Tether’s Ascent: Breaking Down the Dominant Stablecoin's Growth

Get the finest data-driven crypto insights and evaluation each week:

By: Tanay Ved

Stablecoins are sometimes seen as crypto’s ‘killer app,’ taking part in a significant position in bridging conventional finance with the digital asset ecosystem. On this sector, dollar-backed stablecoins have skilled exceptional adoption over the previous few years. Stablecoins facilitate 24/7 worth change, function a retailer of worth, medium of change and supply an important worth proposition to dollar-starved economies, particularly inside rising markets the place individuals deal with excessive inflation, forex devaluation or restricted entry to fundamental monetary companies. Amid a panorama that continues to evolve with new issuers, collateral varieties and increasing utility, Tether (USDT) has established itself as a dominant drive.

As the preeminent fiat-collateralized stablecoin, Tether instructions over 75% of the $120B+ stablecoin market cap. This prominence, nonetheless, has been accompanied by appreciable skepticism, notably round the transparency and nature of its reserves. Recent remarks by Howard Lutnick, the CEO of Cantor Fitzgerald—a agency that manages Tether’s funds—round the legitimacy of its backing could have alleviated some considerations. Nevertheless, the sheer scale of USDT’s affect warrants a more in-depth examination.

On this week’s situation of Coin Metrics’ State of the Community, we delve into Tether’s exceptional ascent, exploring its major avenues of progress, adoption, the nature of its utilization and reserve holdings to realize a holistic understanding of the stablecoin juggernaut by means of on-chain knowledge.

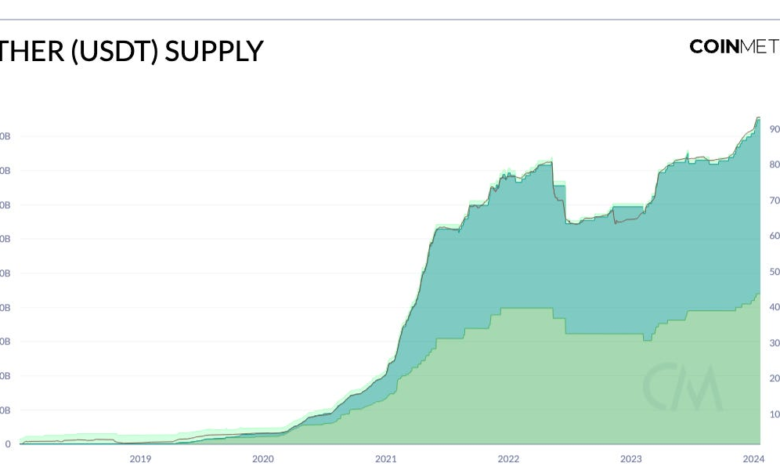

The latest surge in curiosity surrounding the launch of spot Bitcoin ETFs could have inadvertently diverted consideration from Tether’s important progress. Tether just lately achieved a brand new milestone, surpassing its highest-ever provide, reaching over $95 billion—a 35% improve year-over-year. Analyzing the distribution of this whole, $44B—46% of the provide—is minted on the Ethereum blockchain. Conversely, $50.8B, accounting for 53% of provide, is issued on Tron. In the meantime, issuance on Omni constituted almost 33% of the whole in January 2020, which has dwindled to a mere 1% on account of Tether’s resolution to stop help for the community. As the digital asset ecosystem evolves to embrace a number of chains, Tether’s issuance is increasing on various layer-1 networks akin to Solana and Avalanche. This growth enhances USDT’s utility throughout quite a lot of on-chain ecosystems.

Source: Coin Metrics Network Data

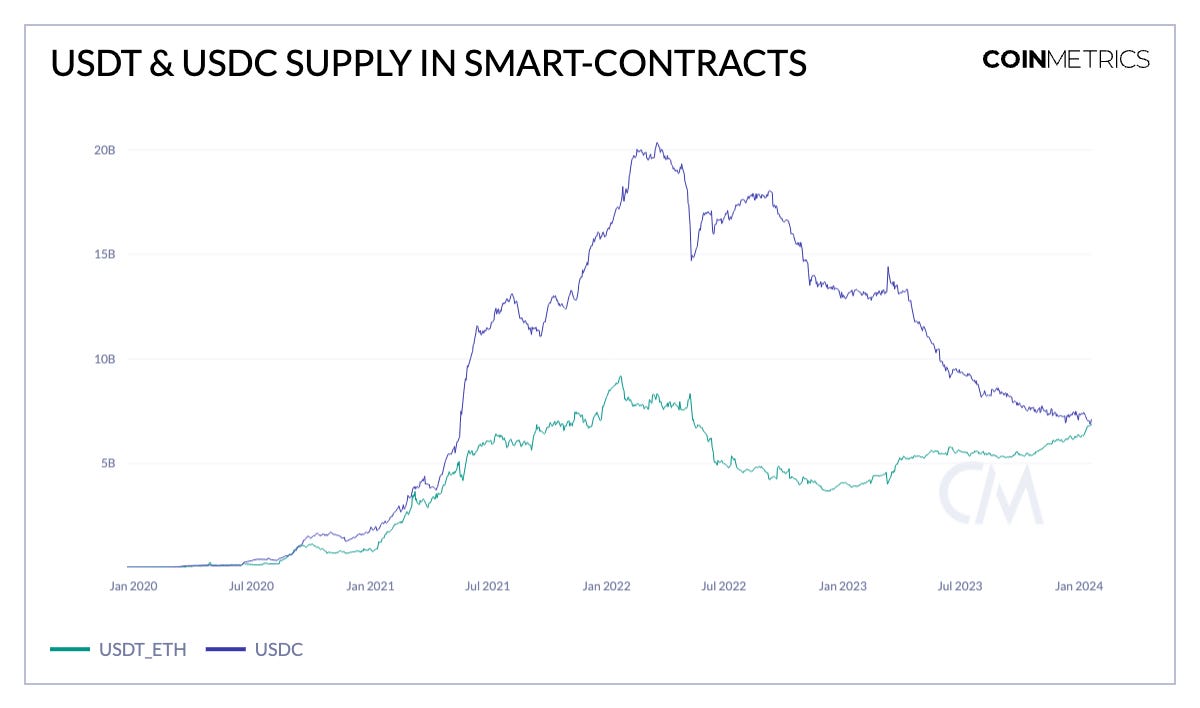

The latest turmoil, notably the collapse of Silicon Valley Financial institution (SVB) and the repercussions of Operation Choke Point 2.0 could have acted as a catalyst for the surge in offshore stablecoins. Delving deeper into the composition of this surge reveals key progress drivers. A very noteworthy pattern is the elevated prominence of USDT (ETH) in sensible contracts, a website traditionally dominated by Circle’s USDC since its institution. The aftermath of the SVB disaster has seemingly shaken market confidence in USDC, inadvertently boosting USDT’s engagement in sensible contracts. Since March 2023, USDT’s presence on this sector has soared from $4B to just about $6.9B. This shift underscores USDT’s rising recognition inside decentralized finance (DeFi) functions, a pattern vividly captured in the “DeFi Balance Sheets” part of our State of the Market report. Notably, USDT has overtaken USDC in main cash markets, together with Aave v2 and Compound, additional cementing its place in the DeFi panorama.

USDT’s escalating affect inside DeFi, evident throughout lending platforms and exchanges, highlights its pivotal position in facilitating trustless transactions tied to the greenback, finally enabling broader and extra environment friendly entry to monetary companies.

Source: Coin Metrics Network Data

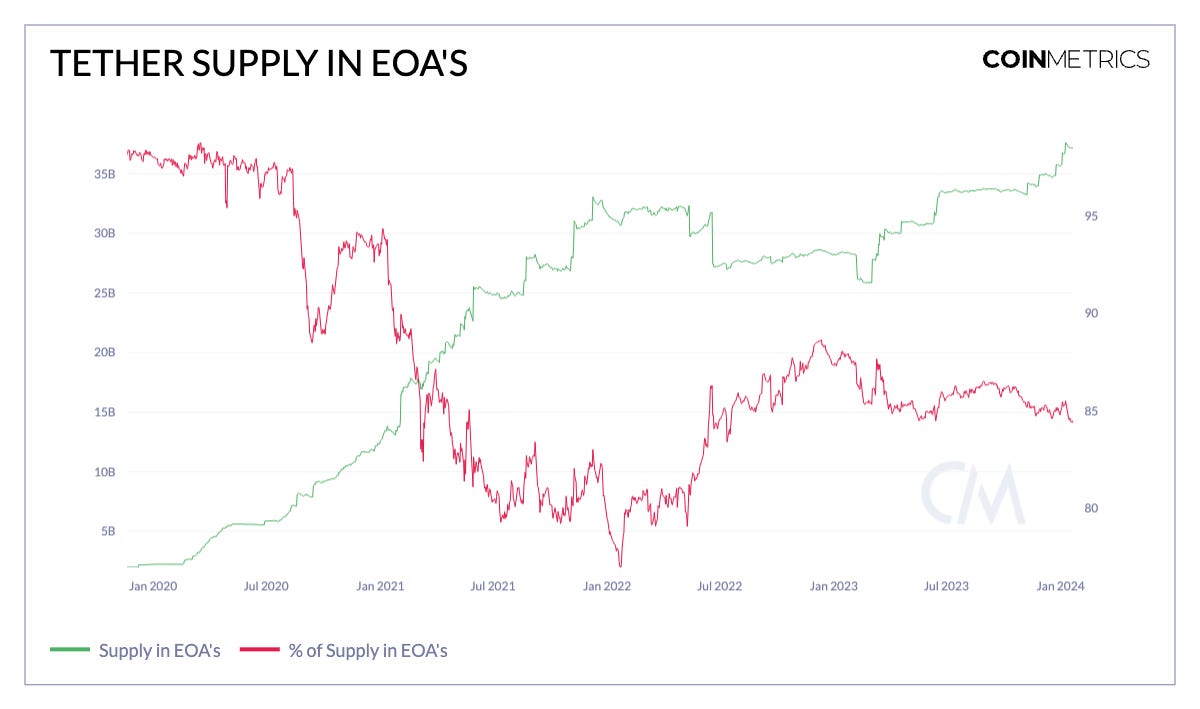

Whereas Tether’s utilization in sensible contracts has expanded, it’s primarily held by externally owned accounts (EOA’s), or accounts managed by personal keys, akin to accounts owned by particular person customers. The provision of Tether (ETH) in EOA’s has risen to $37B, comprising 84% of whole provide on Ethereum. These tendencies are reflective of rising adoption of digital {dollars} not solely as a retailer of worth or hedge in opposition to volatility, but in addition for his or her utility in transactional actions—akin to buying and selling or funds.

Source: Coin Metrics Network Data

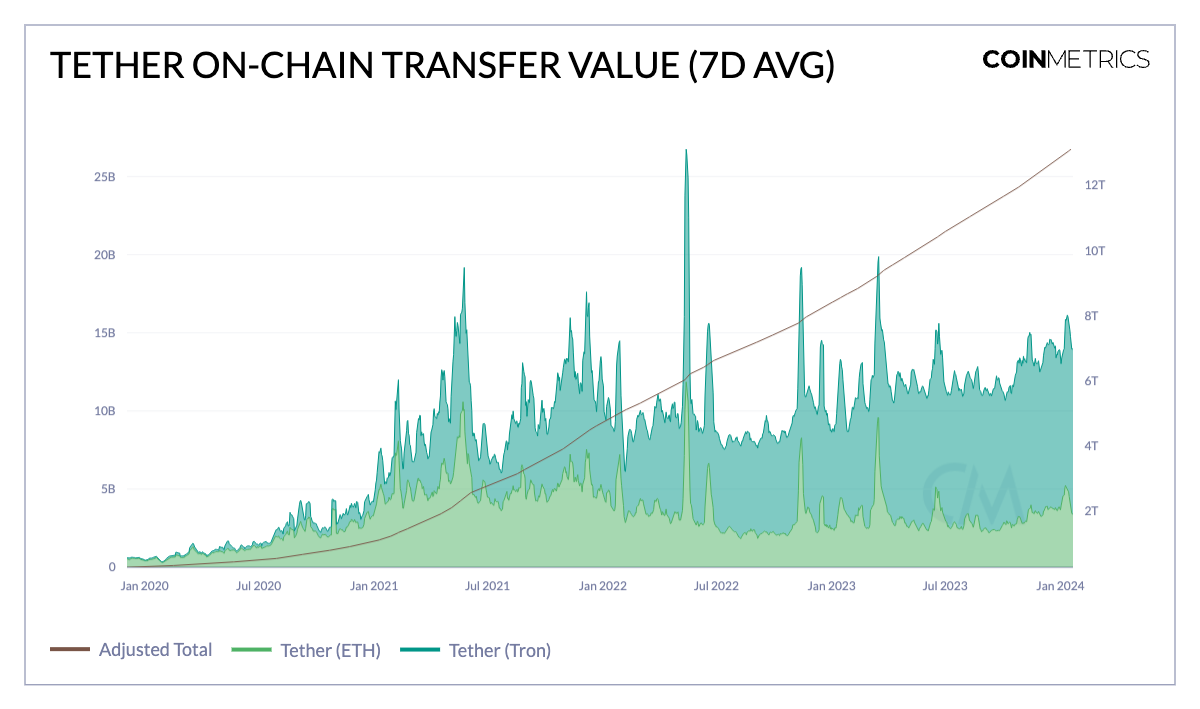

As the largest and most generally adopted stablecoin, Tether has seen substantial utilization. This month, the adjusted on-chain switch worth involving distinct USDT addresses on the Ethereum community exceeded $5B. Concurrently, switch worth on the Tron community surpassed $11B. Cumulatively, since its introduction in 2014, Tether has facilitated the switch of over $13T, emphasizing its rising utilization. This widespread adoption is notably pronounced in rising markets throughout Africa, Latin America, South Asia, and different areas. In these locales, Tether typically acts as a surrogate for the U.S. greenback. It offers the means to protect savings, search financial stability and affords access to banking infrastructure, thereby enabling peer-to-peer transactions for varied functions.

Source: Coin Metrics Network Data

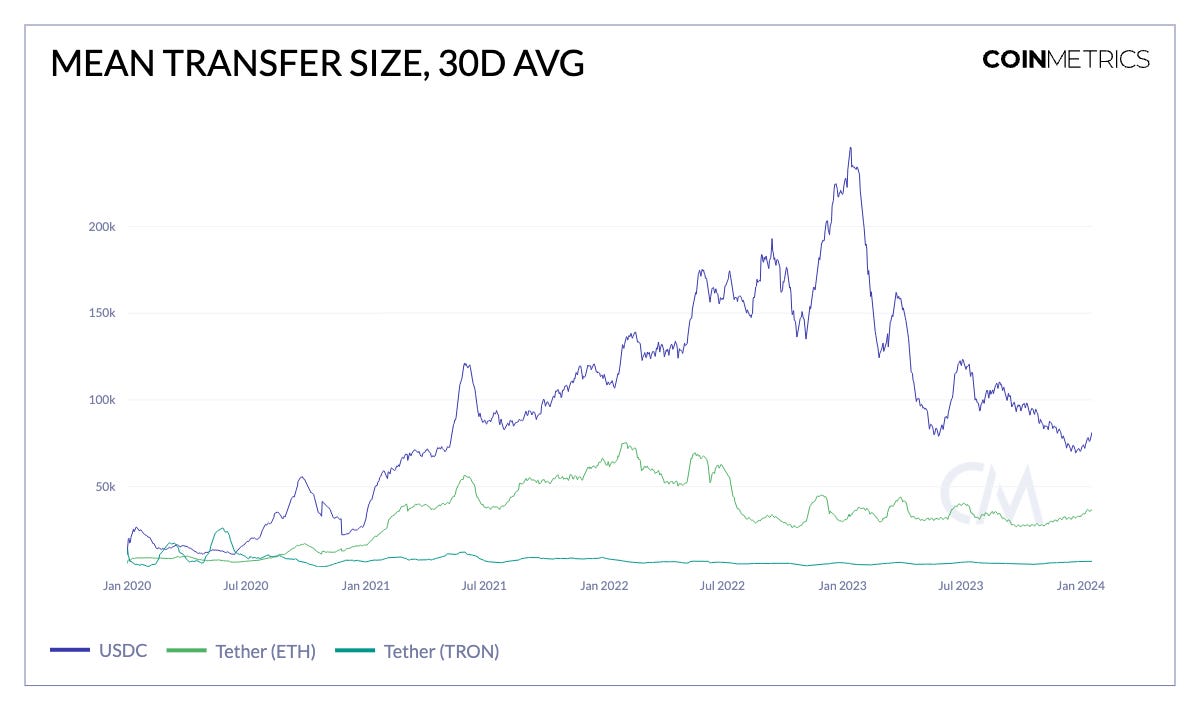

To raised perceive utilization patterns and the demographics served by Tether, analyzing the nature of “typical” Tether transactions is insightful. The info reveals that common switch sizes for USDT are typically smaller than these for USDC, which at the moment averages round $75,000 per switch. This greater common means that USDC is usually used for larger-scale transactions, aligning with its standing as the major onshore stablecoin and its widespread use in DeFi functions.

In distinction, USDT on the Ethereum community exhibits a mean switch dimension of $35,000, indicating its involvement in substantial monetary actions inside the DeFi ecosystem, probably influenced by Ethereum’s greater transaction charges. Conversely, USDT on the Tron community presents a definite situation. With Tron’s minimal transaction charges, the common switch dimension for USDT is round $7,000, facilitating extra frequent, lower-value transactions. This makes it a sensible possibility for every day funds and remittances.

Extra broadly, these patterns not solely mirror various person demographics and preferences but in addition underscore the affect of the underlying networks on which these stablecoins function.

Source: Coin Metrics Network Data

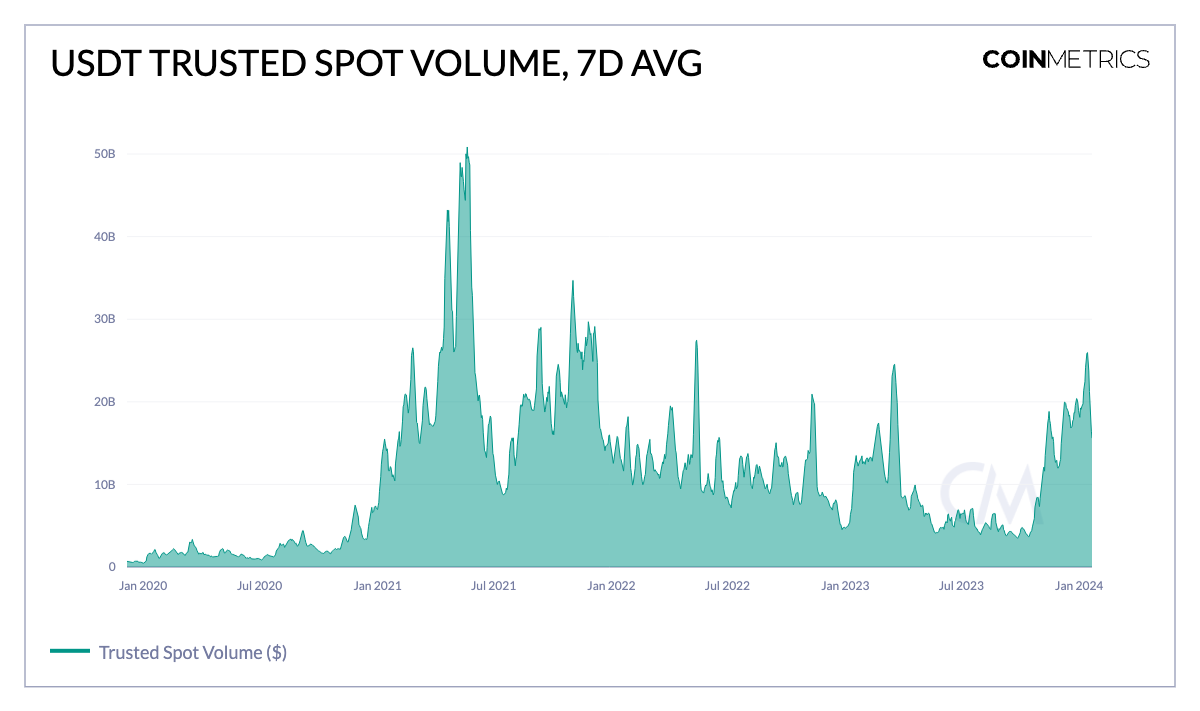

USDT, amongst different stablecoins, additionally performs a significant position as a quote asset—facilitating the liquid buying and selling of digital property on exchanges. With the latest exuberance in digital asset markets main as much as the launch of spot Bitcoin ETFs, USDT has facilitated over $25B in trusted spot volumes, overtaking earlier peaks in November 2022 and March 2023. Tether additionally performs a dominant position on this area, making up more than 85% of stablecoin denominated buying and selling quantity.

Source: Coin Metrics Market Data

The composition and transparency of Tether’s reserves have been contentious subjects, typically resulting in hypothesis about the adequacy of its monetary backing. Nevertheless, Howard Lutnick’s assertive assertion at the World Financial Discussion board in Davos, affirming that “They have the money,” has helped alleviate a few of these considerations, including a measure of credibility to the discussions about Tether’s reserves. Presently, the solely method to confirm that is by means of impartial auditor attestation reports, which offer a breakdown of property held of their reserves on a quarterly foundation.

Tether’s reserve composition has undergone a number of shifts over the years. Whereas types of debt like business paper made up a big portion of reserves in 2021, their newest attestation signifies that reserves are primarily composed of US Treasury payments, reflective of the rising rate of interest setting. In Might 2023, Tether announced that they’d begin allocating as much as 15% completely from realized earnings into BTC in an effort so as to add to USDT’s surplus reserves. This has materialized to 57.5K BTC, amounting to $1.6B value of bitcoin holdings aligning with their newest attestation in Q3 2023. Nevertheless, if this bitcoin account have been to be conclusively linked to Tether, it’d suggest that Tether just lately bought one other 8.9K BTC, bringing their present whole to 66.4K BTC. This inference is bolstered by the commentary that credit to this account appear to be linked to Bitfinex, an change intently related to Tether.

Though the quarterly attestations provide insights into Tether’s holdings, an official, extra frequent audit offering detailed transparency can be a welcome improvement for each customers and skeptics.

Tether’s spectacular ascent is a testomony to its tangible utility, notably in growing economies the place financial instability makes entry to a secure, dependable forex scarce. Regardless of legitimate considerations round centralization and transparency, the various advantages Tether affords shouldn’t be ignored. As one in every of the gateways to broader digital asset adoption, Tether has helped buoy the complete stablecoin market ahead. Whereas it stands as the largest stablecoin in the present day, it is going to be fascinating to see if it continues to reign supreme in opposition to the backdrop of an evolving panorama. Circle’s plans to go public, together with the rise of crypto-collateralized and interest-bearing stablecoins make the dynamic nature of the stablecoin panorama an intriguing one to observe.

To observe the knowledge used on this piece and discover our different on-chain metrics take a look at our charting tool, formula builder, correlation tool, and mobile apps.

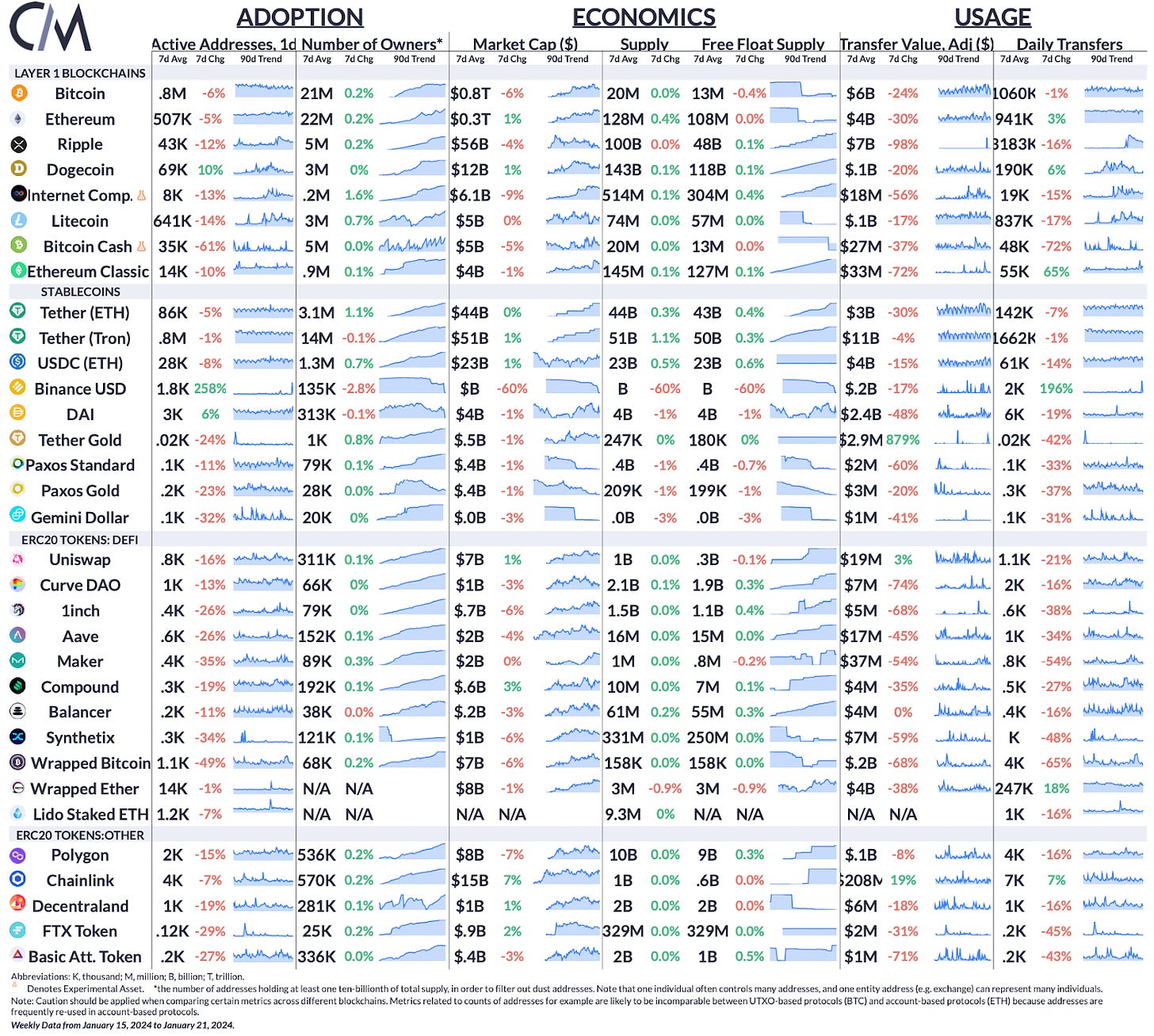

Supply: Coin Metrics Community Information Professional

Bitcoin and Ethereum noticed a decline in lively addresses by 6% and 5% respectively. Concurrently, Bitcoin’s market capitalization dropped by 6%, contributing to an total downturn in digital asset markets following the launch of spot Bitcoin ETFs.

This week’s updates from the Coin Metrics workforce:

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary from the Coin Metrics workforce, wealthy visuals, and well timed knowledge.

As all the time, if in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.