State of the Network’s Q4 2023 Mining Data Special

Get the finest data-driven crypto insights and evaluation each week:

By Parker Merritt & Kyle Waters

On this week’s State of the Community, we proceed our targeted collection on Bitcoin mining, spotlighting information throughout the mining ecosystem. Mining stands as one of the most intriguing components of the digital belongings {industry}, typically capturing the curiosity of the public and fans. As the {industry} matures, mining is transferring effectively past its hobbyist days. With over a dozen publicly-traded mining corporations listed on American and Canadian inventory exchanges, mining has now develop into a sector commanding the consideration of equity analysts on Wall Road.

This previous yr has been an eventful one for Bitcoin miners, marked by a serious enlargement in hashrate throughout North America and the globe, accompanied with a surge in miner revenues—a welcomed departure from the challenges of 2022. This all happens as every block brings us nearer to the subsequent halving occasion in spring 2024. The race to mine recent BTC earlier than the predictable reduce in block rewards is intensifying. Modifications to core mining infrastructure, regulatory discussions, new debates inside the Bitcoin group, and developments in miner effectivity all create a fancy state of affairs for operators and analysts alike.

Bitcoin’s hashrate—a measure of the computational sources being allotted to mining—surged in 2023. Hashrate has leaped to 480 EH/s from 250 EH/s at the begin of the yr, boosted by publicly traded mining corporations who took no relaxation in increasing operations all through the bear market.

Supply: Coin Metrics Community Data

Bettering market circumstances have helped miners regain the narrative, with complete quarterly mining income exceeding $2B in Q2, Q3, and Q4 of this yr, on the again of bitcoin’s 150%+ YTD climb over $40K. The string of excellent news was prolonged by an surprising revival in the long-subdued Bitcoin charge market, with over $180M in transaction charges dished out to miners in Q2 and over $200M paid out up to now this quarter. The associated fee aspect of the equation has additionally improved, with industrial electrical energy charges coming down in the US. Although common charges in the US have risen to $0.085/kWh from $0.075/kWh in April, they’re nonetheless decrease than the peak charges paid in 2022.

Publicly traded mining corporations (or just the “pubcos” in {industry} parlance) proceed to aggressively change on a range of the most effective and trendy machines like the Bitmain Antminer S19 XP. With competitiveness rising (see evaluation additional alongside on this report) sustaining a contemporary fleet of ASICs has develop into important for survival.

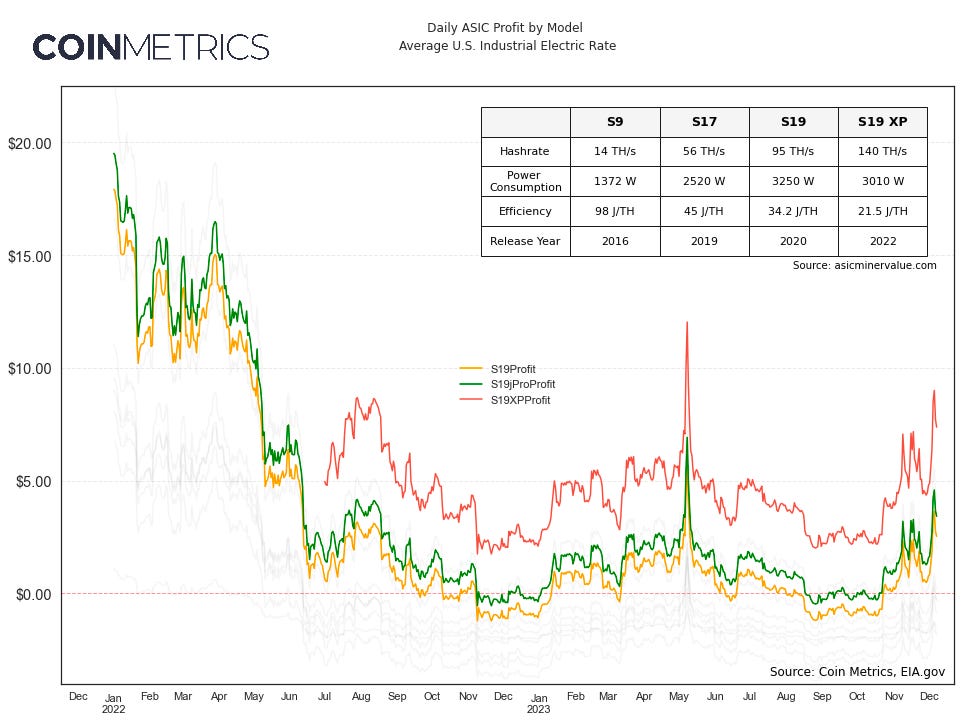

The chart under plots the every day revenue (in $) for the most common ASICs mining on the Bitcoin community right this moment. Our profitability estimates assume the common US industrial electrical energy price from the EIA, and reveal that the most effective machines have comfortably weathered the crypto winter. Furthermore, this can be a conservative estimate contemplating that giant miners typically negotiate extra favorable charges with utility suppliers because of mining’s distinctive potential to be location agnostic and eat extra power in much less populated areas.

Sources: Coin Metrics Network Data Pro, EIA.gov,

However at the same time as the good occasions roll, miners should keep away from complacency: in nearly 4 months time Bitcoin’s subsequent halving occasion will reduce block rewards from 6.25 BTC to three.125 BTC—in addition to mining corporations’ high traces. Miners are presently racing to gather the closing Sats from blocks minting out 6.25 recent BTC. Although the halving is a predictable factor of Bitcoin’s financial design, it nonetheless presents an advanced calculation for operators managing substantial capital investments in bodily infrastructure and computing sources.

At the macro degree, circumstances vastly improved in 2023 for Bitcoin miners. Even the charge market, which was frenzied in Q2, has returned in Q4. However together with it, a brand new debate is now gripping the Bitcoin group.

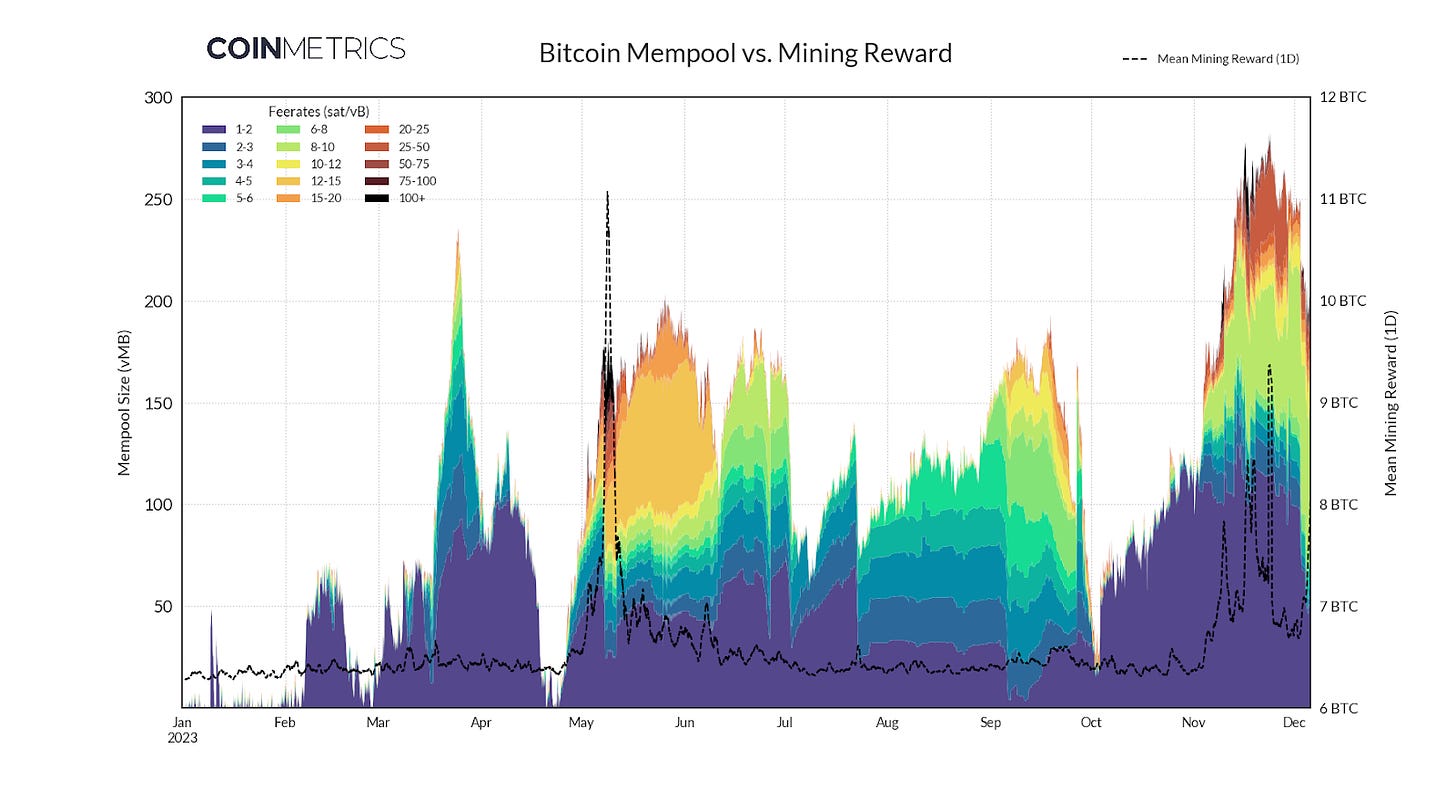

Up to now, each quarter in 2023 has introduced in a brand new wave of mempool congestion, and Q4 isn’t any exception. By early December, the complete measurement of the mempool swelled to all-time-highs, bringing with it a recent spike in transaction charges (and subsequently, mining rewards). At one level, the every day imply block reward tipped 9.37 BTC, reaching near-yearly highs topped solely by the BRC-20 growth in Might 2023.

Supply: Coin Metrics FARUM

In previous durations of congestion, the offender for the charge frenzy has been Ordinals/Inscriptions, with customers using novel Taproot-powered strategies to embed varied kinds of metadata into the blockchain, from JPEGs to JSON. This newest iteration of on-chain imprints, nevertheless, got here with a historic return to type, leveraging an age-old Bitcoin script opcode referred to as OP_RETURN.

OP_RETURN permits customers to retailer small quantities of information on the blockchain, most famously utilized by the Counterparty protocol in 2014. Counterparty ushered in a single of the earliest waves of token minting, together with early NFT precursors like Rare Pepes. Even then, Bitcoin Core builders met the pattern with hostility, introducing an 80 byte restrict on the quantity of allowable OP_RETURN information. Whereas this slowed the tempo of meta-protocol improvement in the Bitcoin ecosystem, OP_RETURN transactions are as soon as once more flooding the mempool. On Dec. 6, the quantity of OP_RETURN outputs hit 115.4K, the highest level since June 2019.

Whereas Ordinals-based BRC-20s have gained immense reputation (ORDI presently trades at a $1.1B market cap), recognition of the commonplace’s inefficiency has led to experimentation with new kinds of OP_RETURN-enabled token sorts. Atomicals (recognized by the phrase “atom” in the OP_RETURN information) try to enhance on quite a few BRC-20 indexing issues with the creation of ARC-20, offering users “self-evident digital object histories.” Runes— a fungible token commonplace proposed by Ordinals inventor Casey Rodarmor— permits the issuance of on-chain belongings by merely together with “R” in an OP_RETURN output.

Although the preliminary waves of Ordinals curiosity appeared like a flash in the pan to some, persistent cycles of iteration & enchancment on Bitcoin-based token requirements point out that miners can anticipate to earn further charges from meta-protocol mints for a lot of quarters to come back.

Traditionally, mining swimming pools have long-established themselves as impartial intermediaries, choosing transactions strictly based mostly on financial components (i.e. charges). Nonetheless, on November 21, Bitcoin analyst 0xB10C alleged that a number of swimming pools have been excluding transactions from OFAC-sanctioned addresses. The OFAC checklist is a set of “Specially Designated Nationals (SDNs)” labeled by the U.S. Division of Treasury, from terrorist teams to drug traffickers. These sanctions legally bar U.S. individuals from transacting with blacklisted people & corporations, in addition to any cryptocurrency pockets addresses linked to those entities.

Based on 0xB10C, the bulk of the lacking transactions gave the impression to be deliberately filtered out of blocks mined by the Third-largest pool, F2Pool. As mentioned in our Q3 Mining Special, F2Pool is infamous for unconventional block-building antics, from transaction acceleration providers to sidechain MEV exploits. These exclusions, nevertheless, could also be the first observable occasion of pool censorship based mostly on OFAC sanctions.

Supply: Coin Metrics ATLAS and FARUM

Regardless of the OFAC transactions spending lots of time in the mempool and providing a aggressive charge price, F2Pool purposefully excluded them from its block templates, imposing a chance value of 0.015 BTC in charge revenue. In response to 0xB10C’s allegations, F2Pool founder Chun Wang justified the censorship, asserting his proper to refuse transactions from “criminals, dictators and terrorists.” Wang later backtracked, claiming to have disabled the ‘filtering patch’ till the group reached a extra “comprehensive consensus.”

Widespread frustrations with the present mining pool panorama have impressed a quantity of new entrants to hitch the fray. OCEAN pool— based by controversial Bitcoin Core developer Luke Dashjr— hopes to “radically decentralize” mining, making claims of improved transparency & censorship-resistance.

Key to OCEAN’s worth prop is a “non-custodial” payout mannequin. Most swimming pools hard-code a ‘0-hop’ payout deal with into the coinbase (a.ok.a. issuance) transaction, taking direct custody of the mining reward. Then, after consolidating funds (and deducting a small charge), the pool distributes rewards to its constituent miners. In place of this “custodial” mannequin of pool administration, OCEAN has opted for a special method, distributing rewards straight from the issuance transaction. OCEAN claims non-custodial payouts enable them to dodge KYC necessities, offering miners with higher privateness ensures.

Whereas OCEAN’s dedication to miner privateness is admirable, its views on censorship-resistance are rather less cut-and-dry. In the weeks since its launch, the pool has sparked a cultural civil battle in the Bitcoin group, censoring a number of transaction sorts their crew deems “spam.” From deliberately filtering out Ordinals transactions to stubbornly excluding privacy-preserving CoinJoins, OCEAN’s acknowledged ideas of censorship-resistance appear at odds with their precise habits, underscoring the problem of constructing consensus round mining pool coverage.

With Bitcoin value and transaction charges up in tandem, publicly-traded mining companies are having fun with the fruits of their bear market labor. BTC is up 150%+ year-to-date, however mining shares are outperforming this benchmark by a big margin, with a imply return of 352% throughout a basket of 10 high mining shares. After a Chapter 11 submitting late final yr, Core Scientific (CORZQ) introduced plans to emerge from the chapter course of by the finish of 2023, resulting in an particularly outsized return of 860%.

Source: Coin Metrics Reference Rates and FactSet

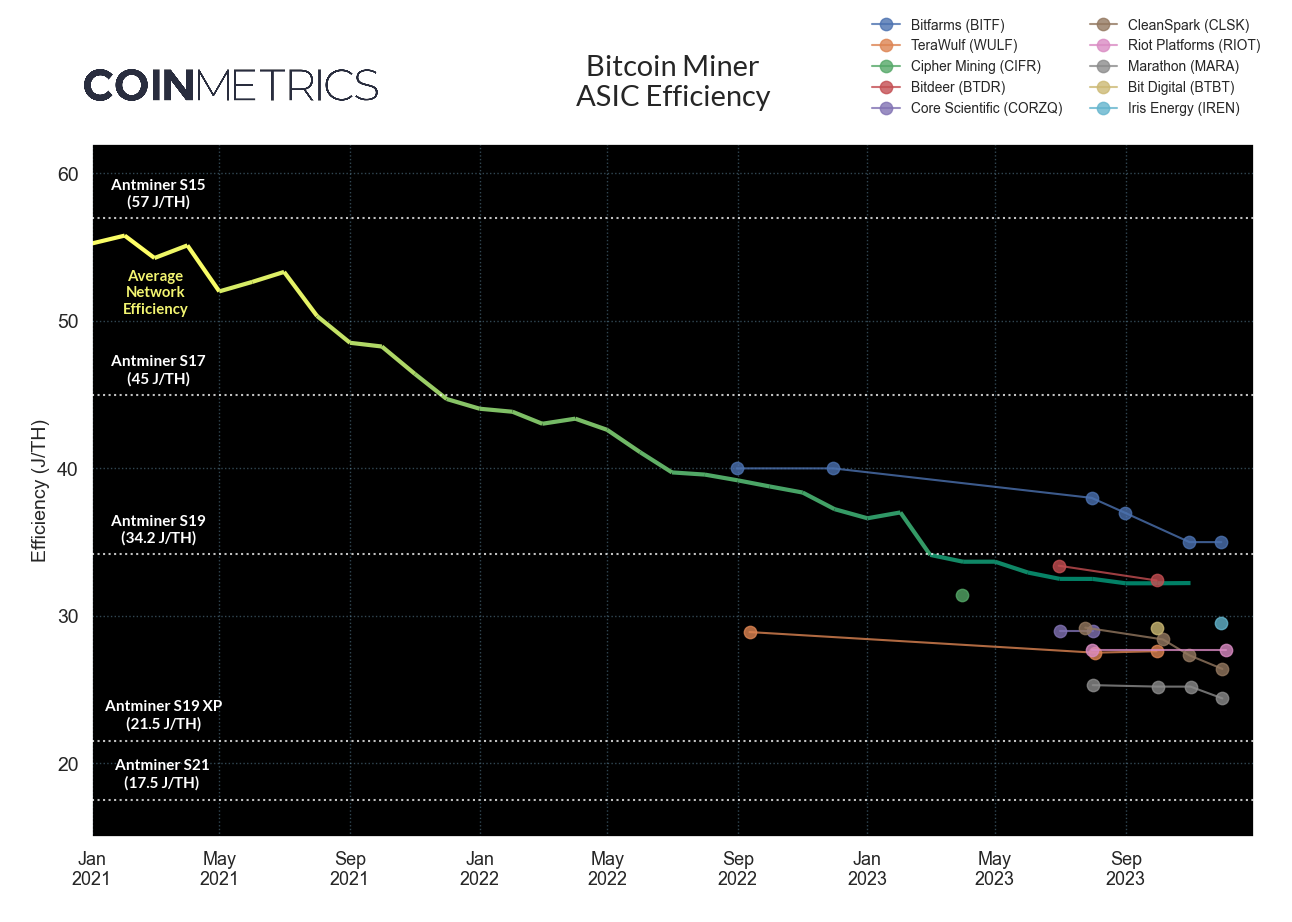

Forward of the halving in April 2024, miners are taking care to improve and optimize their ASIC fleets. One of the most necessary industry-standard metrics is {hardware} effectivity, as measured in Joules per TH (J/TH). This metric measures the ratio of power input-to-hashrate output, with the most effective ASIC fashions presently working in the 18-22 J/TH vary.

Utilizing {hardware} dominance estimates derived from Coin Metrics’ MINE-MATCH methodology, we are able to approximate the common community effectivity at round 32.2 J/TH by November’s finish. That is an particularly necessary benchmark for publicly-traded miners, with companies like Riot Platforms (RIOT) citing the figure in company shows to spotlight their aggressive benefit at 27.7 J/TH. Whereas not all mining operations often disclose their common J/TH score, the metric has develop into an more and more frequent means for flexing operational effectivity.

Source: Coin Metrics MINE-MATCH and SEC Filings

Stacking up public disclosures side-by-side, a handful of companies outperform their friends in effectivity phrases. Marathon leads the pack at 24.4 J/TH, whereas TeraWulf and Riot are neck and neck in the mid-27 J/TH vary. CleanSpark— the analyst darling boasting ‘Buy’ rankings throughout the board— has accelerated their effectivity beneficial properties, dropping from 28.4 J/TH to 26.4 J/TH in slightly below 2 months.

It is necessary to notice that ASIC effectivity shouldn’t be evaluated in isolation. Miners with dirt-cheap energy charges (i.e. Bitfarms locking in 2.1 cents per kWh in Argentina) typically handle to function profitably with older {hardware}. Many companies have waited patiently for the good second to improve their fleets, with premiums on S19s receding as Bitmain prepares to ship the S21. Nonetheless, as we hurdle in direction of the halving, traders are demanding that operators modernize their mines, with J/TH effectivity rankings serving as a vital indicator of hashrate well being.

Bitcoin miners’ needs for higher hashing days have been granted in 2023. However as the calendar turns over to 2024, the new yr guarantees to be an necessary one for the {industry}. The 4th Bitcoin halving occasion will undoubtedly take a look at even the most savvy of operators, and should even spark consolidation amongst miners and push extra vertical integration. However miners cannot get slowed down learning operational variables, as they will even have to maintain abreast of political discussions.

Domestically, they’ve encountered elevated scrutiny, exemplified by New York’s two-year moratorium on new mining operations which started final yr. At the same time as the White Home’s proposed “DAME” tax was dismissed earlier this yr throughout the debt ceiling negotiations, the {industry} stays underneath shut watch by some policymakers. Nonetheless, new analysis is respiratory recent air into long-debated points, whereas additionally highlighting Bitcoin mining’s potential advantages to the grid. For instance, a recent study led by Cornell College researchers means that Bitcoin mining might assist clear power improvement by offering renewables tasks a supply of income throughout the “pre-commercial” section of a mission, when the wind or photo voltaic farm is producing electrical energy, however will not be but serving it to the grid.

Whereas 2023 was all about North American miners, it is necessary to do not forget that Bitcoin mining’s panorama is world and geographically fluid. The 2021 mining ban in China demonstrated how shortly hashrate can shift in response to authorities motion. New tasks in different areas, like South America and the Center East proceed to form the world Bitcoin mining narrative, whereas some nations in Africa are quietly emerging as new hubs.

As we glance to 2024, there are lots of angles to check the {industry} and convey new analytics into the dialog. At the same time as block rewards break up in half, the strongest miners are poised to double down as the {industry} matures and grows.

Ensure to take a look at our previous issues of the mining information particular, in addition to our June report The Signal & the Nonce: Tracing ASIC Fingerprints to Reshape our Understanding of Bitcoin Mining.

As at all times, in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.