effort from US regulators to rein in offshore alternate big Binance, the largest alternate by spot quantity. In March, the US Commodities Futures Buying and selling Fee (CFTC) unveiled a civil enforcement in opposition to Binance and its founder Changpeng Zhao (“CZ”) for quite a few alleged regulatory violations.

Onshore operators have been additionally topic to new regulatory scrutiny. Many began to face intensifying strain in Q1, with financial institution regulators publishing casual steering paperwork singling out cryptocurrency and cryptocurrency prospects as a threat to the banking system, main some in the trade to go so far as dubbing the actions “Operation Choke Point 2.0”—an alleged coordinated, government-led marketing campaign to stymie the digital property trade in the US.

Zooming out to the macroeconomic atmosphere, banks started to face a secular, however troubling scenario of devaluing treasury securities amid a fast improve in rates of interest, most notably impacting the tech-friendly Silicon Valley Financial institution (SVB). SVB’s collapse in March, following a financial institution run, not solely raised considerations about the well being of the US banking sector, but in addition examined the stability of the USDC stablecoin, as Circle had $3.3B of its reserves held at SVB. USDC’s value briefly dipped earlier than recovering again to the $1 peg following federal assurances which assured all deposits.

The turmoil led to a reshuffling of the $100B+ stablecoin market, with a notable shift from USDC to offshore-issued Tether (USDT). It additionally marked a rising divergence between Tether and USDC, a development that may proceed in 2023. The banking disaster additional impacted crypto asset liquidity by disrupting real-time fee techniques like the Silvergate Change Community and Signature Financial institution’s Signet, after the two crypto-friendly banks have been additionally shuttered.

Source: Coin Metrics Network Data Pro

Regardless of the challenges, BTC and ETH skilled a rally in the speedy aftermath of the SVB disaster. The core options of digital bearer property like bitcoin—ease of self-custody, lack of intermediation, and on-chain transparency—turned extra pronounced than ever, resonating with the authentic sentiment that led the pseudonymous Satoshi Nakamoto to introduce Bitcoin throughout the Nice Monetary Disaster in October 2008.

This momentum would carry over to Q2, placing a chord with establishments that started to precise higher appreciation for Bitcoin’s distinctive qualities.

The search for a spot bitcoin ETF in the US has been ongoing since 2013, with the US Securities and Change Fee (SEC) persistently rejecting proposals to introduce a spot ETF product to American monetary markets. The importance of a spot ETF lies in its potential to supply traders a well-recognized and probably extra tax-efficient strategy to embrace BTC in their brokerage accounts and portfolios. The influence of the first gold ETFs in the early 2000s, like the well-known GLD, is a major instance of what many hope to see with the launch of a bitcoin spot ETF. Regardless of the SEC’s inexperienced mild for futures-backed bitcoin ETFs in 2021, these merchandise are usually not superb for holding long-term attributable to vital monitoring errors to the spot value over time, alongside excessive expense charges and taxable distributions.

However issues shortly modified in June of this 12 months when BlackRock, the world’s largest asset supervisor with over $9 trillion in property below administration, filed for the iShares Bitcoin Belief on June 15th. This transfer immediately injected a renewed legitimacy into the ETF effort, with BlackRock’s CEO Larry Fink recognizing bitcoin as a world asset that might “transcend any one currency.” Following BlackRock’s daring step, earlier candidates, together with Constancy, WisdomTree, Bitwise, VanEck, Invesco, Valkyrie, and ARK, re-entered the race, reigniting the push for a spot bitcoin ETF and signaling a rising institutional urge for food for bitcoin and a recognition of its potential position in a diversified portfolio.

Whereas Coinbase secured a major partnership with BlackRock, turning into a key crypto-native ally as BlackRock’s chosen custodian in the ETF utility, the month of June additionally noticed the SEC launch a landmark case in opposition to the main US alternate. The SEC accused Coinbase of working as an unregistered securities alternate and labeled varied property, together with SOL, MATIC, and ADA, as alleged securities. This motion introduced the long-standing trade debate about the distinction between crypto securities and commodities into sharp focus. In response, Coinbase swiftly moved to counter the allegations, and the broader trade is now bracing for an end result that might considerably affect the future trajectory of the digital property trade in the US.

Regardless of a collection of exterior occasions each optimistic and unfavorable, the trade continued to push forward this 12 months, advancing with key deliberate upgrades. In April, Ethereum accomplished its ‘Shapella’ onerous fork, which activated withdrawals of staked ether (ETH) and validators’ amassed staking rewards. The success of the improve eradicated earlier liquidity dangers related to staking, and instantly enticed a brand new surge of staking deposits, a development that may proceed all through most of 2023. At the same time as the staking APR at the moment hovers round 4%, staked ETH has hit 28M, or simply below one quarter of the complete ETH provide.

Source: Coin Metrics Network Data Pro

The improve introduced much-needed assurances to Ethereum validators staking their ETH, as the final leg of a years-long course of to maneuver Ethereum from a proof-of-work to proof-of-stake system, principally completed by way of The Merge, was accomplished with out subject. With issuance falling 90% after The Merge, 2023 additionally marked the first full 12 months in which Ethereum’s provide declined, after making an allowance for payment burning.

Supply: Coin Metrics Labs

The second half of 2023 introduced a reinforcing shift, with vital authorized victories and the re-engagement of establishments offering a counterbalance to the regulatory pressures of earlier months.

Notably, Ripple’s triumph in its protracted authorized battle in opposition to the SEC marked a cornerstone occasion. The US District Court docket issued a partial summary judgment on July 13th , establishing that secondary gross sales of XRP on exchanges didn’t represent securities transactions. This ruling not solely vindicated Ripple but in addition set a precedent that challenged the SEC’s strategy in classifying digital property, reverberating throughout the trade and influencing the regulatory therapy for different digital property alleged as securities below the regulators purview.

Supply: Coin Metrics Institutional Metrics

Parallel to this authorized watershed, Grayscale’s win in opposition to the SEC marked one other necessary turning level. The case centered round Grayscale’s bid to transform its Bitcoin Belief (GBTC) right into a spot bitcoin ETF, which the SEC initially rejected. Nevertheless, on August 29th, the Court docket of Appeals overturned this resolution, deeming that its denial was “arbitrary and capricious” highlighting the SEC’s inconsistent therapy of comparable merchandise, particularly given the existence of Bitcoin futures ETFs. This victory considerably fueled market-wide anticipation round the launch of bitcoin spot ETFs, a sentiment mirrored in the narrowing of GBTC’s low cost to its internet asset worth (NAV) from -40% to -10%.

These regulatory milestones hinted at a moderation to this SEC administration’s strategy to crypto regulation, paving the method for broader entry and a part of maturation for the asset class. Concurrently, this shift emphasised the want for clearer rules, particularly as extra dynamic regulatory environments offshore spurred exercise in markets like the UAE, Hong Kong, EU, and UK.

Source: Coin Metrics Network Data Pro

New product launches additionally added to the pleasure, significantly invigorating discussions about stablecoins, a key theme all through 2023. Funds giants like PayPal and Visa entered the fray with the former launching PayPal USD (PYUSD) on the Ethereum blockchain and the latter ramping up stablecoin settlement initiatives. The launch of the Federal Reserve’s immediate funds system, FedNow, additionally re-ignited the discourse round its potential influence on the present stablecoin panorama, and the course of the central financial institution’s digital forex initiatives.

Nevertheless, FedNow’s home attain emphasizes the worth proposition of stablecoins, which function a world medium of alternate, facilitating cross-border funds and bridging the on-chain and off-chain economic system. This tangible influence is clear in the chart above, with the largest fiat-backed stablecoins USDT and USDC settling $4.2 trillion and $1.7 trillion respectively. These developments, together with new entrants comparable to protocol-native stablecoins and interest-bearing stablecoins painting the rising range and evolving position of stablecoins in the broader monetary ecosystem.

Exterior of the stablecoin panorama the launch of Coinbase’s layer-2 community, Base, garnered vital consideration and sparked a wave of exercise on rising purposes on the platform. This marked a pivotal step in the proliferation of layer-2 options, particularly in the context of Ethereum’s upcoming EIP-4844 improve, geared toward enhancing community scalability. Regardless of broader challenges from a tightened monetary atmosphere and sector particular occasions like good contract exploits as skilled by Curve Finance, the quarter introduced a major basis for future development.

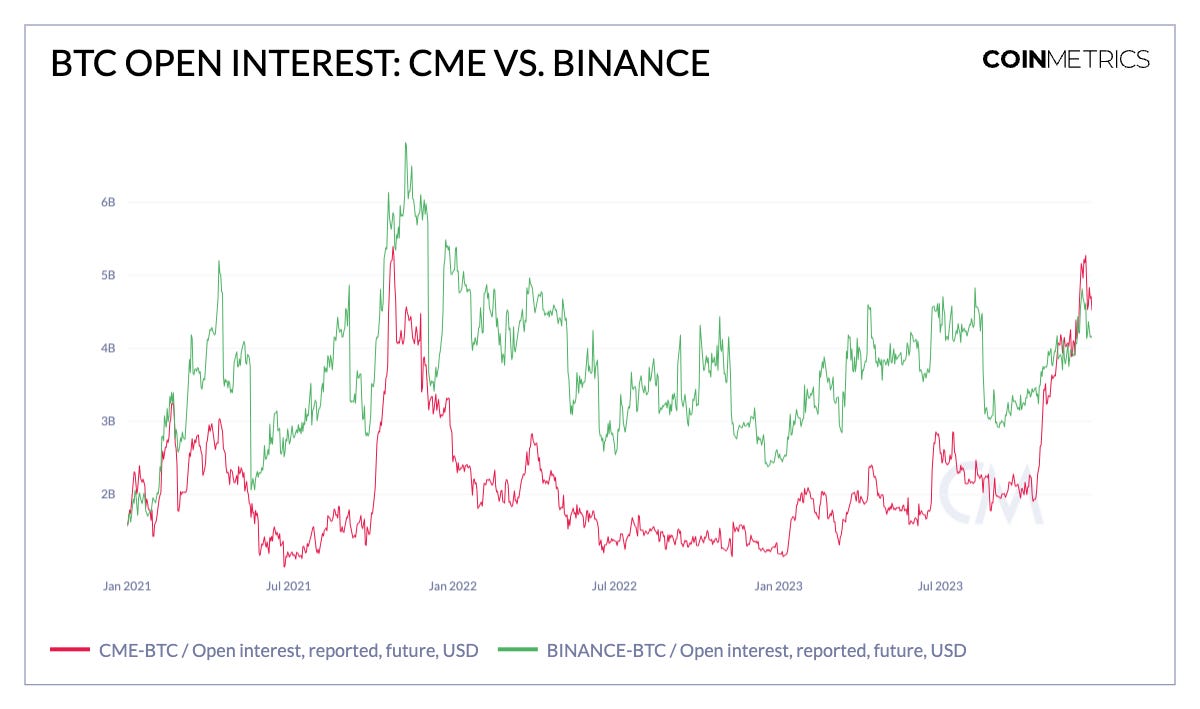

A revitalization in digital asset markets unfolded in This fall as BTC surged over 50%, marking a resurgence in market sentiment and valuations. This rebound was pushed by heightened institutional curiosity, as mirrored in the near-record levels (over $5 billion) in BTC futures open curiosity on the Chicago Mercantile Change (CME), a venue most popular by institutional individuals. This provided clearer proof of Bitcoin’s evolving market construction, as traders actively positioned themselves in anticipation of a spot bitcoin ETF and the subsequent Bitcoin halving. Accompanying this surge in derivatives market exercise, spot volumes escalated to yearly highs. Supply trends additionally bolstered a bullish outlook, with free float provide hitting the lowest ranges since March 2017, and solely 30% of BTC shifting in the previous 12 months, indicating a robust holder base.

Source: Coin Metrics Market Data Feed

The rally broadened past Bitcoin in a cyclical vogue, buoying different sectors of the crypto ecosystem. Grayscale’s Belief merchandise noticed a major discount in reductions and, in some circumstances, achieved spectacular premiums with the likes of GSOL and GLINK buying and selling at premiums of 869% and 250% respectively in November. Various layer-1 blockchains additionally skilled a strong restoration, with Solana (SOL) rising as a standout because it dissociated from prior FTX associated affiliations. An engaged group, rising ecosystem of purposes and infrastructure on the community bolstered Solana’s credibility as a layer-1 platform and ignited conversations round the proliferation of monolithic blockchains amid a rising sea of modular blockchains and layer-2 networks. The surge was not solely contained to valuations. On-chain exercise additionally rebounded with a heightened payment market on each the Bitcoin and Ethereum networks, whereas stablecoin provide turned optimistic after a interval of decline, pointing to indicators of returning liquidity.

Constructing on the thread of prior affiliations, the trial culminating in the conviction of Sam Bankman Fried (SBF), introduced a definitive finish to the trade’s most tumultuous episodes with FTX’s downfall. Concurrently, Binance’s settlement, involving a $4 billion wonderful and the stepping down of Changpeng Zhao (CZ), resolved long-standing allegations surrounding the largest alternate. One other announcement of significance which went below the radar was the Monetary Accounting Customary Board’s (FASB) adjustments to crypto accounting requirements. This replace will permit firms that maintain digital property on their stability sheet to acknowledge property at “fair value” quite than treating them as intangibles, lowering the frictions confronted by such corporations at the moment, whereas incentivizing extra possession. For instance, it will allow Microstrategy (MSTR), a public firm holding over 17,500 BTC, to understand income or losses on their stability sheet in accordance with the measurement interval.

These developments collectively closed a chapter of uncertainty that clouded the trade, paving the method for a extra mature and optimistic future for the asset class.

Supply: Coin Metrics Reference Charges, Indexes & Google Finance (Click on for bigger view)

Amid a backdrop of decade-high inflation, monetary tightening and rising geopolitical tensions, digital asset markets have grappled with vital macroeconomic challenges. Nevertheless, stakeholders have navigated these complexities adeptly, resulting in development in new sectors comparable to tokenized treasuries and real-world property (RWA’s). The energy in digital property is clear once we look again at returns by main asset courses in the investable universe over 2023. The outperformance of crypto-related equities and digital property shines by way of, with Coinbase (COIN) a significant beneficiary of the market rebound. As macroeconomic tides probably endure a shift over the coming months, the digital asset trade is primed for a part of maturation and enlargement.

We launched a quantity of particular reviews in 2023, be sure you discover all of them right here: https://coinmetrics.io/insights/special-insights/

-

Exploring Provide Transparency, with Bitcoin Suisse

-

DeFi’s Double-Edged Sword

-

Decoding the Digital Greenback

-

From Orange Groves to Orange Gold

-

The Sign & the Nonce

-

Decoding Crypto Pricing

-

What’s MEV Anyway?

Additionally be sure you take a look at our 150th issue of State of the Market, the place we offer an outline of crypto market exercise from December 7th – December 13th, 2023.

As all the time, in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier points of State of the Community right here.