The Usage & Evolution of Decentralized Exchanges (DEX’s)

Get the very best data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matías Andrade

-

Regulatory Influence and Market Adaptation: The SEC’s scrutiny of Uniswap highlights the regulatory hurdles dealing with DEXs, whereas market occasions just like the USDC de-peg have examined the resilience and adaptableness of these platforms.

-

Progress in Buying and selling Volumes: DEX’s have seen development in buying and selling quantity, with Uniswap’s quarterly quantity rising to $84 billion in Q1 2024

-

Challenges Dealing with Curve: Curve Finance has seen a dip in liquidity and buying and selling volumes from its peak, although utilization charges are rising.

Decentralized exchanges (DEX’s) kind a core piece of infrastructure within the digital asset ecosystem. They function the gateway to the on-chain economic system and facilitate the itemizing, buying and selling, and provision of liquidity throughout markets with out the necessity for intermediaries. The debut of Uniswap in 2018 marked a pioneering growth within the use of liquidity swimming pools and automated market makers (AMMs), a mannequin that has since been broadly adopted by quite a few DEXs. Because the quantity and maturity of DEXs have advanced, assessing their adoption gives perception right into a important element of the cryptocurrency infrastructure.

On this concern of Coin Metrics’ State of the Community, we make use of a data-driven strategy to discover exercise throughout Ethereum decentralized exchanges, inspecting liquidity, buying and selling volumes, and the tendencies shaping the DEX panorama.

In gentle of the current Wells Discover issued by the Securities and Change Fee (SEC) to Uniswap Labs, it’s essential to underscore the distinctive options of DEXs. Though the particular considerations haven’t been absolutely disclosed, the SEC’s intent to probably topic DEXs to regulatory oversight mirrors actions taken in opposition to main centralized exchanges like Coinbase and Binance, notably concerning the securities classification of traded belongings. Nonetheless, DEXs differ essentially from their centralized counterparts.

On the coronary heart of most DEX’s are automated market makers (AMMs). In contrast to conventional exchanges, which depend on centralized order books and market makers to match counterparties, AMM’s use pricing algorithms to handle the value and liquidity of tokens in a pool. These swimming pools are funded by liquidity suppliers (LPs) who earn buying and selling charges proportionate to their contributions, fostering an setting the place customers preserve management over their funds. This contrasts with the custodial nature of centralized exchanges (CEXs). Due to this fact, the permissionless, autonomous, and non-custodial nature of DEXs, ruled by open-source smart contract code, units them other than platforms below extra stringent regulatory scrutiny.

The following sections will delve into some of the biggest DEXs within the Ethereum ecosystem, specializing in their evolution and utilization, supported by Coin Metrics’ DEX Market Knowledge & Community Knowledge.

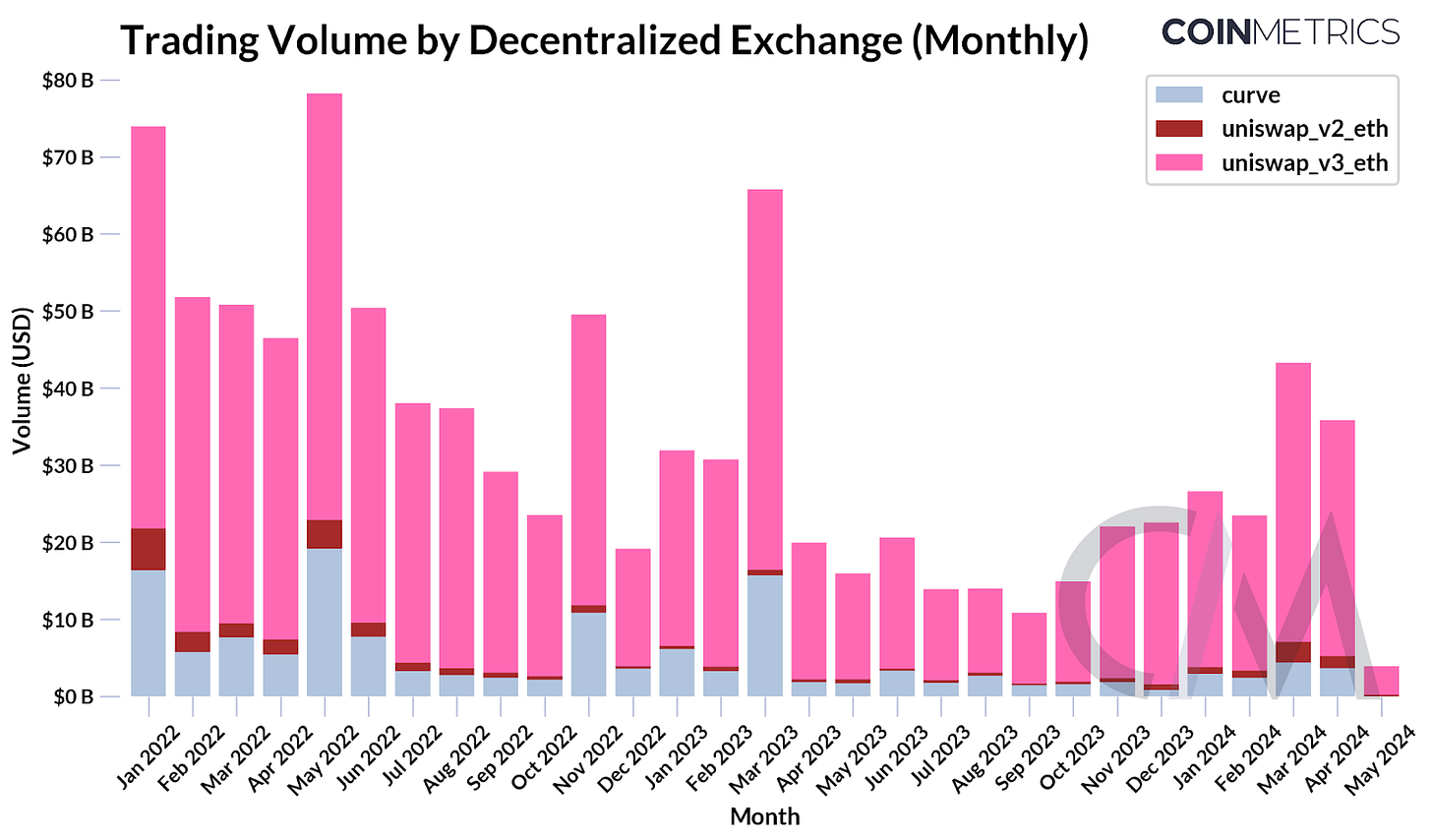

Buying and selling volumes throughout main decentralized exchanges (DEXs) are presently on an uptrend. Whereas market volatility has sometimes spurred spikes in exercise, buying and selling volumes remained subdued for many of final 12 months, averaging round $15B in month-to-month buying and selling quantity. Nonetheless, since October, Uniswap has recorded a quarterly buying and selling quantity of $54B in This autumn 2023 and $84B in Q1 2024. Buying and selling quantity on Curve Finance can be on the rise, although not but reaching the degrees seen earlier than the USDC de-peg in March 2023.

Source: Coin Metrics DEX Market Data & Labs

In the present day, Uniswap stands as the biggest decentralized change by quantity, having facilitated over $2T in cumulative transaction quantity. It’s considered a cornerstone of your entire decentralized finance (DeFi) sector’s enlargement. With every protocol iteration, Uniswap’s liquidity provision mannequin has seen a number of developments.

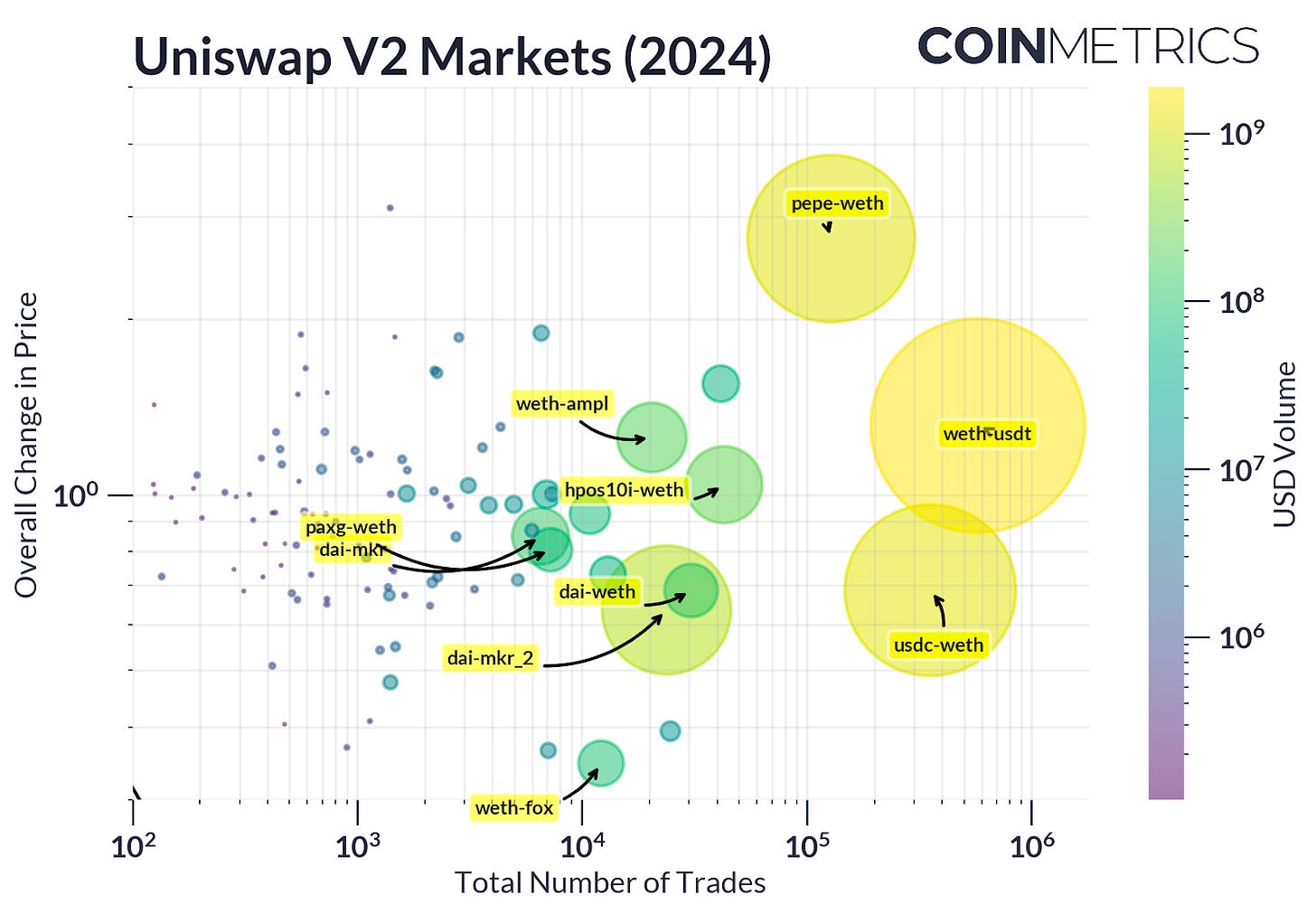

Launched in 2020, Uniswap v2 supplied a foundational AMM platform, using a relentless product invariant (x * y = okay). This model facilitated token swaps by making certain liquidity even in much less energetic markets and its permissionless course of to create markets (additionally known as swimming pools) has made it a nurturing floor for a various set of pairs—starting from blue-chips to memecoins. Whereas buying and selling volumes don’t match that of Uniswap v3, a number of swimming pools on Uniswap v2 boast a higher amount of trades, favoring newly-listed tokens and passive liquidity suppliers. Nonetheless this additionally got here with its challenges, akin to vulnerability to types of maximal extractable value (MEV), lowered capital effectivity as a result of having to allocate capital throughout your entire worth vary, and the potential for impermanent loss, lowering earnings for liquidity suppliers.

Source: Coin Metrics DEX Market Data

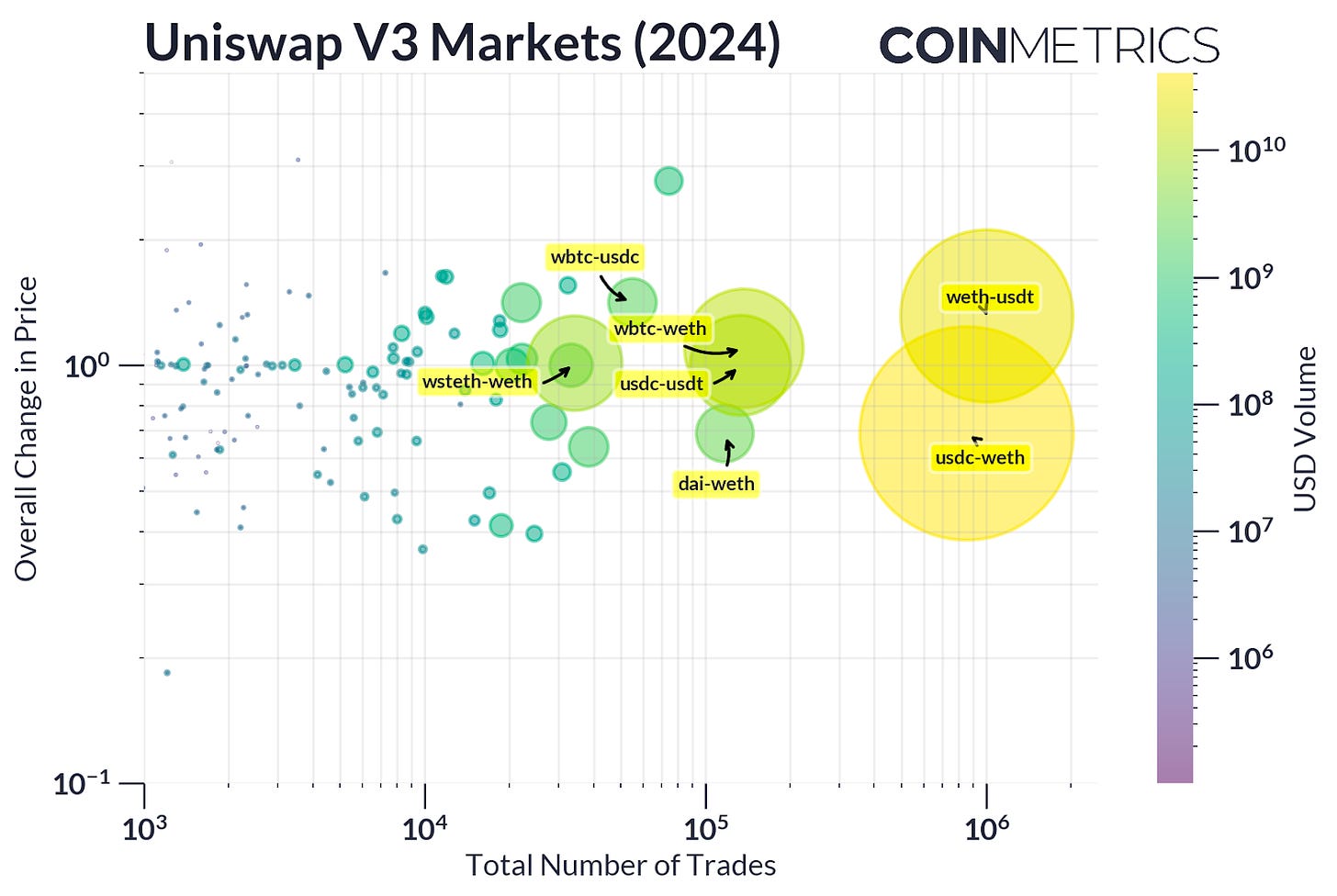

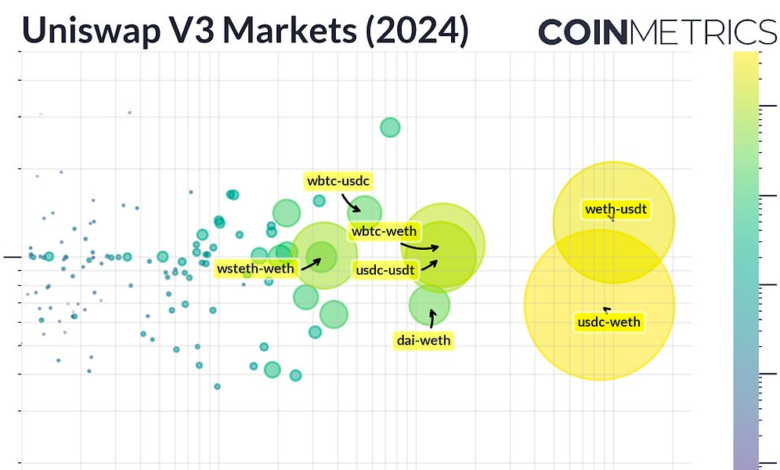

Uniswap v3 addressed some these challenges with its concentrated liquidity mannequin, permitting LP’s to allocate capital inside spcific worth ranges. This enhancement drastically improved capital effectivity and LP returns, as token reserves solely wanted to be maintained throughout an outlined worth vary the place liquidity was most required. As illustrated within the chart under, this mechanism has considerably elevated liquidity in stablecoin markets.

Uniswap v3 additionally launched charge tiers (0.1%, 0.05%, 0.3% and 1%), including granularity to the buying and selling expertise throughout varied swimming pools. This innovation gives LPs and swappers with choices to handle threat extra successfully, permitting them to regulate publicity based mostly on market volatility or the character of asset pairs, whether or not secure or extra unstable.

Source: Coin Metrics DEX Market Data

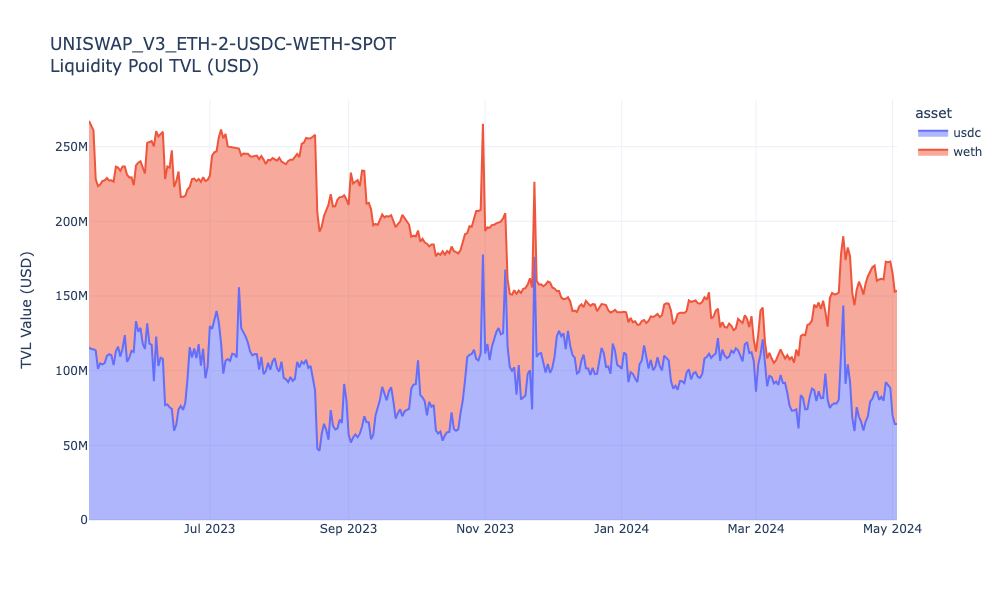

The pairing of Circle’s USDC with wrapped ETH (USDC-WETH pool), that includes a 0.05% charge, is one of essentially the most liquid and actively traded markets on Uniswap v3. This pair attracts a better quantity of trades as a result of its low transaction price, lowered worth volatility, and the recognition of each belongings. These elements make it a lovely choice for each merchants and liquidity suppliers.

Source: Coin Metrics DEX Market Data & ATLAS

Just like Uniswap, Curve Finance is an automatic market maker (AMM)-based DEX that has established itself as a central hub for belongings of related worth. Earlier than the introduction of Uniswap v3’s concentrated liquidity mechanism, stablecoins usually confronted liquidity challenges, and liquidity suppliers (LPs) earned comparatively low charges. Launched in 2020, Curve aimed to deal with these points by enabling low slippage swaps between stablecoins by means of its StableSwap AMM. This technique uniquely combines the fixed sum invariant (x + y = okay) with the fixed product invariant (x * y = okay) utilized by Uniswap. Because of this, Curve has facilitated a various set of markets for stablecoins, wrapped belongings, and liquid staking tokens (LSTs), specializing in deep liquidity inside narrower worth ranges.

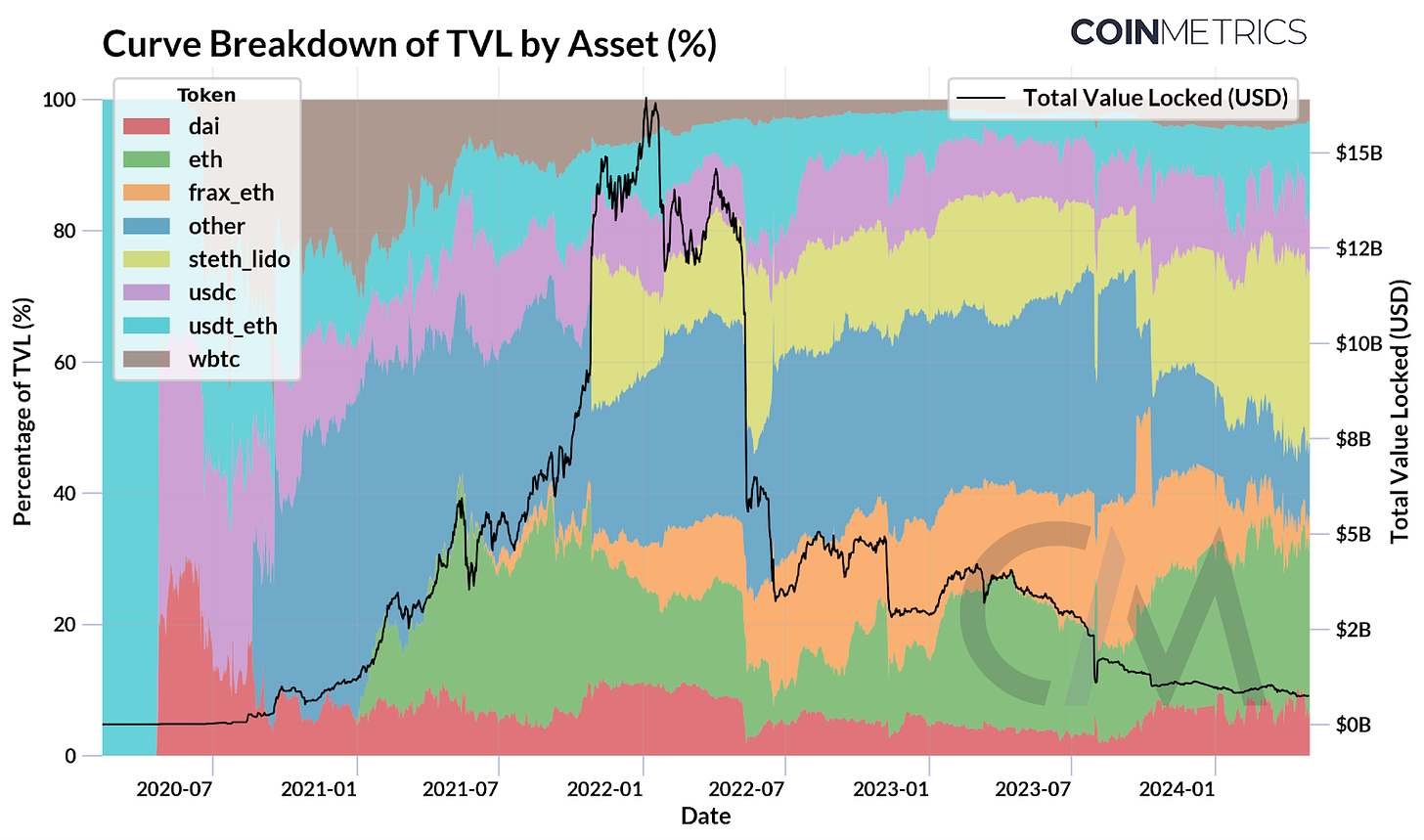

Source: Coin Metrics DeFi Balance Sheets & Labs

As seen within the chart above, the overall worth of locked (TVL) of belongings in Curve sensible contracts rose quickly to over $15B in 2021, earlier than an exodus of liquidity as a result of a loss of consumer confidence to de-peggings and an exploit in 2023. The composition of liquidity in Curve has modified over time, with ETH (26%), stETH (26%) and stablecoins (32%) making up a majority of liquidity, whereas different belongings have lowered in dominance.

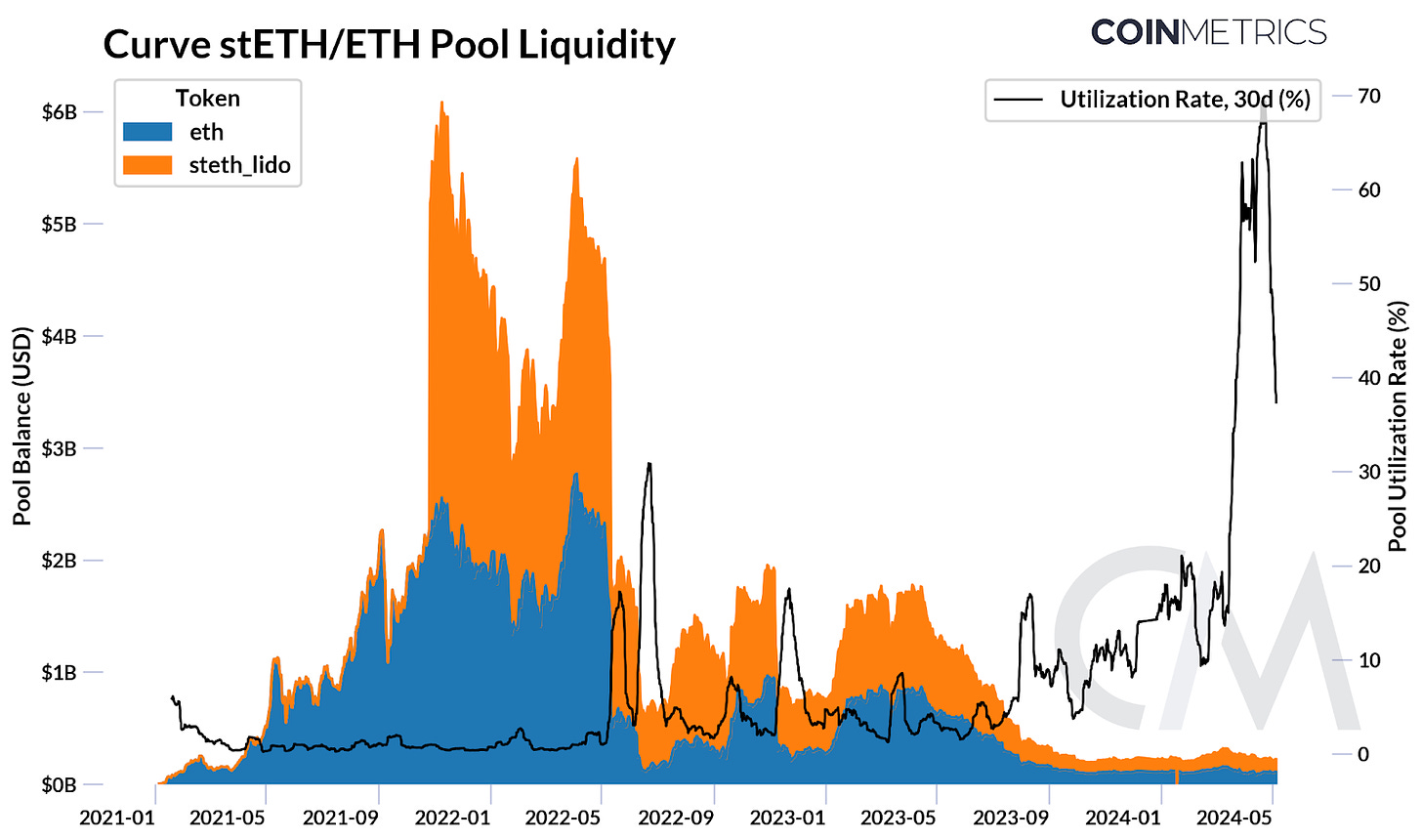

At present, the stETH/ETH pool is the biggest liquidity pool on Curve. Curve was a major hub for stETH, the place a majority of liquidity was concentrated previous to the Shapella improve. Nonetheless, circumstances have modified because the stETH de-pegging in Might 2022 (when worth of stETH deviated from the underlying ETH by ~6.5%) and since withdrawals had been launched. Liquidity has expanded to different AMM’s and CEX’s and there may be additionally a major marketplace for stETH liquidity. At present, there may be ~$220M of liquidity on this pool, considerably decrease than its $6B peak in early 2022.

Supply: Coin Metrics Labs

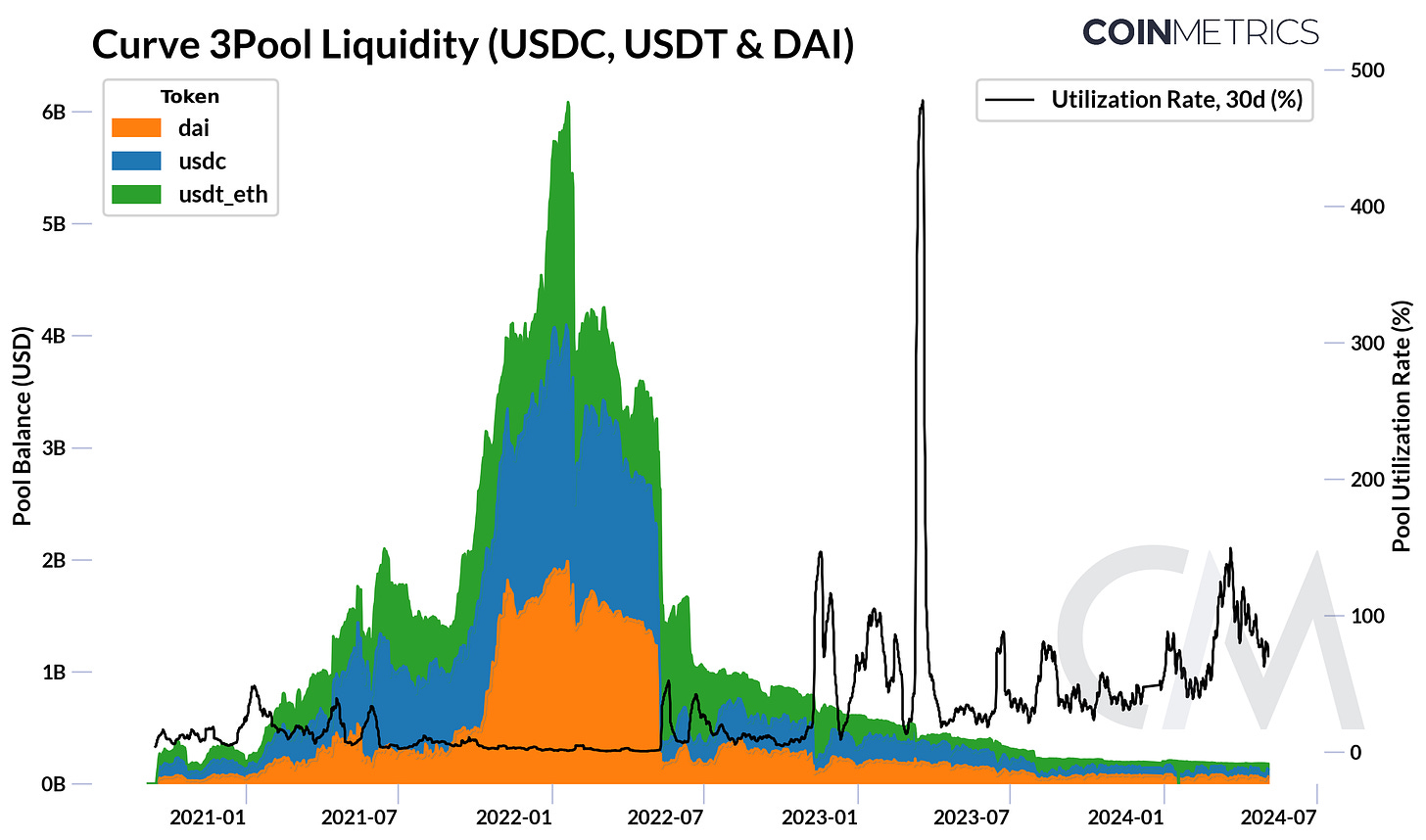

Nonetheless, liquidity or whole worth locked (TVL) alone doesn’t seize the complete image. The utilization fee of the pool, representing how a lot of the deposited liquidity is being actively used/traded, is on the rise. This metric, out there by means of our DeFi Balance Sheets endpoint is relevant to liquidity swimming pools in cash markets like Aave and DEX’s like Curve, capturing the monetary well being of these protocols extra successfully.

Supply: Coin Metrics Labs

With its concentrate on pegged belongings, stablecoins like USDC, USDT and DAI gained traction on the platform, ensuing within the largest stablecoin pool known as the 3Pool. Loss of investor confidence with the de-pegging of Terra’s UST and Circle’s USDC has precipitated liquidity to dry up. Nonetheless, a number of stablecoins which have just lately entered the fray, akin to PayPal’s PYUSD, FRAX and yield-bearing merchandise like MakerDAO’s sDai and Ethena’s USDe, have gained ground on the change.

Curve has additionally advanced to accommodate unstable belongings, that includes dynamic parameters like charges and the power to create multi-asset swimming pools with various volatility profiles. Whereas unstable belongings have not gained as a lot traction as stablecoins, this flexibility has influenced the design of different outstanding DEXs like Balancer.

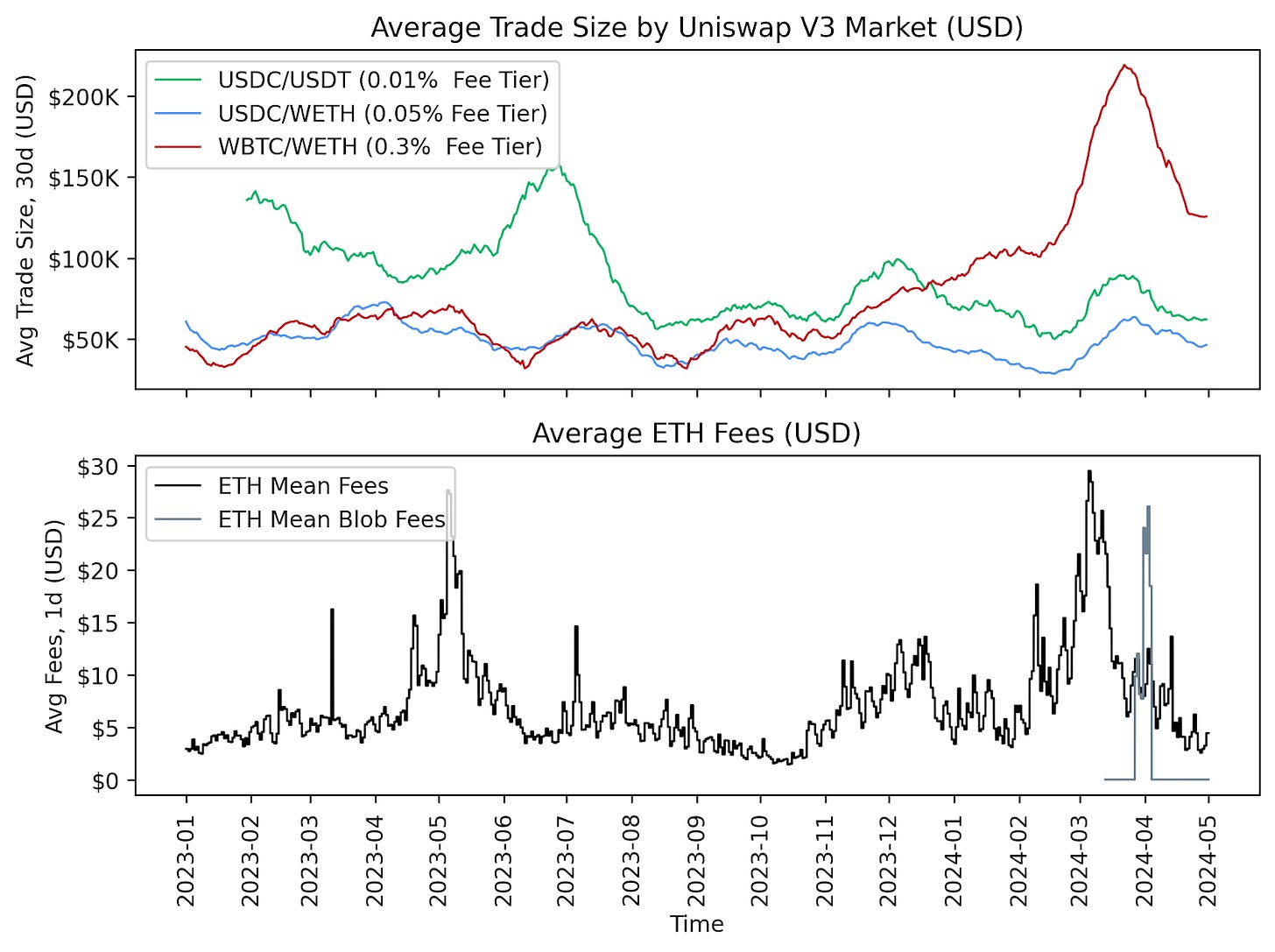

Buying and selling charges on the protocol degree (i.e. Uniswap v3) and transaction charges on the community degree (i.e. Ethereum mainnet or Layer-2’s) can form the habits of merchants and liquidity suppliers on DEX’s. Within the chart under, we are able to observe that greater charge tiers, such because the 0.3% charge tier for WBTC/WETH pair on Uniswap v3, are likely to have bigger common commerce sizes in comparison with decrease charge tiers just like the 0.01% tier for USDC/USDT pair. Along with exterior market circumstances and transaction prices, these charge tiers additionally immediately influence the trade-off between threat and return for swappers and liquidity suppliers (LP’s).

Source: Coin Metrics DEX Swaps Data & Network Data

Community transaction charges characterize a further expense for customers on DEX’s. Excessive transaction charges on Ethereum mainnet are higher suited to bigger and fewer frequent trades, as mounted prices may be unfold over bigger commerce sizes. Alternatively, the implementation of the Dencun improve and the explosion of Layer-2 options implies that customers who prioritize velocity and low prices can transact with out being priced out, whereas those who require the safety of the base-layer can make the most of Ethereum’s L1.

With a quantity of rollups on Ethereum and layer-1 blockchains like Solana bringing transaction charges magnitudes decrease, DEX’s are increasing throughout a number of networks. Uniswap v3 is already deployed on 16 totally different chains. A number of layer-2’s host native DEX’s akin to Aerodrome, the biggest change on Coinbase’s Base community, permitting customers to traverse throughout the ecosystem, whereas others characteristic hybrid AMM or order-book based mostly DEX’s like Raydium and Hyperliquid, leveraging its excessive throughput and low charges. This variety caters to customers with totally different threat profiles and preferences within the DeFi panorama and can proceed to evolve as rollups and L1’s mature.

Uniswap can be set to launch its 4th iteration, introducing a “singleton” structure, the place all swimming pools stay inside a single sensible contract. It will carry main reductions in fuel prices as tokens gained’t want to maneuver between separate pool contracts when a swap is made. Uniswap v4 additionally introduces “hooks”, which allows builders to customise pool performance and execution, extending the flexibleness of the protocol to construct on-chain restrict orders, instruments to guard in opposition to MEV or customized logic for the buying and selling of tokenized real-word belongings (RWA’s). Normally, the tendencies level in direction of DEX’s turning into extra common, increasing their presence throughout networks whereas catering to a wider vary of merchants and liquidity suppliers.

The evolution of decentralized exchanges akin to Uniswap and Curve Finance highlights vital strides within the DeFi sector, notably in enhancing liquidity administration and buying and selling effectivity. These developments not solely cater to a broad spectrum of dealer preferences and threat profiles but in addition sign a strong future for decentralized buying and selling environments, the place accessibility and effectivity proceed to drive widespread adoption within the crypto ecosystem. Because the DeFi ecosystem matures, the regulatory setting round DEXs and their adoption tendencies are poised to proceed evolving.

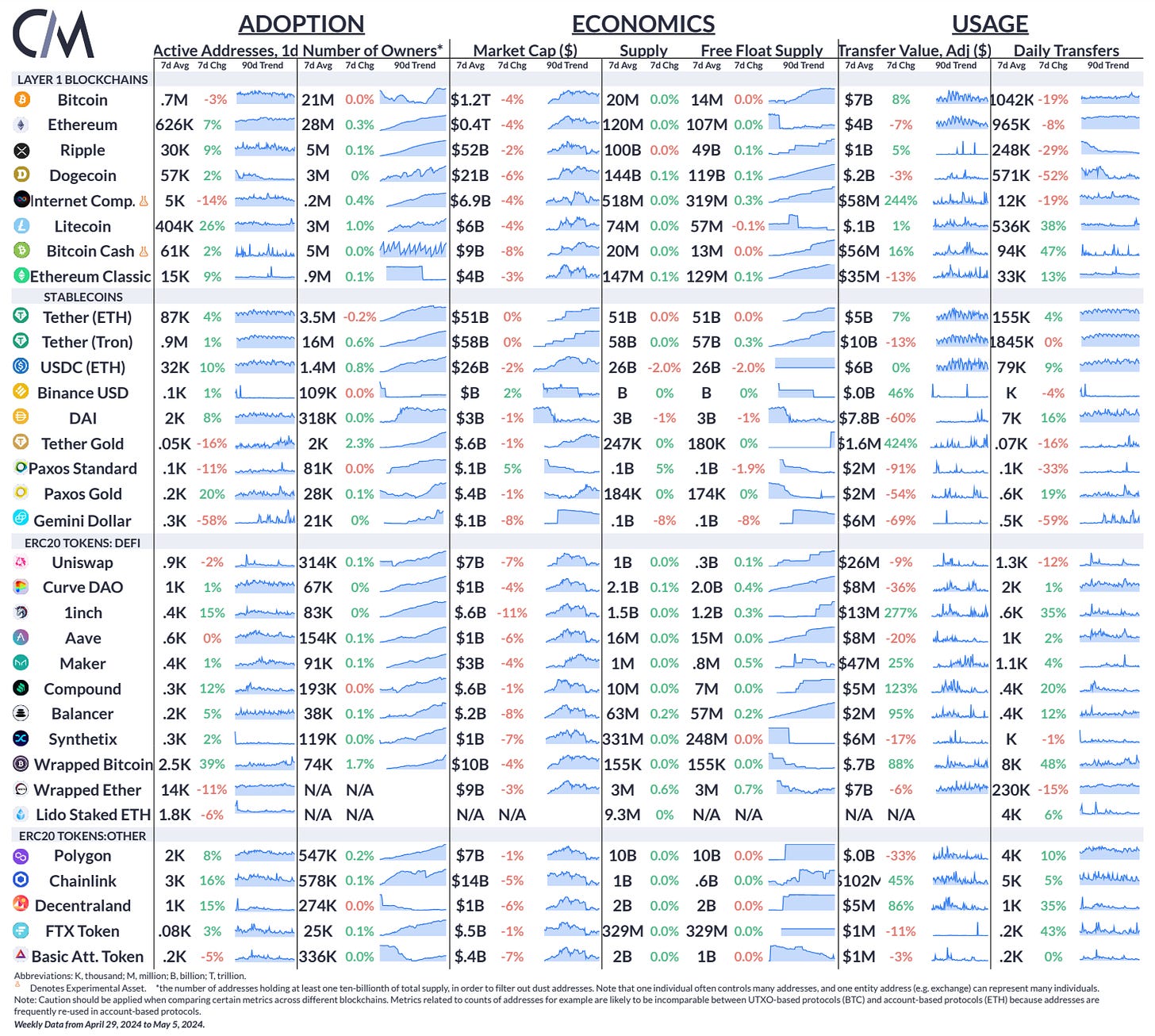

Supply: Coin Metrics Community Knowledge Professional

The market capitalization of Bitcoin and Ethereum declined by 4%, whereas energetic addresses for Wrapped Bitcoin (WBTC) rose by 39% over the week. Aave Labs launched a deployment proposal for Aave V4, aiming for a mid-2025 launch

This week’s updates from the Coin Metrics crew:

-

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, if in case you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier points of State of the Community right here.