State of the Network’s 2024 Outlook

Get the greatest data-driven crypto insights and evaluation each week:

By: Kyle Waters & Tanay Ved

Digital property rebounded sharply in 2023 as market circumstances improved throughout the board and institutional curiosity accelerated alongside the impending launch of a spot Bitcoin ETF. Trying to 2024, there are a selection of essential developments on the horizon. On this situation of State of the Community, we provide our perspective on some of the greatest developments to observe in 2024 in the digital property trade.

After a decade-long effort, the closing steps to introduce a spot Bitcoin ETF to the US monetary markets are underway, with merchandise seemingly launching from a quantity of high-profile issuers like BlackRock and Constancy Investments in 2024. The long-awaited approval of spot ETFs carries many implications that would form the digital property marketplace for years to return.

As the trade anticipates the SEC’s determination on the ARK & 21Shares Bitcoin ETF, the issuer with the earliest closing deadline of January tenth, the newest amended SEC filings from issuers seem to sign an impending inexperienced mild from the SEC at the time of our writing. Nevertheless, the specifics relating to the preliminary wave of approvals and the precise launch date stay unsure. It is broadly anticipated that the SEC will concurrently approve a number of issuers to keep away from perceived favoritism, as noticed in the Ethereum futures ETF launch final fall. Presently, there are 11 main spot ETF filers which are ready for a possible approval in the coming week. There are various completely different elements to the launch corresponding to the estimated magnitude of inflows to the ETFs, the aggressive dynamics between ETF issuers, and Bitcoin’s maturing market construction. Some issuers have already begun a marketing push, whereas different issuers look to compete on having the lowest charges. How precisely this “Cointucky Derby” performs out at the onset continues to be unsure.

We consider it’s additionally essential to contemplate Bitcoin’s on-chain provide dynamics, which can evolve in the medium time period, and the place Coin Metrics’ knowledge might help shed the most mild. Bitcoin’s provide, simply auditable and trackable on-chain, helps make it a novel monetary asset. Anybody who runs a Bitcoin node can hint the whereabouts of all BTC and observe cash as they transfer. This enables us to infer holder conduct, the dispersion of provide, energetic addresses, and many other on-chain metrics that will be not possible to compute for a extra opaque asset. An essential development working parallel to ETF talks is an growing proportion of bitcoin being held by long-term holders. As proven in the chart beneath, over 6 million BTC, or 30% of the whole provide at the moment, hasn’t moved in over 5 years. We take into account this dormant BTC as excluded from Bitcoin’s “free float” provide. For extra on Bitcoin’s latest provide dynamics and free float vs. illiquid provide, see our joint report with Bitcoin Suisse from final fall.

Source: Coin Metrics Network Data Pro

Furthermore, solely 30% of all BTC was energetic on-chain in 2023, with the majority remaining untouched. Though it can be crucial to not oversimplify the determinants of BTC’s value, a dynamic variable impacted by many unknowns, this rising illiquidity blended with outsized inflows into the ETF may squeeze the market, thereby encouraging extra provide to enter the liquid market.

Many different components will likely be fascinating to observe. Counteracting forces will shake up the onshore crypto trade panorama, with an ETF probably attractive consumers away from spot exchanges via decrease charges and fewer frictions. However at the identical time, exchanges like Coinbase are set to realize as an ETF custodian (Coinbase is the named custodian in 8 of the 11 main filings together with BlackRock’s iShares Bitcoin Belief). Extra broadly, the ETF is predicted to reinforce and affirm the legitimacy of digital property, seemingly benefiting US exchanges down the street as the trade continues to mature. Common spot quantity on Coinbase has already jumped above $2B per day on the again of enhancing market sentiment revolving round the ETF. In the meantime, the soar in CME Bitcoin futures open curiosity is reflective of a shifting market construction targeted on the US monetary markets.

With such a transformative growth on the horizon, this yr might mark the transition of digital property from a distinct segment to an rising asset class. With BlackRock and others additionally submitting for an Ethereum spot ETF, the potential approval of an ETH product may also be on trade members’ minds in 2024. However BTC is about to go first in a yr coinciding with one other huge provide occasion able to dominate Bitcoin’s narrative in 2024: the subsequent Bitcoin halving.

One of Bitcoin’s core worth propositions lies in the programmatic nature of its financial coverage. Each 210,000 Bitcoin blocks, or about each 4 years, the quantity of newly issued bitcoins cuts in half in an occasion often called a “halving.” Bitcoin block 840,000, anticipated to be mined this upcoming April, will cut back the reward for newly mined blocks from 6.25 BTC to three.125, marking the 4th halving in Bitcoin’s historical past and a key milestone for the protocol as its issuance undergoes exponential decay on the path to Bitcoin’s finish provide of 21M.

Source: Coin Metrics Network Data Pro

Though the halving is a predictable factor of Bitcoin, it nonetheless carries some essential implications. The primary is the impression on Bitcoin miners, who’re incentivized to speculate capital and power into securing the community in trade for BTC. Miner income is derived from new BTC issuance, which is decreased via the halving, and costs paid by transactors, that are a operate of demand for Bitcoin blockspace. The halving impacts miner economics by nearly definitely lowering whole mixture miner revenues in greenback phrases, whereas pressuring the margins of operators with excessive power prices and/or inefficient {hardware}.

Illustrated merely, if the halving had occurred in April of 2023, miners would have made $6.8B instead of the $10.3B in whole income they acquired final yr. Nevertheless, the year-end increase in BTC’s value and the resurgent charge market helped miners in 2023, displaying how the halving doesn’t essentially imply that yearly USD revenues will fall by 50% precisely. Nonetheless, with hashrate hitting an all-time excessive above 500 EH/s, miners are racing to realize economies of scale and modernize their ASIC fleets to place themselves for continued success after the halving.

As in previous halvings, there may be prone to be renewed debate surrounding the halving’s impression on bitcoin’s provide and demand dynamics, and whether or not this discount in issuance is already “priced in.” In a single camp, there are those that consider that the Bitcoin halving, inherently programmed into the protocol’s guidelines, is an occasion well-understood prematurely—particularly by the rising quantity of subtle establishments researching Bitcoin. On the different hand, some clarify the halving via a flows-based lens, noting that gross sales from miners, who’re pure sellers of BTC, will abate post-halving. Extra abstractly, additionally they consider the halving serves as a reinforcement of Bitcoin’s financial properties and advances BTC as a dependable retailer of worth, attracting new curiosity via the consideration every halving brings.

The market will seemingly really feel the results of halving-related sentiment all through 2024. A lot of the consideration will fall on miner profitability, and drive new dialogue round Bitcoin’s must ultimately shift in the direction of a fee-based income mannequin for miners. However the halving additionally corresponds to a pivotal second in Bitcoin’s historical past with the launch of spot ETFs in the US. Although future outcomes needn’t mirror previous ones, the historical past of Bitcoin aligns neatly with its four-year halving epochs. This new epoch is poised to be simply as momentous.

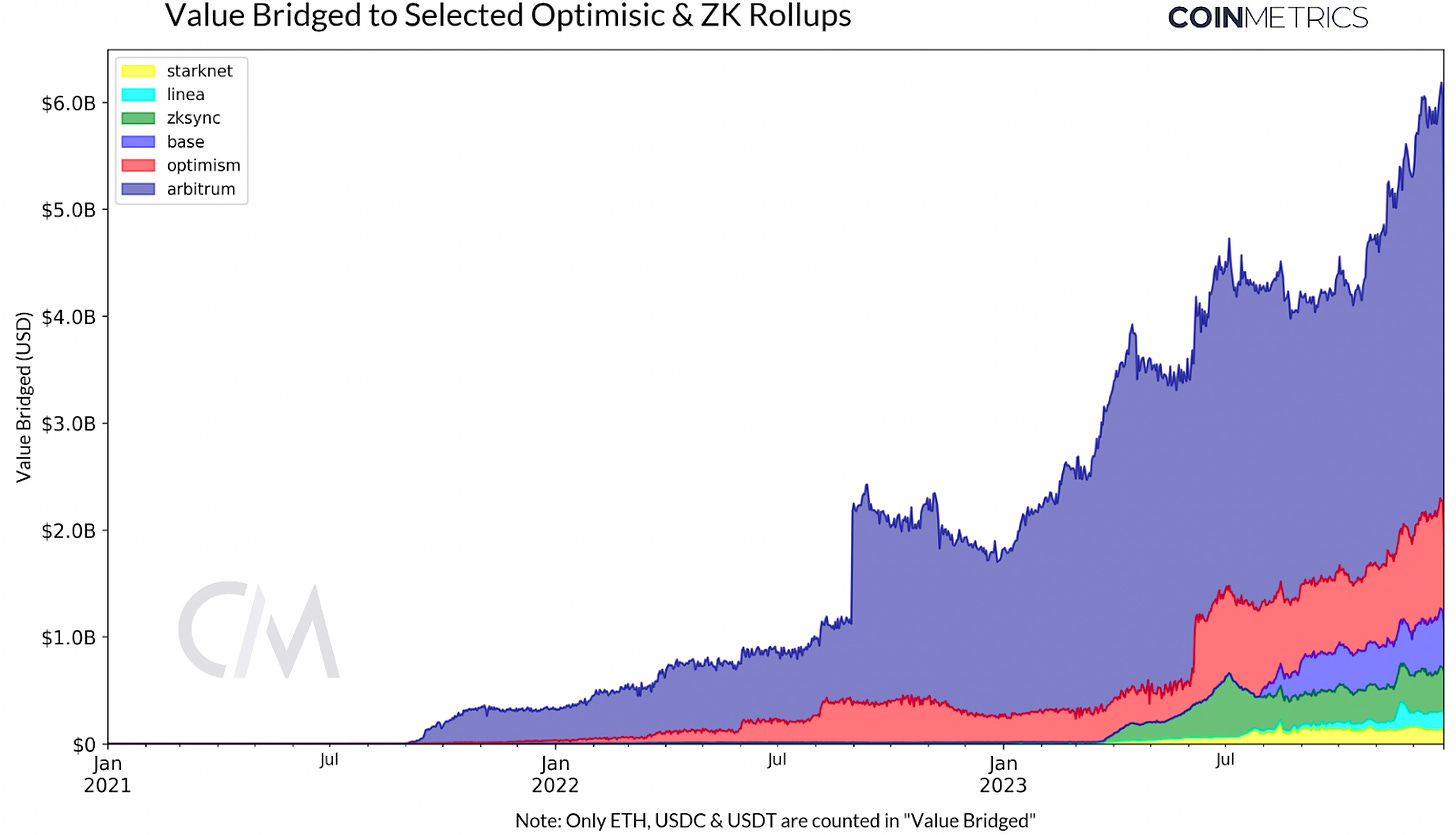

Layer-2 (L2) options have been integral in tackling Ethereum’s scalability challenges, together with excessive gasoline charges and restricted transaction throughput, which have affected consumer experiences particularly in periods of excessive blockspace demand. L2 options, like Optimistic & ZK-rollups, bundle a number of transactions right into a single “rollup” and course of them off-chain, whereas leveraging the Layer-1 (L1) community as a “data availability layer” for settlement and safety. This technique has been instrumental in lowering common transaction charges from about $8 on the mainnet to roughly $0.01 on L2’s like Arbitrum. Nonetheless, with the speedy proliferation of rollups, the prices related to storing knowledge on-chain has emerged as a focus of dialogue and an important step ahead in Ethereum’s evolution (see part on EIP-4844 beneath).

Bridges have performed an essential function on this transition, facilitating the motion of property between Ethereum mainnet and varied L2’s. As seen beneath, canonical Optimistic & ZK Rollup bridges have seen a big circulation of ETH, and ERC-20 tokens corresponding to USDC & USDT locked of their contracts—reflective of a rising demand to transact on layer-2 networks. Whereas optimistic rollups corresponding to Arbitrum and Optimism host the lion’s share of property with 1.3 Million and 330K ETH bridged, the L2 panorama continues to develop with the introduction of Coinbase’s Base, ZK-rollups (zero-knowledge) and software particular rollups optimized for explicit use circumstances.

A pivotal step on this transition is the ‘Dencun’ hard-fork, with its activation probably arriving by Q2 2024. By means of Ethereum Enchancment Proposal (EIP) 4844 (“proto-danksharding”), this improve is about to introduce the idea of “blob-carrying transactions,” a brand new transaction kind enabling rollups to retailer giant quantities of knowledge on Ethereum L1 (knowledge availability) for shorter durations at decrease prices. That is anticipated to cut back the operational overhead for rollups whereas additional lowering transaction charges on L2s, finally enhancing the financial feasibility of utilizing Ethereum and unlocking new use circumstances.

Regardless of progress in the direction of Ethereum’s rollup-centric roadmap and the anticipated Dencun hard-fork, lingering questions on the long run effectivity and consumer expertise inside the ecosystem stay. Complexities in asset bridging and the want for standardization, coupled with the speedy proliferation of rollups fragmenting customers and liquidity, underscore the significance of interoperability amongst these ecosystems. As Ethereum adopts a modular method to alleviate its limitations, it additionally contends with the potential re-distribution of sure actions away from its layer-1, a shift that would affect the trajectory of Ethereum mainnet and the utility of ETH. Regardless of some legitimate critiques, the Ethereum ecosystem will nonetheless head into 2024 holding a big lead in a quantity of essential classes together with stablecoin liquidity, DeFi exercise, whole charges spent by customers, and several other different measures.

Nevertheless, in parallel to Ethereum’s L2 roadmap, the resurgence of different layer-1 blockchains like Solana and Avalanche—reaching returns of 975% and 300% respectively over the yr—is refocusing consideration on their architectural trade-offs. The core of this dialogue juxtaposes the monolithic method, like that of Solana, which unifies execution, knowledge availability, and consensus in a single layer in opposition to Ethereum’s modular method, which splits some of these capabilities. This distinction is central to the discourse round good contract platforms and can proceed to affect the debate round their relative dominance, finally trickling into discussions round commerce offs of scalability, consumer expertise, safety, and the ecosystem of purposes.

It’s clear that there are a selection of competing efforts underway to scale good contract platforms; nonetheless, it’s nonetheless unclear if a single winner will emerge or if a mess of options will exist alongside one another. It’s unlikely 2024 will yield a definitive reply. But, it’s obvious that there’s vital demand for blockspace, and as we’ll see in the subsequent part, there are lots of rising purposes that may search out dependable and low-cost blockspace in 2024.

Stablecoins have been a central theme all through the previous yr, which we consider will proceed to persist into 2024. Over 2023, the $120+ billion stablecoin market noticed a significant re-shuffling as the market grappled with occasions corresponding to Silicon Valley Banks collapse. This influenced the trajectory of the two largest fiat backed stablecoins, Tether and the onshore issued USDC with their supply trending in reverse instructions. But regardless of shedding some market share in 2023, USDC issuer Circle is contemplating going public in the US in 2024, its enterprise boosted closely by rising charges in 2023, whereas it plans an growth overseas in locations like Japan and Brazil. In the meantime, the stablecoin sector in mixture has continued its expansion going into 2024, cementing its worth proposition and powerful product market match inside the digital asset ecosystem.

This growth is exemplified by newer stablecoins gaining adoption, corresponding to PayPal’s PYUSD, the Euro-backed EURCV issued by Société Générale, and protocol-native stablecoins like Aave’s GHO. This development is obvious not solely in the selection of stablecoins—starting from fiat-backed to crypto-backed—but in addition in the variety of issuers, together with funds and monetary establishments. Furthermore, interest-bearing stablecoins, backed by off-chain property like tokenized treasuries and on-chain collateral corresponding to ETH and liquid staking tokens (LSTs), are gaining traction. Whereas these developments are nonetheless rising and carry distinct threat profiles, they maintain the promise of enriching the evolving stablecoin ecosystem.

Working parallel to the speedy rise of stablecoins on public blockchains is the ongoing analysis and growth round Central Financial institution Digital Currencies (CBDCs). With some nations like Brazil hoping to launch a CBDC in the new yr, 2024 might present a brand new lens for evaluating permissionless vs. centralized digital monetary infrastructure.

As we anticipated in 2023, the actual world asset (RWA) ecosystem has seen substantial progress over the previous yr. This has been fueled by two main classes in the house, specifically the tokenization of public securities and personal credit score, with each themes bridging the hole between the conventional finance and the digital asset financial system. Whereas tokenization of public securities has introduced the huge market of conventional monetary property corresponding to US Treasuries to public blockchains, globalizing their entry, non-public credit score initiatives have served the wants of rising economies via autos to entry low-cost credit score. The marketplace for tokenized treasuries surpassed $500 million in 2023, partly fueled by the Federal Reserve’s price climbing cycle growing the attractiveness of yield supplied via the “risk-free” price—buoying initiatives like Ondo’s OUSG to $175 million in market capitalization and offering a lift to MakerDAO’s revenues. Sooner settlement instances, enhanced transparency and cheaper operational prices are some of the worth propositions introduced by blockchains which are serving to speed up this development as the alternative expands to different monetary devices like equities, non-public market funds and actual property.

Trying forward, initiatives like Coinbase’s layer-2 community Base are set to propel the RWA sector’s progress. “Project Diamond”, leveraging Base’s scaling capabilities, Coinbase’s pockets and custody companies, and Circle’s USDC stablecoin goals to create a regulated capital market for digital monetary devices. Equally, “Project Guardian”, a collaboration involving JP Morgan, Apollo, and the Financial Authority of Singapore, displays a rising curiosity in tokenization amongst monetary establishments. Though some RWA initiatives have occurred on permissioned blockchains, limiting their full potential, the growth of this sector on public blockchains holds nice promise.

In the Ethereum DeFi ecosystem, liquid staking has surged submit the Shapella improve, with almost 29 million ETH staked on the Beacon chain and Lido managing near 32% of this whole (9 million ETH). This existence of an on-chain yield, rewarded for validating the community, has boosted ETH’s attraction as a productive capital asset. Layer-2s bridges like Blast, staking idle ETH for yield era, additional accentuates this development. The 2024 launch of EigenLayer mainnet will introduce restaking, enabling the use of staked ETH to bootstrap financial safety for different networks like knowledge availability layers, oracles, or bridges, primarily re-using Ethereum’s safety mannequin. Whereas restaking would supply better incentives via increased yields, it may additionally amplify good contract, operator, and slashing related dangers, making it a key theme to observe in 2024.

Inside the bigger DeFi ecosystem we anticipate decentralized exchanges (DEX’s) and lending protocols to play an important function in 2024, significantly with Uniswap v4 anticipated to enter the scene. The brand new iteration will allow the creation of personalized swimming pools and buying and selling methods by way of “hooks” together with gasoline price reductions enhanced by the Dencun improve. As protocols change into extra generalized, they are going to provide better flexibility and management over threat administration which can externalize some complexities, but in addition cater to a broader viewers and selection of use circumstances.

Blockchains are more and more impacting non-financial purposes, as seen with decentralized bodily infrastructure (DePIN). By facilitating useful resource sharing in areas like storage (Filecoin), networking infrastructure (Helium), and compute (Akash) via token incentives, entry to those important assets is being democratized. That is additionally essential in the realm of synthetic intelligence, enabling international, permissionless participation in compute markets at the moment dominated by main know-how companies, whereas additionally making AI generated content material or knowledge safer and reliable via blockchain privateness options. The convergence of these groundbreaking applied sciences affords an thrilling growth to observe.

Gaming and social media may also seemingly see a lift, pushed by developments in account abstraction—streamlining pockets interactions and transaction processes, thereby enhancing consumer expertise. Layer-2 enhancements, significantly in gaming-specific L2’s like Immutable, are making frequent, low-value transactions, together with in-game merchandise purchases and NFT utilization, extra possible. Whereas the NFT panorama has witnessed a trough and altering dynamics with marketplaces like Blur overtaking Opensea and the progress of inscriptions on Bitcoin, the space holds nice potential in enhancing engagement between model or artist communities. The bull market is poised to carry renewed curiosity in the shopper software ecosystem, facilitating the mainstream adoption of blockchain know-how.

With an onslaught of regulatory challenges over the previous yr in the US, the materialization of a extra optimistic political atmosphere can be a welcomed change. Nevertheless, there are a number of developments on the coverage entrance that digital asset market members will likely be seeking to search readability from earlier than that turns into a actuality. One promising growth in the US is a extra politically energetic crypto base, with the Fairshake super PAC elevating $78M to advocate for candidates in the 2024 US election who assist blockchain know-how. The continuing authorized continuing between Coinbase and the SEC may also be an essential space to observe, with Coinbase’s oral arguments on its movement for judgment to be heard in the courts on January seventeenth. Identical to the Ripple and Grayscale proceedings, the consequence of this battle may have far reaching implications for the trade, doubtlessly influencing worldwide laws. Whereas a number of jurisdictions globally have made vital strides in crypto coverage, corresponding to the UAE, and the EU—with its MiCA laws set to return into impact in 2024—others have quite a bit of catching as much as do.

The digital property market is poised for maturation in 2024. The anticipated launch of a spot ETF stands as a milestone in Bitcoin’s comparatively temporary however impactful historical past, a mere 15 years in the past at the moment since its genesis block was mined, unleashing a brand new idea of cash upon the world.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier points of State of the Community right here.