State of the Network’s Q2 2024 Mining Data Special

Get the finest data-driven crypto insights and evaluation each week:

-

In the wake of the Halving, Bitcoin’s hashrate (30D MA) has fallen -7% from its all-time-high of 626 EH/s, now at 580 EH/s

-

A large UTXO consolidation by OKX offered a quick enhance in transaction charge income, with miners incomes $38M in charges over a 3-day interval

-

Toronto-based miner Bitfarms has made spectacular enhancements to fleet effectivity, reducing incremental power consumption from 35 to 27 J/TH in 2024

-

After buying and selling as excessive as $100/TH at the peak of the 2021 bull run, Antminer S19s now commerce as little as $2.5/TH on secondary markets

This week’s State of the Community revisits the Bitcoin mining panorama, persevering with our collection of quarterly updates on the state of proof-of-work stakeholders. Since the Bitcoin Halving in April, mining margins have confronted stress because of a stagnant BTC value and a subdued charge market, although brief intervals of on-chain congestion have offered some income aid. Many operators are diversifying past pure-play mining, reinventing themselves as generalized infrastructure suppliers in an try and safe internet hosting contracts for power-hungry AI purposes. At the similar time, enhancements in chip effectivity proceed unabated, forcing miners to ponder whether or not to push ahead with getting older ASIC {hardware} or carry out complete fleet upgrades. On this report, we dive deeper into every of these components, surveying the well being of the mining sector past BTC value efficiency.

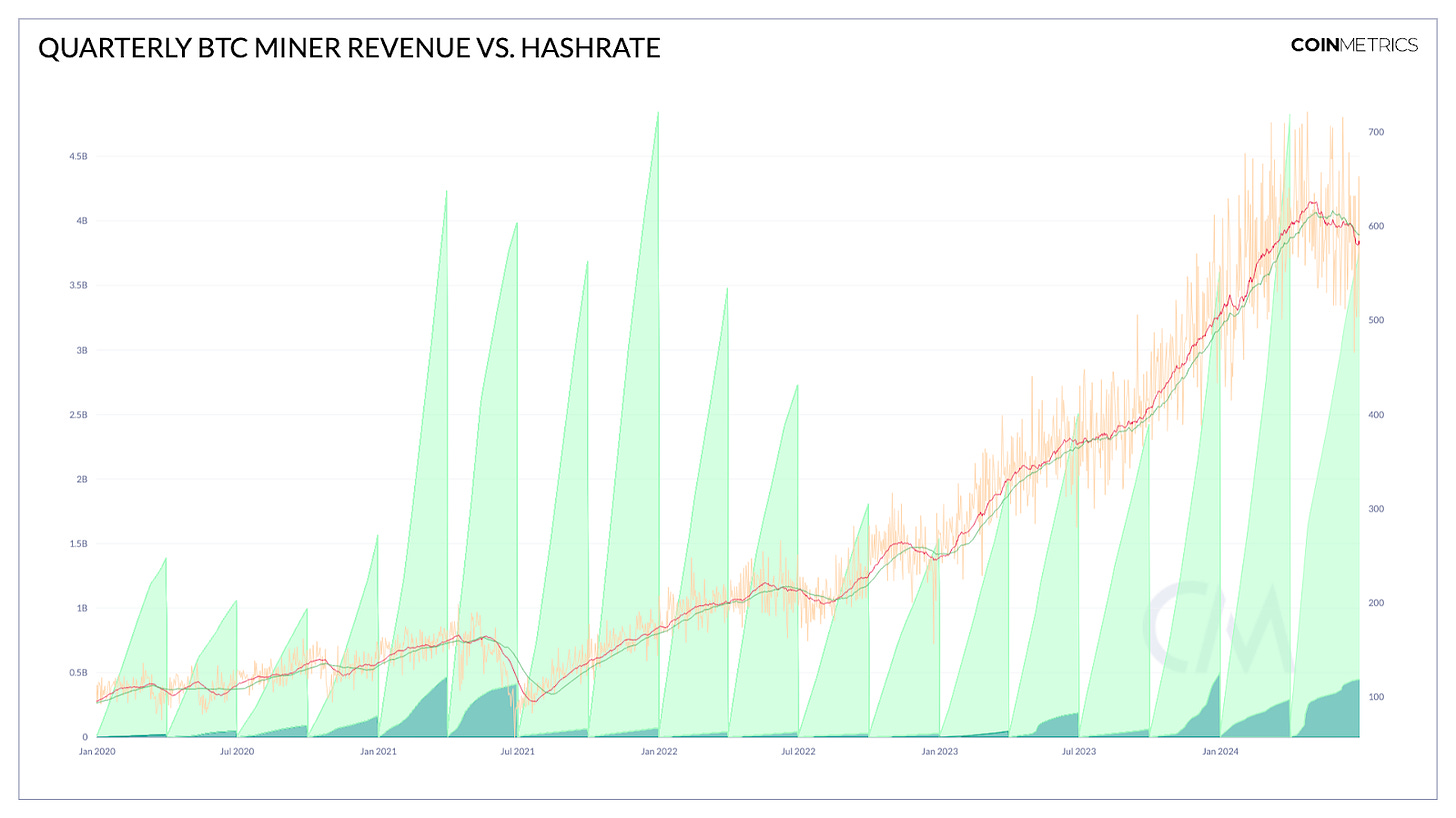

From a primary look, Q2 2024 was a comparatively profitable interval for Bitcoin miners. Of the 18 quarters since Jan. 2020, this quarter ranks fifth in phrases of complete USD income earned, with miners bringing in $3.77B between block subsidies & transaction charges. After all, because of the Halving, these earnings have been front-loaded, with practically half of the quarter’s income coming in throughout April alone. After the Bitcoin block reward dropped from 6.25 to three.125 BTC on April 20 and the “Runes” token hype progressively eased in the weeks that adopted, Could and June have been far harder months for miners. In consequence, Bitcoin’s hashrate exhibits indicators of miner capitulation— at 580 EH/s, the 30-day transferring common of hashrate is -7% off the all-time-high of 626 EH/s.

Source: Coin Metrics Network Data Pro

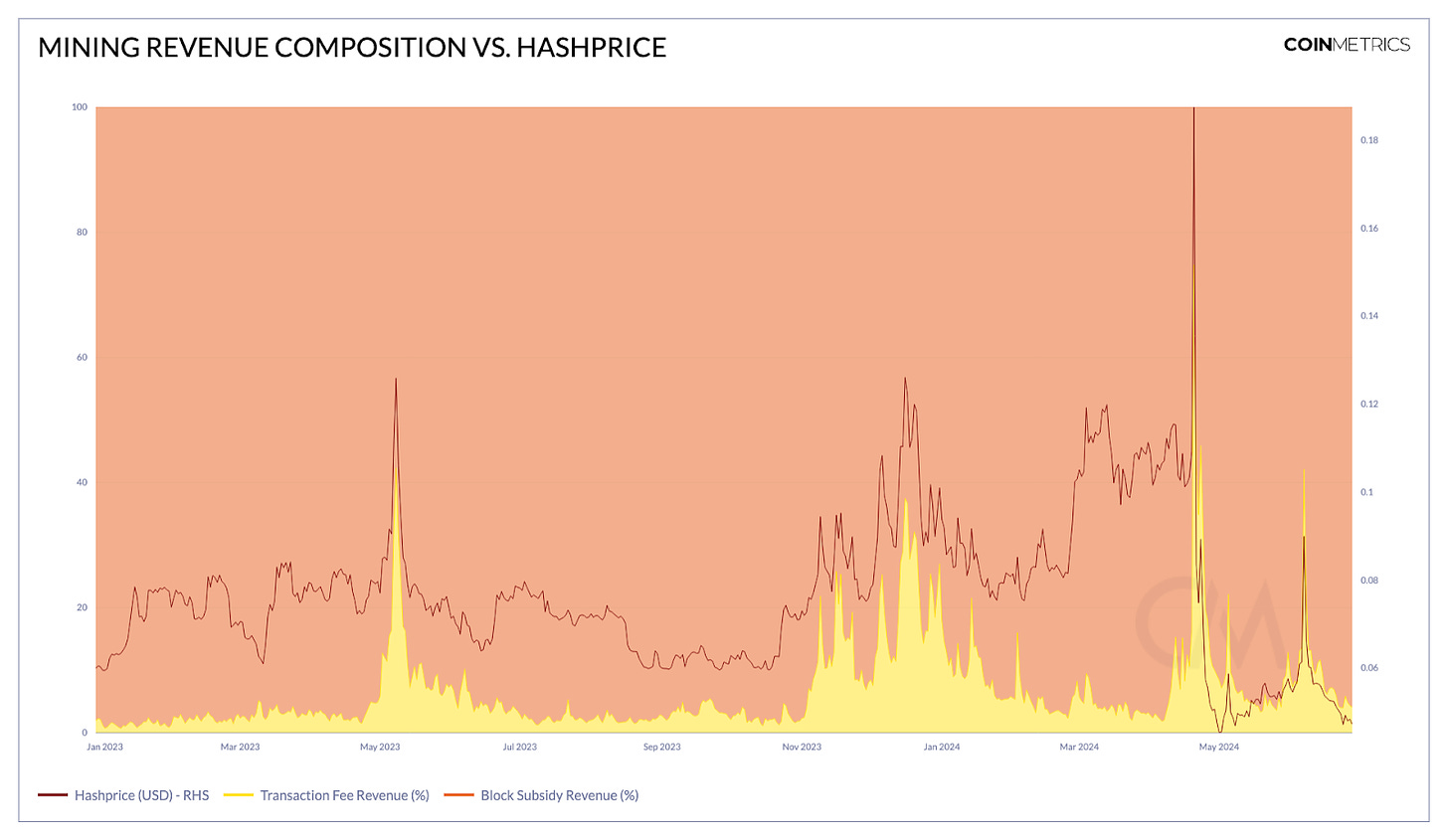

Regardless of the total loss of income momentum, surprising will increase in on-chain site visitors have nonetheless provided miners some reprieve. In early June, the Bitcoin mempool was slammed with an enormous inflow of high-fee paying transactions, with the common hourly transaction charge reaching as excessive as $945 by mid-day June 7. The congestion offered a serious enhance to mining income, with hashprice (each day USD income per TH/s) spiking to $0.09 and charges contributing over 42% of earnings.

Source: Coin Metrics Network Data Pro

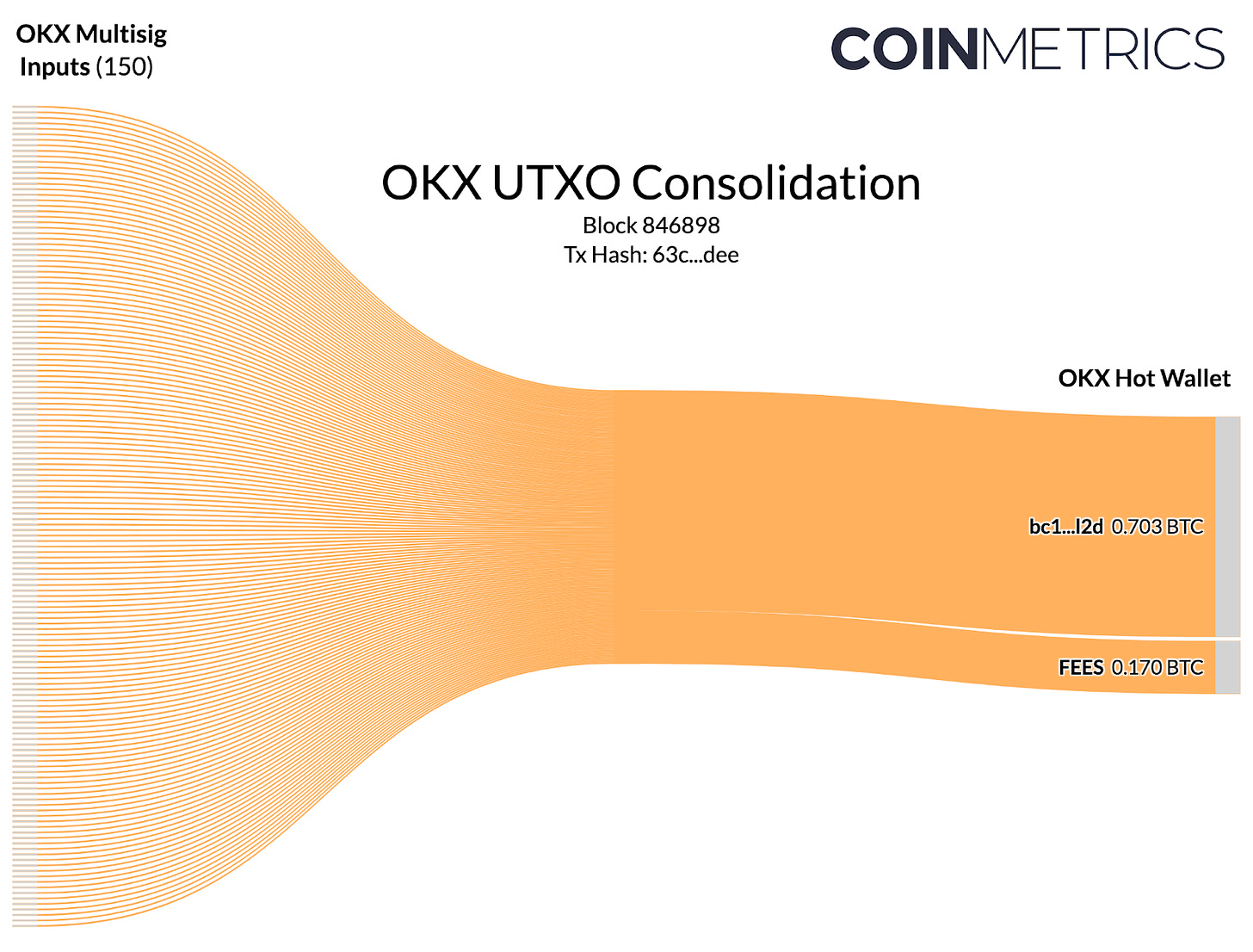

Whereas charge spikes are sometimes attributed to token protocols like Ordinals & Runes, the newest mining income enhance was introduced on by the inside operations of a single centralized trade. OKX (the 4th largest trade by BTC spot quantity) carried out an enormous collection of “UTXO consolidations,” cleansing up their books by combining fragmented fractions of Bitcoin into bigger, extra compact denominations. As a result of BTC transactions are priced in line with the blockspace they eat, transactions involving many UTXOs are dearer to switch, whereas “consolidated” UTXOs unlock funds with a lighter and more cost effective on-chain footprint.

Supply: Coin Metrics ATLAS

The UTXO consolidation course of is just like dumping a jar of unfastened change right into a coin-counting kiosk in trade for a $20 invoice. Like Coinstar, nevertheless, this service comes at a price. Whereas each day charge income usually ranges round $1-2M, miners raked in practically $38M in the 3 days following OKX’s UTXO consolidation. Looking back, OKX may have executed their accounting cleanup in a extra environment friendly method, having paid a major premium for expedient settlement— however in the face of a quiet transaction queue and record-low hashprice, miners definitely aren’t complaining.

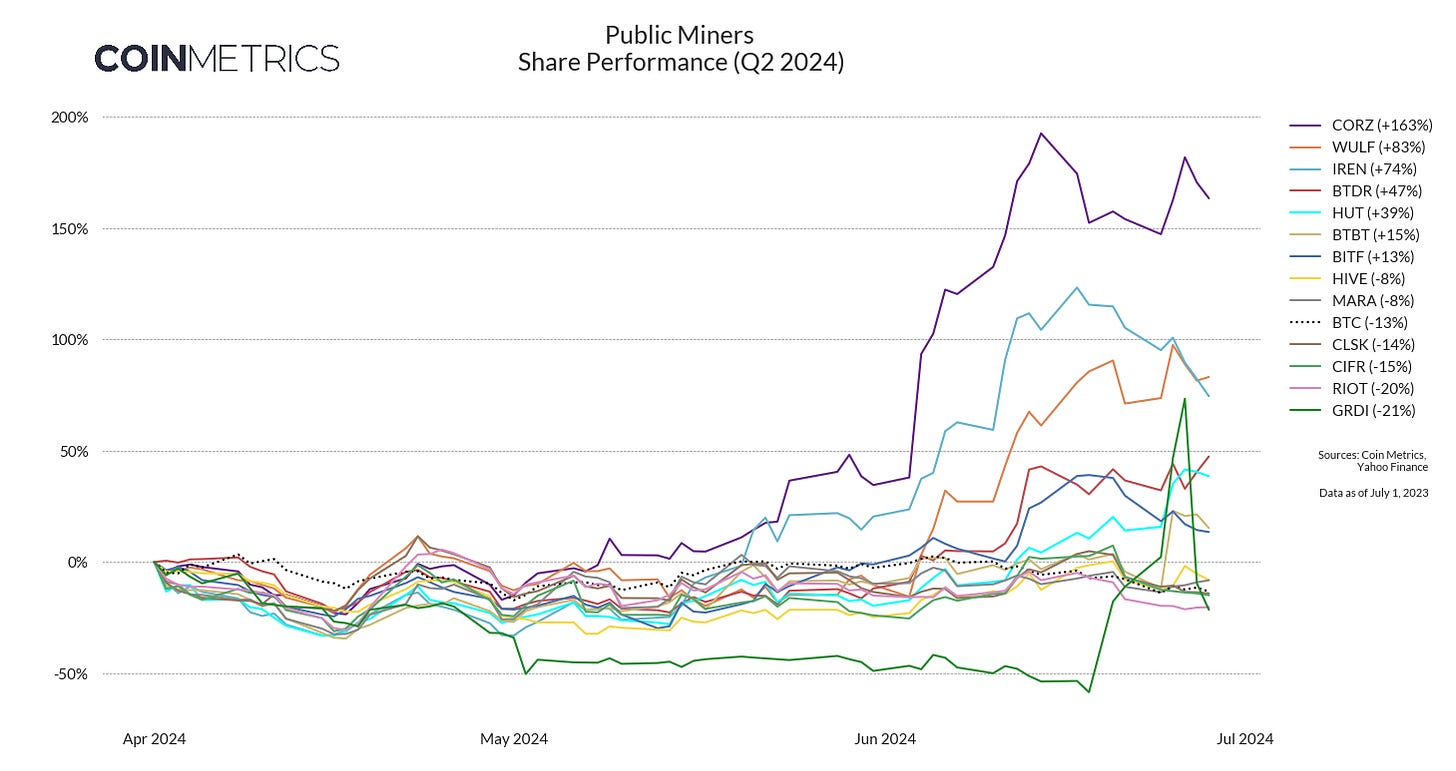

In the weeks since Bitcoin’s Halving, the majority of publicly-traded mining corporations have meandered sideways alongside BTC. Shares of the 3 largest miners— Marathon Digital (MARA), CleanSpark (CLSK), & Riot Platforms (RIOT)— have struggled to outperform BTC in Q2, with solely Marathon managing to eke out a small relative return. By far, the largest gainers have been underdogs in the Bitcoin mining race, with Core Scientific (CORZ), Iris Vitality (IREN), and TeraWulf (WULF) outperforming rivals by double-digit margins. It’s no coincidence these similar corporations are leaning closely into the AI hype wave, every positioning themselves as an power & infrastructure supplier for broader compute purposes.

In June, Core Scientific inked a collection of multi-billion greenback contracts with “AI Hyperscaler” CoreWeave, agreeing to make use of a whole bunch of megawatts in energy capability to host the firm’s high-performance computing (HPC) {hardware}. Shortly afterwards, Core Scientific acquired an “unsolicited proposal” from CoreWeave to buyout their whole enterprise, rejected on the foundation of Core’s “growth prospects” and “value creation potential.” IREN and WULF have additionally emphasised their distinctive positioning to host HPC infrastructure, making them enticing companions (and attainable acquisition targets) for an more and more energy-constrained group of AI-focused companies.

Supply: Coin Metrics Reference Charges & Yahoo Finance

For different miners, value motion has been pushed primarily by the trade’s inside M&A. Although micro-cap miner GRIID Infrastructure (GRDI) has lagged friends since itemizing this yr, CleanSpark announced an acquisition of the agency in June, boasting the transaction would enhance their energy capability by 400 MW inside 2 years. In Could, Riot Platforms revealed a 9.25% stake in Bitfarms (BITF), a barely smaller miner present process company governance points. Riot provided ~$950M to accumulate Bitfarms wholesale, claiming the purchase would create the “largest publicly listed Bitcoin miner globally” by yr’s finish. Bitfarms promptly rejected the supply, holding Riot’s hostile takeover at bay by issuing a “poison pill” plan aiming to dilute entities angling for a buyout on public markets.

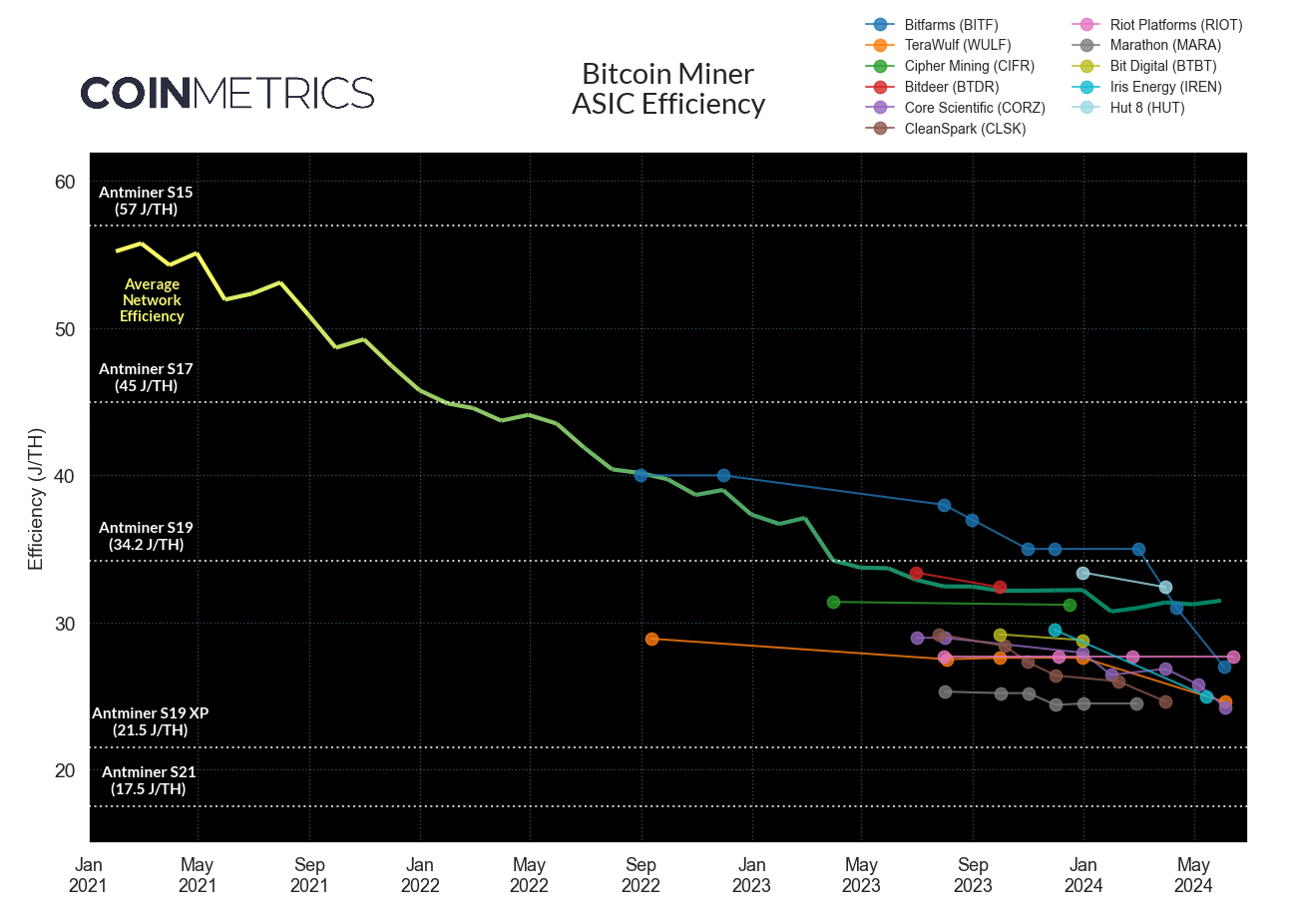

Riot’s motivation for buying Bitfarms might be attributed to a quantity of components, however one notable side is their sizable enchancment in effectivity. Traditionally, Bitfarms has capitalized on entry to low-cost hydroelectricity, using older-generation ASICs slightly than upgrading to the most cutting-edge {hardware}. This led them to lag rivals in metrics like fleet effectivity— measured in “joules per terahash” (J/TH)— representing the incremental quantity of power expended to generate hashrate. Nonetheless, Bitfarms lately applied a complete fleet refresh, buying 16 EH/s value of Antminer T21s (19 J/TH). In 2024, Bitfarms common fleet effectivity improved from 35 to 27 J/TH, leapfrogging Riot’s stagnant effectivity of 27.7 J/TH.

Source: Coin Metrics MINE-MATCH & Public Disclosures

Bitfarms isn’t alone in making spectacular enhancements to their common fleet effectivity. Iris Vitality lowered common power consumption -15% to 25 J/TH over the previous 6 months, whereas TeraWulf made an -11% effectivity achieve reaching 24.6 J/TH over the similar interval. Having emerged from Chapter 11 chapter proceedings, Core Scientific now leads the pack at 24.23 J/TH, edging out incumbent effectivity chief Marathon Digital at 24.5 J/TH. With the race to streamline & optimize operations narrowing to single-decimal precision, miners now look in direction of the subsequent era of ASICs for his or her subsequent likelihood to outstrip the competitors.

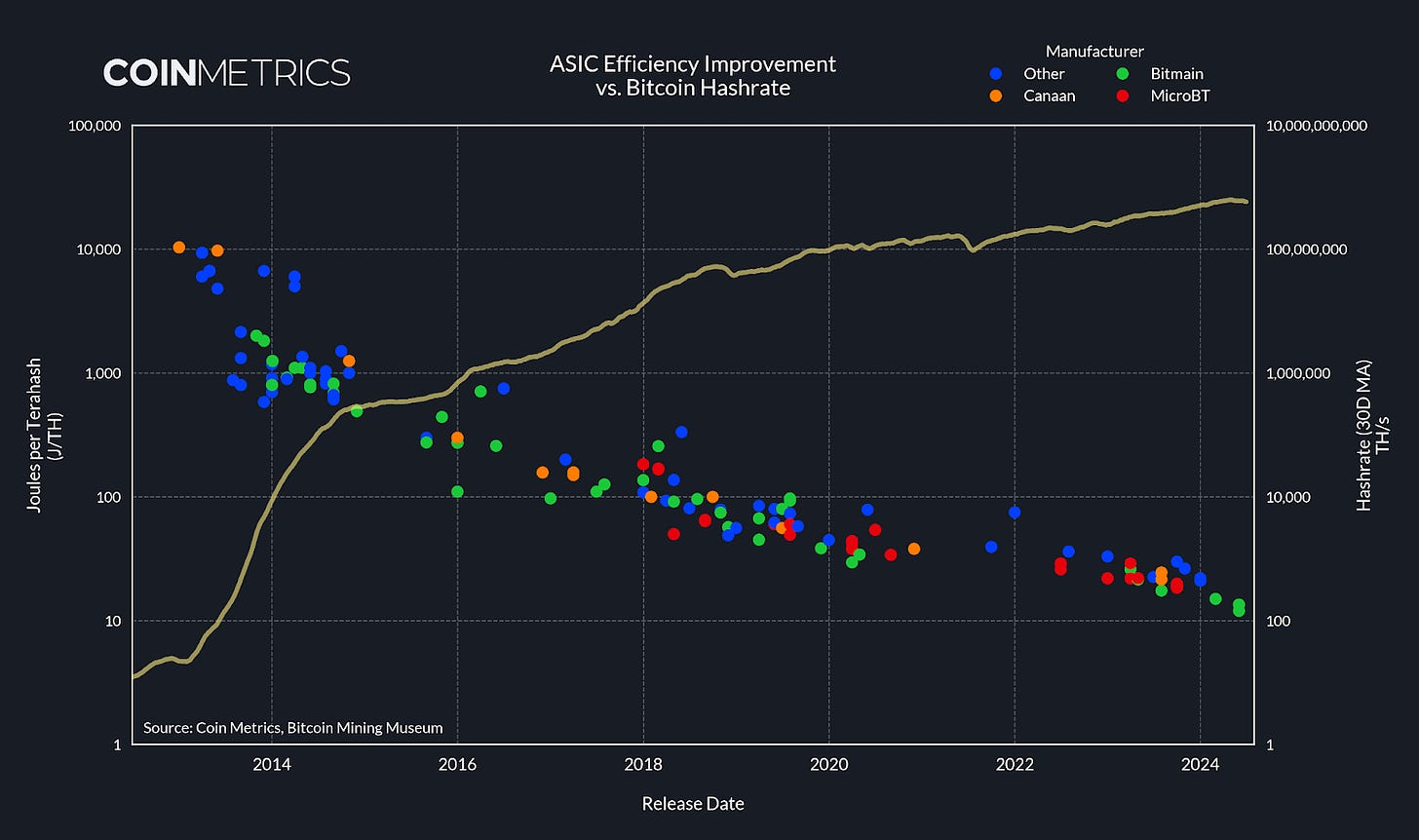

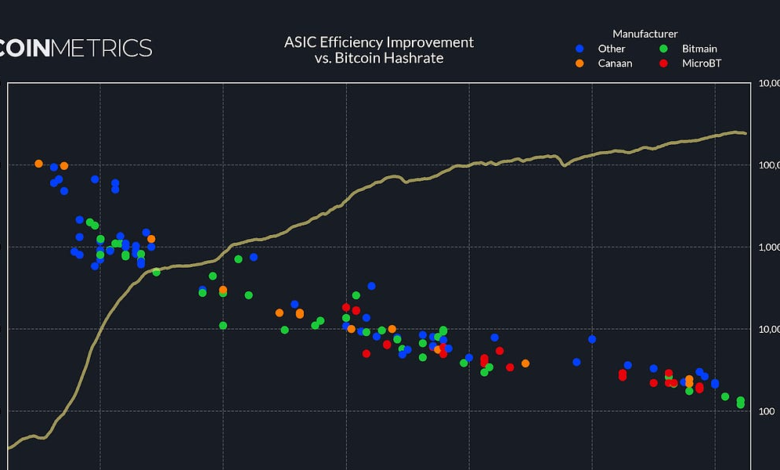

After greater than a decade of chipmaking innovation, Bitcoin mining ASICs have skilled unprecedented enhancements in effectivity. The primary commercially obtainable ASIC— Canaan’s Avalon 1— got here to market in Jan. 2013 with a meager 0.06 TH/s in hashrate. At an influence consumption of 620 watts, this equates to an effectivity of 10,333 J/TH. At the time, this was an enormous leap ahead in uncooked hashrate output, with complete community hashrate sitting at simply 22 TH/s. Quickly after the Avalon 1’s launch, competing producers aggressively entered the market, and continued technological progress drove hashrate up by an element of 14,000x inside 2 years.

The magnitude of effectivity enchancment has since tapered from its early interval of exponential features, however producers proceed to aggressively slash the power required to provide an incremental unit of hashrate. In June, Bitmain introduced their newest collection of Antminer S21 XP fashions, with the hydro-cooled model reaching 473 TH/s at an effectivity of 12 J/TH. Although Bitmain stays the trade’s 800-pound gorilla, upstart entrants like Bitdeer— led by ex-Bitmain CEO Jihan Wu— have announced ambitious plans to provide a 5 J/TH ASIC by Q2 2025.

Source: Coin Metrics Network Data Pro & Bitcoin Mining Museum

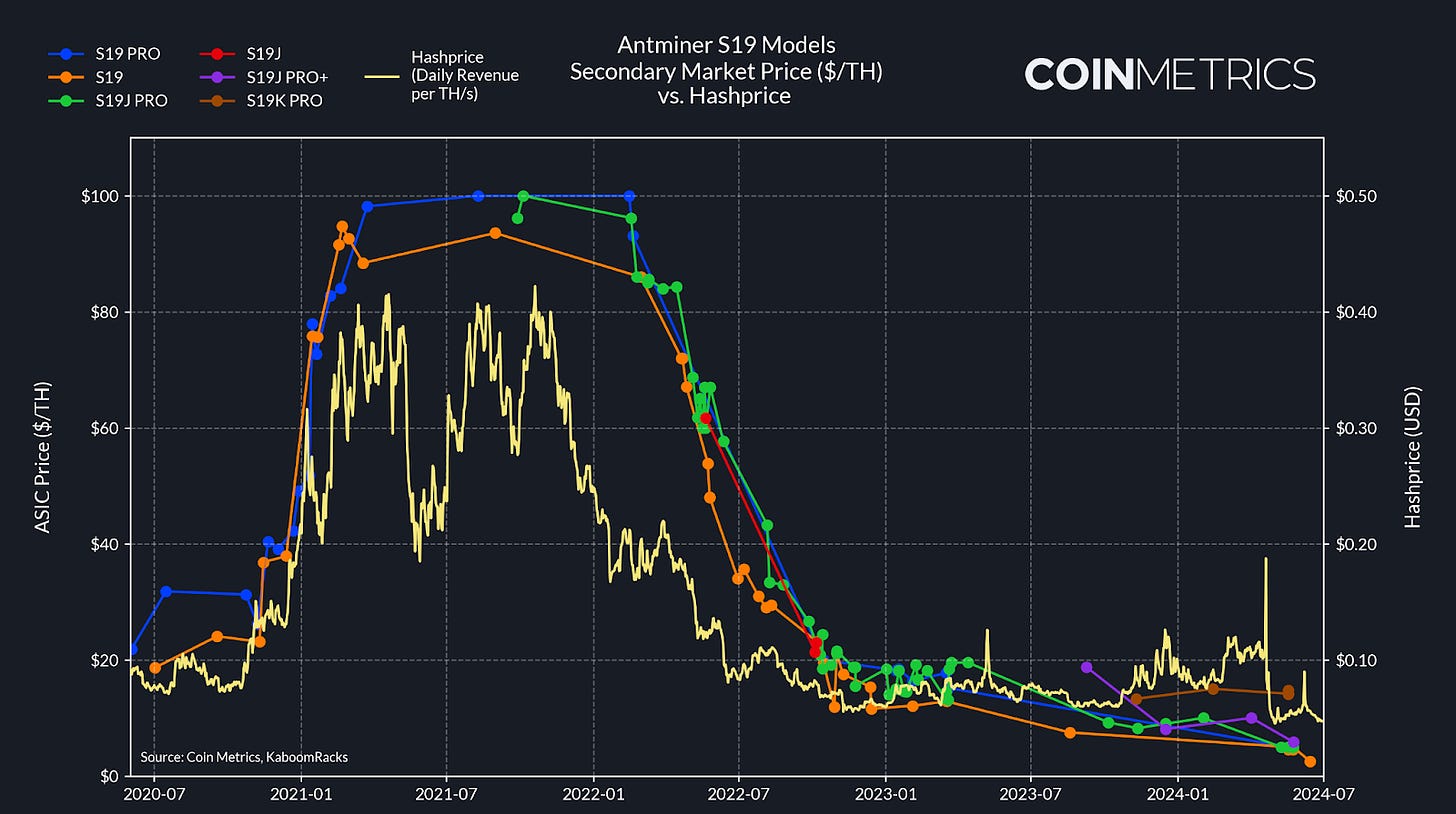

As Bitcoin miners start to liquidate their current {hardware} fleets in favor of extra environment friendly fashions, ASIC costs have tumbled in tandem. Whereas nominal costs range extensively based mostly on {hardware} specs, ASIC buying and selling desks usually quote orders in “dollars per terahash” ($/TH) phrases, offering an easily-comparable metric for measuring premiums throughout a range of fashions.

The 2021 bull run (paired with the China mining ban) precipitated a interval of outsized profitability for BTC mining. This translated to sky-high premiums on Antminer S19 fashions (90-110 TH/s), with costs remaining elevated close to $90-100/TH all through the yr. In 2022, nevertheless, collapsing income put main stress on ASIC premiums, with S19 costs dropping over 80%. Put up-Halving, capitulation continues in secondary markets like Kaboomracks, with lower-performing S19 fashions buying and selling as little as $2.5/TH in June.

Source: Coin Metrics Network Data Pro & Kaboomracks

Regardless of shedding their new-gen luster, ASIC fingerprinting methods reveal the S19 collection nonetheless contributes north of 50% of hashrate, indicating they’re being redeployed at lower-cost websites slightly than retired fully. Even the 2016-era Antminer S9 maintains a small foothold at the edges of the grid, reliably changing waste power to digital money practically a decade after its debut. Although the best operators will undoubtedly decide to cycle out their fleets for the newest fashions, the hardy and highly-industrialized type issue of the fashionable Bitcoin mining ASIC ensures practically each machine finally finds its personal area of interest in the proof-of-work ecosystem.

Bitcoin’s fifth epoch appears to be like prone to be characterised by consolidation, with well-capitalized miners shopping for up the property of less-efficient operators. The AI sector can also be enviously enamored with the trade’s distinctive entry to power infrastructure, and lots of publicly-traded miners have seen success in embracing a extra generalized datacenter technique. Others stay laser-focused on Bitcoin, treating the HPC sideshow as a momentary distraction. Regardless, surviving the onslaught of effectivity features and aggressive pressures requires all miners to show their sights in direction of the future, with the long-term trajectory of BTC value remaining an unpredictable enter to a extremely capital-intensive enterprise mannequin.

Ensure to take a look at our previous issues of the mining information particular, in addition to our June report The Signal & the Nonce: Tracing ASIC Fingerprints to Reshape our Understanding of Bitcoin Mining.

Source: Coin Metrics Network Data Pro

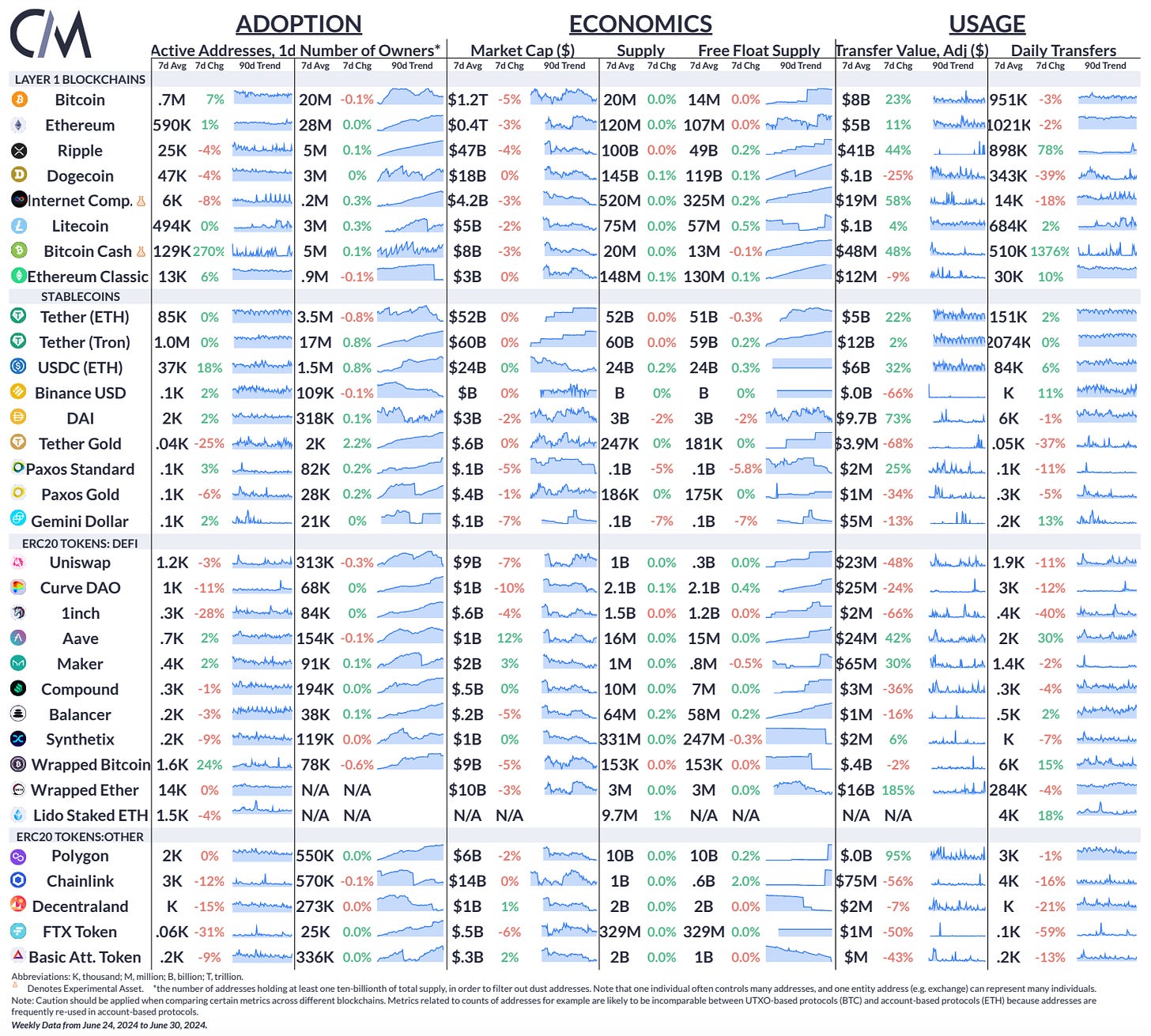

USD switch worth (adjusted) elevated by 23% on the Bitcoin community and 11% on the Ethereum community over the previous week. Stablecoins additionally noticed rising (adjusted) switch values for Dai (+73%), USDC on Ethereum (+32%), and USDT on Ethereum (+22%). This week, Circle turned the first stablecoin issuer to be compliant with the EU’s MiCA laws, permitting them to difficulty USDC and EURC in Europe.

This week’s updates from the Coin Metrics workforce:

As at all times, if in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier points of State of the Community right here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution just isn’t permitted with out consent. This article doesn’t represent funding recommendation and is for informational functions solely and you shouldn’t make an funding resolution on the foundation of this data. The e-newsletter is offered “as is” and Coin Metrics won’t be responsible for any loss or harm ensuing from data obtained from the e-newsletter.