The US Faces the Risk of Losing Its Position as a Leader in Stablecoins

The U.S. Dangers Its Position as a Stablecoin Leader

This content material highlights the want for regulators and policymakers to strategy stablecoin regulation otherwise than conventional cost programs. Whereas stablecoins could not current kind of threat, they do current totally different dangers resulting from their underlying know-how and use in new kinds of cost exercise. On the optimistic facet, stablecoins’ fully-backed nature will help mitigate systemic threat and make supervision simpler for regulators. Nevertheless, there are additionally operational dangers related to stablecoins that won’t have been beforehand thought-about by regulators. Due to this fact, it’s essential for regulators to evaluate these distinctive dangers and develop acceptable rules for stablecoins.

Title: The U.S. Dangers Its Position as a Stablecoin Leader: A Tumultuous Highway Forward

Byline: [Your Name]

Date: [Current Date]

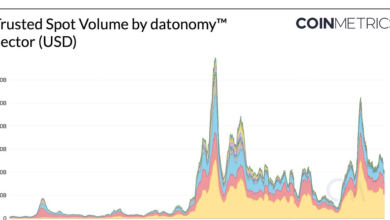

(Insert Location) – The United States, as soon as at the forefront of the burgeoning stablecoin trade, is now dealing with the threat of dropping its dominant place in the international market. Regulatory uncertainty and mounting considerations round financial coverage have forged a shadow over the nation’s stablecoin panorama, inflicting specialists to query the reliability and stability lengthy related to the U.S. stablecoin ecosystem.

At the epicenter of this rising storm lies the ever-popular Tether (USDT), the world’s largest stablecoin. Tether, with its one-to-one peg to the U.S. greenback, has historically loved immense belief and widespread adoption. Nevertheless, latest regulatory scrutiny, coupled with mounting allegations of market manipulation, has forged doubts on Tether’s stability and credibility.

The U.S. authorities’s ambiguous stance on stablecoins has left the trade grappling with uncertainty. The lack of clear rules has not solely impacted market contributors however has additionally allowed international rivals to realize a aggressive edge. Stablecoin tasks from jurisdictions like Switzerland, Singapore, and the United Arab Emirates are gaining momentum as buyers search alternate options in search of regulatory readability.

This instability and lack of regulatory steering might have far-reaching penalties for the U.S. financial system. Stablecoins serve as important instruments for dollarization in different nations, enabling people and companies to bypass conventional banking programs and facilitate worldwide transactions. By doubtlessly dropping its grip on the stablecoin trade, the U.S. could inadvertently threat relinquishing a good portion of its international financial affect.

Market observers argue that the time for swift and decisive motion is now. The U.S. Congress, regulators, and trade gamers should come collectively to determine a strong and forward-thinking regulatory framework for stablecoins. With out correct oversight, stablecoins might turn into a breeding floor for illicit actions, resulting in monetary instability domestically and overseas.

Whereas the dangers related to stablecoins are obvious, a well-regulated and clear stablecoin trade might present vital advantages for the U.S. financial system. It might foster monetary innovation, creating new avenues for cross-border funds and enabling a extra environment friendly and inclusive monetary system. Moreover, a sturdy and secure stablecoin ecosystem would appeal to funding, additional solidifying the U.S.’s place as a international monetary powerhouse.

Nevertheless, making regulatory headway in this area will undoubtedly be a difficult process. Balancing shopper safety, nationwide safety, and monetary stability requires cautious consideration from all stakeholders concerned. The U.S. isn’t alone in navigating these waters. Governments worldwide are grappling with related challenges and are exploring their choices cautiously.

For the U.S. to regain its standing as a stablecoin chief, collaboration between regulators, lawmakers, and trade contributors is essential. Clear tips encompassing facets such as capital necessities, liquidity administration, and compliance measures should be established. The intention must be to foster innovation whereas minimizing dangers.

Furthermore, regulators should take a proactive strategy in addressing the governance and transparency of stablecoins. Public audits, common reporting, and strong inner management mechanisms must be applied to make sure full accountability. Undertaking founders and administration groups must be required to satisfy stringent eligibility standards and endure thorough due diligence to make sure their functionality to safeguard investor pursuits.

Time is of the essence, and the U.S. should act swiftly to regain its place as a international chief in stablecoins. Failure to take action might have extreme implications for the nation’s financial system and its standing on the world stage. The stability and reliability lengthy related to the U.S. should be restored if it intends to stay at the forefront of the digital finance revolution.

As stakeholders await regulatory readability, the future of stablecoins in the U.S. stays unsure. The clock is ticking, and the nation should resolve whether or not it needs to steer the cost or be left behind in this transformative monetary panorama.

I don’t personal the rights to this content material & no infringement meant, CREDIT: The Authentic Supply: www.coindesk.com