State of the Network’s Q1 2024 Mining Data Special

Get the finest data-driven crypto insights and evaluation each week:

-

With BTC worth rising and transaction charges remaining elevated, Bitcoin miner income hit a brand new all-time-high in March, surpassing $76M in a single day

-

Prime 3 publicly-traded miners Marathon Digital, CleanSpark, and Riot Platforms compete for investor consideration, every leaning right into a differentiated strategic focus

-

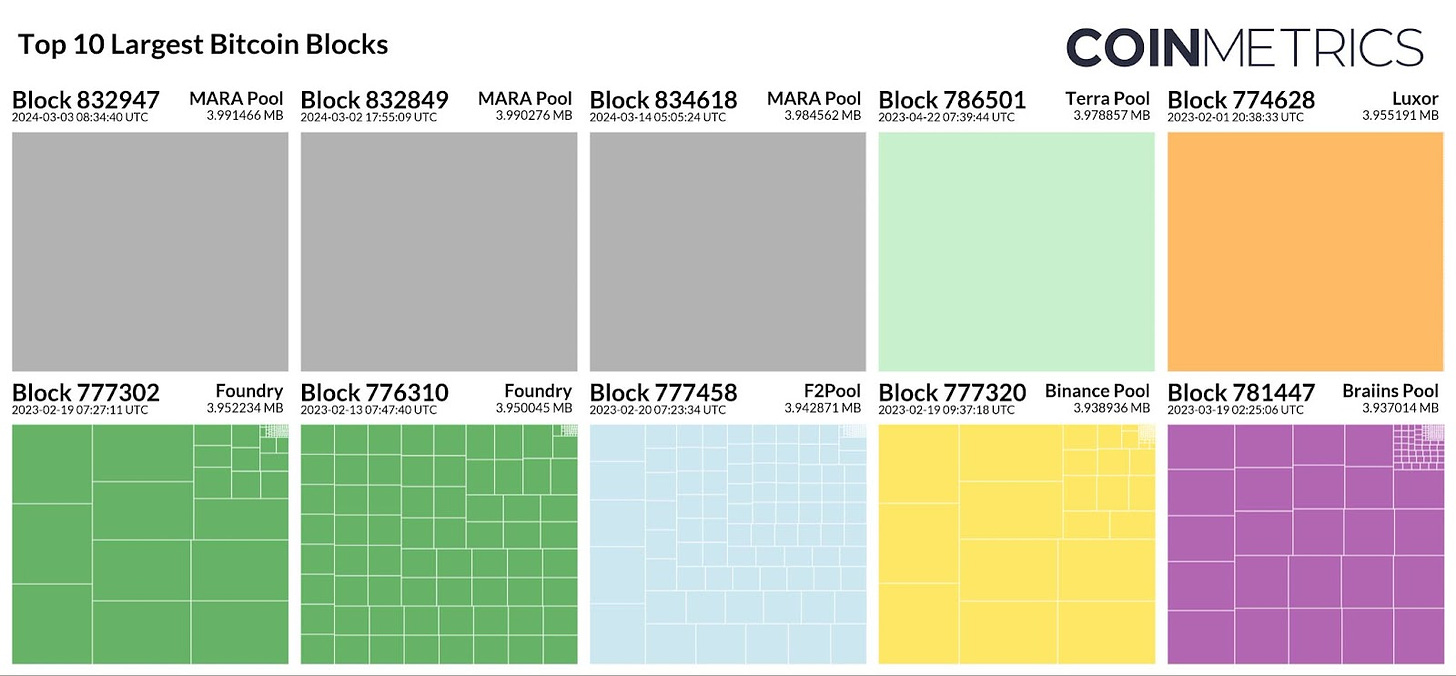

Marathon Digital’s new “Slipstream” service permits extra-large transactions, with the agency mining the 3 largest Bitcoin blocks ever at 3.98+ MB every

-

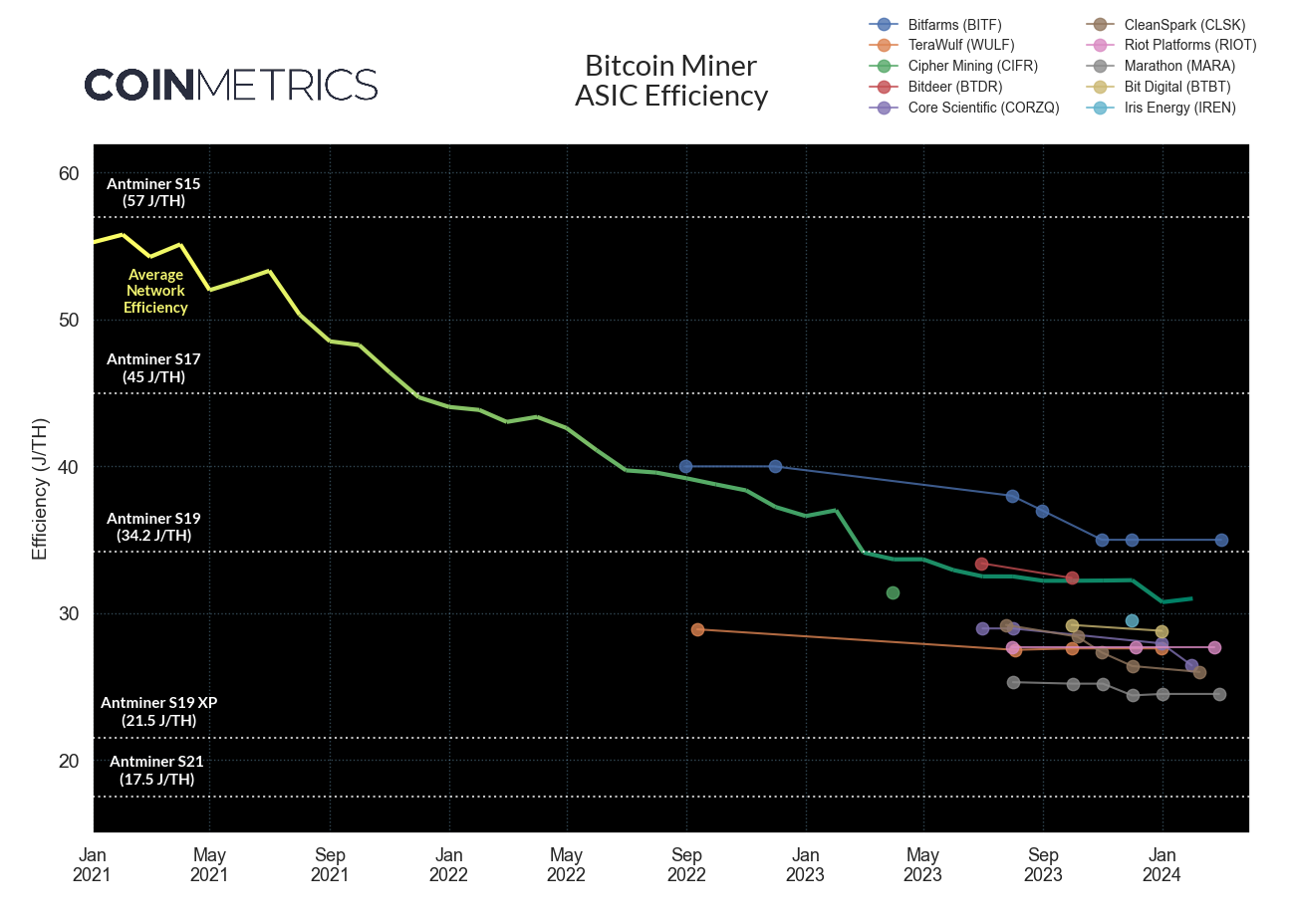

Bitcoin’s estimated energy consumption hits a brand new excessive of 19.6 GW in February, although the common ASIC is turning into extra environment friendly, consuming simply 30.99 J/TH

This week’s State of the Community returns to our quarterly replace on Bitcoin mining, zeroing in on the spectacular restoration of miner profitability amid enhancing market situations. Naturally, the introduction of spot Bitcoin ETFs raised mining revenues throughout the board, boosting the worth of the protocol-mandated 6.25 BTC block reward. Like final 12 months, on-chain exercise stays a major tailwind, with Ordinals lifting transaction charges and providing miners novel revenue-generation alternatives.

Nonetheless, the Bitcoin Halving looms forward, and miners inevitably face a 50% discount in top-line BTC earnings. In the coming weeks, miners will expertise elevated scrutiny of their operations, with on-chain metrics enjoying a key position in informing the views of stakeholders and strategists.

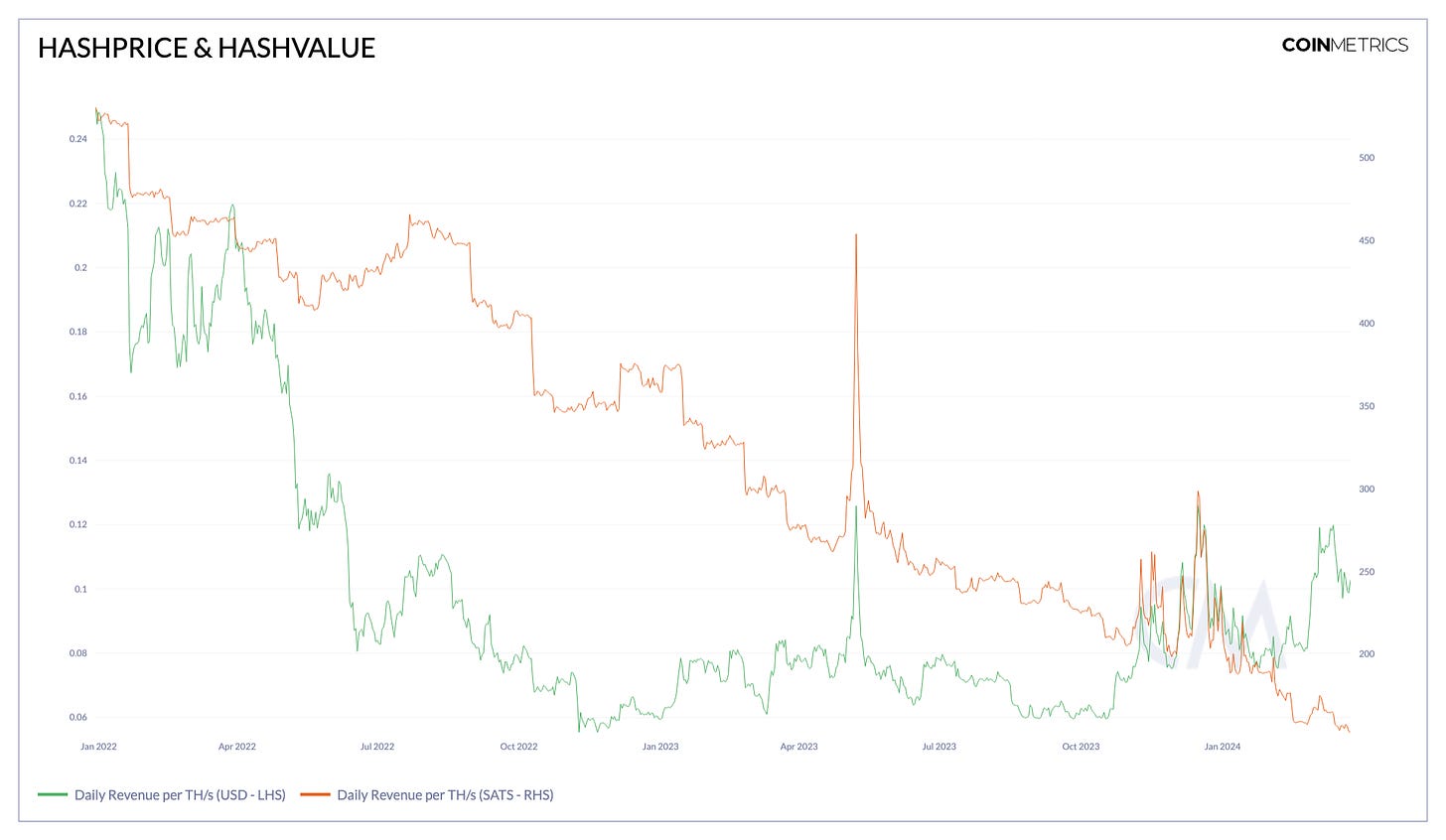

Due to the rally in Bitcoin worth, hashprice (day by day USD income per TH/s, a basic unit of hashrate) is again on an uptrend, at the moment regular at 10 cents per TH/s. Hashprice peaked at 12.6 cents per TH/s in December, the highest degree since June 2022, and stays comfortably above the 6-7 cent vary it occupied via most of 2023.

In the meantime, hashvalue (day by day BTC income per TH/s) continues its perpetual trek decrease, with extra miners competing for his or her share of the mounted block reward pie. Nonetheless, durations of peak on-chain exercise (accompanied by elevated transaction charges) intermittently enhance BTC-denominated earnings. December noticed a sustained improve in hashvalue, incomes miners 300 Satoshis (0.000003 BTC) per TH/s deployed. This spike was largely attributed to Ordinals exercise, with BRC-20 transfers flooding the mempool for the majority of the month. As of late, hashvalue sits close to all-time-lows of 150 Satoshis per TH/s, with BTC-denominated rewards rising ever scarcer.

Source: Coin Metrics Network Data Pro

Caught between aggressive pressures and {hardware} effectivity enhancements, the worth of a person unit of hashrate stays on a gentle slope downwards over the long-term, regardless of the denomination. Because of this, miners are compelled to repeatedly hunt down newer, extra environment friendly machines, producing extra hashes for a decrease price, and so forth the cycle repeats.

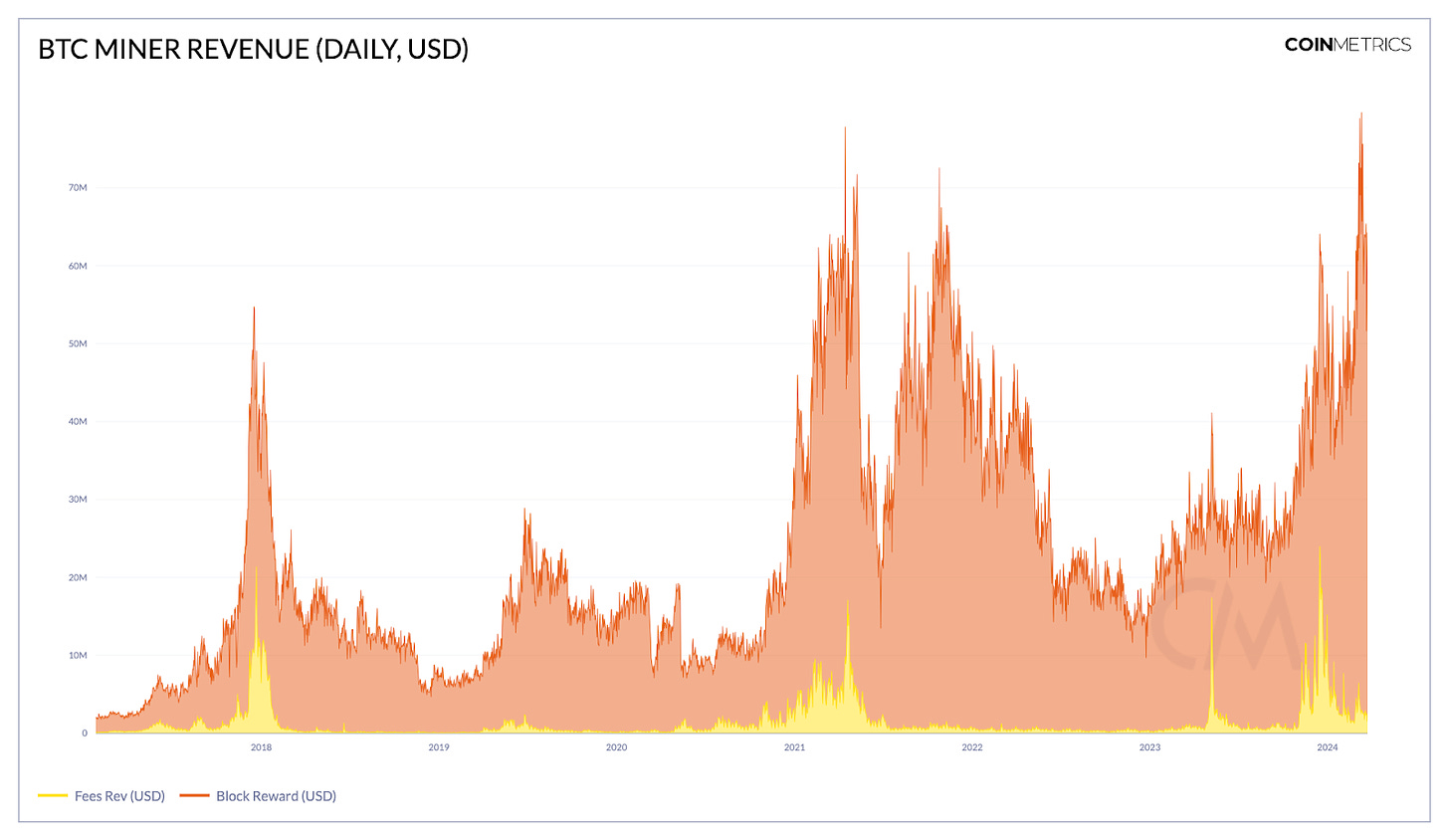

Regardless of the long-term drawdown in earnings per hash, mixture miner income (USD) has skyrocketed in 2024, hitting an all-time-high of $76.71M on March 11. Transaction charges aren’t almost at the degree they reached in the late phases of 2023’s Ordinals mania, however they continue to be comparatively elevated in Q1, averaging $2-3M per day. In fact, the main purpose for report highs in mining income are report highs in BTC worth, with the asset’s 50% acquire buoying each revenues and treasuries in the mining ecosystem.

Source: Coin Metrics Network Data Pro

Although the 2024 Halving appears prone to dial again miners’ day by day earnings, the upwards trajectory of USD-denominated revenues helps alleviate longer-term “security budget” considerations. Particular person operators will come and go, however for the second, the community’s issuance schedule seems sustainable sufficient to assist the expensive calls for of proof-of-work consensus.

Whereas miners are sometimes considered as a homogenous group of commodity producers, many of the publicly-listed entities supply a differentiated strategic focus, from value-added companies to fine-tuned energy buy agreements. The sector boasts dozens of high-profile names, however Marathon Digital (MARA), CleanSpark (CLSK), and Riot Platforms (RIOT) are at the moment the prime 3 by market capitalization, engaged in a relentless tug-of-war for shareholder dominance.

With an enormous operational hashrate of 28.7 EH/s and a treasury of almost 17K BTC, Marathon Digital stays the king of the hill with a $5.6B market cap, however the juggernaut isn’t resting on its laurels. Marathon not too long ago rolled out a number of ancillary companies to diversify income streams, introducing a white-glove transaction submission service (“Slipstream”) and a collection of merged-mined Bitcoin sidechains (“Anduro”) in February.

With the express goal to facilitate “non-standard transactions,” Slipstream has been especially provocative in the BTC neighborhood. By default, Bitcoin nodes implement an higher restrict on the max transaction measurement relayed to friends— however extra-large transactions are nonetheless technically legitimate in accordance with consensus guidelines. As the solely public miner with its personal pool, Marathon is uniquely positioned to facilitate the inclusion of these transactions, enabling them to earn additional charges via a direct submission service.

In March, Marathon mined the 3 largest Bitcoin blocks ever at 3.98+ MB every, surpassing Luxor’s notorious 3.96 MB “Taproot Wizards” block simply over one 12 months prior. Whereas the common block accommodates 2,000 – 4,000 transactions, these 3 blocks have a mixed whole of simply 17 transactions, with the bulk of block house occupied by 3 large metadata Inscriptions. The primary two blocks contained a pair of NFTs linked to the “Runestone” undertaking, setting the stage for an enormous community airdrop just a few weeks later. The third MARA mega-block contained an audio Inscription from rapper French Montana, permanently etching a MP4 file for his unique tune (“Bag Curious”) into the blockchain.

At 16 EH/s, the majority of CleanSpark amenities are concentrated in Georgia, with a handful of deployments in New York & Mississippi. Their focus is on operational effectivity, with cutting-edge immersion tech and clear power inputs driving their margins to some of the trade’s highest. Although they’ve traditionally been an underdog in the standoff towards Riot and Marathon, in early March CleanSpark flipped Riot to grow to be the 2nd-largest publicly traded miner by market cap, at the moment valued at $4.6B.

Mapping the recipients of mining pool payouts to public disclosures, tackle 3Km…9ab seems to match CleanSpark’s anticipated influx profile. We are able to see the affect transaction charge spikes have made on CleanSpark’s income— in December, day by day income per EH/s tipped 3 BTC, bringing their month-to-month manufacturing whole to 720 BTC. Although hashvalue is considerably decrease in March, on-chain flows point out CleanSpark continues to be on observe for a report month, with 653 BTC mined as of March 25.

Supply: Coin Metrics ATLAS, Community Data Professional, & CleanSpark Manufacturing Updates

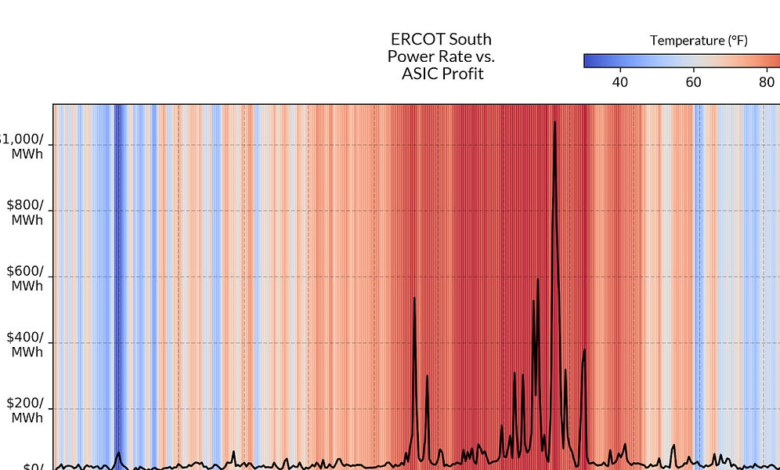

Riot Platforms is Bitcoin’s poster-child for grid integration, centered on dynamically responding to cost fluctuations in the Texas power market. As a participant in ERCOT’s “demand response” program, Riot ramps down their fleet in periods of grid pressure, responding to market alerts in real-time. Of the Large 3, RIOT inventory is the laggard, returning 54% year-over-year (relative to MARA’s 195% and CLSK’s 807% return). Nonetheless, the agency holds sturdy in the higher ranks, with a market cap of $3.15B.

For Riot, financial incentives are well-aligned— final August, a record-breaking warmth wave put the Texas grid beneath stress, inflicting energy costs to spike to greater than $1,000/MWh in the South load zone. Naturally, elevated charges briefly rendered Riot’s operations unprofitable, so the miner curtailed their consumption, rapidly liberating up extra capability on the grid. Riot later reported their curtailment was rewarded with $31.7M in power credit, over 3 instances the worth of their BTC mined over the identical interval.

Supply: Coin Metrics Community Data Professional, ERCOT, & Visible Crossing Climate Data

As the miner most carefully tied to the power consumption narrative, Riot has confronted substantial scrutiny from climate-conscious regulators. The White Home has repeatedly proposed a 30% excise tax on miners’ energy purchases, and the Power Data Administration (EIA) not too long ago issued a “mandatory survey,” requiring miners to report meticulous particulars about their power inputs.

The EIA’s survey was met with broad pushback from the mining sector, with the Texas Blockchain Council and Riot Platforms becoming a member of forces to sue the company on the foundation of overreach. In the short-term, Riot’s go well with was a success, with a decide granting miners a short lived restraining order and forcing the EIA to retract their “emergency” mandate in favor of a typical public remark interval.

Miners nonetheless stay a serious goal in regulatory crosshairs, however the trade’s capacity to rapidly mobilize a protection towards political stress underscores the sector’s maturation, with well-capitalized corporations efficiently shielding the whole ecosystem from overbearing reporting necessities.

The mining trade has fended off the EIA’s information assortment efforts (for now), however on-chain heuristics nonetheless supply a glimpse into the network-wide degree of energy utilization. Following 2022’s chapter flush-out and 2023’s market rebound, hashrate is as soon as once more on a gentle march upwards, bringing with it a considerable rise in electrical energy consumption. In keeping with Coin Metrics’ MINE-MATCH methodology, the community’s estimated energy draw clocked a brand new all-time-high of 19.6 GW in February, a 62% improve year-over-year.

Source: Coin Metrics MINE-MATCH

Miners are consuming extra power, however they’re additionally squeezing extra efficiency out of their machines. The trade’s favored metric for measuring effectivity is an ASIC’s “joules per terahash” (J/TH) score, quantifying the quantity of hashrate produced per joule of power consumed. The decrease the J/TH score, the extra environment friendly the ASIC. Hashrate contributed by newer-generation miners like the S19 XP (21.5 J/TH) has grown almost 60% YTD. Although a steadily rising BTC worth seems to have reactivated some older, less-efficient fashions like the S9, the common community effectivity at the moment sits at simply 30.99 J/TH, a testomony to the relentless nature of the {hardware} improve cycle.

Source: Coin Metrics MINE-MATCH and SEC Filings

Fleet effectivity (in J/TH) is an more and more widespread metric for mining companies, permitting them to underscore their aggressive edge. Primarily based on public disclosures, CleanSpark has lowered their power consumption to 26 J/TH, whereas Core Scientific has improved self-mining effectivity to 26.44 J/TH following an emergence from Chapter 11 chapter. With 1 month left to the Halving, miners should proceed rolling out high-performance {hardware} to make sure their survival in the shakeup forward.

The mining trade continues to be recovering from 2022’s market volatility, with a quantity of corporations making recent exits from intensive chapter proceedings. Fortunately, ETF inflows have softened the touchdown, and margins are slowly increasing. Fairness traders are as soon as once more warming as much as the notion of Bitcoin publicity by way of mining inventory proxies, with many tickers outperforming BTC itself.

The Halving of block rewards in April will likely be a do-or-die second for a lot of miners, and it stands to query whether or not these corporations can abdomen the drop to three.125 BTC per block. Nonetheless, the current injection of institutional capital could but hold some weaker hyperlinks afloat, offering a brief window of favorable M&A situations. Extra consolidation lies forward, however political dangers will even persist, with many miners deploying ASICs past U.S. borders in an try and decentralize operations.

U.S. ventures have dominated mining for a number of years, however 2024 seems to be to be a 12 months marked by geographic decentralization. In earlier cycles, capital markets have performed kingmaker in deciding which operators obtain the most favorable financing phrases. Submit-Halving, nevertheless, operators will likely be compelled to stability easy accessibility to capital towards the low-cost energy charges and relaxed regulatory outlooks provided by rising markets, unlocking enlargement throughout South America, Africa, and past.

Be sure that to take a look at our previous issues of the mining information particular, in addition to our June report The Signal & the Nonce: Tracing ASIC Fingerprints to Reshape our Understanding of Bitcoin Mining.

Supply: Coin Metrics Community Data Professional

Market capitalization of Bitcoin and Ethereum slid by 7% and 11%, respectively, over the week. This downturn got here as spot Bitcoin ETFs noticed 3 consecutive days of web outflows. In the meantime, the Ethereum Basis is being investigated by state authorities in an effort by the SEC to categorise ETH as a safety. BlackRock made a foray into tokenization, launching “BlackRock USD Institutional Digital Liquidity Fund” (BUIDL), an on-chain cash market fund on Ethereum.

This week’s updates from the Coin Metrics crew:

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, when you have any suggestions or requests please let us know here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier points of State of the Community right here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution just isn’t permitted with out consent. This text doesn’t represent funding recommendation and is for informational functions solely and you shouldn’t make an funding resolution on the foundation of this info. The e-newsletter is offered “as is” and Coin Metrics won’t be chargeable for any loss or injury ensuing from info obtained from the e-newsletter.