The Airdrop Trilemma: A Data Problem in Disguise.

Just lately, Starkware initiated their much-awaited airdrop. Like, most airdrops it resulted in a ton of controversy. Which in a tragic manner, would not actually shock anybody anymore.

So why is it the case that this retains on occurring time and again? One may hear a number of of those views:

-

Insiders simply need to dump and transfer on, cashing out billions

-

The group did not know any higher and did not have the correct counsel

-

Whales ought to have been given extra precedence since they convey TVL

-

Airdrops are about democratising what it means to be in crypto

-

With out farmers, there isn’t a utilization or stress testing of the protocol

-

Misaligned airdrop incentives proceed to provide unusual unintended effects

None of those view is unsuitable, however none of those views are utterly true by themselves. Let’s unpack a number of takes to verify now we have a complete understanding of the issue at hand.

There exists a basic pressure when doing an airdrop, you are selecting between three elements:

-

Capital Effectivity

-

Decentralisation

-

Retention

You typically find yourself in a situation the place airdrops strike properly in 1 dimension, however not often strike stability between even 2 or all 3. Retention in explicit is the toughest dimension with something north of 15% usually exceptional.

-

Capital effectivity is outlined as the standards used to what number of tokens you give to a participant. The extra effectively you distribute your airdrop, the extra it would change into liquidity mining (one token per greenback deposited)—benefiting whales.

-

Decentralisation is outlined as who will get your tokens and beneath what standards. Latest airdrops have adopted the tactic of going for arbitrary standards in order to maximise the protection of who will get stated tokens. That is usually factor because it saves you from authorized troubles and buys you extra clout for making folks wealthy (or paying for his or her parking fines).

-

Retention is outlined as how a lot do customers stick round after the airdrop. In some sense it is a method to gauge how aligned have been your customers together with your intent. The decrease the retention, the much less aligned your customers have been. 10% retention charges as an business benchmark imply just one in 10 addresses are literally right here for the correct causes!

Placing retention apart, lets study the primary 2 in extra element: capital effectivity and decentralisation.

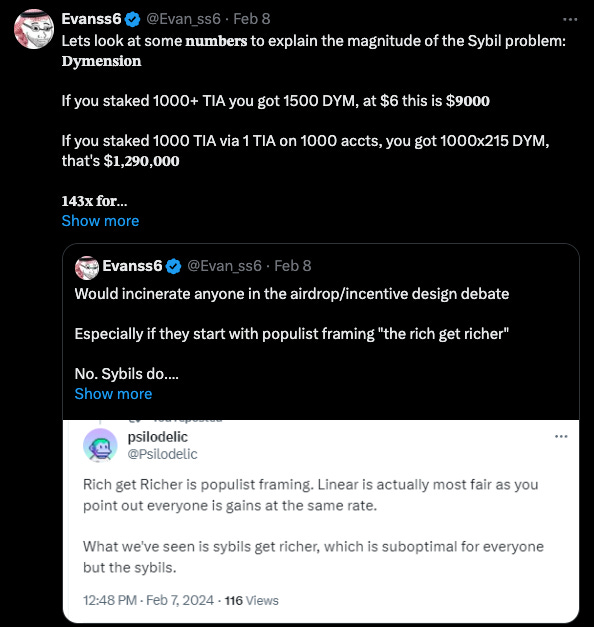

To grasp the primary level round capital effectivity, let’s introduce a brand new time period known as the “sybil co-efficient”. It mainly calculates how a lot you profit from splitting one greenback of capital throughout a sure variety of accounts.

The place you lie on this spectrum will finally be how wasteful your airdrop will change into. When you’ve got a sybil coefficient of 1, it technically means you are working a liquidity mining scheme and can anger a number of customers.

Nevertheless if you get to one thing like Celestia the place the sybil coefficient balloons out to 143, you are going to get extraordinarily wasteful behaviour and rampant farming.

This leads us to our second level round decentralisation: you need to finally assist “the small guy” who’s an actual consumer and taking the prospect to make use of your product early — regardless of them not being wealthy. In case your sybil coefficient reaches too near 1 then you are going to be giving near nothing to the “small guy” and most if it to the “whales”.

Now that is the place the airdrop debate turns into heated. You have got three lessons of customers that exist right here:

-

“small guys” who’re right here to make a fast buck and transfer on (perhaps utilizing a number of wallets in the method)

-

“small guys” who’re right here to remain and just like the product you have made

-

“industrial-farmers-who-act-like-lots-of-small-guys” right here to utterly take most of your incentives and promote them earlier than shifting to the subsequent factor

3 is the worst, 1 remains to be type of acceptable and a pair of is perfect. How we differentiate between the three is the grand problem of the airdrop drawback.

So how do you resolve for this drawback? Whereas I haven’t got a concrete resolution, I’ve a philosophy round how one can resolve this that I’ve spent the previous few years interested by and likewise observing first-hand: project-relative segmentation.

I will clarify what I imply. Zoom out and take into consideration the meta-problem: you’ve gotten all of your customers and also you want to have the ability to divide them up into teams based mostly on some form of worth judgement. Worth right here is context-specific to the observer so will differ from challenge to challenge. Attempting to ascribe some “magical airdrop filter” is rarely going to be ample. By exploring the info you can begin to know what your customers really seem like and begin to make data-science based mostly selections on what the suitable method to execute your airdrop is thru segmentation.

Why does nobody do that? That is one other article that I will be writing in the long run however the very lengthy TLDR is that it is a arduous information drawback that requires information experience, money and time. Not many groups are prepared or ready to try this.

The final dimension that I need to speak about is retention. Earlier than we speak about it, it is most likely finest to outline what retention means in the primary place. I might sum it as much as the next:

“

quantity of people that an airdrop is given to

---------------------------------------------

quantity of people that hold the airdrop

What most airdrops make the basic mistake of is making this a one-time equation.

So as to show this, I assumed some information may assist right here! Fortunately, Optimism has really executed on multi-round airdrops! I hoped I might discover some simple Dune dashboards that gave me the retention numbers I used to be after however I used to be sadly unsuitable. So, I made a decision to roll up my sleeves and get the info myself.

With out overcomplicating it, I wished to know one easy factor: how does the proportion of customers with a non-zero OP stability change over successive airdrops.

I went to: to get the record of all addresses that had participated in the Optimism airdrop. Then I constructed somewhat scraper that will manually get the OP stability of each deal with in the record (burned a few of our inside RPC credit for this) and did a bit of knowledge wrangling.

Earlier than we dive in, one caveat is that every OP airdrop is impartial of the prior airdrop. There is not any bonus or hyperlink for retaining tokens from the earlier airdrop. I do know the rationale why however in any case let’s keep it up.

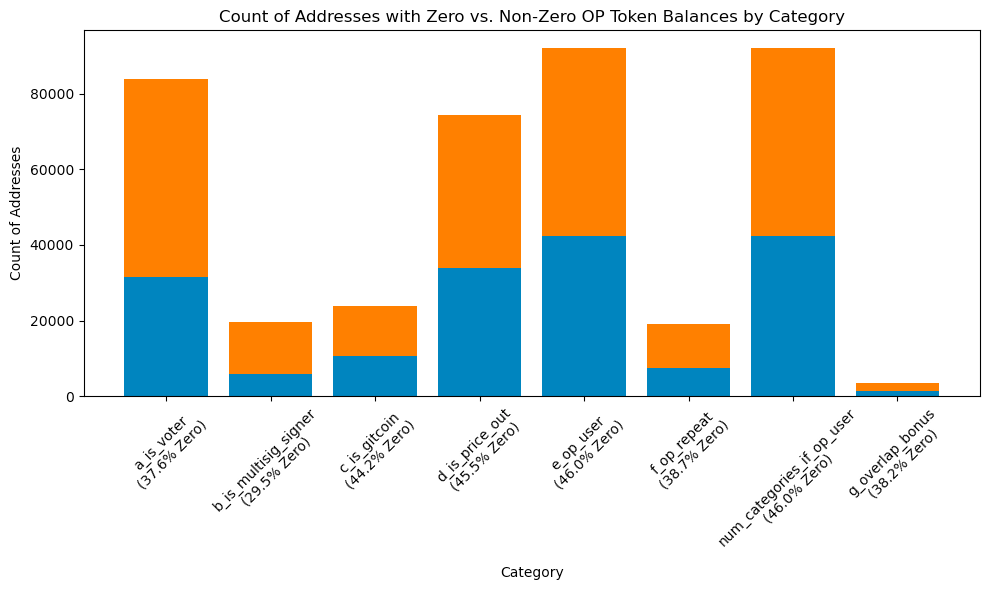

Given to 248,699 recipients with the standards out there right here: https://community.optimism.io/docs/governance/airdrop-1/#background. The TLDR is that customers got tokens for the next actions:

-

OP Mainnet customers (92k addresses)

-

Repeat OP Mainnet customers (19k addresses)

-

DAO Voters (84k addresses)

-

Multisig Signers (19.5k addresses)

-

Gitcoin Donors on L1 (24k addresses)

-

Customers Priced Out of Ethereum (74k addresses(),

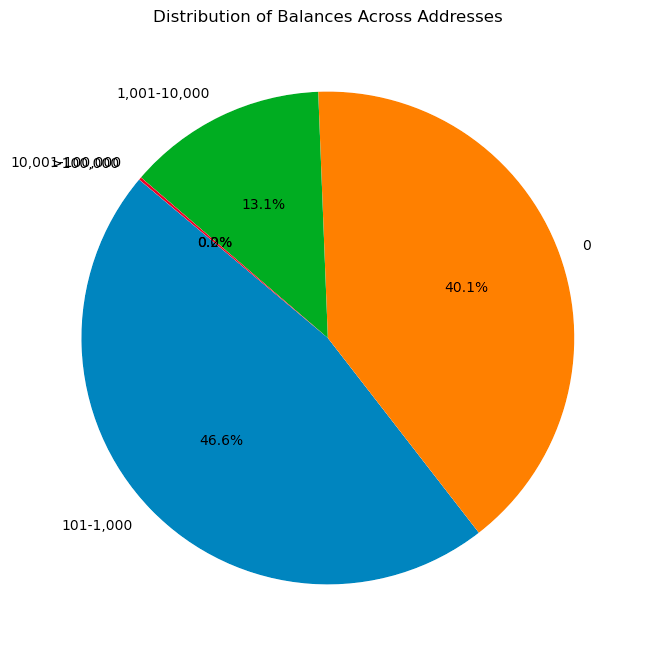

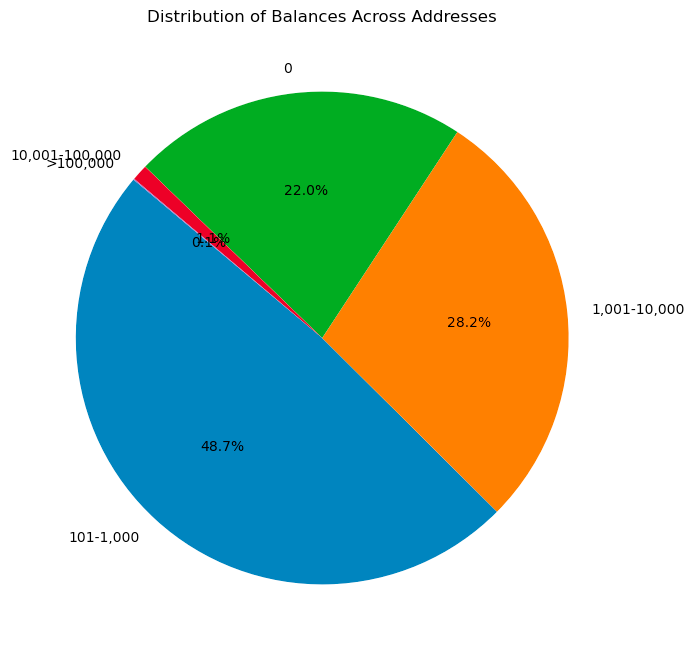

After working the evaluation of all these customers and their OP stability, I received the next distribution. 0 balances are indicative of customers who dumped since unclaimed OP tokens have been despatched on to eligible addresses on the finish of the airdrop (as per https://dune.com/optimismfnd/optimism-airdrop-1).

Regardless, this primary airdrop is surprisingly good relative to earlier airdrops executed that I’ve noticed! Most have a 90%+ dump fee. For less than 40% to have a 0% stability is surprisingly good.

I then wished to know how every standards performed a job in figuring out whether or not customers have been prone to retain tokens or not. The solely subject with this system is that addresses could be in a number of classes which skews the info. I would not take this at face worth however reasonably a tough indicator:

One time OP customers had the very best share of customers with a 0 stability, following customers who have been priced out of Etheruem. Clearly these weren’t the perfect segments to distribute customers to. Multisig signers have been the bottom which I feel is a good indicator since it is not apparent to airdrop farmers to setup a multi-sig the place you signal transactions to farm an airdrop!

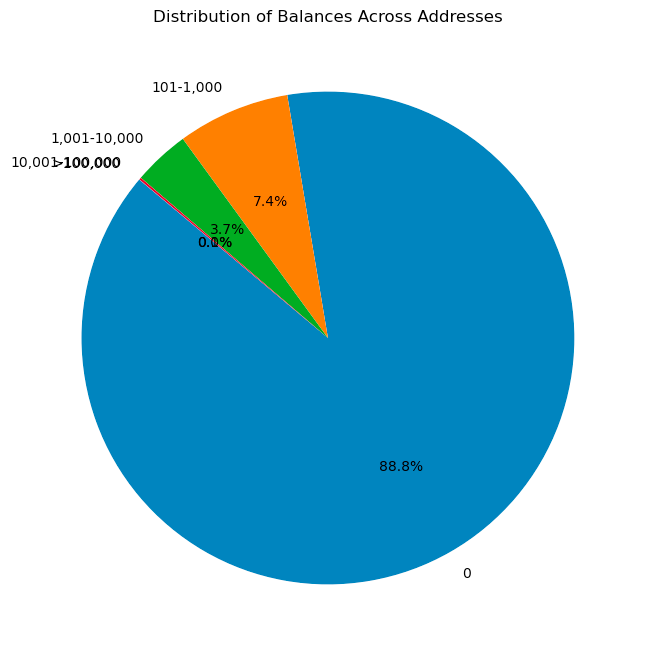

This airdrop was distributed to 307,000 addresses however was rather a lot much less considerate imo. The standards was set to the next (supply: https://community.optimism.io/docs/governance/airdrop-2/#background):

-

Governance delegation rewards based mostly on the quantity of OP delegated and the size of time it was delegated.

-

Partial fuel rebates for energetic Optimism customers who’ve spent over a certain quantity on fuel charges.

-

Multiplier bonuses decided by extra attributes associated to governance and utilization.

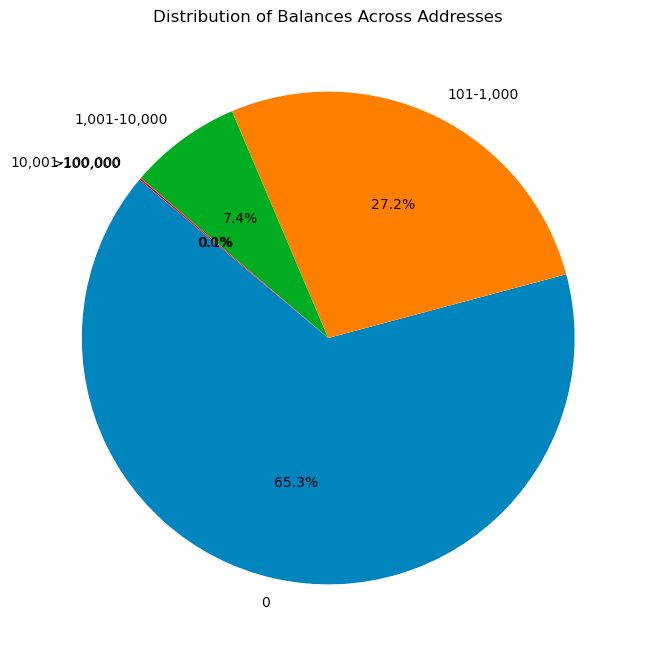

To me this intuitively felt like a foul standards as a result of governance voting is a simple factor to bot and pretty predictable. As we’ll discover out beneath, my instinct wasn’t too off. I used to be shocked simply how low the retention really was!

Near 90% of addresses held a 0 OP stability! That is your common airdrop retention stats that persons are used to seeing. I might love to enter this deeper however I am eager to maneuver to the remaining airdrops.

That is by far the perfect executed airdrop by the OP group. The standards is extra refined than earlier than and has a component of “linearisation” that was talked about in earlier articles. This was distributed to about 31k addresses, so smaller however simpler. The particulars are outlined beneath (supply: https://community.optimism.io/docs/governance/airdrop-3/#airdrop-3-allocations):

-

OP Delegated x Days= Cumulative Sum of OP Delegated per Day (i.e. 20 OP delegated for 100 days: 20 * 100 = 2,000 OP Delegated x Days). -

Delegate should have voted onchain in OP Governance in the course of the snapshot interval (01-20-2023 at 0:00 UTC and 07-20-2023 0:00 UTC )

One important element to notice right here is that the standards for voting on-chain is AFTER the interval from the final airdrop. So the farmers that got here in the primary spherical thought “okay, I’m done farming, time to move on to the next thing”. This was sensible and helps with this evaluation as a result of have a look at these retention stats!

Woah! Solely 22% of those airdrop recipients have a token stability of 0! To me this indicators the waste on this airdrop was far lower than any of the earlier ones. This performs into my thesis of retention being important and extra information that having multi-round airdrops has extra utility than folks given credit score for.

This airdrop was given to a complete of 23k addresses and had a extra attention-grabbing standards. I personally thought the retention of this may be excessive however after interested by it I’ve a thesis for why it was most likely decrease than anticipated:

-

You created partaking NFTs on the Superchain. Complete fuel on OP Chains (OP Mainnet, Base, Zora) in transactions involving transfers of NFTs created by your deal with. Measured in the course of the trailing twelve months earlier than the airdrop cutoff (Jan 10, 2023 – Jan 10, 2024).

-

You created partaking NFTs on Ethereum Mainnet. Complete fuel on Ethereum L1 in transactions involving transfers of NFTs created by your deal with. Measured in the course of the trailing twelve months earlier than the airdrop cutoff (Jan 10, 2023 – Jan 10, 2024).

Absolutely you’d suppose that folks creating NFT contracts could be indicator? Sadly not. The information suggests in any other case.

Whereas it is not as dangerous as Airdrop #2, we have taken a fairly large step again in phrases of retention relative to Airdrop #3.

My speculation is that if they did extra filtering on NFT contracts that have been marked as spam or had some type of “legitimacy”, these numbers would have improved considerably. This standards was too broad. As well as, since tokens have been airdropped to those addresses instantly (reasonably than having to be claimed) you find yourself in a scenario the place rip-off NFT creators went “wow, free money. time to dump”.

As I wrote this text and sourced the info myself, I managed to show/disprove sure assumptions I had that turned out to be very worthwhile. Specifically, that the standard of your airdrop is instantly associated to how good your filtering standards is. Folks that attempt to create a common “airdrop score” or use superior machine studying fashions will fail vulnerable to inaccurate information or a number of false positives. Machine studying is nice till you attempt to perceive the way it derived the reply it did.

Whereas writing the scripts and code for this text I received the numbers for the Starkware airdrop which can also be an attention-grabbing mental train. I will write about that for subsequent time’s submit. The key takeaways that groups needs to be studying from right here:

-

Cease doing one-off airdrops! You are taking pictures your self in the foot. You need to deploy incentives type of like a/b testing. A number of iteration and utilizing the previous’s learnings to information your future goal.

-

Have standards that builds off previous airdrops, you are going to improve your effectiveness. Really give extra tokens to folks that maintain tokens on the identical pockets. Make it clear to your customers that they need to stick to at least one pockets and solely change wallets if completely essential.

-

Get higher information to make sure smarter and better high quality segmentation. Poor information = poor outcomes. As we noticed in the article above, the much less “predictable” the standards, the higher the outcomes for retention.

When you’re actively considering of doing an airdrop or need to jam about these items, attain out. I spend all my waking hours interested by this drawback and have been for the previous 3 years. The stuff we’re constructing instantly pertains to the entire above, even when it would not appear so on the floor.

Aspect be aware: I have been a bit out of the loop with posting resulting from poor well being and many work. Which means content material creation usually finally ends up sliding off my plate. I am slowly feeling higher and rising the group to make sure I can get again to having an everyday cadence right here.